How pay off debt fast using the stack method? This method offers a strategic approach to conquering debt, prioritizing high-interest debts to accelerate repayment. It’s a powerful technique that can significantly reduce your debt burden, and we’ll explore its intricacies, from categorization to budgeting, providing you with a roadmap for achieving financial freedom.

Unlike the debt avalanche method that focuses on the highest interest rate first, or the debt snowball that prioritizes the smallest balance, the stack method prioritizes debt based on a unique strategy. This detailed guide will walk you through each step, helping you understand the core principles and implement them effectively.

Understanding the Stack Method

The relentless pursuit of financial freedom often involves tackling the daunting task of debt. Various strategies exist to navigate this challenge, each with its own set of strengths and weaknesses. Understanding these different approaches is crucial for selecting the most effective path towards debt elimination.

Debt Repayment Strategies

Debt repayment methods, like the avalanche and snowball methods, are popular approaches. The avalanche method prioritizes high-interest debts, aiming to save money on interest over time. The snowball method focuses on smaller debts, building momentum and motivation to tackle larger debts. However, these methods don’t always provide the fastest path to debt freedom. The stack method, in contrast, offers a more streamlined and often quicker way to conquer debt by leveraging the power of interest rates.

Core Principles of the Stack Method

The stack method, a variation on the avalanche approach, focuses on strategically prioritizing high-interest debts, similar to the avalanche method. Unlike the snowball method, which prioritizes smaller debts, the stack method is more about efficient debt reduction, leveraging the power of compounding interest in a way that can accelerate the overall process. The core principle is to tackle debts systematically, based on their interest rates, to minimize interest costs and maximize savings over time.

Steps Involved in Implementing the Stack Method

The stack method requires careful planning and execution. The first step involves meticulously documenting all outstanding debts, including the principal balance, interest rate, and minimum monthly payment for each account. Once this comprehensive debt inventory is established, debts are ranked by their interest rates, from highest to lowest. This is the foundational step for efficient prioritization. Then, the monthly payments are structured to target the highest interest debt.

A crucial aspect of the stack method is ensuring the minimum payment on other debts is made. Once the highest interest debt is eliminated, the focus shifts to the next highest-interest debt, and so on.

Prioritizing High-Interest Debts

The stack method prioritizes high-interest debts to reduce the overall cost of borrowing. By focusing on the debt with the highest interest rate, the method aims to maximize savings. The key is to minimize interest expenses by paying down the most expensive debt first, preventing these costs from compounding over time.

Benefits of the Stack Method

The stack method offers several advantages over other debt repayment strategies. It is designed to minimize the overall cost of borrowing by focusing on high-interest debts. This strategy aims to maximize savings and accelerate the debt payoff process. The strategic approach promotes financial discipline and encourages a more structured approach to debt repayment.

Comparison of Debt Repayment Methods

| Method Name | Debt Handling Strategy | Advantages | Disadvantages |

|---|---|---|---|

| Stack Method | Prioritizes debts based on interest rate from highest to lowest. Focuses on high-interest debt repayment, while ensuring minimum payments on other debts. | Accelerated debt payoff; minimized interest costs over time; financial discipline promoted; structured approach. | Requires meticulous tracking and planning; potentially less motivating initially compared to snowball method. |

| Avalanche Method | Prioritizes debts based on interest rate from highest to lowest. | Maximizes savings by paying down the most expensive debts first. | Requires consistent tracking and planning; may not be as motivating initially compared to snowball method. |

| Snowball Method | Prioritizes debts based on smallest balance, regardless of interest rate. | Provides a sense of accomplishment as debts are paid off; motivation can be a powerful driver. | Can lead to higher interest costs over time, potentially increasing the overall cost of borrowing; may not be the most efficient method. |

Debt Categorization and Prioritization

Mastering the stack method for debt payoff hinges on strategically categorizing and prioritizing your debts. This crucial step ensures you’re attacking the most damaging debt first, maximizing your savings and minimizing interest accrued. Understanding which debts to tackle first is a key component of a successful debt payoff strategy.

