Money mistakes even good savers dont know theyre making – Money mistakes even good savers don’t know they’re making can silently erode savings, even with a budget. From sneaky spending habits to poor investment choices and overlooking inflation, these pitfalls can derail your financial future. This post dives deep into common errors, offering practical strategies to identify and avoid them, so you can maximize your savings and achieve your financial goals.

We’ll explore how seemingly small, unintentional spending habits can chip away at your savings, even with a meticulous budget. We’ll also discuss poor investment choices, inflation’s insidious effect on savings, and the importance of planning for emergencies. Plus, we’ll touch on debt management, estate planning, tax implications, unrealistic goals, budgeting practices, and the critical need to regularly review and adjust your financial strategies.

Unintentional Spending Habits

Saving money is a marathon, not a sprint. Even dedicated savers can unknowingly fall into spending traps that erode their hard-earned savings. These aren’t necessarily big, obvious splurges, but rather subtle, everyday habits that can chip away at financial goals over time. Understanding these unintentional spending habits is crucial to building a more robust financial plan.Identifying and eliminating these spending patterns requires self-awareness and a willingness to scrutinize daily spending habits.

This article explores common, often overlooked spending behaviors that can undermine even the most diligent budget. It also offers practical strategies for recognizing these traps and creating a more intentional approach to managing finances.

Subscription Services

Many subscription services seem innocuous at first glance. Streaming platforms, meal delivery kits, and even monthly coffee subscriptions can quickly add up. The “small” cost per month, coupled with the convenience, often makes it easy to overlook the cumulative effect. Regularly reviewing subscription services and canceling unused or unnecessary ones is vital.

- Example: A saver might subscribe to several streaming services, each seemingly affordable, but the total cost adds up to a considerable amount each month. They might also have forgotten about a forgotten gym membership.

- Solution: Regularly review subscription services and cancel any unused or unnecessary ones. Consider bundling services to potentially lower the overall cost. Track the cost of each subscription and the frequency of use to evaluate their value.

Impulse Buys

Impulse purchases, whether online or in-store, can quickly drain savings. The allure of a “good deal” or the immediate gratification of a desired item often overshadows long-term financial goals. Developing strategies to delay gratification and recognize the true cost of an item is essential.

- Example: A tempting sale on a new gadget or clothing item can lead to an unplanned purchase, especially if the decision is made impulsively. Online shopping, with its readily available options, can also make it easier to fall prey to impulse purchases.

- Solution: Implement a “cooling-off period” before making a purchase. Wait 24 hours or even a week before buying an item, allowing time to reassess the need and the cost.

Dining Out

Eating out frequently, even if it’s for a casual meal, can significantly impact savings. The convenience and social aspect of dining out often outweigh the financial cost. Shifting to more cost-effective meals, such as cooking at home, can be a game-changer.

- Example: Good savers might frequently choose quick meals or dining out on weekends, believing it’s a small expense. The sum of these meals can erode savings over time.

- Solution: Create a budget for dining out, treating it as a discretionary expense. Plan more meals at home and prepare some ingredients in bulk to reduce food costs.

Comparing Spending Habits

| Spending Type | How Good Savers Might Fall Prey | Strategies to Avoid |

|---|---|---|

| Subscription Services | Multiple streaming subscriptions, forgotten memberships | Regular review and cancellation of unused services, bundling, cost tracking |

| Impulse Buys | Tempting sales, online shopping convenience | Cooling-off period, awareness of true cost, budgeting for purchases |

| Dining Out | Frequent casual meals, weekend outings | Meal planning, cooking at home, budgeting for dining |

Poor Investment Choices

Even diligent savers can make costly investment errors. These mistakes often stem from a lack of understanding, emotional decision-making, or a failure to adapt to changing market conditions. Knowing these pitfalls and adopting a disciplined approach can significantly enhance investment returns and portfolio growth.Investment decisions, while important, are frequently influenced by emotions. Fear of loss or the allure of quick gains can lead to impulsive choices that may not align with long-term financial goals.

Conversely, a lack of understanding about different investment vehicles and strategies can also lead to suboptimal choices.

Common Investment Mistakes

Understanding the common pitfalls in investment strategies is crucial for making informed decisions. These mistakes, while often unintentional, can erode investment returns and delay financial goals.

