What can money buy? This isn’t just about material possessions; it delves into a fascinating exploration of how money shapes our lives, from basic needs to experiences, opportunities, and even relationships. We’ll examine how financial security can impact everything from our physical comfort to our social standing, and even the very time we have available.

From the tangible comforts of a luxurious car to the intangible freedom of time, we’ll dissect the complex relationship between money and various aspects of human existence. We’ll explore the different facets of this relationship, looking at both the positives and the potential drawbacks of prioritizing monetary gain.

Material Possessions

Money, a universal language of exchange, unlocks a world of tangible possessions. From basic necessities to extravagant luxuries, its influence on our material lives is undeniable. This exploration delves into the intricate relationship between monetary value and the perceived worth of goods, highlighting the nuances of quality, craftsmanship, and utility.

Money can buy a lot of things, from fancy gadgets to luxurious vacations. But sometimes, the best investments aren’t necessarily the flashiest. For example, choosing the right zipper for your travel luggage can significantly impact your trip’s success, and 3 ways to select the best zipper for your travel luggage will help you make smart decisions.

Ultimately, while money can’t buy happiness, it can certainly buy peace of mind when your luggage stays securely zipped throughout your adventures.

Tangible Goods and Their Price Points

The purchasing power of money extends to a vast array of items, from the fundamental necessities to the luxurious indulgences. Basic necessities like food, shelter, and clothing are essential for survival, while luxury goods, such as fine jewelry or designer clothing, are acquired for status and personal gratification. The spectrum of quality and craftsmanship varies dramatically across price points, impacting both the longevity and the aesthetic appeal of an item.

- Housing: A house, apartment, or condo represents a significant investment. Basic housing options offer shelter and essential features. Luxury homes feature upscale finishes, expansive spaces, and premium amenities. The difference in quality between a basic apartment and a high-end mansion is substantial, ranging from simple fixtures and finishes to sophisticated architectural design and bespoke interiors. The perceived value of a home is often influenced by location, size, and features, in addition to the price tag.

- Transportation: Vehicles illustrate the price-quality correlation vividly. Basic transportation options like used cars provide essential mobility. Luxury cars, on the other hand, are often crafted with superior materials, advanced technology, and intricate design. The perceived value of a vehicle is influenced by factors such as fuel efficiency, safety features, performance, and brand reputation. The craftsmanship of luxury vehicles is often evident in the meticulous attention to detail, from the leather upholstery to the precision of the engine.

- Clothing: Clothing ranges from basic everyday wear to designer garments. Mass-produced clothing emphasizes affordability, while designer labels focus on high-end materials and craftsmanship. The quality of stitching, the durability of fabrics, and the overall design differentiate garments across price points. The perceived value of clothing is affected by factors such as brand recognition, fashion trends, and personal preferences.

- Entertainment: Entertainment encompasses a broad range of experiences. Tickets to local performances or concerts provide affordable enjoyment, while exclusive events and high-end entertainment packages are often associated with premium prices. The quality of an entertainment experience can vary based on factors like venue, seating arrangements, artist caliber, and overall atmosphere.

Cost Range and Features of Automobiles

The automotive industry exemplifies the diverse relationship between price and quality. A table outlining the cost range and features of various types of cars will provide a clearer picture.

| Vehicle Type | Price Range (USD) | Key Features |

|---|---|---|

| Economy Sedan | $15,000 – $25,000 | Basic safety features, fuel efficiency, standard amenities. |

| Mid-size Sedan | $25,000 – $40,000 | Improved safety features, advanced technology, enhanced interior design. |

| Luxury Sedan | $40,000 – $100,000+ | Premium materials, sophisticated technology, bespoke design, advanced safety features, powerful engines. |

| Sports Car | $30,000 – $200,000+ | Performance-oriented design, powerful engines, advanced suspension systems, high-end materials. |

The perceived value of a product often transcends its basic utility, reflecting social status, brand recognition, and personal preferences.

Experiences and Opportunities

Money can unlock a world of experiences, from fleeting moments of joy to life-altering adventures. Beyond material possessions, it often provides access to opportunities that enrich lives and broaden horizons. This often translates to increased social interaction and a perceived elevation in status.Beyond the tangible, money can purchase experiences that cultivate personal growth and build memories. From intimate gatherings to grand vacations, these experiences can be deeply impactful and shape our understanding of the world around us.

The nature of these experiences can vary dramatically, reflecting the diverse range of opportunities available.