Crucial Factors for Debt Categorization

Debt categorization for the stack method goes beyond simply listing your debts. It’s about analyzing each debt’s unique characteristics to determine its impact on your financial well-being. Key factors include the balance outstanding, the interest rate, and the minimum payment amount. These factors work together to determine which debts will have the largest impact on your overall financial health.

Analyzing Debt Balances, Interest Rates, and Minimum Payments

Understanding your debt balances, interest rates, and minimum payments is fundamental to prioritizing your debt repayment. Higher balances, particularly when coupled with high interest rates, represent a significant threat to your financial stability. A high-interest debt will accrue more interest over time, potentially increasing the total cost of the debt. Analyzing minimum payments helps determine the pace of repayment and the time needed to pay off the debt.

Prioritizing Debts Using the Stack Method

The stack method prioritizes debts based on their interest rates. A step-by-step approach is essential for efficient debt management.

- List All Debts: Compile a comprehensive list of all your debts, including the account name, balance, interest rate, minimum payment, and any applicable fees.

- Calculate Interest Rates: Determine the annual percentage rate (APR) for each debt. This is crucial for understanding the true cost of borrowing.

- Identify Minimum Payments: Note the minimum monthly payment required for each debt. This will help you gauge the pace of repayment.

- Categorize Debts: Arrange your debts based on interest rates from highest to lowest. High-interest debts should be tackled first.

- Prioritize Repayment: Allocate your extra money to pay off the highest interest debt first. This is the cornerstone of the stack method.

Tracking Debt Payments, Interest, and Remaining Balance

A well-organized spreadsheet or document is indispensable for tracking your debt payoff progress. It allows you to monitor your progress, adjust your strategy as needed, and see the positive impact of your efforts over time. This tracking helps you maintain motivation and stay on course.

Paying off debt fast using the stack method is all about prioritizing. It’s a powerful strategy, but setting clear milestones is key to staying motivated. Think of those smaller, achievable wins as steps towards a bigger goal, like conquering your debt. Understanding what a milestone is – a smarter approach for achieving life goals like eliminating debt – is crucial for success.

what is a milestone a smarter approach for achieving life goals This structured approach helps you visualize progress and stay focused on your financial freedom journey. Breaking down the debt into smaller, manageable chunks, celebrating each milestone, will keep you on track to pay off debt fast using the stack method.

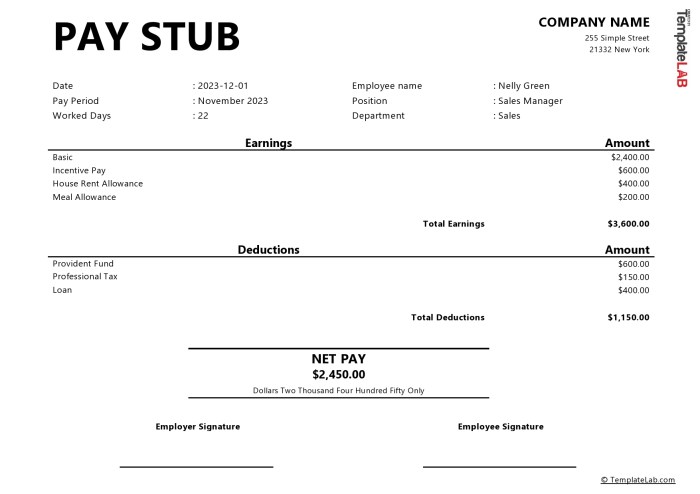

| Debt Type | Interest Rate | Minimum Payment | Estimated Stack Method Priority |

|---|---|---|---|

| Credit Card 1 | 18.99% | $200 | High |

| Credit Card 2 | 15.50% | $150 | Medium |

| Personal Loan | 10.25% | $300 | Low |

| Student Loan | 6.75% | $250 | Very Low |

Building a Stacking Strategy

Putting your debt payoff plan into action requires a detailed stacking strategy. This involves not only identifying your highest-interest debts but also allocating resources effectively to tackle them systematically. A well-defined strategy helps maintain momentum and avoids setbacks.A solid stacking strategy is more than just a list of debts; it’s a roadmap that allows you to allocate resources strategically and stay motivated throughout the process.