- Chasing Hot Stocks or Trends: Investors sometimes get caught up in the excitement surrounding a rapidly rising stock or a popular investment trend. The lure of quick gains can overshadow the risks involved, and such investments may not always deliver the expected returns. A disciplined approach based on research and a well-defined investment strategy is essential.

- Ignoring Diversification: A portfolio limited to a single investment or a small group of similar assets is highly vulnerable to market fluctuations. Diversification across various asset classes (stocks, bonds, real estate, etc.) reduces risk and potentially enhances long-term returns.

- Over-reliance on Short-Term Gains: Focusing solely on short-term gains often leads to poor investment choices. A long-term investment horizon with a focus on compounding returns over time is crucial for building wealth.

- Ignoring Fees and Expenses: Many investors underestimate the impact of fees and expenses associated with various investment vehicles. Fund management fees, transaction costs, and other expenses can significantly reduce investment returns over time.

Diversifying Investments

Diversification is a cornerstone of sound investment strategy. By spreading investments across different asset classes, you reduce the impact of a poor performance in any one area.

- Reducing Risk: A diversified portfolio is less susceptible to significant losses if one particular investment performs poorly. This is crucial for maintaining stability and protecting capital in uncertain markets.

- Enhancing Potential Returns: While not guaranteed, diversification often allows access to a wider range of potential returns, maximizing opportunities to grow wealth.

- Adapting to Market Changes: Diversification allows your portfolio to adapt to changing market conditions. If one sector experiences difficulties, other sectors within the portfolio may remain stable.

Comparing Investment Strategies

Different investment strategies offer varying degrees of risk and potential return. Understanding these differences is key to choosing an approach aligned with individual financial goals.

| Investment Strategy | Description | Potential Pitfalls |

|---|---|---|

| Index Funds | Track a specific market index (e.g., S&P 500). Typically low-cost and passively managed. | May not provide the highest possible returns compared to actively managed funds. May not keep pace with rapidly growing sectors. |

| Actively Managed Funds | Managed by professional fund managers who actively buy and sell securities to outperform the market. | Higher fees than index funds. No guarantee of outperforming the market. The skill of the fund manager can significantly impact performance. |

| Real Estate Investment Trusts (REITs) | Own and manage income-producing real estate. | Can be sensitive to economic cycles and interest rate fluctuations. Potential for lower returns than other investment strategies. |

Diversification, while not a guarantee of profit, is a vital strategy to mitigate risk and potentially maximize returns over the long term.

Ignoring Inflation

Inflation, often a silent thief, gradually erodes the purchasing power of your savings. While you might think your savings are growing, the real value might be shrinking if inflation isn’t factored in. Understanding this insidious force and adapting your savings strategies accordingly is crucial for achieving your long-term financial goals.Inflation is the sustained increase in the general price level of goods and services in an economy over a period.

This means that the same amount of money buys fewer goods and services in the future compared to the present. Even small inflation rates, when compounded over decades, can significantly diminish the value of your savings.

Impact of Inflation on Savings

Inflation significantly impacts the real value of savings. A savings account that yields a modest return might appear to be growing, but if inflation outpaces the return, the purchasing power of those savings is actually declining. For example, if you save $10,000 today and inflation averages 3% annually for 10 years, the $10,000 will not buy the same amount of goods or services in 10 years.

Adjusting Saving Strategies for Inflation

Adjusting your savings strategies to account for inflation is essential for maintaining purchasing power. A simple way to combat this is to ensure your savings grow at a rate that exceeds inflation. This might involve seeking out investment options that have a higher expected return.

Calculating Real Value of Savings

Calculating the real value of your savings over time requires considering inflation’s impact. A common method is using the real rate of return. The real rate of return is the rate of return after adjusting for inflation. The formula to calculate the real value of savings over time is:

Real Value = Nominal Value

(1 – Inflation Rate)^Number of Years

Where:* Real Value is the value of your savings adjusted for inflation

- Nominal Value is the initial value of your savings

- Inflation Rate is the average inflation rate during the period

- Number of Years is the time period over which you’re calculating the real value.

Example Calculation

Let’s say you save $5,000 today and expect an average inflation rate of 2% per year for the next 5 years. You anticipate your savings will earn a 4% return. To calculate the real value after 5 years, you would use the formula above.

