How get rich and achieve financial independence – How to get rich and achieve financial independence is a journey that many aspire to. This guide provides a roadmap to understanding the steps involved in building wealth, managing debt, and creating a sustainable financial plan. We’ll explore the key components of financial independence, the strategies for wealth accumulation, and the crucial skills needed to navigate the complexities of personal finance.

It’s a comprehensive exploration of building a secure and fulfilling financial future.

From defining financial independence and understanding its nuances to outlining practical steps for creating a comprehensive financial plan, this guide aims to empower readers to take control of their financial destinies. We’ll discuss various investment strategies, effective debt management techniques, and the importance of developing essential financial skills.

Defining Financial Independence

Financial independence isn’t just about having a lot of money; it’s about achieving a state where your financial resources allow you to live the life you want without constant pressure from work or financial worries. It’s a powerful feeling of freedom and control over your time and future. This freedom comes from having sufficient resources to meet your needs and desires, allowing you to pursue your passions and goals without the constraint of financial limitations.This freedom goes beyond just having a high net worth; it’s about the ability to choose your lifestyle, prioritize your well-being, and make decisions aligned with your values, rather than being dictated by financial obligations.

It involves building a solid financial foundation that supports your long-term goals and aspirations.

Defining Financial Independence

Financial independence is a state where an individual’s income, assets, and investments generate enough revenue to cover their living expenses, allowing them to pursue their goals and passions without relying on external employment. This encompasses a strong understanding of personal finances, strategic investments, and a well-defined plan for long-term financial security. Crucially, it transcends the accumulation of wealth, focusing instead on the freedom it provides.

Wealth vs. Financial Independence

While wealth is the accumulation of assets, financial independence is the ability to live without relying on earned income. A wealthy person might still be burdened by financial responsibilities, while a financially independent person has the flexibility to make choices based on their values and desires. A key distinction lies in the ability to live comfortably without constant income generation.

For example, a person with a large inheritance might be considered wealthy but not financially independent if they rely on the principal for their living expenses, depleting it over time.

Wanting to get rich and achieve financial independence is a common goal. It often involves understanding how to leverage resources effectively. Interestingly, highly intuitive people often avoid some common pitfalls that can hinder financial success. For example, learning about the 13 things highly intuitive people don’t do, like getting caught up in emotional decisions instead of logical financial strategies, can be hugely beneficial in your journey towards financial freedom.

13 things highly intuitive people dont can provide insightful perspectives on improving your financial decisions. Ultimately, understanding these traits can help you make better choices to reach your financial independence goals.

Stages of Achieving Financial Independence

Achieving financial independence is a journey, not a destination. It involves several key stages, each building upon the previous one. These stages are not necessarily linear and can overlap. Early stages might focus on building an emergency fund and establishing good spending habits, while later stages involve more complex financial strategies like investing in stocks and real estate.

- Building a Solid Foundation: This stage involves creating a budget, paying off high-interest debt, and establishing an emergency fund. This is the cornerstone of long-term financial health.

- Strategic Investing: This involves researching and investing in assets that can generate returns over time, such as stocks, bonds, real estate, or other income-generating ventures. Diversification is crucial to manage risk.

- Passive Income Generation: This involves creating streams of income that require minimal ongoing effort, such as dividend-paying stocks, rental properties, or online businesses.

- Review and Refinement: Regularly reviewing your financial plan and adjusting it based on your changing needs and goals is essential. Life circumstances and market conditions evolve, and adaptation is key.

Comparing Financial Independence Goals

This table illustrates how different goals for financial independence can be achieved through varying strategies and timeframes.

| Goal | Focus | Strategies | Timeframe |

|---|---|---|---|

| Early Retirement | Achieving financial freedom early in life | Aggressive saving, high-return investments, minimizing expenses | Typically 5-15 years |

| Passive Income | Creating multiple income streams requiring minimal effort | Investing in dividend-paying stocks, rental properties, creating online courses | Variable, depending on investment type |

| Debt-Free Living | Eliminating all debt and living within one’s means | Creating a budget, prioritizing debt repayment, avoiding unnecessary expenses | Variable, depending on debt levels |

Financial independence is a marathon, not a sprint. It requires consistent effort, discipline, and a well-defined plan.