This roadmap ensures that your efforts are focused on the most impactful debts first, leading to quicker debt elimination and financial freedom.

Sample Debt Repayment Schedule

This schedule Artikels a hypothetical debt repayment plan using the stack method for a person with multiple debts. Remember, this is a template; adjust it to your specific financial situation.

Month | Debt | Minimum Payment | Additional Payment | Total Payment ------- | -------- | -------- | -------- | -------- 1 | Credit Card 1 (highest interest) | $100 | $200 | $300 2 | Credit Card 1 | $100 | $200 | $300 3 | Credit Card 1 | $100 | $200 | $300 4 | Credit Card 2 (second highest interest) | $50 | $150 | $200 5 | Credit Card 2 | $50 | $150 | $200 6 | Credit Card 2 | $50 | $150 | $200 7 | Personal Loan | $100 | $100 | $200 8 | Personal Loan | $100 | $100 | $200

Allocating Funds

The key to successful stacking is consistent additional payments to the highest-interest debts.

Your additional payments should be directed towards the debt with the highest interest rate, and you should consistently allocate resources to achieve this. The example above shows a consistent allocation strategy for each month.

Adjusting the Strategy

Life circumstances can change, impacting your debt repayment plan. A job loss, unexpected medical expenses, or a change in income can disrupt your strategy. Adjustments might include reducing the additional payments on some debts or temporarily pausing payments on others. Flexibility is crucial to maintain a sustainable plan.

Potential Obstacles

Several obstacles can hinder successful implementation of the stack method. Unexpected expenses, financial emergencies, or a lack of discipline can lead to missed payments or deviations from the plan. Having a backup plan and establishing a support system can help you navigate these challenges.

Debt Repayment Strategy Comparison

| Strategy | Debt Handling | Strengths | Weaknesses |

|---|---|---|---|

| Stack Method | Prioritizes high-interest debts | Faster payoff of high-interest debts, increased savings potential | May not be ideal for those with multiple small debts, requires strict adherence |

| Avalanche Method | Prioritizes debts with the highest interest rates | Fastest overall debt payoff, significant savings | Requires discipline and may not be suitable for emotional debts |

| Snowball Method | Prioritizes smallest debts first | Provides emotional motivation and early wins | Slower payoff of high-interest debts, may not maximize savings |

Budgeting and Saving for Debt Repayment

The stack method for debt repayment hinges on meticulous budgeting and saving. Without a solid financial plan, even the most carefully prioritized debt repayment strategy can falter. A well-structured budget allows you to track income and expenses, identify areas where you can cut back, and allocate funds specifically for debt repayment. This, in turn, accelerates the process and minimizes the overall financial strain.

Effective budgeting isn’t just about saving; it’s about consciously directing your financial resources towards a specific goal – paying off debt. A realistic budget, combined with consistent saving strategies, is the cornerstone of rapid debt reduction. By understanding your spending patterns and proactively managing your finances, you gain control over your debt and build a stronger financial foundation.

Importance of Budgeting for Efficient Debt Repayment

A well-defined budget is crucial for effective debt repayment. It acts as a roadmap, guiding your spending habits and ensuring that you’re allocating funds towards debt reduction. Without a budget, you risk overspending, potentially derailing your debt repayment progress. A budget allows for precise tracking of income and expenses, which is vital for identifying areas where you can save and allocate those savings toward debt.

Creating a Realistic Budget

Creating a realistic budget involves several key steps. First, meticulously track all your income and expenses for a period of several weeks or months. This provides a clear picture of your spending habits. Categorize your expenses (housing, food, transportation, entertainment, etc.) to identify areas where you can potentially cut back. Next, create a budget that includes both fixed and variable expenses.