Premium Experiences and Their Influence

Money often opens doors to exclusive experiences, from private concerts and sporting events to curated travel itineraries. These experiences can significantly impact social standing and perceived status. For example, a private jet trip to a remote island destination, or a front-row seat at a highly-sought-after concert, can be symbols of wealth and success. This influence isn’t solely about the experience itself, but the perceived exclusivity and prestige associated with it.

While money can’t buy happiness, it can buy experiences and things that contribute to a fulfilling holiday season. Think of a relaxing spa day or a delicious meal out, or maybe even a cozy blanket to snuggle under. Taking care of yourself is crucial during the holidays, and I’ve got 5 tips to help you prioritize self-care this year.

Check out these helpful strategies for making the holidays less stressful and more enjoyable: 5 tips for self care during the holidays. Ultimately, the best way to use money during the holidays is to invest in your well-being, so you can fully appreciate the season and all the special moments it brings.

The opportunity to network with influential individuals at such events can be a significant catalyst for career advancement.

Vacation Options: Costs and Benefits

Different vacation options offer varying degrees of cost and benefit. A comparison is helpful in understanding the trade-offs between different types of experiences.

| Vacation Type | Cost | Benefits |

|---|---|---|

| All-inclusive Resorts | Generally higher upfront cost, but often includes meals, activities, and accommodation in one package. | Convenience, ease of planning, predictability of expenses, potentially a greater variety of activities within the resort. |

| Backpacking Trips | Generally lower upfront cost, often requiring more independent planning and flexibility. | Greater sense of immersion in the local culture, deeper connection with the environment, more opportunities for personal growth, and potential for greater cost savings. |

| Luxury Cruises | Significant upfront cost, but can include multiple destinations and experiences in one trip. | Convenience of travel, multiple destinations in one trip, often high-quality amenities, and social interaction opportunities. |

This table highlights the trade-offs inherent in different vacation options. The best choice depends on individual priorities and preferences.

Money and Personal Growth Opportunities

Money can play a crucial role in facilitating personal growth opportunities. Investment in educational courses, workshops, or mentorship programs can significantly accelerate skill development and career advancement. Travel, especially to diverse locations, broadens perspectives and cultivates intercultural understanding. The freedom from financial constraints allows individuals to explore passions and pursue ambitions without the constant pressure of daily survival.

Exposure to new ideas, cultures, and challenges can foster personal resilience and creativity.

Access and Influence: What Can Money Buy

Money acts as a powerful gatekeeper, influencing access to resources and opportunities far beyond basic needs. It opens doors to exclusive services, prestigious networks, and even shapes the trajectory of one’s life. The disparity in access created by economic inequalities has profound social implications, impacting education, healthcare, and legal processes. Understanding this influence is crucial to comprehending the complexities of social mobility and the perpetuation of societal structures.The relationship between wealth and access is multifaceted.

While money doesn’t guarantee success, it often provides a significant advantage in navigating systems designed to favor those with financial resources. This unequal playing field creates a complex interplay of opportunity and limitation.

Access to Services and Networks

Money can significantly enhance access to exclusive services and networks. This access often transcends simple convenience, influencing social connections and career prospects. Financial resources can open doors to private clubs, high-end healthcare facilities, and exclusive educational programs, fostering a network effect that can accelerate professional advancement. For example, access to private jets, luxury yachts, or private golf courses can foster relationships with influential individuals in various fields, potentially leading to favorable business outcomes.

The potential for increased opportunities is a major factor that drives the pursuit of wealth.

Influence on Education, Healthcare, and Legal Representation

Financial resources demonstrably influence access to quality education, healthcare, and legal representation. Individuals with substantial financial means often have access to better educational institutions, leading to improved academic outcomes and broader career prospects. Similarly, wealthier individuals can afford superior healthcare options, potentially leading to better health outcomes and longer lifespans. The availability of high-quality legal representation can also significantly impact legal proceedings, providing a more favorable outcome for those with the means to engage such services.

Social Implications of Economic Disparities

Economic disparities in access to resources create significant social implications. The unequal distribution of wealth can perpetuate cycles of poverty and disadvantage, hindering social mobility and exacerbating existing inequalities. This can lead to disparities in housing, nutrition, and overall well-being. For example, access to quality childcare and preschool education is often more readily available to wealthier families, creating a further divide in educational opportunities.

Impact of Wealth on Different Social Classes

The impact of wealth on different social classes varies considerably. Wealthier individuals typically experience a more favorable access to resources, networks, and opportunities. Conversely, those with limited financial means often face significant barriers to accessing essential services and opportunities, potentially perpetuating cycles of disadvantage. This disparity can be observed in various areas of life, such as housing, education, and healthcare, creating a substantial gap in societal outcomes.