Ever feel like you’re saving diligently but still not quite reaching your financial goals? It’s easy to fall into money traps even when you’re a pretty good saver! Fortunately, five quick money tips for the new year can help you identify some of those sneaky pitfalls. Learning to avoid these common mistakes will help you stay on track for a more secure financial future.

Small changes can make a big difference in your savings journey, and avoiding these pitfalls will help you become a better saver overall.

Real Value = $5,000 – (1 – 0.02)^5 = $4,704.65

The $5,000 you initially saved will have a real value of approximately $4,704.65 after five years of inflation at 2% annually. This illustrates the significance of considering inflation when planning for the future.

Lack of Emergency Fund Planning

A crucial aspect of financial well-being often overlooked is the importance of an emergency fund. While many people understand the concept, many fail to adequately plan for unforeseen circumstances. This lack of preparedness can lead to significant financial stress and potentially derail long-term financial goals. This section delves into the significance of an emergency fund, outlining various emergency situations and their financial implications, and providing a framework for effective planning.Robust emergency fund planning is not just about saving for the occasional flat tire; it’s about establishing a financial safety net.

This safety net protects you from unexpected events, allowing you to weather storms without jeopardizing your long-term financial stability. A well-structured emergency fund can provide peace of mind and enable you to navigate life’s inevitable challenges.

Understanding Emergency Situations

Emergency situations can take various forms, each with its own financial implications. These range from the relatively minor, like a sudden appliance breakdown, to the potentially catastrophic, such as a job loss or a major illness.

- Unexpected Medical Expenses: Medical emergencies, including unexpected illnesses or injuries, can quickly deplete savings. These costs can include doctor visits, hospital stays, surgeries, and ongoing therapies. Examples include unforeseen accidents or chronic illnesses requiring extensive treatment.

- Job Loss or Reduced Income: Unemployment, business closures, or reduced work hours can significantly impact household income. A period of unemployment can require considerable resources for living expenses, especially if there is no income replacement plan in place.

- Home Repairs and Maintenance: Unexpected home repairs, from a burst pipe to a major appliance failure, can quickly drain funds. These costs can easily spiral out of control if not anticipated and planned for.

- Vehicle Repairs and Replacements: Vehicle breakdowns, particularly major repairs or replacements, can be costly. These costs can include engine repairs, accidents, or even the purchase of a new vehicle due to an unavoidable situation.

- Natural Disasters: Natural disasters, such as floods, fires, or hurricanes, can cause significant damage to homes and possessions. These events can lead to substantial financial losses, including the need for temporary housing, rebuilding, and replacement of lost belongings.

Emergency Fund Plan Essentials

Having a structured emergency fund plan is vital for financial security. This involves more than just setting aside money; it’s about understanding how much is needed and how to allocate funds effectively.

| Category | Description | Example |

|---|---|---|

| Emergency Fund Size | Determine the amount needed to cover anticipated emergencies. | 3-6 months of essential living expenses. |

| Savings Strategy | Develop a savings plan to achieve the target emergency fund amount. | Regular contributions to a savings account or high-yield savings vehicle. |

| Investment Considerations | Choose appropriate investment options based on your risk tolerance and goals. | Consider high-yield savings accounts, CDs, or money market accounts for safety and liquidity. |

| Budgeting and Tracking | Monitor spending habits to ensure savings are consistent and in line with the goals. | Create a budget and track expenses regularly. |

| Contingency Planning | Consider various scenarios and develop a plan for each. | Artikel strategies for handling job loss, medical emergencies, and other unexpected events. |

Impact of Emergency Fund Size

The size of your emergency fund directly impacts your financial security during challenging times.

- Small Emergency Funds: A small emergency fund provides minimal protection against financial setbacks. A small fund might cover a minor repair but is inadequate for larger, more significant emergencies.

- Sufficient Emergency Funds: A sufficient emergency fund, typically 3-6 months of living expenses, provides a safety net during periods of job loss, illness, or other unforeseen events. This allows you to address emergencies without jeopardizing your long-term financial goals.

- Large Emergency Funds: A large emergency fund offers significant financial protection, allowing you to navigate major life disruptions with relative ease. This fund offers flexibility and stability during unexpected events and can provide a cushion for significant financial shocks.

