Want to make your first million dont save every penny you should spend money wisely instead – Want to make your first million? Don’t save every penny; you should spend money wisely instead. This isn’t about frivolous spending, but strategic investment. Building wealth often involves calculated risk-taking and understanding the true value of your purchases. It’s about finding the right balance between needs, wants, and investments, and this journey explores the nuances of making those choices effectively.

This post dives into the critical strategies for wealth building, challenging the common misconception that saving every penny is the sole path to riches. We’ll examine different methods of wise spending, the dangers of excessive frugality, and how to leverage spending for financial freedom. The journey towards financial success isn’t always about hoarding money, but about smart allocation and calculated growth.

Introduction to Wealth Building

Building wealth is a journey, not a destination. It’s about creating a system of income and investments that consistently grows over time. It’s not about accumulating every penny, but rather about smart spending and strategic investments that compound your earnings. This approach is often misunderstood, with many focusing solely on saving, neglecting the vital role of strategic spending.

The key to lasting wealth lies in a balanced approach.The common misconception is that wealth is solely built by saving every penny. While saving is crucial, it’s often portrayed as the only path to financial freedom. This narrow view overlooks the importance of using money wisely to generate income and increase your overall financial potential. The truth is that saving alone, without strategic spending, can be slow and less effective than a combined approach.

The power of compounding returns is unlocked when you invest strategically.

The Misconception of Saving Every Penny

The idea that saving every penny is the key to wealth is often presented as a straightforward formula. However, this strategy overlooks the significant role of strategic spending. Saving every penny might seem prudent, but it can stifle growth and opportunities. Many people have fallen into the trap of saving every penny, only to find their financial progress significantly hampered by a lack of investment and opportunity.

This approach can be seen as a missed opportunity to grow their capital.

The Importance of Spending Money Wisely

Strategic spending is not about frivolous spending, but rather about making informed choices that support your financial goals. It’s about investing in yourself and your future through education, training, and experiences that ultimately boost your earning potential. It’s also about understanding your financial needs and budgeting effectively to avoid unnecessary expenses. Making smart financial decisions, like choosing the right investments, is a crucial part of this process.

This approach recognizes that not all spending is equal; some investments provide higher returns than others.

Creating a Wealth-Building Strategy

Developing a personalized wealth-building strategy is crucial. It’s about understanding your financial situation, identifying your goals, and creating a roadmap that aligns your spending and saving habits to reach those objectives. This involves creating a budget that prioritizes your needs and goals, and understanding how to allocate resources effectively for maximum returns. Consider investing in education, training, or valuable experiences that will elevate your future earning potential.

This will often require careful analysis and the identification of areas where your spending can be optimized for maximum impact.

Strategies for Wise Spending

Building wealth isn’t just about accumulating money; it’s about strategically managing your resources. Wise spending is a crucial component of this process. It involves understanding your financial goals, making informed decisions about your expenses, and maximizing your returns on investments. This approach allows you to not only maintain a comfortable lifestyle but also to grow your wealth over time.Effective spending strategies are intertwined with your overall financial plan.

These strategies aren’t about deprivation, but rather about prioritizing your needs and desires in a way that supports your long-term financial objectives. Understanding the difference between needs and wants, and allocating resources accordingly, is paramount.

Budgeting and Financial Planning

Effective budgeting is the cornerstone of any sound financial plan. It involves creating a detailed record of your income and expenses, allowing you to track your spending habits and identify areas where you can save or redirect funds. A well-defined budget helps you understand where your money is going and enables you to make informed decisions about your spending.

This, in turn, leads to greater financial awareness and control. Financial planning extends beyond budgeting, encompassing long-term goals, like retirement planning, education funding, or purchasing a home. It involves assessing your current financial situation, identifying your goals, and developing a roadmap to achieve them.

Smart Investment Strategies

Investing wisely is essential for growing your wealth. However, it’s not a one-size-fits-all approach. Different investment strategies cater to varying risk tolerances and financial goals. Diversification is a key principle in investing. This means spreading your investments across various asset classes, such as stocks, bonds, real estate, and mutual funds.