Building Wealth & Income Streams: How Get Rich And Achieve Financial Independence

Building wealth and achieving financial independence requires a multifaceted approach, encompassing various investment strategies and the creation of passive income streams. This process is not a sprint but a marathon, demanding discipline, patience, and a long-term perspective. Smart investment choices and consistent savings habits are crucial components in this journey.A comprehensive strategy for building wealth considers the interplay of accumulating capital through investments and generating additional income streams.

This requires understanding risk tolerance, financial goals, and the time horizon for achieving those goals. A well-structured budget is fundamental to managing resources effectively and ensuring that investments align with overall financial objectives.

Wanting to get rich and achieve financial independence takes more than just a lucky break; it often involves navigating complex social dynamics. Learning the “secrets getting along with difficult people” here can be surprisingly helpful in building strong relationships, which are crucial for career advancement and ultimately, financial success. Ultimately, mastering these interpersonal skills is key to unlocking your full potential and reaching your financial goals.

Investment Strategies for Accumulating Wealth

Different investment strategies cater to varying risk tolerances and financial goals. Diversification across asset classes is crucial to mitigate risk and potentially enhance returns. Strategies include value investing, growth investing, and dividend investing, each with its own set of characteristics and potential outcomes. Careful consideration of personal circumstances and financial objectives is paramount when selecting an investment strategy.

Methods of Generating Passive Income Streams

Passive income streams provide a steady flow of revenue without requiring significant active management. These streams can include rental properties, dividend-paying stocks, royalties from intellectual property, or online businesses. Consistent effort and careful planning are essential for building sustainable passive income streams.

Budgeting and Saving for Wealth Building

A well-defined budget is a cornerstone of wealth building. It helps track income and expenses, identify areas for savings, and allocate funds towards investments. Regular saving, even small amounts, compounds over time, generating substantial returns. Prioritizing savings and minimizing unnecessary spending are key components of successful wealth building.

Comparison of Investment Vehicles

Various investment vehicles offer different levels of risk and potential return. Stocks, bonds, real estate, and alternative investments like commodities and precious metals each have unique characteristics. Understanding the nuances of each vehicle is critical to making informed investment decisions.

- Stocks offer the potential for significant returns but also carry substantial risk. Company performance, market fluctuations, and economic conditions all impact stock values. Diversification across various sectors is often recommended to mitigate risk.

- Bonds typically offer lower returns compared to stocks but are considered less risky. They represent loans to corporations or governments, providing a more stable investment.

- Real Estate can generate passive income through rental properties. However, real estate investments require significant upfront capital and ongoing maintenance costs. Property values can fluctuate, and market conditions impact returns.

- Alternative Investments like commodities or precious metals can act as a hedge against inflation or economic uncertainty. However, their values can be volatile and require in-depth understanding.

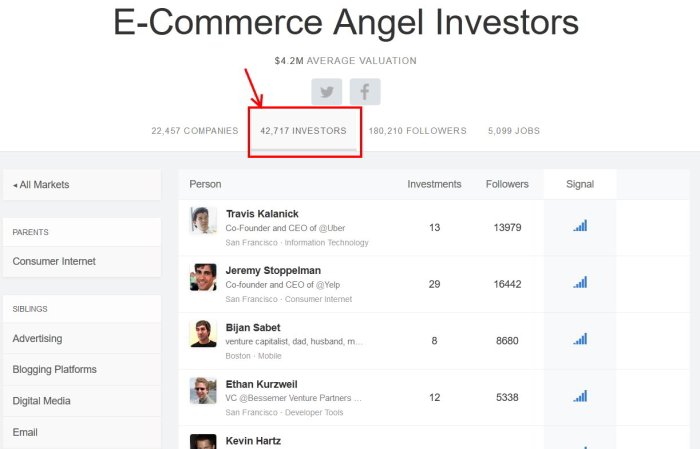

Successful Entrepreneurs and Financial Independence

Numerous entrepreneurs have achieved financial independence through innovative business ventures. Analyzing their strategies, resilience, and commitment to their goals can provide valuable insights. Examples include individuals in technology, retail, or service industries who have successfully built scalable businesses.

