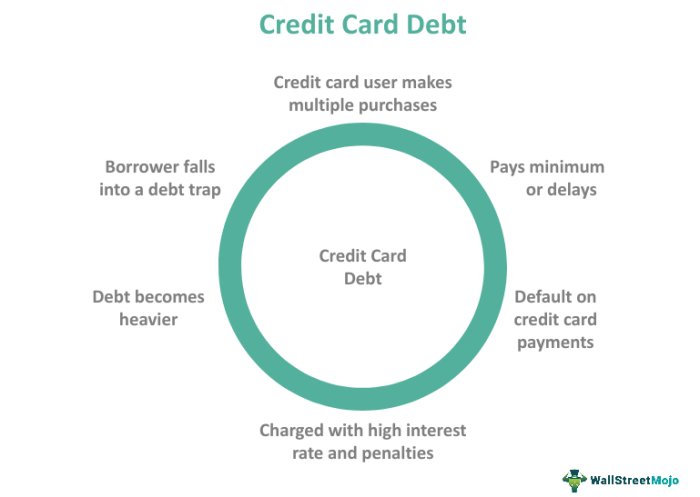

This how credit cards are manipulating you into more debt. Credit cards, seemingly convenient tools for modern living, often become instruments of financial enslavement. Hidden fees, deceptive interest rates, and manipulative minimum payment schemes are just some of the ways credit card companies encourage you to spend beyond your means, trapping you in a cycle of debt. This exploration dives deep into the intricate strategies employed by credit card providers, exposing the often-hidden costs and psychological triggers that fuel the debt trap.

The article meticulously examines the various tactics used by credit card companies, from hidden fees and interest rate manipulation to the subtle psychological pressures exerted through reward programs and promotional offers. It explores the complex interplay of financial engineering and consumer psychology that drives this insidious debt accumulation. By understanding these strategies, you can gain the power to protect yourself from these predatory practices.

Hidden Fees and Charges

Credit cards, while offering convenience, can often be a source of hidden financial pitfalls. Understanding the various fees associated with credit card use is crucial for responsible spending and avoiding unnecessary debt. This section delves into the intricacies of these fees, examining their impact, how they are often obscured, and how consumers can better navigate this complex landscape.

Common Types of Hidden Fees

Understanding the different types of hidden fees is the first step towards avoiding their impact on your finances. These fees can significantly impact your overall spending and budget.

- Annual Fees: These fees are charged annually for the privilege of using the card. While some cards offer substantial rewards, many offer minimal or no benefits to offset the annual cost. Annual fees can quickly add up, especially if you hold multiple cards.

- Balance Transfer Fees: These fees are charged when you transfer a balance from another credit card to the new card. Be wary of high balance transfer fees as they can significantly increase your overall debt burden.

- Foreign Transaction Fees: These fees are charged when you use your credit card in a foreign country. These fees can add up quickly, particularly for extensive international travel or frequent transactions.

- Cash Advance Fees: Fees charged when you use your credit card to obtain cash. Cash advances typically come with higher interest rates and significant fees, often making them a less favorable option compared to other financial instruments.

- Late Payment Fees: These fees are charged when you fail to make your minimum payment by the due date. Consistent late payments can severely damage your credit score and increase your debt burden.

- Over-the-Limit Fees: Fees charged if your credit card spending exceeds your credit limit.

- Returned Payment Fees: Fees incurred when a payment you initiate is declined by the recipient.

Methods of Obscuring Fees

Credit card companies often employ various tactics to conceal these fees within the fine print of their agreements. This can make it difficult for consumers to fully understand the financial implications of using a particular card.

- Tiny Print: Fees are often buried deep within lengthy terms and conditions documents, making them nearly impossible to locate without significant effort. This tactic relies on the assumption that most consumers will not meticulously review every detail.

- Jargon-Heavy Language: Using complex financial terminology to describe fees can obfuscate their true meaning and make them seem less impactful.

- Abstract Explanations: Fees are sometimes explained in ways that fail to directly state the financial cost. Instead of providing a numerical value, the explanation might focus on a vague concept, making the true cost unclear.