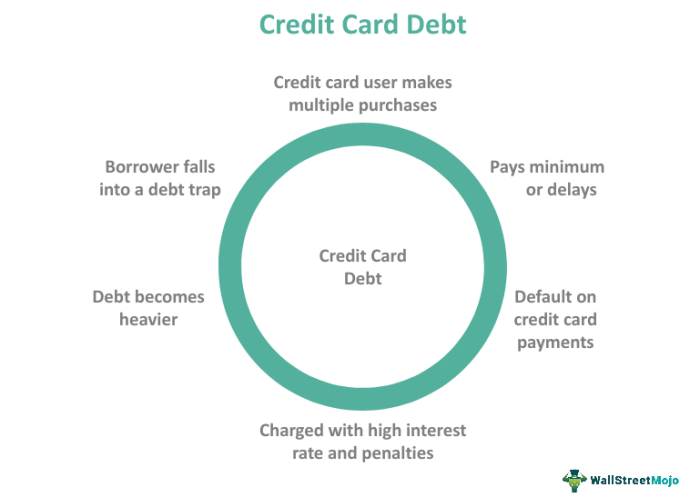

Ignoring Debt Management

Ignoring high-interest debt can significantly hinder your financial progress, eating away at your savings potential and making long-term financial goals unattainable. Debt, especially high-interest debt, acts like a financial vampire, sucking the life out of your earnings and savings. Understanding how to manage debt effectively is crucial for building wealth and achieving financial freedom.High-interest debt, such as credit card debt, personal loans with high APRs, and payday loans, can quickly spiral out of control.

Each month, a portion of your income is consumed by interest payments, leaving less for savings, investments, or other financial priorities. This cycle of debt can lead to a vicious downward spiral, impacting your credit score and potentially causing financial distress. Understanding the impact and developing strategies to manage this is key to a healthier financial future.

Figuring out your financial footing can be tricky, even for those who diligently save. Sometimes, even the savviest among us make money mistakes without realizing it. Are you looking for love, or maybe just a stable financial future? Consider these things that might point you in the right direction. You might be surprised by how much your financial habits are intertwined with your personal happiness, or even if you’ve found the one, based on 8 signs you have found the one.

Often, the same mindful approach that helps you spot the right partner can help you spot those hidden financial pitfalls. So, next time you’re reviewing your budget, remember to be thorough and ask yourself if you’re truly making the most of your money.

Impact of High-Interest Debt on Savings Potential

High-interest debt significantly reduces your savings potential. A substantial portion of your income is diverted to interest payments, leaving less disposable income to allocate toward savings, investments, or other financial goals. This erosion of your savings capacity can lead to missed opportunities for wealth accumulation and delayed achievement of long-term financial aspirations. For example, if your credit card interest rate is 20%, you’re essentially paying a premium for borrowing, reducing the amount you can save or invest.

Prioritizing High-Interest Debt Repayment

Prioritizing high-interest debt repayment is a crucial step in gaining financial control. A debt repayment plan should focus on aggressively tackling the debts with the highest interest rates first. This strategy, often called the “debt snowball” or “debt avalanche” method, helps you minimize interest expenses over time. By making extra payments on these debts, you reduce the overall cost of borrowing and free up more resources for other financial goals.

This strategy is particularly effective for consolidating and managing debt.

Debt Consolidation Strategies

Debt consolidation strategies involve combining multiple debts into a single loan with a potentially lower interest rate. This simplifies repayment and can significantly reduce your monthly interest burden. A lower interest rate can save you money on interest payments over the life of the loan. This often involves seeking a personal loan with a lower interest rate than your current high-interest debts.

Be wary of high-fee consolidation options; scrutinize all terms and conditions.

Strategies for Avoiding Accumulating New Debt

Avoiding accumulating new debt requires conscious effort and discipline. Creating a realistic budget, tracking expenses, and living below your means are essential for preventing overspending and subsequent debt accumulation. Regularly review your spending habits and identify areas where you can cut back. Developing good financial habits early can prevent the accumulation of unnecessary debt.