Dreaming of hitting that first million? Don’t just hoard every penny; spend money wisely instead. A recent study, which finds a surprisingly accurate predictor of happiness , suggests that experiences and investments, not just savings, contribute significantly to overall well-being. So, if you want to make your first million, think strategically about how you spend and invest, and not just how you save.

That happy path might just lead to a million dollars sooner than you think.

Diversification helps mitigate risk, as the performance of one investment doesn’t necessarily impact the others. Consider your risk tolerance, time horizon, and financial goals when choosing investment strategies.

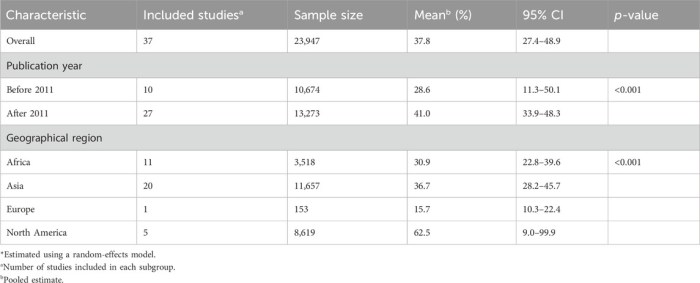

Investment Approaches Comparison

Various investment approaches exist, each with its own set of characteristics and potential returns. For instance, a growth-oriented approach focuses on high-growth potential stocks, but it often carries higher risk. A value-oriented approach seeks investments that are undervalued compared to their intrinsic worth. A balanced approach combines growth and value strategies to mitigate risk while aiming for moderate returns.

Want to make your first million? Don’t just hoard every penny; spend money wisely instead. Learning to budget and invest strategically is key. And while you’re mastering those financial skills, why not try some fun, healthy recipes with your kids? Checking out easy recipes for kids might spark some culinary creativity and teach valuable life lessons in the kitchen.

Remember, smart spending habits, like those needed for financial success, can be nurtured and practiced in many different ways, starting with cooking together.

The best approach depends on individual circumstances and financial goals.

Evaluating Investment Opportunities

Thorough research and due diligence are crucial when evaluating investment opportunities. This involves examining financial statements, understanding the company’s business model, and considering industry trends. Analyzing historical performance data and assessing the potential for future growth are important steps in this process. Seeking advice from financial advisors can also provide valuable insights and help in making informed decisions.

Do your research, understand the risks, and seek professional advice where necessary.

Spending Categories and Management Strategies

| Spending Category | Strategies for Management |

|---|---|

| Needs (Essential Expenses) | Prioritize essential expenses like housing, food, and utilities. Create a budget that covers these needs, and avoid cutting them too drastically. Look for ways to reduce unnecessary expenses without sacrificing essential needs. |

| Wants (Discretionary Expenses) | Differentiate between wants and needs. Allocate a specific amount for wants, and track how you spend it. Consider postponing purchases for non-essential items. Look for ways to save money on your desired purchases, or consider alternatives to reduce your spending. |

| Investments | Allocate a portion of your income to investments. Research and choose investments that align with your risk tolerance and financial goals. Reassess your investments regularly and adjust your strategy as needed. |

The Dangers of Saving Every Penny

The allure of saving every penny is understandable. It embodies a sense of financial responsibility and discipline. However, an unwavering focus on saving without considering strategic spending and calculated risk-taking can ultimately hinder your wealth-building journey. This approach, while seemingly prudent, can become a significant obstacle to accumulating substantial wealth.Prioritizing saving over all else can lead to missed opportunities for growth and can limit your ability to capitalize on potential investment returns.

While saving is crucial, a balanced approach is vital for building a robust financial future.

Potential Hindrances of Extreme Frugality

An overly frugal approach can lead to missed opportunities for personal and professional development. Sticking rigidly to a budget that doesn’t account for necessary investments can significantly impact your future earning potential. For example, refusing to invest in professional development courses or neglecting to upgrade equipment vital for your job could lead to stagnation in your career, hindering your earning potential.