- Bundled Fees: Sometimes, fees are grouped together with other charges or benefits, making them harder to isolate and understand in isolation.

Comparing Credit Card Provider Fee Structures

Transparency in fee structures varies significantly between different credit card providers. This comparison table highlights the difference in transparency and clarity.

| Provider | Annual Fee | Balance Transfer Fee | Foreign Transaction Fee | Transparency Rating |

|---|---|---|---|---|

| Provider A | $50 | 3% of transfer amount | 3% | Average |

| Provider B | $0 | 2% of transfer amount | 2% | Good |

| Provider C | $75 | 4% of transfer amount | 3.5% | Poor |

Deceptive Language in Credit Card Terms

Some credit card companies use language that can mislead consumers about the true cost of fees. These examples highlight the importance of careful scrutiny.

- “Low introductory APR”

-This phrasing might suggest favorable interest rates, but the true rate might be significantly higher after the introductory period. - “No annual fee for the first year”

-This phrasing creates a deceptive illusion of cost-effectiveness while hiding the potential for future annual charges. - “Rewards program”

-While the rewards are beneficial, the phrasing often fails to mention the corresponding fees or hidden costs associated with accumulating these rewards.

Potential Financial Impact of Fees

The financial impact of various fees over a 5-year period can be substantial. This table demonstrates the potential cumulative effect.

| Fee Type | Example Amount (per transaction/year) | Estimated 5-Year Impact |

|---|---|---|

| Annual Fee | $50 | $250 |

| Balance Transfer Fee | $100 | $500-$1000 (depending on amount transferred and fee percentage) |

| Foreign Transaction Fee | $10 | $50-$100 (depending on frequency of transactions) |

Interest Rates and APRs

Credit cards, while offering convenience, often hide complex interest rate structures that can quickly lead to significant debt. Understanding these rates and how they compound is crucial for responsible credit card usage. Knowing the different types of interest rates, how compounding works, and how creditworthiness affects rates is vital for making informed financial decisions.Interest rates, and their associated Annual Percentage Rates (APRs), are the heart of credit card debt.

They determine the cost of borrowing money and significantly impact how quickly your debt grows. A deeper understanding of these rates is key to avoiding costly financial traps.

Different Types of Interest Rates

Credit cards employ various interest rate structures. The most common are:

- Variable Interest Rates: These rates fluctuate based on market conditions and the credit card issuer’s benchmark rates. Changes can result in higher or lower monthly payments, making budgeting challenging. These rates are often tied to prime lending rates or other economic indicators.

- Fixed Interest Rates: These rates remain constant for the duration of the credit card agreement. While predictable, they may not always be the most favorable, especially during periods of fluctuating market conditions.

- Introductory APRs: These are often promotional rates offered for a limited time to attract new customers. Once the introductory period ends, the standard APR applies, potentially resulting in a significant increase in monthly payments.

Understanding these variations is crucial to comparing offers and choosing a credit card that aligns with your financial goals.

How Compound Interest Works with Credit Card Debt

Compound interest is the interest calculated not only on the initial principal but also on the accumulated interest from previous periods. This snowball effect can quickly escalate credit card debt.

Example: If you carry a balance of $1,000 on a credit card with a 15% APR, the interest charged in the first month might be $12.50. However, in subsequent months, the interest is calculated on the principal plus the accumulated interest from prior months, leading to an exponentially increasing debt burden.

The formula for calculating compound interest is:A = P(1 + r/n)^(nt)Where:A = the future value of the investment/loan, including interestP = the principal investment amount (the initial deposit or loan amount)r = the annual interest rate (decimal)n = the number of times that interest is compounded per yeart = the number of years the money is invested or borrowed for

Comparing Interest Rates by Creditworthiness

Credit card issuers often tailor interest rates based on an applicant’s creditworthiness.

| Creditworthiness Level | Typical Interest Rate Range |

|---|---|

| Excellent | 8-15% |

| Good | 12-18% |

| Fair | 15-25% |

| Poor | 20%+ |

Individuals with stronger credit histories generally qualify for lower interest rates, enabling more manageable monthly payments. This reflects the risk assessment made by credit card companies.

