How find the best investors for your new product – How to find the best investors for your new product is a crucial step in launching any innovative venture. This guide will walk you through identifying potential investors, crafting a compelling pitch, and building strong relationships to secure the funding your product needs.

From understanding different investor types and their investment stages to researching their portfolios and evaluating their alignment with your vision, this comprehensive guide covers every aspect of the process. It also includes essential steps like structuring investment deals, navigating due diligence, and negotiating favorable terms. Mastering these steps is key to securing the right investment for your product’s success.

Identifying Potential Investors

Securing funding is crucial for the success of any new product. Knowing which investors are most likely to support your specific stage and vision is paramount. This section delves into the various investor types, their investment strategies, and how to assess their suitability for your product.Understanding the diverse landscape of investors allows you to make informed decisions about who to approach and tailor your pitch to maximize your chances of securing the right funding.

Investor Types and Their Target Stages

Different investor types specialize in specific investment stages. Recognizing these preferences is key to finding the right fit for your product’s development phase.

- Angel Investors: These high-net-worth individuals often invest in early-stage ventures, typically providing seed funding or Series A funding. They often have extensive industry experience and are looking for promising ventures with strong growth potential. They typically seek significant returns, often in the range of 20-30% or more. They are frequently drawn to innovative ideas that solve a problem or fulfill a need in the market.

- Venture Capitalists (VCs): VCs are professional investors who typically focus on later-stage funding rounds (Series B, Series C, and beyond). They invest substantial capital in companies with proven traction and high growth potential. VCs are often involved in providing strategic guidance to portfolio companies, and they typically have a longer investment horizon than angel investors. Their investments typically involve more risk than angel investments, but also the potential for larger returns.

- Crowdfunding Platforms: These platforms allow individuals to raise capital from a large number of investors through online campaigns. They are ideal for early-stage projects looking for seed funding. Crowdfunding is often suited for products with a strong consumer appeal and a clear value proposition. A significant advantage is the potential to generate pre-orders and early feedback, which can be critical for product development.

However, the returns may be lower than those from traditional investors.

- Private Equity Firms: These firms typically invest in established companies seeking to acquire or restructure them for greater profitability. They often invest in mature companies that have established a track record but need additional capital to expand or execute a specific strategic plan. The investment timeframe can be longer than other investor types.

Investor Motivations and Characteristics

Investors are motivated by different factors, and understanding these motivations is essential to tailoring your pitch.

- Angel Investors: Often driven by a desire to support entrepreneurs, a personal connection with the founder, and a belief in the product’s potential. They seek both financial returns and a sense of impact.

- Venture Capitalists: Driven by financial returns and a belief in the company’s potential for substantial growth. They often look for teams with strong leadership and a clear path to profitability.

- Crowdfunding Platforms: Motivated by the potential for high visibility and engagement with a large investor base. They often seek products with strong market demand and a clear narrative that appeals to a broad audience.

- Private Equity Firms: Motivated by the potential for significant financial returns through restructuring or acquisitions. They focus on the financial health and growth potential of the company.

Advantages and Disadvantages of Different Investor Types

Each investor type offers distinct advantages and disadvantages.

| Investor Type | Investment Amount | Risk Tolerance | Expected Return | Advantages | Disadvantages |

|---|---|---|---|---|---|

| Angel Investors | $25,000 – $100,000+ | High | 20-30%+ | Early-stage support, mentorship, strategic guidance | Limited capital, potential for less flexibility in decision-making |

| Venture Capitalists | $1,000,000 – $100,000,000+ | Moderate to High | 20-50%+ (or more) | Significant capital, potential for strategic partnerships | High level of due diligence, potential loss of control |

| Crowdfunding Platforms | $1,000 – $100,000+ | High | Variable (often lower than traditional investors) | Broad reach, early feedback, potential for pre-orders | Lower returns, limited strategic guidance |

| Private Equity Firms | $10,000,000 – $Billions+ | Moderate | 10-30%+ (or more) | Significant capital, established expertise in acquisitions and restructuring | Long investment horizon, potentially less flexibility in decision-making |

Researching Investors

Finding the right investors is crucial for the success of any new product. Thorough research allows you to identify investors aligned with your vision and capable of providing the necessary support. This process involves more than just looking at their past investments; it requires understanding their investment philosophies and identifying potential synergies.A successful investor search goes beyond simply identifying potential funders.