This, in turn, affects your ability to save and grow wealth in the long run. A lack of investment in personal growth can also impact the quality of life and satisfaction, which might indirectly influence financial decisions.

Negative Consequences of Excessive Saving

Excessive frugality can lead to missed opportunities for growth. This approach can often be counterproductive in the long run. Investing in yourself, your business, or new opportunities requires capital. Saving every penny often means delaying these investments, potentially missing out on substantial returns. A lack of calculated risk-taking can limit the ability to capitalize on potential growth opportunities.

For example, a business venture might require initial capital that a purely saving-oriented strategy would prevent you from deploying.

The Importance of Calculated Risk-Taking, Want to make your first million dont save every penny you should spend money wisely instead

Calculated risk-taking is an integral part of wealth building. It’s not about reckless gambling, but about strategically evaluating potential investments and understanding the associated risks. Investing in a diverse portfolio of assets, including stocks, bonds, and real estate, allows you to diversify your investments and mitigate potential losses. This approach enables you to navigate market fluctuations and potentially maximize your returns over time.

Examples of calculated risks include investing in a promising startup, diversifying your portfolio, or investing in real estate, each requiring a careful evaluation of potential risks and rewards.

Pitfalls of Saving Every Penny and Solutions

| Pitfall | Solution |

|---|---|

| Missed Investment Opportunities | Develop a financial plan that includes a budget for investments, and regularly review and adjust the plan based on market conditions and personal goals. |

| Limited Earning Potential | Invest in your education, skills, and professional development to increase your earning potential. Consider additional training or courses related to your career. |

| Reduced Quality of Life | Establish a system of financial reward and recognition for achieving financial milestones. This can motivate you and make the process of wealth building more sustainable. |

| Missed Opportunities for Business Growth | Identify potential business ventures, analyze their feasibility, and develop a business plan to explore calculated risks and reward opportunities. |

| Delayed Retirement Savings | Allocate a portion of your income to retirement savings, even if it’s a small amount, to ensure financial security in your later years. |

Financial Freedom and Spending

Unlocking financial freedom isn’t about hoarding every penny; it’s about strategically managing your money to achieve your goals. Wise spending, coupled with smart saving, forms the bedrock of long-term wealth. This crucial connection between spending and freedom is often misunderstood, leading many to either overspend or under-spend, hindering their journey towards financial independence. This section will explore the nuanced relationship between spending and financial freedom, offering practical strategies to balance your desires with your financial goals.The key to financial freedom lies not in avoiding spending altogether, but in understanding how spending choices contribute to, or detract from, your overall financial well-being.

Smart spending isn’t about deprivation, but about making conscious decisions aligned with your financial goals. It involves understanding your values, needs, and desires, and then aligning your spending habits accordingly.

The Role of Smart Spending in Achieving Financial Goals

Smart spending is an active and intentional process, not a passive one. It involves understanding your financial situation, setting realistic financial goals, and then making spending choices that support those goals. This proactive approach empowers you to direct your resources towards achieving financial security and freedom.

Balancing Spending and Saving for Long-Term Wealth

Achieving long-term wealth requires a delicate balance between spending and saving. It’s not about sacrificing all enjoyment; rather, it’s about prioritizing your needs and wants in a way that allows you to save for the future. A well-structured budget is essential for managing your finances effectively and ensuring that you are saving enough to achieve your long-term financial goals.

Importance of Financial Education and Continuous Learning

Financial literacy is not a one-time event; it’s a continuous journey of learning and adaptation. The financial landscape is constantly evolving, with new investment opportunities and challenges emerging regularly. Staying informed about financial concepts, market trends, and personal finance strategies is crucial for making sound financial decisions. Investing time in continuous learning about personal finance will equip you with the tools and knowledge to navigate the complexities of the financial world effectively.

This ongoing learning process is essential for long-term financial success.

Examples of Financial Freedom Strategies

- Creating a Budget and Sticking to It: A well-defined budget allows you to track your income and expenses, identify areas where you can save, and ensure that your spending aligns with your financial goals. Regularly reviewing and adjusting your budget ensures that it remains relevant and effective in supporting your financial aspirations.

