How to achieve financial freedom is a journey, not a destination. This guide delves into the multifaceted aspects of financial independence, from defining what it means to you, to building a robust financial plan. We’ll explore budgeting, debt management, income maximization, investing, and essential mindsets to help you chart your course toward financial freedom.

Understanding the different interpretations of financial freedom, whether it’s passive income or complete debt-free living, is key to crafting a plan that aligns with your personal goals and values. This comprehensive guide will walk you through proven strategies and actionable steps to help you reach your financial dreams, no matter where you are in your financial journey.

Defining Financial Freedom

Financial freedom is more than just having a lot of money; it’s a state of mind and a lifestyle. It’s about achieving a level of financial security that allows you to live life on your own terms, free from the constant pressure of financial worries. This freedom isn’t just about accumulating wealth; it’s about controlling your resources and using them to achieve your personal goals and passions.

It’s a multifaceted concept encompassing various aspects of your financial life and personal well-being.Understanding financial freedom involves recognizing the different paths individuals take to reach this state. Some prioritize debt elimination, while others focus on building substantial passive income streams. This exploration will delve into the diverse interpretations of financial freedom, highlighting its key characteristics and the profound emotional and psychological impact it can have.

Comprehensive Definition of Financial Freedom

Financial freedom is a state where individuals have sufficient financial resources to live comfortably without relying on external income sources for daily needs. This allows for greater flexibility in career choices, pursuing personal interests, and contributing to causes they believe in. It transcends mere wealth accumulation and encompasses a sense of control over one’s financial destiny.

Key Characteristics of Financial Freedom

Achieving financial freedom is characterized by several key indicators. These indicators demonstrate a significant shift in one’s financial situation, moving from a position of dependence to one of autonomy. These characteristics are often interconnected and build upon each other.

- Elimination of Debt: Debt significantly limits financial freedom. A debt-free status provides immediate relief and frees up resources for investment and future goals. For example, paying off student loans or a mortgage can create a sense of accomplishment and significantly reduce financial stress.

- Sufficient Emergency Fund: Having a readily available emergency fund provides a safety net against unforeseen circumstances. This fund should be substantial enough to cover several months of living expenses, providing a buffer against job loss, medical emergencies, or unexpected repairs.

- Consistent Passive Income: Passive income streams, such as rental properties, dividend-paying stocks, or online businesses, provide a consistent source of income that requires minimal effort to maintain. This allows for greater financial flexibility and control.

- Control over Expenses: Financial freedom involves the ability to control and manage expenses effectively. This requires careful budgeting, identifying areas for savings, and making informed financial decisions.

Emotional and Psychological Aspects of Financial Freedom

Financial freedom extends beyond the financial realm; it significantly impacts emotional and psychological well-being. It’s about reducing stress, fostering confidence, and enabling a sense of empowerment.

- Reduced Stress and Anxiety: Financial worries are a significant source of stress. Financial freedom reduces this burden, leading to improved mental and emotional health. Individuals can focus on their personal well-being and goals without the constant pressure of financial concerns.

- Increased Confidence and Self-Esteem: Achieving financial freedom often comes with a sense of accomplishment and pride. This boosts self-esteem and confidence, allowing individuals to pursue their passions and make informed decisions about their future.

- Enhanced Life Satisfaction: Financial freedom provides the opportunity to live life on their own terms. This leads to increased life satisfaction, as individuals are free to pursue their interests and contribute to their communities without financial constraints.

Different Interpretations of Financial Freedom

The concept of financial freedom can be interpreted in various ways, each with its own characteristics and indicators. The table below compares different perspectives, highlighting the key distinctions between them.

| Interpretation | Key Characteristics | Indicators |

|---|---|---|

| Passive Income Focus | Reliance on passive income streams for a substantial portion of income. | High-yield investments, multiple rental properties, substantial dividend income. |

| Debt-Free Lifestyle | Elimination of all forms of debt, including credit cards, loans, and mortgages. | Zero outstanding debt, high savings rate, robust emergency fund. |

| Lifestyle Adjustment | Significant reduction in expenses, prioritizing experiences over material possessions. | Minimalist lifestyle, focusing on experiences, reducing consumerism. |

Budgeting and Saving Strategies

Achieving financial freedom isn’t just about accumulating wealth; it’s about managing your resources effectively. A well-structured budget and consistent saving strategy are cornerstones of this journey. This section dives into proven methods for creating and sticking to a budget, building an emergency fund, exploring different saving accounts, and understanding various investment options.Effective financial management requires a clear understanding of your income and expenses.