It’s about finding investors who understand your product’s unique value proposition and are willing to partner with you for the long term. This requires digging deeper than just basic information and delving into their investment track records and portfolio composition.

Finding the right investors for your startup is crucial, but it’s not always easy. Think about the nutritional value of potential investors, just like you’d consider the nutritional value of your food. You need to carefully assess their experience and track record, just like you’d research 10 foods you should never eat 2 for potential health risks.

Ultimately, the best investors are those who share your vision and have the resources to help you succeed. Focus on building a strong foundation and you’ll attract the best partners.

Identifying Potential Investor Sources

Understanding where to find potential investors is the first step in the research process. Various avenues offer insights into the investor landscape.

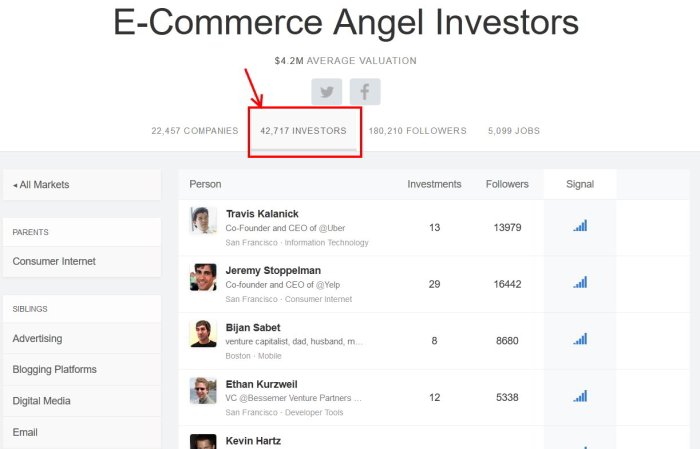

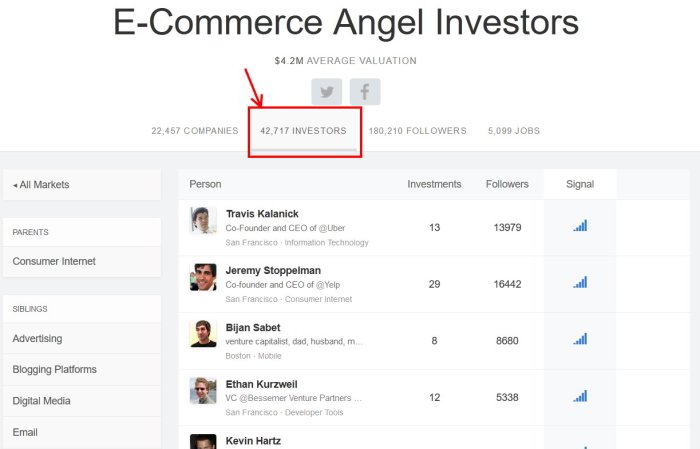

- Online Databases: Specialized databases provide comprehensive information on investors, including their investment strategies, portfolio companies, and contact information. These resources allow for targeted searches based on specific investment areas, fund sizes, and geographic locations. Examples include PitchBook, Preqin, and Crunchbase.

- Industry Events: Attending industry conferences and trade shows offers invaluable networking opportunities. These events bring together entrepreneurs, investors, and industry experts, fostering valuable connections and allowing for direct interactions with potential investors.

- Networking: Building relationships with mentors, advisors, and other entrepreneurs is crucial. These individuals often have insights into the investor community and can introduce you to relevant investors.

Evaluating Investor Portfolios and Track Records

Analyzing an investor’s portfolio and investment track record provides critical insights into their investment style and preferences.