Strategies to Maximize Interest Rates

Credit card companies employ various strategies to maximize interest rates:

- Targeting high-risk applicants: Issuers often set higher rates for individuals with a less favorable credit history.

- Introductory rates as bait: Temporary low rates are used to attract new customers, but these often revert to much higher standard rates.

- Fees for exceeding credit limits: High interest rates may be applied to purchases exceeding credit limits, encouraging customers to stick within the prescribed limits.

Understanding these strategies helps consumers avoid becoming victims of predatory lending practices.

Interest Rates and Minimum Payments

Minimum payments are often a significant contributor to snowballing credit card debt.

Credit card companies are masters at subtly encouraging spending. They use enticing rewards programs and seemingly low interest rates to hook you, but often the fine print reveals hidden fees and high APRs. Learning to manage your finances effectively is crucial, and understanding these manipulative tactics is a key first step. Luckily, if you’re struggling to recall essential language skills, you can find 5 essential steps learn language you’ve forgotten at this link: 5 essential steps learn language you’ve forgotten.

This self-improvement can translate to better money management, and ultimately, breaking free from the cycle of credit card debt.

- Minimum payments typically cover only the interest: This means the principal balance remains largely unchanged, and the debt grows due to compounding interest.

- High interest rates amplify the problem: The higher the interest rate, the more quickly the debt grows, and the longer it takes to pay off the principal balance.

Consumers should aim to pay more than the minimum payment to effectively manage their credit card debt.

Examples of Varying Interest Rates Affecting Repayment Timelines

Different interest rates significantly impact debt repayment timelines.

- Scenario 1: A credit card with a 10% interest rate and a $1,000 balance will take approximately 10-12 months to pay off if the minimum payment is exceeded.

- Scenario 2: A similar $1,000 balance but with a 20% interest rate could take significantly longer, possibly 20 months or more.

These examples demonstrate how crucial it is to prioritize reducing the principal balance and managing interest payments effectively.

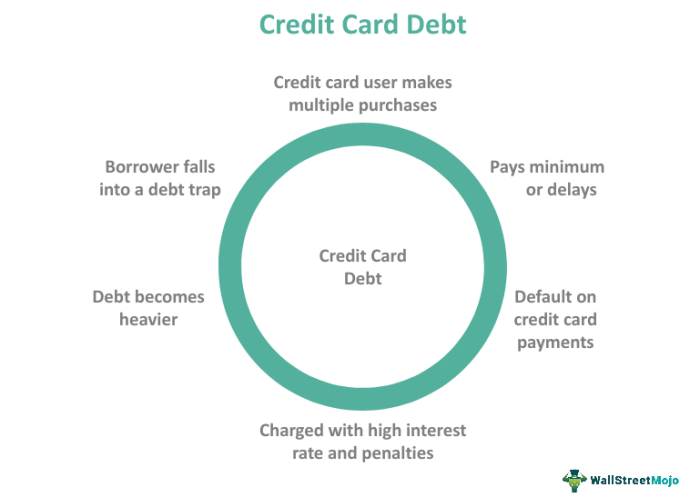

Minimum Payment Schemes

Credit card companies employ minimum payment schemes to lure consumers into a cycle of debt. Understanding how these schemes work is crucial for avoiding financial pitfalls. These schemes often seem harmless, but they can be insidious tools for accumulating interest and maximizing profits. The seemingly small minimum payments can mask the true cost of borrowing and lead to a significant accumulation of debt over time.Minimum payment calculations are often based on a percentage of the outstanding balance, which is often the most deceptive method.

This percentage is usually set by the card issuer and varies across different cards. The calculation often ignores the accruing interest, which is where the real danger lies.

Common Minimum Payment Calculation Methods

Minimum payments are calculated using a variety of methods, each designed to appear fair but often leaving consumers trapped in a debt cycle. A common method is a percentage of the outstanding balance. Another calculation method might factor in both principal and interest. Some cards may base minimum payments on a specific dollar amount, which, while appearing fixed, can be deceiving.

