Daily quote buy things dont need – Daily quote buy things don’t need: It’s a simple concept, yet often challenging to implement. We’re bombarded with messages encouraging us to buy more, more, more. But what if our happiness wasn’t tied to the next purchase? This exploration dives deep into the psychology of unnecessary buying, the impact on our finances, and practical strategies for mindful consumption.

We’ll uncover how to break free from the cycle and cultivate a healthier relationship with our spending.

From the emotional drivers behind impulsive purchases to the subtle influence of social media, this blog post will help you understand the forces at play. We’ll also discuss how to create a budget that prioritizes needs over wants and explore practical strategies for resisting the urge to buy things you don’t need. Ultimately, we’ll focus on the connection between material possessions and well-being, helping you achieve a more balanced approach to life.

Understanding the Concept

The relentless pursuit of acquiring material possessions often leads us down a path of unnecessary spending. We’re bombarded with marketing messages that subtly encourage us to buy things we don’t truly need, and this can have profound effects on our financial well-being and mental health. Understanding the psychology behind this behavior and the potential consequences is crucial for developing a more mindful approach to consumption.The act of buying things we don’t need is a complex phenomenon rooted in various psychological factors.

Often, these purchases are driven by emotional needs rather than rational ones. We might buy something to alleviate boredom, boost our self-esteem, or simply to conform to social pressures. These impulsive decisions can quickly derail our financial stability and leave us feeling unsatisfied.

Definition of Unnecessary Purchases

Unnecessary purchases are defined as acquisitions of goods or services that do not fulfill a genuine need or contribute meaningfully to our well-being. These purchases are frequently made impulsively and without careful consideration of long-term consequences.

Psychological Factors Driving Unnecessary Purchases

Several psychological factors contribute to our tendency to buy things we don’t need. These include:

- Social Comparison: We often compare ourselves to others and strive to keep up with perceived societal standards, leading to the purchase of items that enhance our perceived social status.

- Emotional Needs: Purchases can be driven by a desire to alleviate negative emotions like boredom, stress, or loneliness. These items provide temporary satisfaction, but the fulfillment is fleeting.

- Marketing Influence: Intentional manipulation by advertisers can exploit our psychological vulnerabilities and trigger impulsive purchasing decisions.

- Impulsivity: The lack of forethought and planning in making a purchase can lead to buying things we don’t truly need.

Potential Consequences of Unnecessary Purchases

The consequences of buying things we don’t need can be far-reaching. These include:

- Financial Instability: Unnecessary purchases can quickly deplete our savings, leading to debt and financial stress.

- Reduced Life Satisfaction: While temporary gratification may be felt, lasting satisfaction often eludes us with these purchases.

- Clutter and Disorganization: Accumulating items we don’t need can lead to a cluttered living space, causing stress and a feeling of being overwhelmed.

- Guilt and Regret: Many people experience guilt and regret after making impulsive purchases that they later realize were unnecessary.

Types of Unnecessary Purchases

Unnecessary purchases manifest in various forms:

- Luxury Items: Purchasing expensive items without a clear justification or need.

- Fashion Trends: Following fleeting trends in clothing, accessories, or other consumer products.

- Impulse Buys: Acquiring items on a whim without considering their long-term value.

- Subscription Services: Signing up for subscriptions to services or products that are not regularly used.

Mindful Consumption vs. Unnecessary Purchases

Mindful consumption emphasizes conscious decision-making before making a purchase. This involves understanding our needs, evaluating the long-term value of an item, and considering alternative solutions. Unnecessary purchases, on the other hand, are impulsive decisions made without considering the implications. The key difference lies in the presence or absence of thoughtful consideration before the purchase.

Examining the Motivations

The allure of acquiring possessions extends far beyond the tangible benefits. Understanding the underlying motivations behind impulsive purchases is crucial for developing a more mindful approach to spending. These motivations often stem from complex emotional responses and societal pressures, weaving a compelling narrative that often obscures the true cost of unnecessary acquisitions.Impulsive purchases aren’t always about a simple desire for an item.

Often, they’re driven by a deeper need to fulfill emotional gaps or to react to external influences. This exploration dives into the psychological underpinnings of these purchases, revealing the intricate interplay between personal needs, societal expectations, and marketing strategies.

Emotional Drivers of Impulsive Purchases

Emotional drivers are powerful motivators in the realm of impulsive purchases. Feelings of inadequacy, anxiety, or boredom can be subtly channeled into a desire for a new item, offering a temporary, yet often fleeting, sense of gratification. This emotional satisfaction often masks the long-term financial consequences. For instance, a fleeting moment of boredom might lead to an impulsive purchase of a video game, providing temporary relief but ultimately contributing to a larger financial burden.

That daily quote about not buying things you don’t need? It’s a great reminder, but sometimes, we all need a little extra income to escape the cycle of unnecessary purchases. Luckily, there are plenty of online jobs that could significantly change your financial situation. For example, checking out 5 online jobs that could change your life might just give you the inspiration you need to focus on your goals and stop buying things you don’t need.

Ultimately, a little financial freedom can help you prioritize the things that truly matter.