Investment Options, Risks, and Returns

| Investment Option | Risk | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Low | Low |

| Real Estate | Medium | Medium to High |

| Alternative Investments | Variable | Variable |

Time Horizon for Investment Goals

Different investment goals require varying time horizons. Short-term goals, such as saving for a down payment on a house, may require a shorter time frame than long-term goals like retirement planning. Understanding the time horizon is critical for selecting appropriate investment strategies and vehicles.

| Investment Goal | Time Horizon |

|---|---|

| Emergency Fund | 1-3 Months |

| Down Payment | 2-5 Years |

| Retirement | 20+ Years |

Managing Debt & Expenses

Debt and expenses are significant hurdles on the path to financial independence. Effective management of these areas is crucial for building wealth and achieving your financial goals. Without a strong plan to control debt and expenses, progress towards financial independence can be significantly hindered. Understanding the impact of your lifestyle choices and meticulously tracking your spending are fundamental to success.Managing your finances effectively involves a multi-faceted approach that encompasses debt reduction strategies, budgeting, and mindful expense control.

A well-defined plan for managing debt and expenses not only reduces financial stress but also frees up resources for investment and future growth.

Debt Reduction Strategies

Debt reduction strategies are essential for freeing up capital and minimizing interest payments. Choosing the right strategy depends on your individual circumstances, debt amounts, and interest rates. Different methods offer varying levels of efficiency and may require different levels of discipline.

- The Snowball Method: Focuses on paying off the smallest debts first, regardless of interest rates. This method provides early wins and can boost motivation, encouraging continued progress. For example, if you have multiple credit card debts with varying balances, the snowball method involves paying off the smallest balance first, then using the freed-up funds to pay down the next smallest balance.

This positive reinforcement can be a powerful motivator for consistent progress.

- The Avalanche Method: Prioritizes debts with the highest interest rates. This approach minimizes overall interest paid over time, although it may require more initial effort and financial commitment. This method is more effective for long-term debt management, ensuring that the most costly debts are addressed first, thus reducing interest expense significantly over the lifetime of the loan.

- Debt Consolidation: Involves combining multiple debts into a single loan with a lower interest rate. This simplifies payments and can save money on interest. However, it’s important to evaluate the new interest rate and terms carefully before consolidating to ensure that the consolidation strategy truly benefits your overall financial situation.

Expense Tracking and Budgeting

Tracking expenses and creating a realistic budget are fundamental to understanding where your money goes. This knowledge is critical for identifying areas where you can reduce spending and allocate funds more effectively towards your financial goals. A well-constructed budget is a roadmap for managing your finances, helping you stay on track and achieve financial independence.

Building wealth and achieving financial independence is a journey, not a sprint. One key step is smart real estate investment. Learning how to buy pre-construction townhomes, for example, can be a fantastic way to build equity and potentially increase your returns. By researching the market and understanding the process of how buy pre construction townhome , you can strategically position yourself for future financial success.

This careful planning and calculated approach are crucial for long-term financial security.

Creating a Realistic Budget

Creating a realistic budget involves careful planning and a clear understanding of your income and expenses. This is not a one-time task but a continuous process of monitoring and adjusting your spending habits.

- Income Tracking: List all sources of income, including salary, side hustles, and any other revenue streams.

- Expense Categorization: Divide expenses into categories (housing, food, transportation, entertainment, etc.). Be as specific as possible to identify areas for potential savings.

- Expense Tracking: Monitor your spending for a period (e.g., a month) to accurately reflect your spending habits.

- Budgeting: Allocate funds to each category based on your income and priorities. Ensure that your spending aligns with your financial goals.

- Review and Adjustment: Regularly review your budget and adjust it as needed. This flexibility is critical for adapting to changes in income or expenses.

Lifestyle Choices and Financial Independence

Lifestyle choices significantly impact financial independence. Making conscious decisions about spending and adopting habits that encourage saving can dramatically accelerate your progress.

“A penny saved is a penny earned.”

Avoiding unnecessary expenses is a powerful strategy for freeing up funds for investments and debt reduction.

Impact of Avoiding Unnecessary Expenses

Avoiding unnecessary expenses can significantly impact your financial situation, allowing you to save more and achieve financial independence faster. Prioritizing needs over wants can lead to substantial savings over time. This process involves conscious decisions and a willingness to forgo non-essential spending.

Debt Reduction Strategies Table

| Strategy | Pros | Cons |

|---|---|---|

| Snowball Method | Motivational, quick wins | May not minimize total interest paid |

| Avalanche Method | Minimizes total interest paid | Requires discipline, slower initial progress |

| Debt Consolidation | Simplified payments, potentially lower interest | May have hidden fees, evaluate new interest rate carefully |

Understanding Your Personal Financial Situation

Understanding your personal financial situation is critical for effective debt management and expense control. This requires thorough analysis of your income, expenses, debts, and assets. This process is a crucial step towards building a solid financial foundation and achieving financial independence.

