Simple tips to manage spending as a young professional is crucial for financial well-being. This guide provides practical strategies for budgeting, tracking expenses, saving, and investing, empowering you to build a strong financial foundation. From basic budgeting methods to smart shopping habits and debt management, we’ll cover everything you need to know to take control of your finances and achieve your financial goals.

Understanding your income and expenses is the first step. Categorizing these effectively will reveal spending patterns and highlight areas for potential savings. Learn about different expense tracking methods and apps, and discover common pitfalls young professionals face when managing their money.

Budgeting Basics

Managing your finances effectively as a young professional is crucial for achieving your goals and building a secure future. A well-structured budget acts as a roadmap, helping you track your income and expenses, identify areas for improvement, and ultimately, achieve financial freedom. This section will delve into the fundamentals of budgeting, offering practical strategies and tools to empower you.

Simple Budgeting Method

A straightforward budgeting method involves tracking all your income and expenses. This allows you to understand where your money is going and identify areas where you can save or cut back. It’s a continuous process that needs consistent monitoring and adjustments.

Categorizing Income and Expenses

Accurate categorization of income and expenses is key to effective budgeting. Income should be categorized by source (salary, side hustle, investments). Expenses should be grouped into meaningful categories like housing, food, transportation, entertainment, and debt repayment. This detailed breakdown allows for a clearer picture of spending patterns.

Sample Budget Template

| Category | Actual | Budget | Difference |

|---|---|---|---|

| Housing | $1,000 | $1,000 | $0 |

| Food | $300 | $250 | +$50 |

| Transportation | $150 | $150 | $0 |

| Entertainment | $100 | $100 | $0 |

| Debt Repayment | $200 | $200 | $0 |

| Savings | $100 | $150 | -$50 |

| Other | $50 | $50 | $0 |

| Total | $1,900 | $1,900 | $0 |

This template provides a basic framework. You can customize it by adding or removing categories based on your specific needs and spending habits. The “Difference” column helps to quickly identify areas where spending is exceeding or falling short of the budget.

Common Budgeting Mistakes

Young professionals often encounter pitfalls when budgeting. One common error is failing to account for unexpected expenses, like car repairs or medical bills. Another is underestimating their spending on non-essential items. A third common mistake is neglecting to adjust the budget periodically as circumstances change.

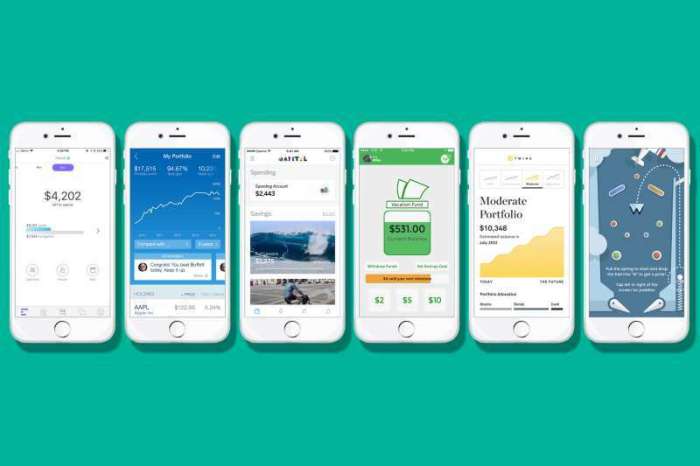

Free Budgeting Tools and Apps

Several free tools and apps can simplify the budgeting process. Mint, Personal Capital, and YNAB (You Need a Budget) offer various features to track income and expenses, set budgets, and generate reports. These tools can automate much of the process, providing insights into spending patterns and helping to make informed financial decisions.

Expense Tracking Strategies

Knowing where your money goes is crucial for effective budgeting. Tracking expenses allows you to identify spending patterns, pinpoint areas for potential savings, and ultimately achieve your financial goals. This understanding empowers you to make informed decisions and avoid costly mistakes. A robust expense tracking system is a powerful tool for financial success.Expense tracking goes beyond simply noting what you spend.

It’s about understandingwhy* you spend and whether those expenditures align with your priorities and values. This deep dive into your spending habits gives you the insights necessary to adjust your financial strategies and achieve greater financial stability.