- Establish a Realistic Budget: A detailed budget allows you to track income and expenses, enabling you to identify areas where you can cut back and avoid overspending. This proactive approach allows you to allocate funds effectively and prevent accumulating debt.

- Review Spending Habits: Regularly evaluate your spending patterns. Identify areas where you’re overspending and make adjustments to create a more balanced budget. This includes identifying unnecessary expenses and developing strategies to curb them.

- Emergency Fund Planning: Having an emergency fund protects you from unexpected expenses, avoiding the need to resort to high-interest debt during difficult times. This proactive approach safeguards your financial stability and minimizes the risk of debt accumulation.

Insufficient Estate Planning

Estate planning is often overlooked, yet it’s crucial for long-term financial security and ensuring your wishes are carried out after you’re gone. Many individuals focus on accumulating wealth, but fail to plan how that wealth will be distributed and managed in the future. This oversight can lead to significant financial complications for heirs and potentially diminish the value of accumulated savings.Failing to plan your estate can have severe consequences, impacting not only your immediate family but also future generations.

Without a clear plan, assets may be subject to probate, a lengthy and costly legal process. This can result in delays in receiving inheritances, increased legal fees, and potential conflicts among beneficiaries. Moreover, improper estate planning can result in taxes being levied at higher rates, reducing the overall value of the estate. Ultimately, a lack of foresight can hinder the financial well-being of your loved ones and leave them grappling with unnecessary complications.

Importance of a Basic Estate Plan

A basic estate plan, even without complex legal instruments, is essential for safeguarding your assets and ensuring your wishes are followed. It provides a roadmap for distributing your assets, minimizing potential conflicts, and potentially lowering tax burdens. This proactive approach protects your legacy and provides peace of mind for you and your loved ones.

Creating a Basic Estate Plan

Developing a basic estate plan involves several key steps. First, identify your assets—including real estate, bank accounts, investments, and personal property. Document these assets in a comprehensive inventory. Second, designate beneficiaries for your accounts and assets. This designates who will receive specific items or accounts.

Third, consider a will, a legal document outlining how your assets will be distributed. Lastly, consider appointing a trusted individual as your executor, responsible for carrying out the terms of your will. This executor should be someone you trust to manage the estate according to your wishes.

Protecting Savings and Assets Through Estate Planning

A well-structured estate plan safeguards your savings and assets in several ways. It ensures that your assets are distributed according to your wishes, minimizing potential conflicts and maximizing the value of your estate. Proper estate planning can also help reduce estate taxes, allowing more of your assets to be passed on to your heirs. This careful planning protects your financial legacy and ensures your assets are distributed according to your intentions.

Methods for Estate Planning

A basic estate plan can be created through several methods. These include using online estate planning tools, consulting with an estate attorney, or using templates. Online tools offer convenient and cost-effective solutions for basic planning, while an attorney can offer specialized advice and guidance. Templates, while potentially less expensive than an attorney, may not address all your specific circumstances.

Each method has its own strengths and weaknesses, and the most suitable option depends on your individual needs and circumstances.

Ignoring Tax Implications

Ignoring the tax implications of your savings and investments can significantly impact your long-term financial health. Taxes on earnings can eat into your returns, potentially diminishing the overall value of your hard-earned savings. Understanding how taxes affect different investment strategies is crucial for maximizing your wealth and achieving your financial goals.Tax laws are complex and constantly evolving. This means staying informed and adapting your financial strategies accordingly is vital.

A financial advisor can be invaluable in navigating the nuances of tax implications specific to your situation.

Tax-Advantaged Accounts

Tax-advantaged accounts offer a powerful way to reduce your tax burden while saving and investing. These accounts allow you to defer or reduce the amount of taxes you pay on your investment earnings, effectively increasing your overall return. This can lead to substantial savings over time.

Types of Tax-Advantaged Accounts

- 401(k): A retirement savings plan sponsored by employers. Employees typically contribute pre-tax dollars, reducing their current taxable income. Earnings grow tax-deferred until retirement, when withdrawals are taxed as ordinary income. Matching contributions from employers can significantly boost savings. A key benefit is that they often provide a significant employer match, increasing the overall savings potential.