A robust budget acts as a roadmap, helping you track where your money goes and identify areas for improvement. This, in turn, empowers you to make informed decisions about your spending and saving habits.

Creating and Sticking to a Budget

A budget is a plan for how you will spend your money each month. It helps you track your income and expenses, identify areas where you can save, and create a financial roadmap to achieve your goals. Successful budgeting relies on accurate tracking and realistic estimations.

- Track Your Spending: Use a budgeting app, spreadsheet, or notebook to meticulously record every expense. Categorize expenses (housing, food, transportation, entertainment) to understand where your money is going.

- Identify Areas for Savings: Analyze your spending patterns. Are there areas where you can reduce unnecessary expenses? This might involve cutting back on subscriptions, eating out less, or finding cheaper alternatives for services.

- Set Realistic Goals: Don’t try to change everything at once. Start with small, achievable goals and gradually adjust your spending as you become more comfortable with budgeting.

- Review and Adjust Regularly: Your financial situation is dynamic. Regularly review your budget and adjust it as needed. Life events, changes in income, or new expenses necessitate budget revisions.

Building an Emergency Fund and Savings Goals

An emergency fund is a crucial aspect of financial security. It provides a safety net for unexpected expenses like car repairs, medical bills, or job loss. Having a substantial emergency fund allows you to address these situations without resorting to high-interest debt.

- Establish an Emergency Fund Target: Aim for 3-6 months of living expenses in a readily accessible savings account. This amount will vary based on individual circumstances and risk tolerance.

- Set Savings Goals: Beyond emergencies, set specific savings goals, such as a down payment on a house, a new car, or a vacation. Breaking down large goals into smaller, achievable milestones fosters motivation.

- Automate Savings: Schedule automatic transfers from your checking account to your savings account each pay period. This ensures consistent savings without requiring conscious effort.

Different Saving Accounts and Investment Options

Various savings accounts and investment options cater to different financial goals and risk tolerances.

- High-Yield Savings Accounts: These accounts offer higher interest rates compared to traditional savings accounts, allowing for faster growth of your savings.

- Certificates of Deposit (CDs): CDs offer fixed interest rates for a specific period. The longer the term, the higher the interest rate, but accessing the funds early may incur penalties.

- Money Market Accounts: These accounts offer higher interest rates than savings accounts and allow for limited check writing or debit card transactions.

Investment Strategies Comparison

Investing allows for long-term wealth growth. Different investment strategies carry varying levels of risk and potential return.

| Investment Strategy | Description | Risk | Potential Return |

|---|---|---|---|

| Stocks | Represent ownership in a company. | Medium to High | High |

| Bonds | Loans made to governments or corporations. | Low to Medium | Lower than stocks |

| Real Estate | Investing in physical property. | Medium to High | High |

Importance of Automating Savings and Budgeting

Automating your savings and budgeting is crucial for consistency. It removes the mental barrier of remembering to save or budget, ensuring that your financial goals are consistently addressed.

“Automating your savings and budgeting streamlines your financial management, promoting long-term financial security.”

Debt Management and Reduction

Debt is a common hurdle on the path to financial freedom. High-interest debt, such as credit card debt, can quickly spiral out of control if not managed effectively. Understanding various strategies for managing and reducing debt is crucial for achieving financial stability and building wealth. This section explores effective methods for tackling debt, from negotiating repayment terms to utilizing debt consolidation strategies.High-interest debt can quickly become a significant financial burden.

Achieving financial freedom takes more than just a good job, it’s about smart spending habits and wise investments. Think about all the sacrifices you made growing up, like going without new clothes or missing out on a few fun things. It’s those experiences, as detailed in this insightful article about 10 things you suffered through that your kids will never understand , that can shape your financial decisions.