Influence on Political Processes

Money plays a significant role in influencing political processes. Campaign contributions, lobbying efforts, and political donations can shape the political landscape and influence policy decisions. Wealthier individuals and organizations often have greater influence on policymakers and can potentially sway public opinion through targeted campaigns. This influence is often a significant concern, especially when financial considerations outweigh public interest.

The potential for corruption and undue influence is a persistent concern in political systems around the world.

Time and Freedom

Money can often be a key to unlocking more time and freedom in life. It’s not just about buying expensive gadgets; it’s about freeing up valuable hours that can be used for personal pursuits, relaxation, or simply enjoying life’s moments. Financial security, gained through wise money management and potentially investment, can significantly reduce stress and anxiety related to financial concerns, allowing individuals to focus on other aspects of their well-being.Beyond material possessions, the freedom money provides often manifests in the ability to outsource tasks, leading to a reduced workload and more leisure time.

This isn’t about abandoning responsibility; rather, it’s about strategically allocating resources to maximize efficiency and enjoy life more fully. It’s important to acknowledge that there are trade-offs to consider, as spending money on time-saving services may mean sacrificing time in other areas. This careful consideration of value and opportunity cost is crucial for making informed decisions about how to use financial resources to optimize time and well-being.

Outsourcing Tasks and Hiring Help

Financial resources allow individuals to outsource tasks, freeing up their time for more fulfilling activities. This includes hiring help for household chores, childcare, or even professional assistance with tasks like project management or bookkeeping. The decision to outsource depends on a careful evaluation of cost-benefit analysis, comparing the expense of hiring help to the value of the time saved.

Financial Security and Reduced Stress

Financial security significantly reduces stress and anxiety related to financial concerns. When individuals have a stable financial foundation, they can focus on other aspects of life without constant worry about bills or unexpected expenses. This financial freedom translates to greater mental clarity and emotional well-being, which, in turn, can have a positive impact on productivity and overall quality of life.

Examples of Increased Leisure Time and Reduced Workload

Individuals with sufficient financial resources can often reduce their workload or choose less demanding jobs. This allows for more leisure time, whether through pursuing hobbies, spending quality time with loved ones, or simply enjoying personal downtime. For example, a freelance writer with savings might choose to work fewer hours or take on fewer clients, allowing for more time to pursue creative endeavors.

Trade-offs Between Spending Money and Investing Time

The act of spending money on time-saving services often involves a trade-off. Investing time in personal pursuits or hobbies can lead to increased creativity, self-improvement, and overall well-being. Balancing financial investments with personal time investments is essential for achieving a fulfilling and balanced life. A crucial factor in this trade-off is to carefully consider the value and potential return of each activity.

Comparison of Time-Saving Services

| Service | Cost | Benefits | Potential Drawbacks |

|---|---|---|---|

| Professional Cleaning Service | Variable (hourly/monthly rates) | Clean home, free time | Potential for inconsistent quality, time commitment for scheduling |

| Meal Delivery Service | Variable (per meal/subscription) | Prepared meals, time for other activities | Higher cost than cooking at home, potential for less variety |

| Personal Chef | High (per meal/event) | Nutritious meals, stress-free dining | Significant cost, potential for less control over dietary needs |

| Virtual Assistant | Variable (hourly/project) | Administrative support, increased efficiency | Communication challenges, potential for miscommunication |

The table above provides a simplified comparison of time-saving services. Costs and benefits can vary significantly depending on the specific service provider and individual needs. Careful consideration of individual circumstances is critical before making any decisions.

Security and Safety

Money, in many ways, is a crucial component of security and safety, especially during challenging times. It’s not the sole determinant, but it undeniably plays a significant role in mitigating risks and providing a sense of stability and control. This is particularly evident in emergencies and crises, when access to resources becomes paramount. Financial preparedness is a key element in fostering a feeling of safety and security.A well-structured financial plan, incorporating a safety net of emergency funds and insurance, can significantly reduce anxieties and allow for proactive risk management.

A strong financial foundation, built on sound budgeting, saving habits, and responsible investment strategies, provides a cushion during periods of uncertainty. This buffer can offer the necessary resources to navigate unexpected expenses, medical emergencies, or job loss.

Financial Resources in Times of Need

Having a dedicated emergency fund is akin to a safety net. This fund serves as a crucial resource during unexpected events, like sudden job loss, car repairs, or medical bills. It acts as a buffer against unforeseen circumstances, providing financial stability during periods of hardship. Ideally, this fund should cover three to six months of living expenses.