Fixed expenses, like rent or mortgage, remain consistent, while variable expenses, like dining out, can fluctuate. Allocate a specific portion of your income to debt repayment, and factor in any unexpected expenses or savings goals.

Paying off debt fast using the stack method is all about prioritizing and strategizing. It’s a powerful tool, but understanding the realities of achieving your goals, like those explored in 7 harsh truths living your dream , is equally crucial. Ultimately, consistent effort and a realistic understanding of the challenges ahead are key to successfully tackling debt using this method.

Strategies for Saving Extra Money

Identifying and eliminating unnecessary expenses is key to freeing up funds for debt repayment. Evaluate your spending habits and look for areas where you can cut back without sacrificing essential needs. Consider strategies such as meal prepping, using public transportation, or canceling subscriptions you no longer use. Automate savings by setting up automatic transfers from your checking account to a savings account dedicated to debt repayment.

Every little bit counts.

Avoiding New Debt

Avoiding new debt is paramount while focusing on debt repayment. This means diligently reviewing all new credit applications and refraining from taking on unnecessary loans or credit card debt. A strong commitment to staying focused on paying down existing debt will greatly accelerate your progress and minimize the burden of accumulating additional financial obligations.

Budgeting Methods for Debt Repayment

This table Artikels various budgeting methods for debt repayment, highlighting their key principles, advantages, and disadvantages.

| Method | Key Principles | Pros | Cons |

|---|---|---|---|

| Zero-Based Budgeting | Allocating every dollar of income to a specific category, leaving no room for unplanned spending. | Forces you to be mindful of every dollar, promoting financial awareness and reducing overspending. | Can be overly rigid and challenging to adapt to unexpected expenses. |

| 50/30/20 Budget | Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. | Provides a simple framework for budgeting and promotes savings. | May not be suitable for everyone’s financial situation. |

| Envelope System | Assigning physical cash envelopes to different expense categories, limiting spending to the amount in each envelope. | Provides tangible visual representation of spending, encouraging discipline. | Can be cumbersome and time-consuming for tracking. |

| Cash Flow Statement Budgeting | Focuses on the movement of money into and out of your accounts. | Identifies cash flow problems and opportunities for improvement. | Requires detailed record-keeping and can be complex. |

Tracking Progress and Staying Motivated

Staying motivated throughout your debt repayment journey is crucial for success. The Stack Method, while providing a structured approach, demands consistent effort and a positive mindset. Regular progress monitoring, coupled with celebrating milestones and maintaining discipline, will significantly boost your morale and keep you on track. This section details strategies for tracking progress, celebrating achievements, and overcoming potential setbacks.

Monitoring Debt Reduction Progress

Monitoring your debt reduction progress is essential for staying motivated and ensuring you’re on track. Regularly checking your progress helps you identify areas where you’re excelling and pinpoint any potential roadblocks. Visualizing your reduction in debt provides a powerful motivator. Use a spreadsheet or a dedicated debt management tool to record the principal balances of each debt.

Tracking the progress of each debt allows for a clear picture of your overall performance. This method also helps you identify which debts are being paid off more quickly and which ones are lagging behind, enabling you to adjust your strategy if needed.

Celebrating Milestones and Maintaining Motivation

Celebrating your milestones is crucial for maintaining motivation. Each small victory, no matter how insignificant it may seem, is a testament to your hard work and commitment. These celebrations could be anything from treating yourself to a small indulgence to rewarding yourself with a fun activity. Recognizing your achievements, no matter how big or small, is vital in maintaining motivation and preventing burnout.

Significance of Discipline and Consistency

Discipline and consistency are paramount in the debt repayment process. The Stack Method relies on a systematic approach to debt repayment, and unwavering adherence to your plan is key. The more disciplined and consistent you are, the faster you’ll see results. Staying disciplined also means avoiding impulsive spending and temptations that could derail your progress.