Understanding your past can help you make better choices in the present, ultimately paving the way for a financially free future.

It’s vital to develop a comprehensive debt management plan that considers the specific circumstances of your debts and financial situation. This plan should Artikel the steps needed to reduce the debt load and build a stronger financial foundation.

Debt Management Methods

Effective debt management involves a range of strategies. A proactive approach to reducing high-interest debt can significantly impact your financial well-being.

- Debt Snowball Method: This method focuses on paying off smaller debts first, regardless of interest rates. This approach builds momentum and creates a sense of accomplishment, motivating you to continue paying down larger debts. For example, if you have debts of $500, $1000, and $2000, the snowball method would prioritize paying off the $500 debt first, then $1000, and finally $2000.

The psychological aspect of achieving quick wins is often more effective than focusing solely on the highest interest debt first.

- Debt Avalanche Method: This strategy prioritizes debts with the highest interest rates. By tackling the most expensive debts first, you save money on interest charges in the long run. For instance, if you have a credit card with 20% interest and another with 15%, the avalanche method would focus on paying off the 20% interest credit card first.

- Balance Transfer: Transferring high-interest debt to a credit card with a lower or 0% introductory APR can significantly reduce your monthly payments and interest charges. However, be wary of the fine print; some cards may have high annual fees or other restrictions that could offset any savings. Always carefully review the terms and conditions before making a transfer.

Negotiating Debt Repayments

Negotiating with creditors can sometimes lead to better repayment terms. It’s important to be prepared and assertive, but also polite and professional in your communication.

- Contact Creditors Directly: Reaching out to creditors directly can open avenues for negotiation, potentially lowering interest rates or monthly payments.

- Understand Your Rights: Research your rights and responsibilities as a borrower. Knowing your rights can help you confidently approach creditors for better repayment terms.

- Present a Strong Case: Artikel your financial situation and explain why you are seeking a modification in payment terms. Be prepared to provide supporting documentation such as proof of income and expenses.

Debt Consolidation and Balance Transfers

Debt consolidation involves combining multiple debts into a single loan or account. Balance transfers move high-interest debt from one account to another with a lower interest rate.

| Feature | Debt Consolidation | Balance Transfer |

|---|---|---|

| Purpose | Combine multiple debts into one | Move debt to a new account |

| Interest Rate | Often lower, but not always | Potentially lower, but depends on terms |

| Fees | Possible fees for setup and processing | Possible fees for transfer, and annual fees |

| Impact on Credit Score | Could potentially impact credit score if not managed correctly | Could potentially impact credit score if not managed correctly |

- Pros of Debt Consolidation: Simplified monthly payments, potentially lower interest rates, and reduced stress from multiple creditors. Consolidating can streamline the repayment process, and a lower interest rate can save significant money over time.

- Cons of Debt Consolidation: Potential for higher interest rates than expected, hidden fees, and a negative impact on your credit score if not done correctly.

- Pros of Balance Transfer: Temporary reduction in interest payments, and a fresh start with a new credit card. The ability to temporarily reduce payments can be a great motivation to get ahead of debt.

- Cons of Balance Transfer: Introductory rates may expire, leading to higher interest payments, and the possibility of accumulating new debt if not managed carefully. Be sure to plan for a long-term repayment strategy.

Creating a Debt Repayment Plan

Developing a debt repayment plan is a crucial step in reducing debt and achieving financial freedom.

A well-structured plan considers income, expenses, and debt amounts to create a realistic and achievable strategy.

- Assess Your Debt: List all debts, including amounts, interest rates, and minimum payments. Thoroughly evaluate your current financial situation to accurately assess your debts.

- Develop a Budget: Create a detailed budget that accounts for all income and expenses. This will help determine how much you can realistically allocate to debt repayment each month.

- Choose a Repayment Strategy: Select a method like the debt snowball or debt avalanche, based on your goals and preferences.

- Track Your Progress: Monitor your progress regularly and adjust your plan as needed. Consistent tracking helps you stay motivated and focused.

Debt Management Tools and Services

Various tools and services can assist with debt management.