- Portfolio Analysis: Examining an investor’s past investments reveals their areas of interest and investment strategies. Analyzing the industries, stages of companies, and types of investments in their portfolio helps assess their potential fit with your product.

- Investment Track Record: Evaluating an investor’s historical performance offers a glimpse into their success rate and investment approach. Analyzing their returns, investment timelines, and exit strategies provides valuable data for assessing their investment prowess and risk tolerance.

Assessing Investor Alignment

Matching your product’s vision with an investor’s investment philosophy is paramount. This involves a deeper understanding of their motivations and interests.

- Understanding Investor Motivations: Investors often have specific motivations for investing, such as financial returns, social impact, or industry growth. Understanding these motivations helps determine if an investor aligns with your product’s goals and mission. For example, an investor focused on sustainable technologies may be more interested in a product with environmental benefits.

- Identifying Synergies: Identifying potential synergies between your product and an investor’s portfolio or network can significantly enhance your chances of securing funding. If an investor has a strong network in your target market, leveraging that connection can prove invaluable.

Structured Approach to Investor Assessment

A structured approach to investor assessment is essential for making informed decisions.

| Criteria | Description |

|---|---|

| Investment Philosophy | Evaluate how well the investor’s stated investment philosophy aligns with your product’s vision and goals. |

| Portfolio Fit | Analyze the investor’s portfolio to determine if the product aligns with their investment interests and previous investments. |

| Track Record | Examine the investor’s past performance to assess their investment success and strategies. |

| Network and Connections | Assess the investor’s network and connections to identify potential partnerships and support. |

| Investment Stage | Determine if the investor typically invests in startups at the stage of your product’s development. |

Crafting a Compelling Investment Pitch

Landing the right investors hinges on a compelling pitch. It’s your chance to showcase your product’s potential and convince potential investors of its market value and your team’s ability to deliver. A well-structured pitch transcends a simple presentation; it’s a narrative that paints a vivid picture of your vision and its transformative power.Crafting an effective investment pitch isn’t about overwhelming investors with details; it’s about distilling the essence of your product and its market impact into a concise and engaging narrative.

Your pitch should resonate with their investment criteria, demonstrating a clear understanding of their interests and highlighting your product’s unique value proposition.

Key Elements of a Strong Investment Pitch

A robust investment pitch incorporates several crucial elements, each contributing to a comprehensive and persuasive presentation. These elements paint a clear picture of your product’s value proposition and your team’s competence.

- Problem Definition: Clearly articulate the problem your product solves. Investors want to understand the pain points your product addresses and why it’s a necessary solution. A strong problem statement establishes the need for your product and positions it as a valuable solution.

- Solution Description: Explain how your product directly addresses the defined problem. Emphasize its unique features and benefits, highlighting how it surpasses existing solutions. Quantify the benefits whenever possible, illustrating the impact on users or the market.

- Market Analysis: Detail the market size and growth potential for your product. Provide evidence-based data to support your claims. Highlight your understanding of target demographics and their needs. Identify competitive advantages and potential market penetration strategies.

- Team Introduction: Introduce the key members of your team and their relevant experience. Showcase their expertise and highlight their collective capabilities. Demonstrate how their skills and experience directly support the success of your product.

- Financial Projections: Provide realistic and well-supported financial projections, including revenue forecasts, expense estimates, and key financial metrics. Highlight key milestones and potential returns for investors. Be transparent about potential risks and uncertainties, but emphasize your strategies to mitigate them.

Presentation Formats for Investment Pitches

Different presentation formats cater to varying investor preferences and communication styles. Choose the format that best suits your product, target investors, and your team’s strengths.

- Slide Decks: A common format, slide decks are highly visual and effective for presenting complex information in a structured manner. Use clear visuals, concise text, and compelling visuals to capture attention. Maintain a consistent design and flow throughout the presentation.

- Videos: Videos can be highly engaging, allowing you to convey a product’s functionality and value proposition in a dynamic and memorable way. Use high-quality video and audio, and ensure the video is concise and focuses on key information.