How Minimum Payments Trap Consumers in Debt

Minimum payments are structured to be just enough to avoid immediate penalties, but not enough to pay down the principal quickly. The result is a slow but steady accumulation of interest charges. Over time, this interest compounds, increasing the total debt exponentially. Consumers often get lulled into a false sense of security, paying off the minimum each month while their balance grows relentlessly.

Strategies Credit Card Companies Use to Keep Minimum Payments Low

Credit card companies employ various strategies to keep minimum payments low. One common tactic is to set a low percentage of the outstanding balance as the minimum payment, making it seem affordable. By focusing on a small percentage rather than the full amount owed, they conceal the true cost of borrowing. Another strategy is to make the minimum payment calculation complicated, potentially misleading consumers about the true impact of their payments.

Effect of Minimum Payments on Total Debt Over Time

The following table illustrates the impact of minimum payments on total debt over a specific timeframe, assuming an initial balance of $1000, an interest rate of 18%, and various minimum payment percentages. Note that these figures are illustrative and can vary based on specific card terms and conditions.

| Month | Balance (Minimum Payment 5%) | Balance (Minimum Payment 10%) | Balance (Minimum Payment 15%) |

|---|---|---|---|

| 1 | $1000 | $1000 | $1000 |

| 2 | $1009.00 | $1004.50 | $1001.00 |

| 3 | $1018.00 | $1009.50 | $1005.00 |

| … | … | … | … |

| 12 | $1198.50 | $1090.20 | $1040.70 |

| 24 | $1530.50 | $1325.00 | $1200.50 |

| 36 | $2005.50 | $1725.00 | $1520.50 |

Comparison of Different Minimum Payment Structures

Different credit cards offer varying minimum payment structures. Some cards base their minimum payment on a fixed percentage, while others may offer tiered percentages depending on the balance. Some cards might use a more complex formula that combines principal and interest. Comparing the terms and conditions of different cards is crucial for making informed decisions. Always read the fine print to understand the specific calculations and potential implications.

Examples of Minimum Payment Scenarios Leading to Different Debt Accumulation Outcomes

A consumer with a $5000 balance paying a 5% minimum payment will see their balance rise considerably faster than a consumer with the same balance paying a 15% minimum payment. The longer the consumer waits, the more their debt will accrue.

A consumer with a high-interest card might see their debt accumulate rapidly even with a 15% minimum payment.

Rewards Programs and Incentives

Credit card companies often use alluring reward programs to entice consumers into racking up debt. These programs, while seemingly beneficial, often mask the true cost of borrowing, leading to a cycle of overspending and accumulating debt that’s harder to escape than anticipated. The perceived value of rewards is frequently outweighed by the interest accrued on the outstanding balance, ultimately making the rewards less attractive and more detrimental to your financial health.Reward programs are meticulously designed to encourage spending.

Credit card companies are masters at making you feel like you need more, even when you don’t. It’s a clever system, really, and it’s not unlike some of the anxieties surrounding pregnancy, like those detailed in this insightful article on top fears about giving birth and why you shouldnt worry too much. The constant barrage of rewards and enticing offers can be overwhelming, leading to impulsive spending and, unfortunately, a cycle of debt.

It’s important to be aware of these tactics so you can manage your finances effectively and avoid falling prey to these manipulative strategies.

The promise of free flights, hotel stays, or gift cards acts as a powerful motivator, often overshadowing the associated interest rates and fees. This psychological manipulation is a key factor in how these programs can lead to detrimental spending habits.

How Reward Programs Encourage Spending

Reward programs are often structured to encourage spending beyond your means. Points or miles are awarded based on spending, creating a direct incentive to make purchases. This encourages a mindset of “earning” rewards rather than considering the actual cost of the purchase. The allure of accumulating rewards can lead to impulsive purchases that wouldn’t otherwise be made.

Examples of Excessive Spending

Many credit card reward programs offer bonus points for specific categories of spending, such as travel, dining, or groceries. This can incentivize customers to make unnecessary purchases within these categories simply to accumulate points. For example, a customer might choose a more expensive restaurant meal than they normally would to earn more points, even if the cost isn’t justified by their needs or budget.