Managing Potential Setbacks and Obstacles

Setbacks and obstacles are inevitable in any debt repayment journey. It’s important to be prepared for these challenges and have strategies in place to overcome them. If you encounter an unexpected expense or a temporary financial hardship, don’t panic. Instead, re-evaluate your budget and adjust your repayment plan as needed. Communicate with your creditors if necessary, and explore options for temporary relief if required.

Flexibility and adaptability are crucial in overcoming obstacles. By having a plan B, you can navigate unexpected hurdles without derailing your overall progress.

Tracking Progress Methods

Regular tracking is essential to maintain motivation and monitor progress. The following table Artikels various methods for tracking debt reduction progress.

| Method | Tracking Metrics | Pros | Cons |

|---|---|---|---|

| Spreadsheet | Debt balances, payment amounts, dates, interest paid | Simple, customizable, low cost | Can become cumbersome for many debts, requires manual input |

| Debt Management Software | Automated tracking of payments, due dates, interest | Automated calculations, efficient for large amounts of debt | Software costs, potential learning curve |

| Debt Reduction App | Visual progress bars, notifications, goal setting | Motivational, visually appealing, potentially automated | App costs, features may not suit everyone’s needs |

| Journaling | Thoughts, feelings, reflections on progress | Encourages introspection, helps understand emotional responses | Subjective, doesn’t provide concrete data |

Strategies for High-Interest Debt: How Pay Off Debt Fast Using The Stack Method

High-interest debt, like credit card debt with exorbitant APRs, can quickly spiral out of control. It’s crucial to address these debts aggressively and strategically to avoid accumulating even more financial burden. The stack method, when applied correctly to high-interest debt, provides a powerful tool for rapid repayment.

The stack method, when applied to high-interest debts, becomes a more focused and potentially faster approach. By prioritizing high-interest debts, you can minimize the overall interest paid and accelerate your debt-free journey.

Dealing with High-Interest Debts Using the Stack Method

Prioritizing high-interest debts within the stack method requires careful consideration. This involves aggressive repayment strategies and meticulous budgeting. Strategies like snowballing and avalanche methods can be integrated into the stack method, allowing for the rapid reduction of high-interest debt. Remember that consistency is key to success.

Quick Payoff Strategies for High-Interest Debts

Aggressive strategies are essential when dealing with high-interest debts. One approach is to allocate a significantly larger portion of your budget to high-interest debts. Consider automating payments or utilizing a debt repayment calculator to track progress and ensure consistency. The faster you pay off these debts, the less interest you accumulate. Examples include setting up automatic transfers from your checking account to the high-interest debt accounts or increasing your savings rate to accommodate extra payments.

Avoiding Further Debt Accumulation

To avoid adding to existing high-interest debt, a crucial strategy is meticulous budgeting. Creating a detailed budget helps track income and expenses, allowing you to identify areas where spending can be reduced. A crucial part of this strategy is to avoid taking on new debt unless absolutely necessary. For example, if you are using credit cards to pay for everyday expenses, identify ways to reduce your spending.

This might involve using cash or debit cards instead, or creating a system for tracking spending.

Negotiating with Creditors for Interest Rate Reductions, How pay off debt fast using the stack method

Negotiating with creditors for interest rate reductions is a viable strategy. This can significantly impact the overall cost of repayment. When contacting creditors, be polite and professional, and clearly articulate your financial situation. Demonstrate a commitment to repayment by providing a clear repayment plan. Remember that every situation is different, and success in negotiation depends on several factors.

Paying off debt fast using the debt snowball method is all about prioritizing. But the Stack method, focusing on high-interest debts first, often requires a bit more mental fortitude. Understanding cognitive dissonance, that internal conflict between our beliefs and actions, what is cognitive dissonance , can be key. Recognizing that discomfort can be a powerful motivator for staying on track with your plan helps you stick to the Stack method for faster debt payoff.