- One-Pagers: One-pagers are concise summaries of your business plan, ideal for initial contact or quick overviews. Use bullet points, clear headings, and visuals to communicate key information quickly and efficiently.

Critical Components of an Investment Pitch

A well-structured investment pitch necessitates a meticulous approach to its components. This table Artikels the critical components and their importance in the investor’s decision-making process.

| Component | Importance |

|---|---|

| Problem Definition | Establishes the need and justification for your product. |

| Solution Description | Highlights the unique value proposition and how it solves the problem. |

| Market Analysis | Demonstrates the size, growth potential, and opportunity in the market. |

| Team Introduction | Showcases expertise and experience crucial for product success. |

| Financial Projections | Provides evidence of financial viability and potential return on investment. |

| Call to Action | Clearly Artikels the next steps and what you’re seeking from investors. |

Building Relationships with Investors

Securing funding often hinges not just on a compelling pitch, but also on fostering genuine relationships with potential investors. This phase demands active engagement, strategic networking, and consistent follow-up to build trust and demonstrate your commitment to the venture. Understanding the nuances of investor interactions and tailoring your approach to each individual is key to success.Effective networking transcends simply attending events; it involves actively participating in conversations, demonstrating genuine interest in the investor’s background and perspective, and leaving a lasting positive impression.

The ability to connect on a human level is invaluable in the pursuit of investment.

Networking Strategies for Connecting with Potential Investors

Building relationships with potential investors is a crucial aspect of securing funding. Effective networking goes beyond simply attending events; it involves actively engaging with investors, understanding their interests, and demonstrating genuine interest in their perspectives. A thoughtful approach is essential to leave a lasting positive impression.

- Targeted Networking Events: Attending industry-specific conferences, seminars, and workshops provides opportunities to connect with investors directly. Researching potential investors beforehand, understanding their areas of expertise, and aligning your networking efforts with those interests will greatly enhance your chances of productive interactions.

- Online Platforms for Connection: Leveraging LinkedIn, industry-specific forums, and investor networks can broaden your reach and identify potential investors. Actively engaging in relevant discussions, sharing insightful content, and demonstrating thought leadership can attract the attention of potential investors.

- Leveraging Existing Connections: Tap into your existing network – mentors, advisors, colleagues, and friends – to identify potential investors and explore introductions. A strong referral can open doors and provide valuable insights into the investor’s perspective.

Building Relationships through Online Platforms and Industry Events

Online platforms and industry events offer valuable avenues for connecting with potential investors. These venues provide opportunities to showcase your expertise, build credibility, and nurture relationships that can lead to funding. A proactive and thoughtful approach is key to success.

- Engaging in Online Communities: Participate actively in relevant online forums and groups. Offer valuable insights, engage in thoughtful discussions, and demonstrate expertise in your field. Building a reputation as a knowledgeable and reliable individual is essential for attracting investor interest.

- Crafting Compelling Online Profiles: Ensure your LinkedIn profile, website, and other online presences accurately reflect your expertise and the value proposition of your product. Showcase your accomplishments, team expertise, and market analysis to attract investor attention.

- Utilizing Networking Events Effectively: At events, prioritize meaningful conversations over superficial interactions. Listen attentively, ask insightful questions, and demonstrate genuine interest in the investor’s perspective. Follow up promptly after the event to maintain the connection.

Importance of Follow-up Communication and Maintaining Relationships

Follow-up communication and relationship maintenance are essential components of successful fundraising. Demonstrating consistent engagement and proactive communication can foster trust and strengthen your position as a compelling investment opportunity. Investors appreciate individuals who value their time and demonstrate genuine interest in their feedback.

Finding the right investors for your groundbreaking new product takes research and a bit of luck. Networking is key, attending industry events and reaching out to potential investors is crucial. While researching potential partners, you might find yourself wondering about the effectiveness of cell phone cases protect against radiation. cell phone cases protect against radiation is a fascinating area, but ultimately, your focus should be on presenting a compelling business plan and a strong team to potential investors to secure funding for your product’s development and launch.