Another example is purchasing a costly piece of technology or an item they don’t really need to meet a spending threshold for a bonus reward period.

Perceived Value vs. Interest Accrued

The perceived value of rewards is often a mirage compared to the true cost of borrowing. A customer might be lured into a higher balance by the promise of a free flight or a substantial discount. However, the interest accrued on that higher balance often outweighs the value of the reward. The reward is essentially a small piece of the pie, while the interest charges are the majority of the pie.

Masking the True Cost of Borrowing

Reward programs often mask the true cost of borrowing by focusing on the potential benefits, rather than the associated interest rates and fees. This subtle manipulation can lead customers to overlook the long-term financial consequences of using credit cards. By making the reward program the primary focus, the company avoids highlighting the significant cost of interest and potential penalties for late payments.

Psychological Impact on Consumer Behavior

Reward programs leverage psychological principles to influence consumer behavior. The feeling of progress as you accumulate points or miles, the excitement of potential rewards, and the desire to avoid missing out on promotions can all lead to excessive spending. The psychology of rewards is designed to create a cycle of spending and earning, potentially leading to an uncontrollable cycle of debt.

Credit cards are designed to make you spend more than you earn. They subtly trick you into thinking you can afford things you can’t, often by offering tempting rewards programs. To combat this, you need a strong financial plan, and that includes looking for ways to increase your income. A solid job search strategy, like the best job search strategy that goes beyond an incredible cover letter , can help you land a higher-paying role, which in turn can help you better manage your credit card debt.

Ultimately, understanding how these cards work and developing smart financial habits is key to avoiding the debt trap.

Reward Programs and Higher Debt Accumulation

Reward programs, when not managed responsibly, can significantly contribute to higher debt accumulation. The incentive to spend to earn rewards can lead to a cycle of borrowing and repayment, where the interest charges outweigh the perceived value of the rewards. The focus on earning rewards often overshadows the actual financial cost of the purchases, leading to a dangerous and ultimately costly financial cycle.

Promotional Offers and Balance Transfers

Credit card companies often use enticing promotional offers to lure consumers into taking on debt. These offers, while seemingly beneficial, often come with hidden costs and can trap individuals in a cycle of debt if not approached with extreme caution. Understanding the tactics behind these promotions is crucial for responsible financial management.Promotional offers, such as low introductory interest rates or balance transfer deals, are designed to attract customers and encourage spending.

These tempting offers can often mask the true cost of borrowing and lead to significant financial strain if not managed effectively. Understanding the hidden fees and terms is paramount to avoid getting caught in a debt trap.

Promotional Offer Tactics

Promotional offers are carefully crafted to appeal to consumers’ desire for immediate gratification and financial relief. These tactics include highlighting low introductory APRs, emphasizing balance transfer benefits, and offering enticing rewards programs. Understanding these tactics is vital to discerning genuine value from deceptive marketing ploys.

Hidden Costs of Balance Transfers

Balance transfer offers, while appearing attractive, often come with significant hidden costs. These include balance transfer fees, which can be a percentage of the transferred balance or a fixed amount, and potentially high post-promotional interest rates. The fine print often hides these costs, making it easy to overlook the true expense.

Deceptive Balance Transfer Examples

Many balance transfer offers can be deceptive. A common example involves a promotional period with a very low interest rate, but that rate jumps dramatically after a set period. Consumers may be lured into transferring a significant balance believing they’re saving money, only to find themselves paying substantially more in interest over time. Furthermore, balance transfer fees, often not prominently displayed, can erode the initial savings.

Encouraging Spending During Promotional Periods

Promotional periods are meticulously designed to encourage spending. The low interest rates and balance transfer deals create an illusion of affordability, prompting consumers to accumulate debt quickly. The enticing offers often obscure the fact that the overall cost of the debt will increase dramatically if the balance isn’t paid off during the promotional period.