- Debt Management Plans (DMPs): A DMP allows you to consolidate your debt and create a manageable repayment schedule. These programs often offer lower interest rates, making it easier to pay off debt over time.

- Credit Counseling Agencies: These agencies provide free or low-cost guidance and support in creating a debt management plan. These agencies can offer unbiased advice and guidance on navigating debt repayment.

- Debt Consolidation Services: Companies offering debt consolidation services can combine your debts into a single loan. This often involves paying fees and interest, but it may streamline the process.

Income Generation and Maximization

Unlocking financial freedom often involves more than just cutting expenses; it requires strategically increasing your income streams. This crucial step allows for faster debt payoff, greater savings, and ultimately, a more comfortable and secure financial future. Exploring alternative income sources and maximizing existing ones is a key component of achieving financial independence.Beyond your primary job, various opportunities exist to boost your earnings and build wealth.

This section delves into different methods of income generation, from side hustles to entrepreneurial ventures, highlighting the importance of continuous learning and investing for passive income. Understanding the risks and rewards associated with each income stream is essential for making informed decisions.

Achieving financial freedom often involves smart planning and consistent effort. Knowing how to captivate an audience is key, too. For example, mastering presentation skills can significantly boost your earning potential. Check out these 10 secrets making every presentation fun engaging and enjoyable here to see how engaging presentations can translate into higher income and, ultimately, greater financial freedom.

Different Ways to Increase Income Streams

Expanding your income streams beyond your primary job is a vital step toward financial freedom. This involves exploring various avenues to generate additional revenue, each with its own set of advantages and challenges. A diversified approach often proves more resilient to economic fluctuations and allows for greater financial flexibility.

- Side Hustles: These supplemental income sources can range from freelance writing or graphic design to selling handmade crafts or offering tutoring services. Side hustles are often flexible and can be pursued around existing commitments.

- Entrepreneurial Ventures: Starting a small business, even online, can generate substantial income. This route requires more upfront investment and commitment, but the potential for high rewards is significant.

- Investing for Passive Income: Strategies like stock market investments, real estate ventures, or high-yield savings accounts can generate income passively over time. However, these methods carry risk, and success hinges on informed decisions and careful management.

Examples of Side Hustles and Entrepreneurial Ventures

Many successful side hustles and ventures have sprung from everyday passions and skills. Leveraging your existing talents or acquiring new ones can be a rewarding path to additional income.

- Freelance Writing/Editing: Utilizing writing skills to create content for businesses or individuals online. Platforms like Upwork or Fiverr provide opportunities for freelancers.

- Virtual Assistant Services: Offering administrative, technical, or creative support to clients remotely. This can include scheduling, social media management, or email marketing.

- Online Courses/Workshops: Sharing expertise through online courses or workshops on platforms like Teachable or Udemy. This leverages knowledge and skills for recurring income.

- Dropshipping: Starting an online store without managing inventory. Dropshipping involves working with suppliers who handle fulfillment, while you focus on marketing and sales.

Importance of Continuous Learning and Skill Development

The modern financial landscape is constantly evolving. Continuous learning and skill development are essential to staying competitive and adapting to emerging opportunities.

- Adapting to Technological Advancements: Staying updated on new technologies and tools relevant to your field is critical. New technologies create new opportunities for income generation.

- Improving Existing Skills: Upskilling or enhancing existing talents will increase marketability and income potential. This could involve taking online courses, attending workshops, or pursuing certifications.

- Exploring New Skill Sets: Expanding your skill set to new fields can lead to discovering untapped income streams. Learning a new language, for example, can open doors to international freelancing opportunities.

The Role of Investing in Generating Passive Income

Investing wisely is a crucial component of generating passive income. Building a diversified investment portfolio and understanding market trends are key.

- Stocks: Investing in the stock market can yield substantial returns over time, but it involves risk.

- Real Estate: Real estate investments, including rental properties, can generate passive income through rental payments.

- Bonds: Bonds are a lower-risk investment option that can provide a steady stream of income.