Insurance as a Safety Net

Insurance policies, whether for health, home, or car, act as another critical safety net. These policies can protect individuals and families from significant financial losses due to unforeseen events, such as accidents, illnesses, or natural disasters. Having comprehensive insurance coverage can prevent overwhelming financial burdens during crises. For instance, health insurance can help manage substantial medical expenses, while home insurance can cover damage to a property during a natural disaster.

Money and Stability

Money can contribute to a feeling of stability and control over one’s future. By building financial reserves and managing debt effectively, individuals can reduce financial stress and increase their sense of control. This control can manifest in various ways, from having the resources to pursue desired goals to having the financial freedom to make choices aligned with personal values.

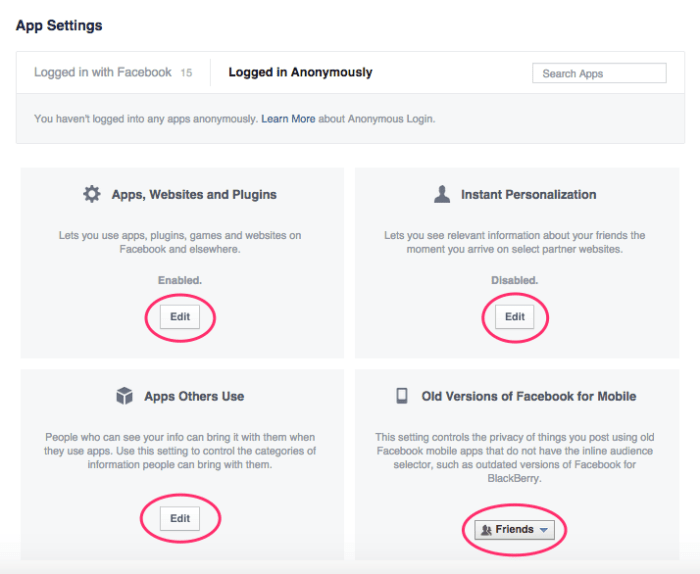

While money can certainly buy you things, like a fancy car or a luxurious vacation, it can’t always buy you happiness. However, mastering 16 smart Google search tricks like those detailed in this helpful guide 16 smart google search tricks that will make life easier can save you time and frustration, making life significantly easier and more efficient.

Ultimately, that efficiency can translate into more time and resources to pursue your goals and, potentially, more fulfilling experiences, regardless of your financial status.

Having a strong financial foundation can also reduce stress and promote a greater sense of mental well-being.

Mitigating Risks and Improving Safety

Money can be used to mitigate risks and improve safety in various ways. For example, investing in security systems for homes or businesses can deter potential threats. Similarly, preventative health measures, such as regular check-ups and vaccinations, often require financial resources. Even simple measures, like having reliable transportation, can improve safety and reduce the risk of accidents.

Impact on Relationships

Money’s influence on relationships extends far beyond the ability to provide basic necessities. It can subtly reshape social dynamics, create new opportunities, and, unfortunately, sometimes exacerbate existing tensions. The interplay between finances and personal connections is complex and often fraught with both potential benefits and significant challenges.Financial resources can significantly impact the types of social circles we find ourselves in and the relationships we cultivate.

A shared financial background can foster stronger bonds, while significant disparities can create friction and strain. The value placed on money and material possessions can also affect how we perceive and interact with others. Understanding these dynamics is crucial for navigating the complexities of relationships in a world where financial realities play such a significant role.

Financial Disparities in Relationships

Financial imbalances within relationships can lead to feelings of inadequacy, resentment, and conflict. Differences in earning potential or financial security can impact how partners perceive their contributions to the relationship and the division of responsibilities. This can lead to arguments about spending habits, saving strategies, and future goals. Moreover, differing financial backgrounds can lead to contrasting values and expectations about how money should be used.

- Perceived Value and Contribution: A partner with a higher income may feel undervalued if their contributions aren’t proportionally recognized or appreciated. Conversely, a partner with a lower income might feel burdened by the financial responsibilities and the need to continuously make compromises.

- Decision-Making Dynamics: Significant financial disparities can shift the balance of power in a relationship. The partner with more financial resources may feel entitled to make more decisions, potentially leading to feelings of control or lack of autonomy on the part of the other partner.

- Communication Breakdown: Open and honest communication about finances is crucial in any relationship, but it can be particularly challenging when there are significant financial differences. Avoiding conversations or downplaying financial realities can create resentment and erode trust.

Money as a Relationship Strengthener, What can money buy

While financial disparities can create challenges, money can also be a powerful tool for strengthening and creating new relationships. Joint financial goals, like saving for a house or retirement, can foster a shared sense of purpose and commitment. The ability to contribute to shared experiences, such as travel or hobbies, can also strengthen bonds.