Table: Strategies for Handling High-Interest Debt

| Strategy | Application | Pros | Cons |

|---|---|---|---|

| Increased Payment Allocations | Allocate a larger portion of your budget to high-interest debt payments. | Faster debt repayment, lower overall interest costs. | Potentially challenging to maintain consistently, requires careful budgeting. |

| Debt Consolidation | Consolidate high-interest debts into a single loan with a lower interest rate. | Potentially lower monthly payments, simplified repayment. | Requires careful evaluation of the new loan’s terms and conditions. |

| Debt Snowballing/Avalanche within the Stack Method | Use the snowball or avalanche method to prioritize high-interest debts. | Increased motivation from early success, focus on minimizing interest costs. | May not always be the fastest strategy, depends on individual circumstances. |

| Negotiation with Creditors | Contact creditors to negotiate lower interest rates. | Potentially significant savings on interest payments. | Requires clear communication and a demonstrated commitment to repayment. |

Beyond the Stack Method

The Stack Method provides a solid framework for tackling debt, but sometimes additional strategies can accelerate the process and build a more resilient financial future. Beyond the structured approach of stacking, exploring supplementary techniques and seeking expert advice are crucial for long-term success.

Maximizing your debt repayment efforts requires a multifaceted approach. Simply focusing on the Stack Method may not always be sufficient, especially in cases with complex debt profiles or challenging financial situations. Understanding alternative strategies and leveraging resources can significantly impact your progress.

Alternative Debt Repayment Strategies

Diversifying your debt repayment approach can be beneficial. Explore options like debt consolidation, balance transfers, or negotiating with creditors for lower interest rates. Each of these methods has specific criteria and potential benefits and drawbacks that need careful consideration. For instance, debt consolidation loans might lower your monthly payments, but they could also come with higher interest rates than anticipated.

A balance transfer card can temporarily lower your interest burden, but the promotional period may expire, leaving you with a potentially higher overall cost. Carefully weigh the pros and cons of each strategy before committing.

Seeking Professional Financial Advice

A financial advisor can provide personalized guidance based on your specific circumstances. They can help assess your debt profile, identify suitable repayment strategies, and navigate complex financial situations. This expert perspective can be invaluable in making informed decisions, especially when dealing with high-interest debts or intricate financial circumstances. They can help you create a tailored plan that addresses your individual needs and financial goals.

Building an Emergency Fund

Establishing an emergency fund is essential, even while paying off debt. Having a financial cushion protects you from unexpected expenses, preventing you from falling back into debt or derailing your progress. The ideal amount depends on your individual needs and expenses, but aiming for three to six months of living expenses is a good starting point. This fund acts as a safety net, providing peace of mind and resilience in the face of unforeseen circumstances.

It allows you to avoid using high-interest debt for emergencies, protecting your progress and avoiding unnecessary debt.

Additional Resources for Debt Management

Numerous resources can support your debt repayment journey. Government agencies, non-profit organizations, and financial institutions offer valuable information and guidance. These resources can provide educational materials, support groups, or even debt counseling services. Leveraging these resources can be instrumental in making informed decisions and seeking guidance when needed.

Additional Resources for Debt Management:

* Consumer Financial Protection Bureau (CFPB): Provides consumer information on various financial topics, including debt management.

– National Foundation for Credit Counseling (NFCC): Offers debt counseling services and educational resources.

– Non-profit credit counseling agencies: Local agencies often provide free or low-cost debt management services.

– Local libraries: Many libraries offer workshops and seminars on personal finance and debt management.

– Your bank or credit union: Your financial institution may offer resources and guidance on managing debt.

Final Conclusion

In conclusion, mastering the stack method for paying off debt fast is a journey that requires careful planning and consistent effort. By understanding the different strategies, categorizing your debts effectively, creating a realistic budget, and tracking your progress, you’ll be well on your way to financial freedom. Remember to stay motivated, be flexible, and seek professional help if needed.

Let’s tackle those debts head-on!