- Individual Retirement Account (IRA): An individual retirement account that allows individuals to contribute pre-tax dollars to save for retirement. Similar to 401(k)s, earnings grow tax-deferred until retirement. Different types of IRAs exist, each with specific contribution limits and tax implications, such as traditional and Roth IRAs. Traditional IRAs allow for tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement.

Comparing 401(k)s and IRAs

| Feature | 401(k) | IRA |

|---|---|---|

| Contribution Limits | Vary based on the year; often higher than IRA limits. | Vary based on the year. |

| Employer Matching | Often available, increasing savings potential. | Not typically offered. |

| Portability | Generally tied to the employer. | Portable, allowing you to move funds to a new employer or open new accounts. |

| Flexibility | Usually less flexibility with investment options than IRAs. | More investment options. |

A comparison table like this highlights the different characteristics and potential advantages of each. Understanding the pros and cons of each account type is critical in making informed financial decisions.

Tax-Efficient Strategies

Tax-efficient strategies involve structuring your investments in ways that minimize your tax liability. This includes maximizing contributions to tax-advantaged accounts, strategically choosing investments with favorable tax treatment, and considering tax-loss harvesting.

Proper tax planning is essential for maximizing savings growth.

Understanding tax implications isn’t just about saving on taxes; it’s about increasing the overall value of your investments and ensuring your financial future.

Unrealistic Financial Goals: Money Mistakes Even Good Savers Dont Know Theyre Making

Setting financial goals is crucial for achieving long-term financial stability. However, aiming too high or focusing on unattainable benchmarks can lead to frustration and discourage progress. Understanding the difference between realistic and unrealistic goals is key to building a sustainable financial plan.Many good savers, driven by ambition or societal pressures, set financial goals that are not grounded in reality.

These aspirations, while admirable, often lack a realistic path to achieving them. This can manifest in unrealistic expectations about income growth, investment returns, or the speed at which debt can be eliminated. A key element in creating a successful financial strategy is setting achievable goals that are aligned with your current circumstances.

Common Unrealistic Financial Goals

Unrealistic financial goals often stem from an inaccurate assessment of personal resources and external factors. These goals frequently lack specific timelines, measurable benchmarks, and actionable steps to achieve them.

- Accumulating a massive sum of money in a short period: Expecting to become a millionaire overnight through aggressive investments or a sudden windfall without considering the inherent risks and time horizons involved is unrealistic. A more sensible approach involves a gradual accumulation strategy that aligns with realistic return projections and investment timelines.

- Eliminating all debt instantly: Attempting to pay off all debts simultaneously without considering the impact on other financial commitments can be overwhelming and counterproductive. A strategic approach that prioritizes high-interest debts while considering budget adjustments is more practical.

- Maintaining a lavish lifestyle beyond current means: Striving for an extravagant lifestyle that exceeds current income without adjusting spending habits is a recipe for financial strain. A realistic approach involves carefully analyzing spending patterns and creating a budget that aligns with current earnings.

Methods for Setting Realistic Financial Goals

Setting realistic financial goals requires a thorough understanding of personal circumstances and a pragmatic approach to planning.

- Detailed Budget Analysis: Creating a detailed budget that tracks income, expenses, and savings allows for a clear understanding of current financial standing. This analysis identifies areas where adjustments can be made to better align with financial goals.

- Realistic Income Projections: Predicting future income growth based on career progression and economic conditions helps set realistic savings targets. Consider potential salary increases, promotions, or other income streams to establish achievable benchmarks.

- Gradual Debt Reduction: Developing a debt reduction plan that prioritizes high-interest debts while considering the impact on other financial obligations. This approach is more sustainable than attempting to pay off all debts at once.

- Long-Term Investment Strategy: Understanding the time horizons and potential returns associated with different investment options helps develop a strategy aligned with long-term financial goals. A more cautious and diversified investment approach is often more realistic than aggressive strategies focused on rapid returns.

Importance of Breaking Down Large Goals into Smaller Steps

Large financial goals, such as purchasing a home or retiring comfortably, can seem daunting. Breaking these goals into smaller, manageable steps makes them less intimidating and more achievable.

- Improved Motivation: Achieving smaller milestones along the way boosts motivation and confidence, preventing feelings of overwhelm or discouragement.

- Increased Accountability: Tracking progress toward smaller goals makes it easier to stay on track and hold yourself accountable for achieving them.