Developing Essential Skills

Unlocking financial independence isn’t just about accumulating wealth; it’s about mastering the skills needed to manage it effectively. This involves a range of competencies that extend beyond basic budgeting. Developing these skills is crucial for long-term financial security and allows you to adapt to changing economic landscapes.

Key Financial Skills for Financial Independence

Developing crucial financial skills is fundamental to achieving financial independence. These skills empower you to make informed decisions, manage resources effectively, and navigate the complexities of the financial world. Proficiency in these areas is essential for building and maintaining wealth over time.

- Budgeting and Financial Planning: A well-structured budget is the cornerstone of sound financial management. It allows you to track income and expenses, identify areas for improvement, and set realistic financial goals. Consistent budgeting helps you make informed decisions and stay on track towards your financial objectives.

- Investing and Portfolio Management: Understanding different investment vehicles, risk tolerance, and diversification strategies is vital for growing your wealth. Learning how to manage a portfolio, and adapting to market fluctuations, is essential for building long-term financial security.

- Debt Management and Credit Utilization: Effective debt management is critical to avoid accumulating unnecessary debt and high interest costs. This includes understanding different types of debt, interest rates, and repayment strategies. Responsible credit utilization is also important to maintain good credit scores for future borrowing opportunities.

- Tax Planning and Optimization: Tax laws are complex, and understanding how they impact your finances is crucial for maximizing your returns. Tax planning strategies can save you money and help you achieve financial independence more efficiently.

- Negotiation and Bargaining Skills: Developing these skills can help you save money on various aspects of your financial life, from purchasing a car to negotiating a better interest rate on a loan. This proactive approach helps to enhance financial well-being.

Continuous Learning and Adaptation

The financial world is constantly evolving. Staying updated with new trends, regulations, and technologies is paramount for maintaining financial well-being. Continuous learning and adaptation are essential to keep pace with the changing landscape and make informed financial decisions. Financial literacy is not a destination, but a continuous journey.

- Staying Informed: Regularly reading financial news, attending seminars, and following reputable financial experts can keep you abreast of market trends, investment opportunities, and relevant financial legislation.

- Seeking Professional Advice: Consulting with financial advisors can provide personalized guidance and support in navigating complex financial situations. Their expertise can be invaluable in developing and implementing strategies tailored to your individual circumstances.

- Trial and Error: Learning through experience is a vital component of financial development. Experimentation with different investment strategies and financial tools can help you discover what works best for you and adjust your approach accordingly.

Resources for Learning Finance

Numerous resources are available to enhance your financial knowledge and skills. These resources can provide valuable insights and guidance for developing financial literacy.

- Books and Articles: Numerous books and articles provide practical advice and strategies for managing finances effectively. Examples include “Rich Dad Poor Dad” by Robert Kiyosaki, and “The Total Money Makeover” by Dave Ramsey.

- Online Courses and Platforms: Online platforms offer a wide range of courses and tutorials on various financial topics. Websites such as Coursera, Udemy, and Khan Academy provide accessible educational materials.

- Financial Institutions: Banks and credit unions often offer workshops and seminars to help their customers develop financial skills. These resources can be very beneficial for learning about different financial products and services.

Financial Literacy and Financial Independence

Financial literacy is the foundation for achieving financial independence. Understanding fundamental financial concepts, including budgeting, saving, investing, and debt management, empowers you to make informed decisions. This, in turn, allows you to build a strong financial foundation and reach your financial goals.

- Financial literacy empowers you to make informed decisions.

- It provides a strong foundation for long-term financial security.

Essential Financial Skills and Their Importance

| Financial Skill | Importance in Achieving Financial Independence |

|---|---|

| Budgeting | Essential for tracking income and expenses, identifying areas for improvement, and setting realistic financial goals. |

| Investing | Crucial for growing wealth over time, managing risk, and achieving financial objectives. |

| Debt Management | Critical for avoiding high-interest debt and maximizing returns. |

| Tax Planning | Essential for optimizing financial returns and minimizing tax liabilities. |

| Negotiation | Helps save money on various aspects of your financial life. |

Tracking Progress Towards Financial Independence

Using financial tools and resources allows you to track your progress and adjust your strategies accordingly. Tracking your progress is essential for staying motivated and ensuring you are on the right path to achieving your financial goals.