- Prioritizing Needs Over Wants: Distinguishing between essential needs and non-essential wants is crucial. Prioritizing needs allows you to allocate resources effectively, preventing unnecessary spending and ensuring that you can save for your financial objectives.

- Investing Wisely: Understanding different investment options, such as stocks, bonds, and mutual funds, allows you to make informed decisions that align with your risk tolerance and long-term financial goals. Diversifying your investments across different asset classes can help mitigate risk and maximize returns.

Understanding Value and ROI

In the journey towards financial freedom, understanding the true value of your spending and investments is paramount. It’s not just about the price tag, but about the return on your investment (ROI) – the benefit you receive in exchange for your money. This section delves into the crucial concepts of ROI, different valuation methods, and the distinction between needs and wants, equipping you with the tools to make informed financial decisions.

Return on Investment (ROI) Explained

Return on Investment (ROI) is a crucial metric for evaluating the profitability of an investment. It measures the gain or loss generated on an investment relative to the cost of the investment. A higher ROI indicates a more favorable return for your investment.

So, you’re dreaming of hitting that first million? Don’t just hoard every penny; spend money wisely. It’s about smart investments and calculated risks, not just saving. Think about it like this – highly authentic people, for example, don’t sacrifice their values for fleeting gains, as you can see in this insightful article about 15 things highly authentic people don’t.

Understanding that balance between personal integrity and financial success is key. Ultimately, it’s about strategic spending that fuels your journey to that million, not just blind saving.

Methods for Assessing Spending Value

Determining the value of a purchase extends beyond simply noting the cost. Several methods can help you evaluate the true worth of an expenditure.

- Benefit Analysis: Carefully consider the tangible and intangible benefits you anticipate from a purchase. A new piece of software, for instance, might improve productivity, leading to higher earnings in the long run.

- Cost-Benefit Analysis: This method systematically compares the total cost of a purchase against the anticipated benefits. If the benefits outweigh the costs, the purchase is likely a worthwhile investment.

- Opportunity Cost: This approach considers what else you could have done with the money spent. For example, if you spend money on a concert ticket, you’re potentially foregoing a higher return on investment in a different investment opportunity.

Needs vs. Wants

Differentiating between needs and wants is fundamental to wise spending. Needs are essential for survival and well-being, while wants are desires that enhance comfort or lifestyle.

- Needs: Essential expenses like housing, food, and healthcare are needs. They are fundamental to maintaining a healthy lifestyle.

- Wants: Shopping for new clothes, going to a movie, or purchasing entertainment are wants. While desirable, they are not essential for survival.

Determining Purchase Value in Relation to Benefits

To determine the value of a purchase, analyze its potential benefits against the cost. Consider the long-term impact and the potential for future gains.

- Long-Term Benefits: A quality education, for instance, may lead to a higher-paying job and greater financial security in the long run.

- Tangible and Intangible Benefits: Consider the direct and indirect returns from a purchase. A gym membership provides physical benefits, but also contributes to improved mental well-being.

Investment Options and Potential ROI

Different investment options offer varying potential returns. This table provides a simplified overview, and it’s crucial to consult with a financial advisor for personalized recommendations.

| Investment Option | Potential ROI (Estimated Range) | Risk Level |

|---|---|---|

| Savings Account | 0.5% – 2% annually | Low |

| Certificates of Deposit (CDs) | 1% – 3% annually | Low |

| Stocks (e.g., diversified portfolio) | 5%

|

Medium to High |

| Bonds | 2% – 8% annually | Medium |

| Real Estate | 3%

|

Medium to High |

Note: ROI figures are estimates and can vary significantly based on market conditions and individual circumstances. Past performance is not indicative of future results.

Examples of Wise Spending

Smart spending isn’t about deprivation; it’s about strategic allocation of resources to maximize returns. It’s about understanding the value of your money and making choices that align with your financial goals, whether those are short-term or long-term. This often involves making conscious decisions about how to spend your money, even when it might seem like a “treat” or “indulgence.”Successful wealth building often hinges on the ability to differentiate between needs and wants.