Comparison of Balance Transfer Offers

Comparing different balance transfer offers from various card providers is essential for making informed decisions. Compare not only the introductory APR but also the balance transfer fee, the length of the promotional period, and the post-promotional APR. Use a spreadsheet or a comparison website to organize the data. Consider your current spending habits and how long it might take you to pay off the balance.

Successful Balance Transfer Strategies and Implications

Successful balance transfer strategies hinge on meticulous planning and a clear understanding of the terms and conditions. A key strategy is to pay off the balance completely during the promotional period. A balance transfer can be a viable solution if you can pay off the debt quickly and avoid accumulating additional charges. However, a poorly executed strategy can lead to increased debt and financial difficulties.

Spending Habits and Psychology

Credit cards aren’t just tools for making purchases; they’re meticulously designed instruments that leverage psychological principles to encourage spending. Understanding these tactics is crucial for responsible financial management, enabling individuals to recognize and resist manipulative techniques. The allure of rewards, the subtle cues of design, and the intricate workings of our own minds all contribute to the often-unintentional accumulation of debt.The psychological factors influencing consumer spending habits are complex and multifaceted, ranging from our innate desire for rewards to our tendency to prioritize immediate gratification.

Marketing strategies play a significant role in shaping these habits, using persuasive techniques to create a strong desire for products and services. Credit card companies employ sophisticated strategies to capitalize on these vulnerabilities, often leading to overspending and a cycle of debt.

Psychological Factors Influencing Spending

Our brains are wired to seek pleasure and avoid pain. Credit card companies capitalize on this by designing systems that create positive reinforcement loops. This can involve reward programs that offer tangible benefits for spending, or subtle design cues that trigger impulsive purchases. The anticipation of rewards, the ease of making purchases, and the perceived value of goods can all influence spending behavior.

Furthermore, the availability of credit can make us more likely to spend beyond our means.

Role of Marketing and Advertising

Marketing and advertising campaigns are strategically crafted to appeal to our emotions and desires. These campaigns often highlight the perceived status, desirability, or usefulness of products and services. By associating these items with positive emotions and experiences, the marketing creates a psychological pull that encourages purchasing. A key component is the use of aspirational imagery, highlighting lifestyles that consumers strive to achieve, further fueling the desire to acquire the products advertised.

Credit Card Design and Impulse Purchases

The design and user interface of credit cards are carefully crafted to influence spending habits. Features like clear, visible rewards programs, intuitive navigation, and prominent purchase buttons can make it easier to make impulsive purchases. The subtle cues in the design, like the color scheme and layout, can subconsciously influence decisions. For example, a card with a bright, eye-catching design might be more likely to attract attention and encourage spending compared to a neutral-colored card.

Mental Accounting and Credit Card Use

“Mental accounting” is the cognitive process by which individuals categorize their money for different purposes. With credit cards, the perception of “free” money from credit lines can lead to the creation of a separate mental account. This detachment from actual cash flow can make it easier to overspend. The perceived lack of a direct cost can significantly influence spending decisions, leading to a disconnection between spending and the actual value of the money being used.

Targeting Specific Consumer Segments

Credit card companies employ sophisticated marketing strategies to target specific consumer segments based on factors such as age, income, and lifestyle. For example, young adults might be targeted with cards offering high reward rates on entertainment and travel, while families with children might be attracted to cards offering cashback rewards for everyday purchases. These targeted strategies increase the likelihood that consumers will select cards tailored to their spending patterns and preferences.

Leveraging Psychological Principles to Increase Spending

Credit card companies leverage a variety of psychological principles to increase spending. These include the anchoring effect (where a suggested price influences spending decisions), the framing effect (where the presentation of information impacts perception), and the loss aversion bias (where the fear of losing something influences decisions). These strategies can create a powerful incentive to spend beyond one’s means.

For example, a promotional offer that highlights the potential loss of rewards if a balance isn’t paid within a certain timeframe can exploit the loss aversion bias.

Alternatives to Credit Cards: This How Credit Cards Are Manipulating You Into More Debt

Credit cards, while convenient, often lead to a cycle of debt. Understanding viable alternatives can empower you to make smarter financial choices, fostering financial stability and reducing the risk of accumulating unnecessary debt. These alternatives often prioritize responsible spending and budgeting, aligning with long-term financial goals.