- Spreadsheet Software: Spreadsheets can be used to create personalized budgets, track investment performance, and monitor progress toward financial goals.

- Financial Management Software: Dedicated financial management software can automate many tasks, providing comprehensive insights into your financial situation.

- Online Banking and Financial Portals: These tools allow you to monitor accounts, track transactions, and access important financial information quickly and easily.

Creating a Financial Plan

A solid financial plan is the cornerstone of achieving financial independence. It’s not just about saving; it’s about strategically managing your money to achieve your long-term goals. This plan acts as a roadmap, guiding you through the complexities of budgeting, investing, and debt management. A well-defined plan provides a clear vision for your financial future, allowing you to navigate unexpected challenges and seize opportunities.A comprehensive financial plan is more than just a list of goals; it’s a dynamic document that evolves with your life and circumstances.

Regular reviews and adjustments are crucial to ensure your plan remains aligned with your changing needs and aspirations. Understanding your risk tolerance and investment goals is essential to create a plan that aligns with your comfort level and desired returns.

Steps in Creating a Comprehensive Financial Plan

A comprehensive financial plan involves several key steps. First, define your short-term and long-term financial goals. This might include buying a house, funding your children’s education, or retiring comfortably. Next, assess your current financial situation, including income, expenses, assets, and liabilities. This step provides a baseline for understanding your current financial standing and identifying areas for improvement.

Third, develop a budget to track and manage your income and expenses. This helps you understand where your money is going and identify areas where you can save. Finally, create a detailed investment strategy, outlining your risk tolerance, investment goals, and desired returns. This strategy should be regularly reviewed and adjusted to reflect changes in your financial circumstances.

Importance of Realistic Financial Goals

Setting realistic financial goals is vital to the success of your plan. Unrealistic goals can lead to frustration and disappointment, hindering your progress toward financial independence. For example, aiming to save a million dollars in one year is likely unrealistic and unsustainable. Instead, break down your goals into smaller, achievable milestones. This approach allows you to track progress, celebrate successes, and maintain motivation.

Examples of Financial Plans for Various Income Levels and Life Stages

Financial plans should be tailored to individual circumstances. A young professional starting their career might focus on building an emergency fund, paying off student loans, and investing for the long term. A family with children might prioritize saving for their children’s education, while a retiree might focus on maximizing income and minimizing expenses. A person with a higher income might have the luxury of investing more aggressively, while someone with a lower income might prioritize building an emergency fund and paying off debt.

Significance of Regular Financial Reviews and Adjustments, How get rich and achieve financial independence

Regular financial reviews are crucial for maintaining a healthy financial plan. Life events like job changes, marriage, or the birth of a child can significantly impact your financial situation. These events necessitate adjustments to your plan to ensure it remains aligned with your goals. Reviewing your plan at least annually, or more frequently as needed, allows you to adapt to changing circumstances.

Key Components of a Financial Plan

| Component | Description ||—|—|| Income | Sources of income, including salary, investments, and other sources. || Expenses | Categorized spending, including housing, food, transportation, and entertainment. || Assets | Possessions of monetary value, such as savings accounts, investments, and real estate. || Liabilities | Debts, including mortgages, loans, and credit card balances. || Investment Strategy | Allocation of assets across different investment vehicles, considering risk tolerance and goals.

|| Risk Tolerance | Individual’s comfort level with potential investment losses. || Investment Goals | Desired returns, time horizon, and specific financial objectives. || Contingency Planning | Strategies for dealing with unexpected events, such as job loss or medical emergencies. |

Understanding Risk Tolerance and Investment Goals

Understanding your risk tolerance and investment goals is crucial for developing a sound investment strategy. Risk tolerance refers to your comfort level with potential investment losses. High-risk investments may offer the potential for higher returns, but they also carry a greater chance of losing money. Conversely, low-risk investments tend to offer lower returns but are more secure.

Investment goals should align with your financial objectives and time horizon. For example, a longer time horizon allows for more aggressive investments, while a shorter time horizon might require a more conservative approach.

Methods of Diversifying Investments

Diversifying investments is a key strategy for managing risk. Diversification involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. This reduces the impact of any single investment’s performance on your overall portfolio. For example, if the stock market experiences a downturn, your diversified portfolio may still yield positive returns from other asset classes.