By carefully considering the long-term implications of every expenditure, individuals can create a strong foundation for financial security and growth. This section delves into real-world examples of individuals who successfully utilized smart spending habits to build substantial wealth, illustrating how wise investments play a crucial role.

Real-World Examples of Wealth-Building Through Wise Spending

Understanding how successful individuals have implemented wise spending practices offers valuable insights into building wealth. Their experiences showcase how strategic spending, rather than simply saving every penny, can accelerate financial progress.

- Warren Buffett: Buffett’s legendary investment success isn’t solely about picking winning stocks. He has famously demonstrated the importance of long-term value investing, often prioritizing companies with strong fundamentals and consistent profitability. This strategy emphasizes careful analysis and a focus on long-term value creation, rather than chasing short-term gains, which exemplifies wise spending in the context of investment decisions.

- Bill Gates: While Gates’ initial success was undeniably tied to Microsoft, his subsequent ventures and investments have demonstrated a calculated approach to spending. He strategically allocated resources to philanthropic endeavors, venture capital, and other initiatives, consistently aiming to maximize the impact of his investments, demonstrating a strategic approach to both personal and societal impact.

- Jeff Bezos: Bezos’ approach to Amazon’s early days exemplified calculated risk-taking. He focused on building a strong foundation for long-term growth, investing heavily in infrastructure and technology, even when it meant foregoing immediate profits. His decision to prioritize long-term strategic investment over short-term gains exemplifies the importance of strategic spending to build a lasting company.

Case Studies of Successful Entrepreneurs Prioritizing Smart Spending

Entrepreneurs often face unique challenges in balancing growth with financial prudence. These case studies highlight how strategic spending can fuel entrepreneurial success.

- Airbnb: In its early stages, Airbnb focused on building a strong online platform and establishing trust among users, rather than immediately seeking maximum revenue. This strategic spending on platform development and community building created a foundation for exponential growth and widespread adoption, demonstrating the value of focused investment in building a robust platform and user experience.

- Tesla: Tesla’s early spending on research and development for electric vehicle technology, battery innovations, and charging infrastructure represented a significant investment in the future of the automotive industry. This focused approach to research and development, despite initial challenges, paid off handsomely, establishing Tesla as a leader in the electric vehicle market, highlighting the importance of strategically investing in groundbreaking technology.

Comparing and Contrasting Wealth-Building Approaches

A table comparing and contrasting different approaches to wealth building can offer a clear understanding of the potential outcomes of different spending strategies.

| Approach | Spending Strategy | Focus | Potential Outcomes |

|---|---|---|---|

| Value Investing | Prioritizing long-term value, focusing on companies with consistent profitability and strong fundamentals. | Long-term growth and sustainability | Steady returns over time, reduced risk compared to high-growth strategies. |

| Growth Investing | Investing in companies with high growth potential, often with higher risk. | Rapid expansion and substantial returns | Potential for significant returns, but also higher risk of loss. |

| Entrepreneurial Venture | Strategic investment in research, development, and infrastructure, focusing on long-term growth potential | Innovation and market disruption | Potential for high rewards, but with significant risk and uncertainty. |

Avoiding Common Spending Mistakes: Want To Make Your First Million Dont Save Every Penny You Should Spend Money Wisely Instead

Mastering wealth building isn’t just about saving; it’s about smart spending. Understanding common spending traps and developing strategies to avoid them is crucial for long-term financial health. This section delves into the pitfalls of impulsive purchases, the dangers of unchecked debt, and practical tips for maintaining financial discipline.

Identifying Spending Traps

Common spending traps often stem from a lack of awareness or poor budgeting habits. These traps can lead to unnecessary expenses, accumulating debt, and hindering financial progress. Understanding these patterns is the first step towards avoiding them.

Avoiding Impulsive Purchases

Impulse buys are a significant contributor to unnecessary spending. They often occur when emotions outweigh rational decision-making. Developing a plan for managing impulses can greatly reduce the frequency of these purchases. A crucial strategy is to create a “cooling-off period” before making significant purchases. This pause allows emotions to subside, enabling a more objective evaluation of the need for the item.