Expense Tracking Methods

Different methods cater to various preferences and needs. Manual records, while time-consuming, offer a tangible record of your spending. Spreadsheets provide more structure and allow for calculations and analysis. Apps offer automation and often integrate with banking accounts for streamlined data input. Choosing the right method depends on your comfort level and the level of detail you require.

Manual Records

Maintaining a physical log of expenses, whether in a notebook or on a dedicated sheet of paper, provides a tangible record of transactions. This method fosters a deeper connection with your spending as you meticulously document each purchase. This approach is particularly helpful for individuals who prefer a hands-on approach to budgeting and expense tracking.

Spreadsheets

Spreadsheets offer a more structured and organized approach to expense tracking. Using spreadsheet software like Google Sheets or Microsoft Excel allows for the creation of detailed expense categories and formulas for calculating totals and averages. You can tailor the spreadsheet to your specific needs and create visual representations of your spending patterns. The benefit is the ability to sort, filter, and analyze your data to uncover spending trends.

Expense Tracking Apps

Numerous apps are designed for expense tracking, offering various features to enhance the process. Some apps connect directly to your bank accounts, automatically importing transactions for easy categorization. Many offer budgeting tools, allowing you to set financial goals and track progress towards them. Features like expense categorization, visual reports, and alerts can streamline your spending management.

Comparing Expense Tracking Apps

Different apps offer varying functionalities and user experiences. Some popular apps include Mint, YNAB (You Need a Budget), and Personal Capital. Mint provides a basic overview of your spending, while YNAB focuses on budgeting principles. Personal Capital is more suitable for investors looking for comprehensive financial insights. Consider factors like ease of use, features, and cost when selecting an app.

Identifying Unnecessary Expenses

Regularly reviewing your expense tracking data reveals unnecessary spending habits. Analyzing receipts, bank statements, and online records helps you identify areas where you can cut back without sacrificing essential needs. For example, you may find that you spend a significant portion of your income on entertainment, but aren’t truly enjoying these activities. A mindful analysis of these patterns will illuminate areas for potential savings.

Spending Traps for Young Professionals

Young professionals often face unique spending traps, including impulsive purchases, subscription fatigue, and social pressure to keep up with peers. Impulsive spending can be mitigated by implementing a waiting period before making significant purchases. Subscription fatigue can be addressed by regularly reviewing and canceling unnecessary subscriptions. Social pressure can be managed by setting financial boundaries and prioritizing your own needs.

Expense Category Savings

| Expense Category | Potential Savings |

|---|---|

| Dining Out | Cook more meals at home, use meal prepping techniques, opt for cheaper dining options. |

| Entertainment | Prioritize free or low-cost activities, consider group discounts, explore local events. |

| Transportation | Utilize public transportation, carpool, or consider alternative transportation options. |

| Subscriptions | Cancel unused subscriptions, negotiate better deals. |

| Shopping | Plan your purchases, stick to a budget, compare prices, shop sales. |

Saving and Investing for the Future

Saving and investing are crucial for young professionals, allowing you to build wealth, achieve financial goals, and secure your future. This phase of life is often characterized by high earning potential and relatively low financial obligations, making it an ideal time to establish strong financial habits. Understanding the importance of both saving and investing will help you achieve long-term financial security.Building a financial foundation early on allows you to navigate life’s inevitable uncertainties and opportunities more effectively.

Whether it’s buying a home, starting a family, or pursuing further education, financial stability empowers you to make informed decisions without the constant pressure of immediate financial constraints. Early investment allows your money to grow over time, benefiting from the power of compounding.

Importance of Saving and Investing

Saving and investing are essential for building wealth, achieving financial goals, and ensuring a secure future. Consistent saving and smart investing can turn modest contributions into significant sums over time, providing financial freedom and flexibility. Early savings habits create a safety net for unexpected expenses and opportunities, like career changes or personal ventures.

Saving Goals for Different Life Stages

Defining your saving goals is critical for effective financial planning. Different life stages necessitate distinct savings strategies. Young professionals might focus on building an emergency fund, paying off student loans, or starting a retirement account. Later, goals might include buying a home, funding a child’s education, or planning for retirement. For example, a young professional saving for a down payment on a house will have a different timeline and amount than someone saving for a comfortable retirement.