Consider a mix of stocks, bonds, and potentially real estate or other alternative investments, such as precious metals or commodities. The specific allocation depends on your risk tolerance, investment goals, and the overall market conditions.

Maintaining Financial Independence

Financial independence isn’t a destination; it’s a journey that requires continuous adaptation and vigilance. While establishing a strong foundation is crucial, maintaining that independence over time demands proactive strategies and a willingness to adjust to life’s inevitable changes. This involves not only preserving your wealth but also protecting it from inflation, market fluctuations, and unexpected events.Maintaining financial independence requires a proactive and adaptable approach.

Simply accumulating wealth is insufficient; you must actively manage it, grow it, and protect it. This includes understanding and adapting to economic shifts, personal circumstances, and potential risks. A robust financial plan, coupled with ongoing learning and foresight, is essential to sustaining financial freedom throughout life.

Preserving and Growing Wealth

Preserving and growing wealth requires a multifaceted approach encompassing various investment strategies and risk management techniques. Diversification across different asset classes (stocks, bonds, real estate, etc.) can mitigate risk. Regular rebalancing of your portfolio is crucial to maintaining the desired asset allocation. Consider consulting with a qualified financial advisor to tailor a strategy that aligns with your risk tolerance and long-term goals.

Employing a disciplined approach to saving and investing, consistently exceeding your expenses with your income, is key.

Adapting to Changing Life Circumstances

Life is full of unexpected turns. A career change, a family expansion, or a significant health event can all impact your financial situation. Flexibility and adaptability are paramount. Review and adjust your financial plan periodically to accommodate these changes. Ensure your investment strategy, spending habits, and emergency fund remain aligned with your evolving needs.

For example, if you have a child, you may need to adjust your retirement savings strategy or consider setting up a college fund.

Importance of Estate Planning

Estate planning is not just for the wealthy; it’s a crucial aspect of securing your financial future for yourself and your loved ones. A well-defined estate plan Artikels how your assets will be distributed after your passing. This includes wills, trusts, powers of attorney, and other legal documents. It minimizes potential conflicts and ensures your wishes are carried out, protecting your family’s financial well-being.

Protecting Assets from Inflation and Market Fluctuations

Inflation erodes the purchasing power of your savings over time. Investing in assets that have historically outpaced inflation, such as real estate or inflation-protected securities, can help safeguard your wealth. Similarly, market fluctuations can impact investment returns. Diversification and a long-term perspective are essential in navigating these uncertainties. For instance, investing in a mix of stocks and bonds can reduce risk.

Staying Informed About Financial Trends

Staying informed about financial trends is critical for making sound decisions. Economic forecasts, market analysis, and regulatory changes all play a role in shaping your financial strategy. Reading reputable financial publications, attending workshops, and seeking advice from experts can provide valuable insights.

Managing Unexpected Financial Situations

Unexpected financial situations, like job loss or major repairs, can significantly impact your financial stability. Developing a plan to handle these contingencies is crucial.

| Situation | Action Plan |

|---|---|

| Job Loss | Assess income sources, reduce expenses, explore unemployment benefits, and consider temporary employment or retraining opportunities. |

| Major Repairs | Prioritize necessary repairs, explore financing options, and potentially consider selling or downsizing assets. |

| Medical Emergency | Understand medical insurance coverage, explore financial assistance programs, and seek guidance from financial advisors. |

Examples of Maintaining Financial Independence

Numerous individuals have successfully maintained financial independence throughout their lives, demonstrating the effectiveness of proactive planning and adaptability. One example could be a small business owner who diversified their income streams and adapted their business model during economic downturns. Another could be a family that successfully navigated a significant medical expense by proactively managing their insurance coverage and exploring financial aid options.

These stories underscore the importance of flexibility, foresight, and preparedness in the face of life’s challenges.

Outcome Summary

In conclusion, achieving financial independence is a multifaceted process requiring careful planning, consistent effort, and a proactive approach. This guide has provided a framework for understanding the key elements involved. By mastering the concepts discussed, readers can embark on a journey towards financial freedom, building a future where they have the autonomy and resources to pursue their passions and aspirations.

Remember that the path to financial independence is unique to each individual, and adaptation and continuous learning are crucial throughout the journey.