- Prompt and Personalized Follow-up: Send personalized thank-you notes after meetings, providing a brief summary of your discussion and highlighting points of mutual interest. This demonstrates appreciation and reinforces the connection.

- Consistent Communication: Maintain regular contact, sharing updates on your progress and any relevant news about your product or company. This demonstrates your commitment and keeps investors informed.

- Building Long-Term Relationships: View your interactions with investors as long-term relationships. Keep them informed about your progress, and be open to their feedback and guidance. Building trust and rapport is vital for securing investment.

Best Practices for Creating a Strong First Impression During Investor Meetings, How find the best investors for your new product

A strong first impression during investor meetings is crucial. Investors evaluate not only your product but also your presentation skills, confidence, and professionalism. Preparing meticulously and presenting your pitch effectively will greatly influence their perception.

- Thorough Preparation: Thoroughly research the investor and their investment interests. Tailor your presentation to address their specific needs and concerns. Demonstrate a deep understanding of the market and your product’s value proposition.

- Professionalism and Confidence: Project confidence and professionalism in your interactions. Maintain eye contact, speak clearly, and be mindful of your body language. A positive and assured demeanor can significantly impact the investor’s perception.

- Clear and Concise Communication: Present your pitch concisely and clearly, highlighting the key aspects of your product, its market potential, and your team’s capabilities. Avoid jargon and complex language, ensuring your message is easily understood.

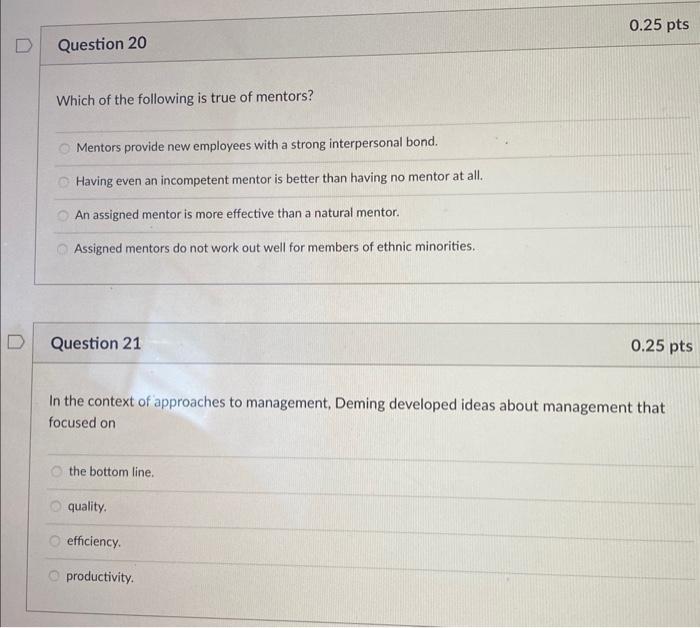

Assessing Investor Fit

Finding the right investor isn’t just about securing funding; it’s about aligning with someone who understands your vision and can support your product’s growth trajectory. A good investor-product fit fosters a collaborative environment where shared goals and values create a strong foundation for success. This involves a deep dive into the investor’s investment strategy and portfolio, ensuring they align with your product’s stage and market.A crucial step in this process is identifying investors who have a proven track record of supporting similar ventures.

This analysis helps you gauge their understanding of your industry and potential for long-term support. This careful evaluation ensures your partnership is a mutually beneficial one, fostering a collaborative environment conducive to innovation and growth.

Investment Strategy and Portfolio Analysis

Understanding an investor’s investment strategy is vital. A well-defined strategy reveals their priorities and investment style. Do they favor early-stage companies, established players, or specific industry niches? Analyzing their portfolio provides insights into their past successes and failures. Have they consistently backed ventures similar to yours?

This information paints a picture of their risk tolerance and industry expertise, crucial factors in determining their potential suitability for your product.