So, you’re a young professional navigating the tricky world of budgeting? Knowing how to manage your spending effectively is key, especially when you’re starting out. A great way to boost your income potential is by mastering the art of crafting a compelling cover letter. Check out this helpful guide on best cover letter format guide nail your dream job to really stand out from the crowd.

Once you land that dream job, you’ll be able to better manage your finances, and have a clearer path to achieving your financial goals.

Investment Options for Young Professionals

Young professionals have a wide range of investment options to consider. Low-cost index funds, for example, offer diversified exposure to the market and are typically managed passively, reducing management fees. This makes them a good choice for beginners and long-term investors. Other investment options may include individual stocks, bonds, mutual funds, and real estate, each with its own set of risk and return characteristics.

Building an Emergency Fund

Establishing an emergency fund is crucial for young professionals. It serves as a safety net for unexpected expenses, such as job loss, medical emergencies, or car repairs. A general rule of thumb is to aim for 3-6 months of living expenses in your emergency fund. This provides a buffer against unforeseen circumstances and allows you to maintain your financial stability.

For instance, if you earn $5,000 a month, aiming for $15,000 to $30,000 in your emergency fund would be prudent.

Investment Option Comparison

| Investment Option | Potential Returns | Risk Level |

|---|---|---|

| Low-cost Index Funds | Generally aligns with market returns | Lower |

| Individual Stocks | Potentially higher returns, but also higher risk | Higher |

| Bonds | Generally lower returns, but lower risk | Lower |

| Real Estate | Potentially high returns, but illiquid and with significant upfront costs | Moderate to High |

“The earlier you start saving and investing, the more time your money has to grow, benefiting from the power of compounding.”

Reducing Unnecessary Spending

As a young professional, it’s easy to fall into the trap of unnecessary spending. We’re often bombarded with tempting offers and social pressures to keep up with the latest trends. However, understanding where your money goes and actively identifying areas for cuts can significantly impact your financial well-being and long-term goals. This section dives into strategies for recognizing and eliminating unnecessary expenses, focusing on common pitfalls and practical solutions for young professionals.

Identifying Areas of Overspending

Young professionals frequently overspend in several areas. Understanding these common pitfalls is crucial for developing targeted strategies to reduce unnecessary spending.

- Subscription Services: Streaming services, gym memberships, and other recurring subscriptions can easily add up. Many people subscribe to services they don’t consistently use, or have forgotten they even signed up for.

- Dining Out: Eating out regularly, especially for lunch or quick meals, can significantly increase expenses. This includes ordering takeout frequently, and even casual dinners.

- Entertainment and Leisure: Going out for drinks, concerts, movies, or other entertainment options can quickly drain a budget if not managed carefully.

- Impulse Purchases: Social media and advertising often encourage impulsive buying decisions. These purchases, while seemingly small, can quickly accumulate and significantly impact the budget.

Negotiating Bills and Reducing Subscriptions

Many bills and subscriptions can be negotiated for better rates. Don’t be afraid to ask for discounts or explore alternatives.

- Telecommunication Services: Contact your providers to see if there are better plans available. Compare plans and features with different providers.

- Utilities: Review your energy bills and look for ways to reduce your consumption, such as adjusting thermostat settings or using energy-efficient appliances.

- Insurance: Compare insurance rates from different providers. Check if you can save money by bundling insurance policies.

- Subscription Management: Regularly review your subscriptions to identify unused or unnecessary services. Cancel or pause services you no longer need or use frequently.

Want vs. Need

Distinguishing between wants and needs is fundamental to responsible spending. This helps to focus spending on essential items and avoid unnecessary purchases.

A want is a desire for something, while a need is something essential for survival or well-being.

- Needs: Essential items like housing, food, transportation, and healthcare are categorized as needs. These are crucial for basic survival and daily life.

- Wants: Wants are desires for things that enhance quality of life but aren’t essential for survival. Examples include entertainment, fashion items, and dining out.

Reducing Entertainment and Leisure Spending

Cutting down on entertainment and leisure spending can free up a significant amount of money.

- Prioritize Free Activities: Explore free or low-cost entertainment options. Attend free events in your community or engage in hobbies like hiking, biking, or visiting local parks.

- Cook at Home More Often: Reduce dining out expenses by preparing meals at home more frequently. This not only saves money but also offers more control over ingredients and portion sizes.