- Reduced Stress: Breaking down large goals reduces the perceived magnitude of the task, thus lowering stress and anxiety associated with achieving them.

- Enhanced Flexibility: Smaller, incremental goals allow for adjustments and modifications along the way, accommodating unexpected circumstances and evolving financial situations.

Realistic vs. Unrealistic Financial Goals

| Characteristic | Realistic Financial Goal | Unrealistic Financial Goal |

|---|---|---|

| Time Horizon | Aligned with personal circumstances and realistic timeframes | Short-term goals exceeding capabilities |

| Measurable Milestones | Defined by specific and measurable milestones | Lacking concrete steps or benchmarks |

| Resources Allocation | Aligned with current income and expenditure | Exceeding current income capabilities |

| Investment Strategy | Diversified and aligned with long-term goals | Aggressive or high-risk investments |

| Adaptability | Flexible and capable of adjusting to unexpected changes | Rigid and inflexible to changing circumstances |

Poor Budgeting Practices

A well-structured budget isn’t just a financial tool; it’s a roadmap to achieving your financial goals. Unfortunately, many individuals, even those who diligently save, overlook the importance of meticulous budgeting. This often leads to missed opportunities for growth and potentially puts their financial well-being at risk. Poor budgeting practices can stem from various factors, from a lack of understanding of the process to a reluctance to track expenses closely.

This section will illuminate the critical role of accurate budgeting and provide a practical guide for creating one.

The Importance of Accurate and Detailed Budgeting

Accurate and detailed budgeting is the cornerstone of sound financial management. A comprehensive budget allows you to understand where your money is going, identify areas where you can save, and make informed financial decisions. It empowers you to take control of your finances, rather than letting them control you. A detailed budget, unlike a cursory overview, offers a precise picture of your financial situation, revealing hidden spending patterns and potential savings opportunities.

Creating a Comprehensive Budget

Developing a comprehensive budget involves several key steps. First, meticulously track your income and expenses for a period, ideally a month. This period provides a representative snapshot of your financial activity. Utilize a budgeting app, spreadsheet, or notebook to record every transaction. Categorize your expenses into meaningful groups such as housing, food, transportation, entertainment, and debt repayments.

This categorization helps identify areas where you might be overspending.

Include all sources of income, including salary, investments, and any other income streams. Next, allocate your income to different categories based on your expenses and financial goals. Be realistic and prioritize essential expenses like housing, utilities, and debt repayment. Reserve a portion for savings and investments. Finally, review and adjust your budget regularly to account for changes in your financial circumstances.

Tracking Expenses and Income

Tracking expenses and income is essential for understanding your spending habits and making informed financial decisions. By meticulously recording every transaction, you gain a clear picture of where your money is going. This detailed insight reveals areas for potential savings and helps you identify patterns of overspending. For example, you might discover that a significant portion of your budget is allocated to dining out, revealing a potential opportunity for cost reduction.

Tracking income allows you to understand your available funds. This understanding is critical for creating a budget that accurately reflects your capacity for saving and investing. A comprehensive understanding of both income and expenses forms the basis for making sound financial choices.

Adjusting Budgets Based on Financial Circumstances

Financial circumstances are rarely static. Life events, such as job changes, marriage, or the birth of a child, often necessitate adjustments to your budget. A flexible budget allows you to adapt to these changes. Regularly review your budget to account for these shifts. If your income increases, consider increasing your savings or investment contributions.

Ever feel like you’re saving diligently but still not seeing the progress you want? It’s surprisingly common for even the most meticulous savers to make costly mistakes. One often overlooked area that can impact your financial well-being is your diet. Did you know that stress and anxiety, often stemming from 2 major flaws in your diet that cause stress and anxiety, can significantly affect your financial decisions?

2 major flaws in your diet that cause stress and anxiety can lead to impulsive spending and poor financial choices. Ultimately, these hidden connections highlight the importance of a holistic approach to achieving financial success, where taking care of your mental and physical health is just as crucial as tracking your savings.

Conversely, if your income decreases, you may need to adjust your spending to align with your new financial reality.

Example: If you experience a significant increase in income, you might decide to increase your monthly contributions to your retirement account or consider paying off high-interest debt more aggressively. Conversely, if you experience a decrease in income, you may need to cut back on non-essential expenses to maintain financial stability. This flexibility ensures your budget remains relevant to your evolving financial situation.