Different Income Streams and Their Associated Risks and Rewards

A comprehensive understanding of the risks and rewards associated with different income streams is essential for informed decision-making.

| Income Stream | Risks | Rewards |

|---|---|---|

| Side Hustles | Limited earning potential, time commitment | Flexibility, potential for quick gains, low startup costs |

| Entrepreneurial Ventures | High startup costs, significant time commitment, potential for failure | High earning potential, independence, personal fulfillment |

| Investing | Market volatility, potential for loss, management complexity | Passive income generation, long-term growth potential, diversification of assets |

Investing and Wealth Building

Unlocking financial freedom isn’t just about saving; it’s about strategically growing your money. Investing wisely is crucial for long-term wealth building, allowing your capital to work for you and outpace inflation. This stage involves understanding different investment strategies, managing risk, and selecting appropriate investment vehicles to maximize your returns over time.Investing is a dynamic process that requires continuous learning and adaptation.

Market trends, economic conditions, and your personal financial goals all play a significant role in shaping your investment strategy. Understanding these factors is key to achieving your financial objectives and building a secure future.

Investment Strategies for Long-Term Wealth

Various strategies can be employed to achieve long-term wealth building. These strategies aim to optimize returns while mitigating risk. Diversification and understanding market trends are crucial elements of successful investment strategies.

Achieving financial freedom often boils down to smart money management and savvy decision-making. But sometimes, the real hurdle is learning how to confidently advocate for your financial needs. Knowing how to speak up for yourself, whether it’s negotiating a better salary or asking for a raise, is a crucial step in the journey. This skill, as described in detail in this helpful guide on how to speak up for yourself , can unlock opportunities for higher income and ultimately faster progress toward your financial goals.

Ultimately, speaking up empowers you to take control of your financial future and achieve the freedom you desire.

- Growth Investing: This strategy focuses on companies with high growth potential. Investors anticipate substantial increases in the company’s value over time, leading to significant capital appreciation. Companies often operating in emerging or innovative industries are often the target of growth investors. However, growth stocks are frequently more volatile than other investments.

- Value Investing: This strategy focuses on undervalued companies. Investors identify companies whose market price is lower than their intrinsic value, expecting their price to rise as the market recognizes their true worth. Value investors typically conduct thorough research to identify undervalued companies and assess their potential for future growth.

- Index Investing: This strategy involves replicating the performance of a broad market index, like the S&P 500. Index funds track the performance of a basket of stocks, offering broad market exposure with relatively low expense ratios. The simplicity and diversification offered by index investing are attractive to many investors.

- Dividend Investing: This strategy focuses on companies that pay regular dividends. Dividend investors prioritize the steady income generated by these payments alongside the potential for capital appreciation. Consistent dividend payments can provide a reliable source of income.

Diversification and Risk Management

Diversification is a fundamental principle in risk management. Spreading your investments across various asset classes, industries, and geographies reduces the impact of potential losses in any single investment.

- Asset Allocation: Distributing investments across different asset classes (stocks, bonds, real estate, etc.) based on your risk tolerance and financial goals is crucial for a well-diversified portfolio. A well-balanced asset allocation can help smooth out market fluctuations.

- Risk Tolerance Assessment: Understanding your risk tolerance is essential for determining the appropriate level of diversification. High-risk investments offer potentially higher returns, but they also carry a greater chance of substantial losses. Conservative investors may prefer lower-risk investments with more stable returns.

- Hedging Strategies: Hedging is a risk management technique that aims to reduce the impact of adverse price movements. Investors can use derivatives like options or futures to offset potential losses in their portfolios. A well-executed hedging strategy can protect your investments during periods of market volatility.

Understanding Investment Products and Market Trends

A deep understanding of investment products and market trends is essential for informed decision-making. Staying abreast of economic factors and industry news can significantly impact your investment choices.

- Investment Product Analysis: Understanding the characteristics, risks, and potential returns of various investment products (stocks, bonds, mutual funds) is crucial for informed investment decisions. Thorough research and analysis help investors select products aligned with their financial goals.

- Market Trend Analysis: Analyzing market trends and economic indicators can help predict future market movements. This knowledge helps investors make informed decisions about asset allocation and investment timing. For instance, understanding inflationary pressures or interest rate changes can help investors adjust their investment strategies.