Consider the “5-second rule”: if you can wait five seconds before purchasing something, you’re likely making a more considered decision. This delay gives you time to assess the true value and necessity of the purchase.

Managing Debt

Uncontrolled debt can severely hamper financial progress. Debt management strategies are essential for avoiding financial strain and achieving financial freedom. Creating a budget that includes debt repayment is vital. Prioritize high-interest debts first and develop a consistent repayment plan. Understanding different debt management strategies, such as the debt snowball or avalanche methods, can help tailor a plan that suits individual circumstances.

Tips for Avoiding Overspending

Overspending is a common financial challenge that can lead to accumulating debt and limiting financial growth. Implementing these tips can significantly reduce overspending.

- Track Your Spending: Maintain a detailed record of all your expenses. This awareness helps identify areas where you might be overspending. A simple spreadsheet or budgeting app can help you visualize your spending patterns and make adjustments as needed.

- Set Realistic Budgets: Create a realistic budget that aligns with your income and expenses. A budget that is too restrictive can be demotivating, while one that is too lenient can lead to overspending. The budget should be tailored to your specific financial situation, considering your income, needs, and wants.

- Avoid Lifestyle Inflation: Be mindful of increasing your spending habits as your income grows. It’s crucial to avoid lifestyle inflation that can lead to an erosion of financial progress.

- Prioritize Needs Over Wants: Distinguish between essential needs and non-essential wants. Focus on meeting your essential needs first and then allocate resources for your wants.

- Negotiate and Shop Smart: Negotiate prices whenever possible and look for deals and discounts before making purchases. Compare prices across different stores or online retailers to find the best value.

Examples of Individuals Who Fell Victim to Common Spending Mistakes

Numerous individuals have faced financial setbacks due to impulsive purchases and poor spending habits. One example is a young professional who impulsively purchased a luxury car, quickly accumulating debt and hindering their ability to save for a down payment on a house. Another example is a family that overspent on entertainment, neglecting their retirement savings and future financial security.

These scenarios highlight the importance of conscious spending choices.

Building a Strong Financial Foundation

Laying a solid financial foundation is crucial for achieving long-term financial security and wealth. It’s not just about accumulating money; it’s about understanding how money works for you and developing smart habits that will serve you well throughout your life. This foundation forms the bedrock upon which future wealth-building strategies can be constructed. A strong foundation encompasses not only savings and investments but also a deep understanding of personal finances and financial literacy.

Understanding Personal Finances

Financial literacy is paramount to building a strong financial foundation. It involves knowing how to manage your income, track your expenses, understand different financial products, and make informed financial decisions. A strong grasp of your personal finances allows you to anticipate potential financial challenges and develop proactive solutions. This includes creating a realistic budget, understanding your net worth, and knowing your financial goals.

Without this knowledge, your financial future may be vulnerable to unforeseen circumstances.

Developing Financial Literacy

Developing financial literacy is a continuous process. It involves learning about budgeting, saving, investing, and debt management. Numerous resources are available to help you develop your financial literacy, including books, websites, and educational courses. The more you learn, the better equipped you are to navigate the complexities of the financial world. This will enable you to make sound financial decisions, minimizing risk and maximizing returns.

Creating a Long-Term Financial Plan

A long-term financial plan is a roadmap that Artikels your financial goals and the strategies you will use to achieve them. This plan should consider your current financial situation, your future goals, and the potential risks you may face. It should be regularly reviewed and updated to reflect changes in your life and financial circumstances. The key is to be adaptable and adjust your plan as needed.