Identifying Investors with a Proven Track Record

Assessing an investor’s track record is paramount. A proven track record in similar industries demonstrates a deep understanding of the market dynamics and a successful history of supporting ventures with similar challenges and opportunities. This analysis can be facilitated through online resources, industry publications, and networking events. Look for investors who have successfully navigated similar market conditions and achieved notable returns in their investments.

This demonstrates their capacity to offer valuable insights and support your journey.

Suitable Investor Profiles for Your Product’s Stage

Different investor profiles are suitable for different stages of a product’s lifecycle. For instance, seed-stage ventures often seek investors with a strong understanding of early-stage innovation and a willingness to take on higher risk. Series A or B rounds might attract investors with experience in scaling companies or those who favor a more established market position. An investor’s investment thesis, their approach to risk management, and their past successes in funding ventures with comparable growth trajectories can help you identify suitable profiles for your product.

| Product Stage | Ideal Investor Profile |

|---|---|

| Seed Funding | Angel investors or venture capital firms focused on early-stage companies, often with a strong track record in similar industries and a willingness to take on higher risk. |

| Series A Funding | Venture capital firms or strategic investors with experience in scaling companies, focusing on growth and market expansion. |

| Series B Funding | Established venture capital firms, private equity firms, or strategic investors seeking established companies with significant market presence. |

Structuring the Investment Deal

Securing funding is a crucial step in launching any new venture. However, securing that funding often involves more than just identifying potential investors. The terms and conditions of the investment agreement are equally vital, as they dictate the future relationship between the entrepreneur and the investor. Navigating these intricacies requires a thorough understanding of different investment structures and a keen awareness of the key terms and conditions associated with each.Investment structures are not a one-size-fits-all solution; the optimal structure depends heavily on the specific needs of both the entrepreneur and the investor.

Understanding the nuances of each option will help you make informed decisions.

Investment Structure Types

Different investment structures offer varying degrees of control and risk for both parties. Choosing the right structure depends on the entrepreneur’s goals, the investor’s preferences, and the nature of the business.

- Equity Investments: Equity investments represent ownership in the company. Investors become shareholders, sharing in the profits and losses of the business. Common equity structures include preferred stock and common stock, each with varying rights and privileges. For example, preferred stock often comes with a priority claim on dividends and assets in the event of liquidation.

This structure gives investors a stake in the company’s future, making it a desirable option for long-term growth.

- Debt Investments: Debt investments involve lending money to the company. The investor receives interest payments and the return of their principal at a predetermined date. This is often a safer investment for the investor, as the return is guaranteed, assuming the company repays the debt. However, the entrepreneur relinquishes less ownership and retains greater control over the company.

- Convertible Notes: Convertible notes are a hybrid investment structure. They typically provide a loan to the company with the option for the investor to convert the loan into equity at a later date. This offers flexibility to both parties, allowing the investor to participate in the company’s growth while maintaining the initial structure of a loan. This is often an attractive option for seed funding rounds, allowing for a quicker and easier funding process.

Key Terms and Conditions

The success of an investment deal hinges on clearly defined terms and conditions. These terms dictate the rights and responsibilities of both parties involved.

- Valuation: The valuation of the company is a crucial aspect of the investment agreement. This establishes the percentage of ownership the investor receives for their investment. A thorough valuation process, often involving financial advisors and independent appraisals, is critical to ensure fairness for both parties.

- Investment Amount: The total amount of funding the company will receive from the investor is clearly defined. This often varies based on the stage of the company and the specific investment structure.

- Exit Strategy: The terms outlining how and when the investor can recoup their investment are defined in the exit strategy. This often involves an exit event, such as an acquisition or an IPO.

Importance of Legal Counsel

Navigating the complexities of investment deals requires expert legal counsel. Experienced lawyers can help ensure the agreement protects the interests of both the entrepreneur and the investor. Their knowledge of relevant laws and regulations can help avoid potential pitfalls and ensure compliance with legal requirements. Legal counsel can also help in drafting the terms and conditions of the agreement, providing guidance on valuation and structuring, and negotiating the agreement to the benefit of all parties.