Investment Vehicles

Various investment vehicles offer different opportunities for wealth building. Choosing the right vehicle depends on your investment goals, risk tolerance, and time horizon.

| Investment Vehicle | Description | Example |

|---|---|---|

| Stocks | Represent ownership in a company. | Apple (AAPL), Amazon (AMZN) |

| Bonds | Represent loans to corporations or governments. | US Treasury bonds, corporate bonds |

| Mutual Funds | Pool money from multiple investors to invest in a diversified portfolio of assets. | Index funds, sector funds |

Investment Time Horizons and Strategies

Different time horizons require tailored investment strategies. Short-term goals may necessitate different approaches compared to long-term objectives.

- Short-Term Investments: These investments are designed for shorter time horizons, often for specific goals like saving for a down payment or a vacation. Short-term investments prioritize liquidity and stability.

- Long-Term Investments: These investments are designed for longer time horizons, allowing for higher risk tolerance and potentially higher returns. The goal is to leverage the power of compounding to build substantial wealth over decades.

Mindset and Habits for Financial Success

Financial freedom isn’t just about accumulating wealth; it’s profoundly tied to your mindset and habits. A positive and resilient attitude, coupled with consistent disciplined actions, are crucial for navigating the inevitable challenges and setbacks along the path to financial security. This section dives into the psychological aspects of wealth building, highlighting the importance of a proactive approach to achieving your financial goals.A strong financial mindset isn’t something you’re born with; it’s a skill you cultivate over time.

This involves understanding your own financial fears, recognizing limiting beliefs, and proactively building positive habits that support your journey toward financial freedom. Cultivating discipline, patience, and resilience are key elements in this process. Continuous learning and staying informed about financial matters are vital to staying ahead of the curve and adapting to evolving market conditions.

The Power of a Positive Mindset

A positive mindset acts as a powerful catalyst for financial success. It fosters a proactive approach to problem-solving, enabling you to view challenges as opportunities for growth and learning. Optimism encourages you to embrace calculated risks and persevere through setbacks. A positive mindset significantly impacts your decision-making process, guiding you toward sound financial choices. This, in turn, enhances your ability to achieve your financial goals and build wealth.

Overcoming Financial Fears and Limiting Beliefs

Financial fears and limiting beliefs can significantly hinder your progress toward financial freedom. These deeply ingrained anxieties often stem from past experiences or societal pressures. Recognizing and challenging these beliefs is crucial for breaking free from their grip. Techniques such as cognitive behavioral therapy (CBT) can be valuable tools in identifying and restructuring these negative thought patterns.

By actively questioning and reframing limiting beliefs, you can empower yourself to make confident financial decisions.

The Role of Discipline, Patience, and Resilience

Discipline is the cornerstone of financial success. It involves consistently adhering to your financial plan, even when faced with temptations or short-term gratification. Patience is equally important, as building wealth takes time and effort. Resilience is the ability to bounce back from setbacks, learn from mistakes, and maintain your focus on long-term goals. These three attributes are essential for navigating the inevitable ups and downs of the financial journey.

Continuous Learning and Staying Informed

Staying informed about financial matters is essential for making sound decisions. The financial landscape is constantly evolving, with new investment opportunities, regulations, and market trends emerging regularly. Continuous learning allows you to adapt to these changes and make informed choices. This involves reading financial news, attending seminars, and seeking guidance from qualified financial advisors. Staying updated is crucial for long-term financial success.

Practical Exercises to Build a Strong Financial Mindset

Developing a strong financial mindset is an ongoing process. Here are some practical exercises to help you cultivate the necessary habits:

- Journaling: Regularly documenting your financial progress, thoughts, and feelings can provide valuable insights into your patterns and motivations. Note down your financial goals, challenges, and any positive steps you take toward them. This helps to identify areas needing improvement and track your progress.

- Visualization: Visualizing yourself achieving financial freedom can be a powerful tool for motivating yourself and maintaining a positive outlook. Imagine yourself living the life you desire and use this mental image to fuel your actions.