Failure to Review and Adjust Strategies

Financial strategies, like meticulously crafted plans, need consistent maintenance. Ignoring the necessity of periodic reviews and adjustments is a common pitfall, even for those who diligently save. Life throws curveballs, and without a mechanism for adapting, your carefully laid plans can quickly become outdated and ineffective. This oversight can lead to missed opportunities and ultimately hinder your financial progress.Regular reviews are crucial for ensuring your financial plan remains aligned with your evolving needs and goals.

Circumstances change—jobs, relationships, family situations, and even market conditions can impact your financial situation, making adjustments necessary. A static plan is a recipe for financial stagnation.

Importance of Regular Financial Checkups

Regular financial checkups are essential to maintaining a healthy financial life. They involve a thorough examination of your current financial situation, including income, expenses, assets, debts, and investments. This process helps identify areas of improvement and potential risks. This proactive approach allows you to address issues before they escalate and ensure your financial strategies remain effective.

Adjusting Savings Plans to Life Events

Life is unpredictable. From unexpected medical expenses to career changes, life events can significantly impact your financial plans. Adapting your savings plans to these events is crucial for maintaining financial stability. A proactive approach to savings adjustments can help mitigate potential financial setbacks and maintain progress towards long-term goals.

Framework for Conducting Regular Financial Checkups

A systematic approach to conducting regular financial checkups is key to success. A detailed framework helps organize the process, making it manageable and effective. This framework typically includes the following steps:

- Reviewing income and expenses:

- Assessing assets and debts:

- Evaluating investment performance:

- Updating financial goals:

- Seeking professional advice:

Analyzing your current income sources and expenditure patterns is the first step. This involves scrutinizing your budget and identifying areas where you can reduce unnecessary expenses. This detailed examination helps to pinpoint any inconsistencies or discrepancies.

Evaluate your assets, such as savings, investments, and property. Similarly, understand your debts, including loans, credit card balances, and outstanding obligations. This holistic view provides a clear picture of your financial position.

If you have investments, it’s important to monitor their performance regularly. This involves assessing returns, risks, and alignment with your overall financial goals. This step helps to ensure that your investments are performing as expected and meeting your long-term financial objectives.

Regularly re-evaluate your financial goals and objectives. This ensures that they remain relevant and aligned with your current circumstances and aspirations. This is critical for maintaining motivation and direction in your financial journey.

If you’re uncertain about any aspect of your financial situation, consulting with a financial advisor is highly recommended. A professional advisor can provide valuable insights and guidance, ensuring that your strategies remain aligned with your needs.

Best Practices for Adapting Savings Plans to Life Events, Money mistakes even good savers dont know theyre making

Adapting savings plans to life events requires flexibility and proactive planning. Consider these best practices:

- Establishing an emergency fund:

- Adjusting budget allocation:

- Re-evaluating investment strategies:

- Seeking professional guidance:

Maintaining a dedicated emergency fund is vital for unforeseen expenses. The size of this fund should be sufficient to cover several months of living expenses. This ensures that unexpected events don’t derail your financial stability.

Life events may necessitate changes in your budget allocation. Prioritizing needs over wants and adjusting spending habits to accommodate new circumstances are essential. This ensures that your financial resources are allocated efficiently.

If a life event significantly alters your risk tolerance or financial goals, adjust your investment strategies accordingly. This ensures that your investments continue to support your long-term financial objectives.

Seeking advice from a qualified financial advisor can be invaluable during life transitions. They can help you navigate complex situations and ensure your financial strategies remain effective.

Last Point

In conclusion, avoiding money mistakes isn’t about perfection, but about awareness and proactive planning. By understanding these common pitfalls, good savers can refine their strategies, fortify their financial security, and build a stronger financial future. We’ve explored how seemingly small, unintentional spending habits can chip away at your savings, even with a meticulous budget. We’ve also discussed poor investment choices, inflation’s insidious effect on savings, and the importance of planning for emergencies.

Plus, we’ve touched on debt management, estate planning, tax implications, unrealistic goals, budgeting practices, and the critical need to regularly review and adjust your financial strategies.