- Utilize Public Transportation: Use public transportation or ride-sharing services to reduce transportation costs. This can be a significant expense reducer, especially if you live in a city.

- Limit Impulse Purchases: Develop a strategy to avoid impulsive purchases. Wait 24 hours before making a large purchase to ensure it’s truly necessary.

Smart Shopping Habits

Mastering your spending habits goes beyond just budgeting. It’s about understanding your spending triggers and making conscious choices when purchasing items, both big and small. Smart shopping habits empower you to meet your financial goals while still enjoying the things you need and want.Effective shopping involves a balance between satisfying needs and desires while avoiding unnecessary expenses. This approach requires discipline and a proactive strategy, which will help you save money and make informed decisions.

Mindful Spending and Impulse Control

Mindful spending involves being aware of your spending habits and motivations. Recognizing impulsive purchases and developing strategies to avoid them is crucial. Impulse buys often lead to unnecessary debt and hinder your financial progress. Practicing delayed gratification, where you pause before making a purchase, allows you to consider the long-term implications.

Strategies for Saving Money When Shopping

Saving money when shopping requires a combination of planning and comparison. First, prioritize needs over wants. Shopping for necessities requires a clear understanding of the best prices and quality products. This means actively comparing prices and considering the value proposition.

Comparing Prices and Finding the Best Deals

Comparison shopping is essential for getting the best value. Look for discounts, coupons, and sales to maximize your savings. Check online retailers and physical stores to compare prices for the same items. Also, consider factors like return policies, warranty, and customer service when making a purchase decision.

Creating and Sticking to a Shopping List, Simple tips to manage spending as a young professional

A well-organized shopping list is a powerful tool for controlling spending. Writing down the items you need helps you avoid impulse buys and stick to your budget. Create a list based on your needs and plan your shopping trip to a single store to minimize the temptation of unplanned purchases. Consider preparing a separate list for non-essential items, allowing you to make conscious choices.

Shopping List Example

- Milk (2 gallons)

- Eggs (1 dozen)

- Bread (1 loaf)

- Cheese (1 block)

- Chicken (1.5 lbs)

- Potatoes (2 lbs)

Price Comparison Table

This table compares prices and features of similar products from different retailers. This allows you to make informed decisions based on value and quality.

| Product | Retailer A | Retailer B | Retailer C |

|---|---|---|---|

| Smartphones (128GB) | $999 (5G, 8GB RAM) | $899 (5G, 6GB RAM) | $1099 (4G, 8GB RAM) |

| Laptop (16GB RAM) | $1299 (Intel i7) | $1199 (AMD Ryzen 7) | $1399 (Intel i5) |

| Headphones (wireless) | $149 (noise cancellation) | $129 (no noise cancellation) | $199 (premium noise cancellation) |

Managing Debt Effectively

Navigating the world of finances as a young professional often involves taking on various forms of debt, from student loans to credit card balances. Understanding how to manage this debt effectively is crucial for financial well-being and future success. It’s not about avoiding debt entirely, but about approaching it strategically and responsibly.Effective debt management isn’t just about paying the minimum; it’s about creating a plan to reduce and ultimately eliminate debt, saving money, and improving your overall financial health.

A proactive approach to debt can unlock opportunities for future investments and financial freedom.

Importance of Managing Debt

Debt management is vital for young professionals because it directly impacts their present and future financial stability. Uncontrolled debt can lead to financial stress, affecting mental well-being, and hindering the ability to achieve personal and professional goals. Responsible debt management allows young professionals to build a strong financial foundation, allowing for future investments, savings, and even homeownership.

Strategies for Paying Off Debt Quickly and Effectively

A well-structured debt repayment plan is key to achieving debt freedom. Prioritizing high-interest debts and using various strategies can significantly reduce the overall debt burden.

Figuring out how to manage your money as a young professional can be tricky, but it’s totally doable! One great way to gain a broader perspective on financial well-being is to explore resources like the 100 best business coaching wealth health self development books. These books can provide valuable insights into budgeting, saving, and building wealth, which can be hugely helpful when putting simple spending strategies into action.

Ultimately, mastering your finances is a journey, not a destination, and starting with these practical tips will set you on the right track!