- Shared Financial Goals: When partners work together towards shared financial objectives, they build a sense of collaboration and shared responsibility. This creates a sense of unity and strengthens the bond between them.

- Supporting Shared Interests: Money can facilitate experiences that foster connection and shared enjoyment. Whether it’s contributing to a partner’s artistic pursuits, taking a course together, or funding a trip, financial support can create shared memories and deepen emotional bonds.

- Acts of Generosity: Acts of kindness and generosity, financed by financial resources, can create a sense of appreciation and strengthen emotional connections. This could involve contributing to a charitable cause together, supporting a friend in need, or simply expressing love through thoughtful gifts.

Building Relationships Through Financial Intelligence

Cultivating financial literacy and open communication about finances can mitigate potential relationship conflicts. Understanding each other’s financial situations, goals, and priorities can create a more stable and equitable foundation for the relationship.

- Financial Literacy and Education: Educating oneself and one’s partner about personal finance, budgeting, and saving strategies can create a shared understanding and common ground for financial discussions.

- Open Communication: Open and honest conversations about financial matters, including aspirations, concerns, and vulnerabilities, can foster trust and understanding. It is vital to discuss financial expectations, goals, and priorities to avoid potential misunderstandings.

- Joint Budgeting and Decision-Making: Developing a joint budget and establishing clear financial responsibilities can create a sense of shared ownership and transparency.

Beyond Materialism

The relentless pursuit of material wealth, fueled by the perceived power of money, often overshadows other aspects of a fulfilling life. While financial security is essential, focusing solely on acquiring material possessions can lead to a distorted perspective and a lack of genuine happiness. This narrow focus can hinder personal growth, impact relationships, and ultimately diminish overall well-being. A deeper understanding of the true value of experiences and the pitfalls of materialism is crucial for leading a balanced and meaningful existence.The allure of material possessions, often amplified by societal pressures, can create a cycle of discontent.

The constant need for more, driven by the perceived status symbols, can lead to a sense of emptiness and dissatisfaction, regardless of the level of wealth attained. This is because true happiness stems from deeper values and connections, not from the accumulation of things.

Negative Consequences of Materialism

The relentless pursuit of material possessions, driven by the perceived power of money, can have profound negative consequences. The focus on acquiring more often leads to neglecting personal relationships, sacrificing time for experiences, and prioritizing external validation over internal fulfillment. This can manifest as anxiety, stress, and a general sense of unfulfillment.

Pitfalls of Solely Focusing on Monetary Gains

Focusing solely on monetary gains and material possessions can lead to a distorted perspective on success and happiness. The emphasis on wealth often overshadows other vital aspects of a fulfilling life, such as personal growth, meaningful relationships, and contributing to something larger than oneself. This myopic focus can result in a superficial existence, devoid of genuine connection and purpose.

Experiences vs. Material Possessions

The value of experiences often surpasses the fleeting nature of material possessions. Experiences, such as travel, hobbies, and time spent with loved ones, create lasting memories and personal growth. These memories and connections enrich our lives in ways that material possessions cannot. While material possessions can provide temporary gratification, experiences cultivate a deeper sense of fulfillment and well-being.

Impact on Mental Well-being and Overall Happiness

A relentless focus on material possessions can significantly impact mental well-being and overall happiness. The constant striving for more often breeds anxiety, stress, and feelings of inadequacy. Comparing oneself to others in terms of possessions can foster envy and dissatisfaction, hindering a sense of self-worth derived from internal values rather than external achievements. Conversely, experiences and relationships contribute to a greater sense of purpose and meaning, leading to a more positive outlook and sustained happiness.

Societal Pressures and the Perception of Wealth

Societal pressures significantly influence the perception of wealth and material success. Media portrayals, advertising campaigns, and social comparisons often create an unrealistic expectation of what constitutes a “successful” life, heavily reliant on material possessions. This pressure can lead individuals to prioritize external validation over internal fulfillment, perpetuating a cycle of discontent and a desire for more. Understanding and challenging these societal pressures is crucial for developing a balanced and realistic perspective on wealth and happiness.

Closing Notes

In conclusion, the answer to “What can money buy?” is surprisingly multifaceted. While money can undoubtedly provide material comfort, experiences, and opportunities, it’s crucial to consider the broader implications and trade-offs. Ultimately, the pursuit of happiness and fulfillment often transcends the limitations of what money can directly purchase. It’s a reminder to consider the true value of experiences, relationships, and personal growth, alongside the tangible benefits of financial security.