- Affirmations: Repeating positive affirmations can help reprogram your subconscious mind and cultivate a more positive financial mindset. Examples include: “I am capable of achieving financial freedom,” “I am resourceful and capable of handling financial challenges,” or “I am attracting wealth and abundance into my life.” Repeat these affirmations daily.

- Seeking Mentorship: Connecting with individuals who have achieved financial success can provide valuable insights and guidance. Learn from their experiences and gain inspiration from their journeys.

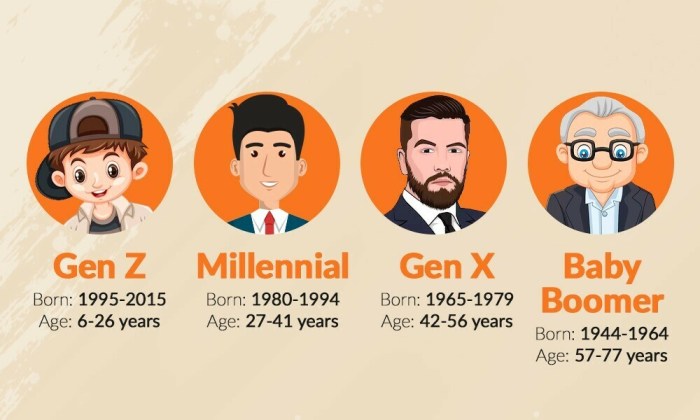

Financial Freedom in Different Life Stages: How To Achieve Financial Freedom

Achieving financial freedom is a journey, not a destination. The strategies and priorities for reaching that goal evolve significantly throughout different life stages. Understanding these variations is crucial for creating a personalized plan that aligns with your current circumstances and future aspirations. A well-defined strategy ensures you’re not just saving, but building a solid financial foundation for every phase of your life.Financial freedom isn’t a one-size-fits-all concept.

Strategies for young adults, families, and retirees will differ drastically due to varying needs and responsibilities. Understanding these distinct needs is vital to developing effective financial plans that adapt and grow with you. This approach empowers you to make informed decisions that optimize your financial well-being at every life stage.

Financial Freedom for Young Adults

Young adults often face the challenge of establishing financial independence, paying off student loans, and building credit. Saving and investing early is paramount. Setting up an emergency fund is crucial, and exploring investment opportunities that align with long-term goals is highly recommended.

Financial Freedom for Families

Families face unique financial pressures, including supporting children, managing household expenses, and planning for education costs. Budgeting for various family needs, such as childcare and education, is essential. Diversifying income streams and creating a family budget that accounts for various needs are key steps towards financial security. Contingency planning for unforeseen circumstances is also crucial.

Financial Freedom for Retirees

Retirement planning involves shifting investment strategies from growth to preservation of capital. Understanding retirement income sources and adjusting spending habits to match retirement income is critical. Minimizing taxes and optimizing social security benefits is often a significant aspect of financial planning in retirement.

Saving and Investing for Specific Life Events

Planning for significant life events, such as education, marriage, and retirement, requires proactive saving and investment strategies. Education funds can be set up through 529 plans or other investment vehicles. Marriage can lead to joint financial planning and potentially increased income streams. Retirement requires careful consideration of investment strategies and the creation of a diversified portfolio.

Adjusting Financial Plans for Major Life Changes

Life changes, such as job loss, illness, or divorce, necessitate adjusting financial plans. Adaptability and flexibility in financial planning are essential. Diversifying income streams and building a strong emergency fund are key considerations in adapting to unexpected life changes.

Adapting Financial Freedom Goals for Different Family Structures

Different family structures, including single-parent households, blended families, and childless couples, necessitate tailored financial plans. Creating a budget that accounts for the unique needs of each structure is important. Prioritizing financial security and considering different needs for each family structure are crucial.

Comparison of Financial Planning for Different Life Stages

| Life Stage | Key Priorities | Saving Strategies | Investment Strategies |

|---|---|---|---|

| Young Adults | Building credit, emergency fund, paying off debt | High-yield savings accounts, emergency fund, student loan repayment | Low-risk investments, index funds, mutual funds |

| Families | Childcare, education, household expenses | 529 plans, college savings accounts, diversified investments | Balanced portfolios, real estate, bonds |

| Retirees | Minimizing taxes, maximizing income | Adjusting spending, downsizing, optimizing social security benefits | Low-risk investments, fixed income securities |

Practical Tools and Resources

Unlocking financial freedom is a journey, not a destination. Having the right tools and resources is crucial for navigating the complexities of personal finance. This section provides essential guidance on leveraging these resources to achieve your financial goals.Effective financial planning isn’t just about knowledge; it’s about consistent action. These practical tools and resources provide the foundation for making informed decisions and building a secure financial future.