- Prioritize high-interest debts: Credit cards with high APRs should be tackled first. Focusing on these debts minimizes the overall interest paid over time. Paying more than the minimum on these accounts accelerates repayment.

- Utilize the debt snowball or debt avalanche methods: The debt snowball method focuses on paying off smaller debts first, which provides a sense of accomplishment and motivates continued repayment. The debt avalanche method, on the other hand, prioritizes debts with the highest interest rates. Both methods can be effective, but the avalanche method generally leads to less interest paid overall.

- Consolidation: Combining multiple debts into a single loan with a lower interest rate can simplify payments and potentially reduce the total interest paid. This requires careful evaluation of different loan options to ensure a more favorable repayment schedule.

Different Types of Debt and Approaches

Understanding the different types of debt and their characteristics is crucial for developing an effective repayment strategy.

| Debt Type | Description | Approach |

|---|---|---|

| Student Loans | Loans taken to finance education. | Create a repayment plan with the lender. Explore options like income-driven repayment plans if needed. |

| Credit Cards | Revolving credit lines for purchases. | Prioritize high-interest cards. Use a balance transfer card with a 0% APR period if appropriate. Track spending carefully. |

| Personal Loans | Loans for various purposes (e.g., car, home improvements). | Compare interest rates and terms from different lenders. Establish a budget and stick to it. |

Implications of High-Interest Debt and Avoidance

High-interest debt significantly increases the overall cost of borrowing. This results in paying more in interest than the principal amount over time. Avoiding high-interest debt is key to managing personal finances effectively.

Figuring out your finances as a young professional can be tricky, but there are some easy ways to get a grip on your spending. Tracking your expenses, setting a budget, and prioritizing needs over wants are great starting points. Plus, learning to say “no” to impulse buys is key! And if you’re struggling to stay within budget, maybe you can relate to some of the financial challenges faced by medical students.

For a unique perspective on the realities of student life, check out this article on 12 things only medical students will understand. Ultimately, understanding your spending habits and making smart choices is crucial for managing your money effectively, no matter your career path.

- Avoid accumulating unnecessary debt: Be mindful of spending habits and avoid taking on more debt than necessary. Prioritize saving before taking on additional loans.

- Shop around for loans and credit cards: Compare interest rates and fees from different lenders to secure the best possible terms. Look for credit cards with low APRs.

- Use credit cards responsibly: Pay off balances in full each month to avoid interest charges. Avoid accumulating high balances on credit cards.

Negotiating with Creditors and Repayment Plans

Communicating with creditors and exploring repayment options can be beneficial in managing debt.

- Contact creditors directly: Reach out to creditors to discuss your financial situation and explore options like a lower interest rate, a longer repayment period, or a reduced monthly payment.

- Understand debt repayment plans: Explore available options like debt consolidation or balance transfers to simplify repayment and potentially reduce interest charges. Research the terms and conditions of each plan carefully.

Financial Resources for Young Professionals

Navigating the financial world as a young professional can feel overwhelming. There are many resources available to help you make informed decisions and build a strong financial future. This section will explore accessible resources for financial education and support, empowering you to take control of your finances.Financial literacy is crucial for young professionals to manage their money effectively and achieve their financial goals.

By leveraging available resources, you can gain the knowledge and support necessary to build a strong financial foundation.

Accessible Financial Education Resources

Numerous resources are available to assist young professionals in their financial journey. These range from online platforms to in-person workshops, providing a variety of learning opportunities.

- Online Educational Platforms: Websites like Investopedia, Khan Academy, and the Motley Fool offer comprehensive guides, articles, and videos on various financial topics, from budgeting to investing. These resources often provide valuable insights into specific areas of finance, making them particularly helpful for learning at your own pace.

- Governmental Resources: Many government agencies provide financial literacy resources. The Consumer Financial Protection Bureau (CFPB) is a valuable source for information on consumer financial products and services. Their website offers a wealth of information on various financial topics, from credit reports to debt management.

- Nonprofit Organizations: Numerous nonprofits offer financial education programs and resources. Organizations like the National Foundation for Credit Counseling (NFCC) provide free or low-cost counseling and workshops on topics like debt management and budgeting.

Financial Literacy Workshops and Seminars

Workshops and seminars provide valuable opportunities to learn from experts and interact with others in a similar financial situation.