Key Steps in Building a Solid Financial Foundation

| Step | Action | Importance |

|---|---|---|

| 1 | Assess your current financial situation. This includes evaluating your income, expenses, assets, and debts. | Understanding your starting point is critical for developing a realistic and effective plan. |

| 2 | Set clear financial goals. Define your short-term and long-term objectives, such as saving for a down payment on a house, paying off debt, or retiring comfortably. | Having specific goals provides direction and motivation for your financial journey. |

| 3 | Develop a budget and track your expenses. A budget helps you allocate your income effectively and identify areas where you can save money. | A budget is a crucial tool for managing your finances and ensuring you’re on track towards your goals. |

| 4 | Create an emergency fund. Having a safety net for unexpected expenses is essential for financial stability. | An emergency fund provides a cushion against unforeseen events and protects you from financial hardship. |

| 5 | Prioritize debt repayment. High-interest debt should be tackled aggressively. | Reducing debt frees up resources for savings and investments. |

| 6 | Start saving and investing. Even small amounts saved regularly can accumulate significantly over time. | Savings and investments are crucial for building wealth and achieving long-term financial goals. |

| 7 | Seek professional advice. Consult with a financial advisor for personalized guidance. | Professional advice can help you develop a tailored financial plan that aligns with your specific needs and goals. |

| 8 | Review and adjust your plan regularly. Your financial circumstances and goals may change over time. | Regular reviews ensure your plan remains relevant and effective. |

The Psychology of Spending and Saving

Beyond the practical aspects of budgeting and investment strategies, understanding the psychological underpinnings of spending and saving is crucial for long-term financial success. Our emotions, biases, and ingrained habits significantly influence our choices. This understanding allows us to proactively address potential pitfalls and build a more resilient financial foundation.

Understanding Your Spending Habits

Recognizing your spending patterns is the first step toward modifying them. This involves meticulous tracking of your expenses, not just the totals, but the

-why* behind each purchase. Are you driven by impulse, stress, or a desire for social acceptance? Detailed records provide a clearer picture of your spending triggers and motivations. Regular review of this data will highlight recurring themes and patterns, revealing unconscious spending habits.

Reframing Your Mindset

Changing your relationship with money is a key aspect of achieving financial freedom. This often involves reframing your perspective on spending and saving. Instead of viewing money as a finite resource to be hoarded, consider it a tool for achieving goals and experiences. This shift in mindset allows for a more flexible and strategic approach to both saving and spending.

This approach enables a greater understanding of how your values and aspirations directly relate to your spending decisions.

Overcoming Psychological Barriers

Several psychological barriers can hinder wise spending habits. These include impulsive buying, the fear of missing out (FOMO), and the desire for instant gratification. Identifying these barriers is the first step in overcoming them. Developing strategies to manage these impulses, such as delaying gratification, setting clear spending limits, and seeking alternative sources of satisfaction, will pave the way for long-term financial well-being.

Creating a plan for dealing with these issues is vital in achieving long-term financial success.

Common Psychological Triggers

Recognizing the psychological triggers behind spending can significantly improve your ability to manage your finances. By understanding the emotional motivations behind your purchases, you can proactively address these triggers and make more conscious choices. This approach leads to a greater sense of control over your spending habits.

| Psychological Trigger | Description | Examples |

|---|---|---|

| Impulse Buying | Sudden, unplanned purchases driven by immediate desires or emotions. | Buying a new gadget after seeing an advertisement, purchasing clothing on a whim. |

| Fear of Missing Out (FOMO) | The anxiety of missing out on experiences or possessions, leading to unnecessary spending. | Attending an event solely to avoid missing out, buying something because others have it. |

| Social Comparison | Comparing one’s spending to others, leading to a feeling of inadequacy or pressure to keep up. | Buying expensive items to impress others, feeling compelled to spend to maintain a social standing. |

| Stress Relief Spending | Using purchases to alleviate stress or negative emotions. | Shopping for comfort after a stressful day, buying something to soothe anxiety. |

| Instant Gratification | Prioritizing immediate satisfaction over long-term goals. | Buying a meal instead of cooking, opting for a quick reward instead of saving. |

Ending Remarks

In conclusion, building wealth is a multifaceted process that goes beyond simple saving. It’s about understanding the psychology behind spending and saving, recognizing the value of investments, and learning from real-world examples of successful wealth builders. By adopting a strategic approach to spending, you can pave the way for financial freedom and create a strong financial foundation for the future.

Remember, wise spending is an active process of continuous learning and adaptation.