Securing the right investors for your startup can feel like a treasure hunt. Researching potential partners, understanding their investment strategies, and tailoring your pitch is key. Knowing how to efficiently manage your data is just as important, especially if you’re juggling multiple projects. For example, checking out these 15 cloud storage tips and tricks you probably don’t know 15 cloud storage tips and tricks you probably don’t know can significantly streamline your workflow and help you focus on what truly matters: finding the perfect investors to fuel your product’s growth.

Typical Investment Agreement Components

| Component | Description |

|---|---|

| Investment Amount | The total amount of capital invested. |

| Equity Stake | The percentage of ownership granted to the investor. |

| Valuation | The estimated worth of the company at the time of investment. |

| Term Sheet | A preliminary agreement outlining the key terms of the deal. |

| Governing Law | The jurisdiction’s laws that will govern the agreement. |

| Intellectual Property | Clarification on ownership of any intellectual property. |

Navigating the Due Diligence Process

The due diligence process is a critical step in securing investment for your startup. It’s a period of intense scrutiny where potential investors thoroughly examine your business, its financials, and its team to assess the viability and risk of the investment. Navigating this process effectively can significantly impact your chances of securing funding. Understanding the process and being prepared with accurate information is key.Investors use due diligence to validate the claims made in your pitch deck and uncover any potential red flags.

This thorough examination allows them to make informed decisions about the investment opportunity. Proactive communication and a transparent approach are essential to successfully navigate this stage.

Steps Involved in the Due Diligence Process

The due diligence process typically involves several key steps. Investors will want to understand the operational aspects of your business, including its market position, competitive landscape, and revenue streams. They’ll need to evaluate your financial statements and projections, including income statements, balance sheets, and cash flow statements.

- Financial Review: Investors meticulously review financial statements to assess the company’s profitability, liquidity, and overall financial health. They will look for historical trends, anomalies, and potential red flags. For example, a sudden drop in revenue or significant increases in expenses could raise concerns.

- Legal Review: Legal due diligence involves examining contracts, licenses, intellectual property rights, and other legal documents to ensure the company operates within legal boundaries and avoids potential liabilities. For instance, undisclosed legal disputes could severely impact the investment decision.

- Market Analysis: Investors assess the market size, growth potential, and competitive landscape. They analyze market trends, customer demographics, and competitive advantages to understand the viability of the market opportunity. This often includes competitor analysis, market research, and industry reports.

- Operational Assessment: This step focuses on evaluating the efficiency and effectiveness of your operations. It encompasses assessing the team’s experience, the company’s processes, and the operational infrastructure. A well-organized and efficient operation is crucial for long-term success.

- Team Assessment: The investor will evaluate the qualifications, experience, and commitment of the management team. They will investigate the backgrounds and experience of key personnel, looking for relevant expertise and leadership qualities.

Documentation and Information Required

To facilitate the due diligence process, be prepared to provide comprehensive documentation. This includes detailed financial records, legal agreements, market research data, and operational procedures. The completeness and accuracy of this information are critical.

- Financial Statements: Comprehensive financial statements, including balance sheets, income statements, and cash flow statements, covering several years. Supporting documentation for key financial figures.

- Legal Documents: All relevant contracts, licenses, intellectual property documents, and any other legal agreements that affect the company.

- Market Research Data: Market analysis reports, competitor analyses, and customer data, demonstrating a clear understanding of the market landscape and the company’s position within it.

- Operational Procedures: Internal procedures and processes for various business functions, including sales, marketing, and customer service.

- Team Bios: Detailed biographies of key personnel, highlighting their experience, expertise, and relevant achievements.

Addressing Potential Concerns

Anticipate potential concerns and questions raised by investors. Prepare detailed responses and supporting documentation to address any doubts or uncertainties.

- Transparency and Honesty: Be completely transparent and honest in your communication. Address any potential weaknesses or challenges head-on.