- Community Colleges and Universities: Many community colleges and universities host financial literacy workshops and seminars, frequently open to the public. These workshops can be a great way to learn from experts in a structured setting.

- Local Libraries: Public libraries often partner with financial institutions or organizations to host workshops and seminars on topics relevant to local communities. These workshops may be especially helpful for individuals with limited access to other resources.

- Financial Institutions: Banks and credit unions frequently offer free financial literacy workshops and seminars, providing valuable information on topics like budgeting, saving, and investing.

Professional Financial Advice

Seeking professional financial advice is an essential step for individuals seeking to achieve their financial goals.

Financial advisors can provide personalized guidance, helping you develop a tailored financial plan based on your specific circumstances and goals. This can be particularly beneficial in situations involving complex investments or significant financial decisions.

Joining a Financial Community

Connecting with others who are navigating similar financial situations can be incredibly beneficial.

- Online Forums and Communities: Online forums and communities dedicated to personal finance offer opportunities to connect with others, share experiences, and ask questions. These communities can provide valuable support and perspectives from people facing similar challenges.

- Support Groups: Some organizations offer support groups for young professionals focusing on financial literacy and personal finance management. These groups can provide a sense of community and shared experience, helping to motivate and encourage members to stay on track with their financial goals.

Building a Strong Financial Foundation: Simple Tips To Manage Spending As A Young Professional

Laying a solid financial foundation as a young professional is crucial for future security and success. This involves more than just saving; it’s about establishing smart habits and a long-term strategy for managing your money. It’s about building a financial ecosystem that supports your aspirations, whether it’s buying a home, starting a family, or pursuing further education.A strong financial foundation is built on a combination of proactive planning, consistent effort, and adaptability.

It’s a journey, not a destination, requiring continuous learning and adjustment as your life and financial goals evolve. This roadmap provides the essential steps to create a strong financial foundation, allowing you to navigate the complexities of personal finance with confidence.

Setting Financial Goals

Establishing clear financial goals is the cornerstone of any successful financial plan. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Defining what you want to achieve, whether it’s paying off debt, building an emergency fund, or saving for a down payment, provides a clear direction for your financial decisions.For example, a goal of saving $5,000 in the next year is more effective than simply “saving more money.” The specific amount and timeframe create a tangible target.

Creating a Financial Plan

Developing a financial plan is a critical step in achieving your goals. This plan should Artikel the steps needed to reach your financial objectives. It should include strategies for saving, budgeting, and investing.This plan should be personalized to your individual circumstances, taking into account your income, expenses, and debts. It’s not a one-size-fits-all solution. Regular review and adjustments are essential as your financial situation changes.

Developing Good Financial Habits

Cultivating good financial habits is paramount for long-term financial success. These habits include budgeting, saving regularly, and avoiding unnecessary debt. These habits form the foundation for consistent financial progress.A key aspect of this is consistent saving, even if it’s a small amount each month. Automating savings through direct deposit or setting up automatic transfers to savings accounts helps ensure consistent contributions.

Adapting to Changing Circumstances

Financial circumstances are dynamic. Life events such as career changes, marriage, or the birth of a child will inevitably impact your budget and financial goals. A robust financial plan needs to be flexible enough to accommodate these changes.For instance, a promotion leading to a higher salary requires adjusting your budget to reflect the increased income and potentially setting new, more ambitious financial goals.

A personal budget should be regularly reviewed and revised to maintain its relevance.

Tracking Progress and Making Adjustments

Regularly tracking your progress toward your financial goals is essential. This allows you to identify areas where you’re exceeding expectations or falling short. This data should be used to make informed adjustments to your plan.Using budgeting apps or spreadsheets to track income and expenses can help visualize your financial health and identify areas for improvement. Analyzing your spending patterns can reveal opportunities to reduce unnecessary expenses and reallocate funds toward your goals.

Regular reviews and adjustments ensure your plan remains effective and relevant to your evolving needs.

Last Word

In conclusion, mastering your finances as a young professional is achievable with the right tools and strategies. By implementing the simple tips and techniques discussed, you can gain control over your spending, build savings, and pave the way for a secure financial future. Remember, consistent effort and a proactive approach are key to achieving long-term financial success.