Alternative Payment Methods

A variety of payment methods exist beyond credit cards, each with unique advantages and disadvantages. These methods promote responsible spending and encourage a focus on budgeting and saving.

- Cash: Using cash necessitates a direct correlation between spending and available funds. This tangible representation of your money fosters a greater awareness of your expenses, discouraging impulse purchases and promoting conscious spending habits. The immediate nature of cash transactions often leads to a more deliberate approach to budgeting.

- Debit Cards: Debit cards directly link your checking account to your spending. Transactions are debited from your account in real-time, limiting spending to your available balance. This feature prevents overspending and encourages careful monitoring of your financial resources. The absence of interest charges is a key advantage.

- Prepaid Cards: Prepaid cards function like debit cards, but you load a specific amount of money onto the card before using it. These cards offer a degree of control over spending, preventing overdraft fees. They can be useful for budgeting and tracking spending, particularly for those who struggle with overspending.

- Check Payments: Checks remain a viable option for transactions, particularly for larger purchases or those requiring a physical record of the payment. They provide a record of the transaction and offer a level of security against unauthorized use, though they are not as convenient as electronic payment methods.

- Digital Wallets: Digital wallets, such as Apple Pay and Google Pay, allow you to store payment information securely on your smartphone or other mobile device. They facilitate quick and convenient transactions, reducing the need for physical cash or cards. They can offer rewards and loyalty programs, and many support contactless payments.

Advantages of Alternative Methods, This how credit cards are manipulating you into more debt

Using alternative payment methods often promotes better financial discipline. These methods inherently limit spending to available funds, encouraging a more conscious approach to budgeting and reducing the risk of accumulating debt.

- Reduced Risk of Debt: By eliminating the ability to spend beyond your available funds, these methods drastically reduce the risk of accumulating credit card debt. The direct correlation between spending and available resources encourages mindful financial choices.

- Improved Budgeting: These methods necessitate a more active approach to budgeting, as you are constantly aware of your spending limits. This heightened awareness of expenses helps you to allocate funds effectively and prioritize financial needs.

- Enhanced Financial Stability: By avoiding the temptation of credit card debt, alternative payment methods promote a stronger foundation for long-term financial stability. These methods encourage saving and investing, leading to a more secure financial future.

Credit Cards vs. Alternative Methods: A Comparative Analysis

| Feature | Credit Cards | Alternative Methods |

|---|---|---|

| Debt Potential | High; interest charges and minimum payments can lead to accumulating debt. | Low; spending is limited to available funds. |

| Spending Control | Limited; can easily overspend. | High; spending is directly tied to available resources. |

| Interest Charges | Potentially high; interest rates can accumulate significant costs. | No interest charges (except for certain prepaid cards). |

| Convenience | High; widely accepted and convenient for everyday transactions. | Variable; depends on the method chosen. |

| Financial Discipline | Can be detrimental if not managed responsibly. | Promotes responsible spending and budgeting. |

Long-Term Financial Benefits

Avoiding credit card debt through alternative payment methods can lead to significant long-term financial benefits. These benefits include improved budgeting skills, reduced stress, and a more secure financial future.

- Stronger Financial Habits: Adopting alternative payment methods fosters the development of stronger financial habits, which are essential for long-term financial stability.

- Reduced Financial Stress: The absence of credit card debt and associated interest charges significantly reduces financial stress and promotes a greater sense of control over your finances.

- Increased Savings Potential: By limiting spending and focusing on budgeting, alternative methods can increase savings potential, allowing you to achieve your financial goals more efficiently.

Last Point

In conclusion, this how credit cards are manipulating you into more debt is a crucial discussion. By understanding the tactics employed by credit card companies, you can take control of your finances and avoid the pitfalls of accumulating unnecessary debt. The exploration of alternative payment methods and the importance of mindful spending habits are also highlighted. Ultimately, this knowledge empowers you to make informed decisions about your financial well-being and break free from the cycle of credit card debt.