- Proactive Communication: Maintain open and consistent communication with investors throughout the process. This builds trust and allows for addressing concerns promptly.

- Detailed Answers: Prepare detailed answers to anticipated questions. Anticipate potential questions and have comprehensive answers readily available.

Importance of Transparency and Honesty

Transparency and honesty are paramount during due diligence. Investors value companies that are forthcoming and transparent about their operations. Building trust and demonstrating integrity are critical for long-term success.

- Building Trust: Demonstrating honesty and transparency creates trust with investors, a crucial element in securing funding. This will create a strong foundation for a long-term partnership.

- Positive Perception: Open communication and accurate information create a positive perception of the company. Investors will view this as a sign of a well-managed and trustworthy enterprise.

Negotiating the Deal: How Find The Best Investors For Your New Product

Securing favorable terms in an investment deal requires meticulous preparation and a strategic approach. Negotiation isn’t about simply agreeing; it’s about understanding the needs of both parties and crafting a mutually beneficial agreement. A clear understanding of your product’s value proposition, your company’s strengths, and the investor’s perspective is paramount to achieving a successful outcome.Effective negotiation involves anticipating potential roadblocks and developing contingency plans.

This process demands a thorough comprehension of your company’s needs and the investor’s motivations. A well-structured negotiation strategy, combined with a deep understanding of the market and your product’s potential, significantly enhances the likelihood of a positive outcome.

Strategies for Favorable Terms

Negotiation strategies should be tailored to the specific investor and the investment stage. Understanding the investor’s priorities, risk tolerance, and investment objectives is crucial. Demonstrating a clear understanding of the market and your product’s unique value proposition strengthens your position. Emphasize the long-term potential and the return on investment for the investor. Proposing different deal structures or offering incentives can create a more favorable outcome for both parties.

Identifying and Resolving Potential Conflicts

Conflicts in investment negotiations are often rooted in differing expectations about the company’s future, the valuation of the product, or the terms of the deal. A thorough due diligence process by both parties is essential to mitigate these conflicts. Open communication, proactive identification of potential disagreements, and a willingness to compromise are crucial to resolving them. Mediation or arbitration may be necessary if negotiations reach an impasse.

Understanding Your Needs and Expectations

A precise understanding of your company’s financial requirements, growth trajectory, and long-term goals is essential. A comprehensive financial model and a clear vision for the company’s future can guide the negotiation process. Establishing realistic expectations about the investment amount, the terms of the agreement, and the investor’s role in the company’s growth ensures alignment and transparency.

A Structured Approach to Negotiation

A structured approach to negotiation ensures a clear and efficient process. This approach includes outlining your company’s needs and objectives, identifying the investor’s priorities, and presenting a compelling case for investment. A detailed Artikel of the proposed deal terms, including valuation, equity structure, and milestones, should be presented. Be prepared to address counter-offers and modify your position to accommodate the investor’s concerns.

Example of a Structured Negotiation

- Initial Meeting: Present a concise overview of your product, its market, and financial projections. Artikel your needs and expectations.

- Understanding Investor Priorities: Actively listen to the investor’s concerns and motivations. Gather information about their investment criteria and potential expectations.

- Detailed Proposal: Develop a comprehensive proposal outlining the deal terms, including valuation, equity structure, milestones, and exit strategies. Include financial projections and risk assessments.

- Negotiating Counter-Offers: Be prepared to discuss and potentially modify the terms of the deal to accommodate the investor’s concerns. Maintain a positive and collaborative tone.

- Agreement and Closing: Formalize the agreement and ensure all parties are satisfied with the terms. Review and sign all necessary documents.

Last Point

In conclusion, securing the right investors for your new product requires a strategic approach. By understanding the different types of investors, conducting thorough research, crafting a compelling pitch, and building strong relationships, you significantly increase your chances of success. This guide provides a roadmap to navigate the complexities of the investment process, empowering you to make informed decisions and ultimately launch your product successfully.