Reliable Resources for Learning

Understanding personal finance involves continuous learning. Numerous resources provide valuable insights into budgeting, saving, investing, and more.

- Governmental Resources: Many government agencies offer free financial education materials, including information on budgeting, credit, and debt management. These resources are often accessible and provide fundamental knowledge essential for beginners.

- Nonprofit Organizations: Nonprofit organizations dedicated to financial literacy offer workshops, seminars, and online courses. These resources frequently provide practical advice and support, tailored to various financial situations.

- Online Platforms: Websites and apps dedicated to personal finance offer a wealth of information, including articles, calculators, and interactive tools. These platforms often provide personalized guidance and support.

- Financial Blogs and Podcasts: Numerous blogs and podcasts focus on personal finance, providing up-to-date insights, expert advice, and practical tips. These resources often provide a more conversational and engaging approach to learning.

Financial Advisors and Their Benefits

A financial advisor can be a valuable asset in your financial journey. They offer personalized guidance, expertise, and objective insights.

- Personalized Financial Plans: Financial advisors can create tailored financial plans based on your specific needs, goals, and risk tolerance. These plans provide a roadmap to achieve financial objectives.

- Investment Strategies: Advisors can assist in developing investment strategies aligned with your goals and risk tolerance. This ensures your investments contribute to your financial success.

- Debt Management: Advisors can provide guidance on managing and reducing debt, helping you navigate complex financial situations.

- Tax Planning: Financial advisors can assist in developing tax-efficient strategies to maximize your financial well-being.

Budgeting Apps and Financial Tracking Tools

Effective budgeting and tracking are essential for managing finances. These tools streamline the process and enhance financial awareness.

- Mint: A popular budgeting app that connects to your bank accounts and credit cards to provide a comprehensive overview of your finances. It allows for budgeting, tracking expenses, and generating reports.

- Personal Capital: A more advanced tool that allows for detailed investment tracking and analysis. It helps users understand their overall financial health and provides insights for optimizing their portfolios.

- YNAB (You Need a Budget): This app emphasizes budgeting based on your income and expenses. It encourages users to prioritize their spending and allocate funds effectively.

Staying Informed About Economic Trends

Economic trends significantly impact personal finances. Understanding these trends is vital for making informed financial decisions.

- News Outlets: Reliable news sources provide in-depth analysis of economic trends, including inflation, interest rates, and market fluctuations. This helps you stay informed about current conditions and anticipate potential impacts.

- Financial Publications: Publications like The Wall Street Journal, Forbes, and Bloomberg offer insightful articles and analysis on economic trends. These resources often provide deeper insights into market dynamics.

- Economic Indicators: Tracking economic indicators like GDP growth, unemployment rates, and inflation provides valuable context for understanding the overall economic climate. These indicators help assess the current state of the economy.

Recommended Books and Articles, How to achieve financial freedom

Numerous books and articles offer valuable insights and strategies for achieving financial freedom.

- “Rich Dad Poor Dad” by Robert Kiyosaki: A classic that explores different perspectives on wealth building and financial literacy.

- “The Total Money Makeover” by Dave Ramsey: A practical guide to debt reduction and building wealth through budgeting and saving.

- Articles from reputable financial websites: Websites like Investopedia, The Motley Fool, and NerdWallet provide articles on various aspects of personal finance, including investing, saving, and budgeting.

Conclusion

Ultimately, achieving financial freedom is a personalized quest. This guide provides a framework for understanding the core components of financial well-being, from defining your vision to developing practical strategies. Remember that consistency, discipline, and a proactive mindset are essential for success. By integrating the insights and tools presented here, you can pave the way toward a future of financial security and freedom.