Social Pressure and Marketing Influence

Social pressure and persuasive marketing strategies play a significant role in shaping consumer behavior. The desire to keep up with trends or emulate others’ perceived success often fuels unnecessary spending. Marketing campaigns frequently exploit our vulnerabilities and aspirations, subtly associating products with happiness, status, or belonging. Advertising often depicts a lifestyle that is attainable only through the purchase of specific products, thereby creating a desire to emulate those lifestyles.

Financial Security and Unnecessary Purchases

Financial security does not inherently preclude unnecessary purchases. Individuals with stable financial situations can still succumb to impulsive spending. The perception of security can be a double-edged sword, sometimes encouraging the belief that financial resources are limitless, leading to a disregard for long-term financial planning. This misconception can be amplified by easy access to credit, making it easier to accumulate debt through unnecessary purchases.

Social Media and the Desire for Unnecessary Items

Social media platforms are potent tools in fostering the desire for unnecessary items. Curated feeds showcasing aspirational lifestyles and desirable possessions often contribute to feelings of inadequacy or the need to keep up with others. The constant exposure to seemingly perfect lives and extravagant purchases can create a pressure to acquire similar items, leading to a cycle of discontent and unnecessary spending.

Individuals might feel compelled to purchase items they don’t genuinely need to maintain a perceived sense of social acceptance on these platforms.

Emotional Needs Met by Unnecessary Purchases, Daily quote buy things dont need

Unnecessary purchases can fulfill a variety of emotional needs, often masking underlying vulnerabilities. These needs can range from a desire for validation, to a need for excitement, to a need for a sense of accomplishment. For example, a person might purchase a luxury item to gain a sense of self-worth, or to impress others. These purchases may temporarily alleviate these feelings, but they rarely provide lasting solutions.

A more sustainable approach to fulfilling these needs would involve exploring alternative avenues, such as pursuing hobbies, strengthening relationships, or seeking professional support.

Impact on Finances

Accumulating unnecessary items can have a significant and often hidden impact on personal finances. It’s easy to justify a purchase as “treating yourself,” but these seemingly small expenses can quickly add up, hindering financial goals and creating unnecessary stress. Understanding how these purchases affect your budget is crucial for long-term financial well-being.The accumulation of non-essential items frequently leads to decreased savings and increased debt.

This isn’t just about the immediate cost of the item; it’s also about the opportunity cost. The money spent on a non-essential item is money that could have been saved, invested, or used to pay down debt. This lost opportunity can significantly impact your financial future.

Tracking and Managing Spending on Non-Essential Items

Tracking spending on non-essential items is crucial for understanding where your money is going. A simple method is a dedicated spreadsheet or app where you log every purchase, regardless of its cost. Categorizing expenses by necessity (rent, utilities, groceries) and non-necessity (entertainment, fashion) allows for a clear visualization of spending habits. This detailed record provides a clearer picture of your spending patterns, highlighting areas where you might be overspending on non-essential items.

Creating a Budget Excluding Unnecessary Spending

Creating a realistic budget is a fundamental step in managing finances. It’s important to prioritize needs over wants, allocating funds to essential expenses before considering non-essential items. This requires careful analysis of your income and expenses, and involves identifying areas where you can reduce spending on non-essential items.A sample budget could allocate a fixed percentage of your income for needs (housing, food, transportation), and a smaller percentage for non-essential items (entertainment, hobbies).

This allocation allows for a clear understanding of how your money is being used. Using a budgeting app or spreadsheet can aid in tracking and monitoring progress.

Prioritizing Needs Over Wants in Savings Plans

Prioritizing needs over wants in a savings plan is crucial for achieving financial stability. This means allocating funds for essential expenses first, before allocating any amount to non-essential items. For example, a savings plan might include a fixed amount for emergency funds, followed by contributions to retirement savings, and then finally, allocation for discretionary spending. This systematic approach ensures that your savings plan is rooted in essential needs and goals.

Identifying and Avoiding Unnecessary Purchases

Identifying and avoiding unnecessary purchases requires conscious decision-making. Before making a purchase, consider if the item is truly necessary or if it’s driven by impulse. Setting a spending limit for non-essential items can help control impulses. Creating a “waiting period” before purchasing non-essential items can also help avoid impulsive decisions.A method for avoiding unnecessary purchases involves creating a “wish list” for non-essential items.

Listing these items provides a visual representation of desired purchases, allowing for a more conscious decision about acquiring them. Only purchasing items from the wish list after carefully considering their necessity can curb impulsive spending. A thorough understanding of the costs and benefits associated with the purchase is paramount.

Practical Strategies for Change

Breaking free from the cycle of unnecessary spending requires more than just understanding the “why.” It demands a practical approach, a toolkit of strategies to identify triggers, resist temptations, and ultimately, achieve financial well-being. This section delves into actionable steps to transform spending habits from impulsive to intentional.Effective financial management involves more than just saving; it’s about understanding the nuances of your spending patterns.

This understanding allows for the development of strategies that are personalized and sustainable, ensuring long-term success.

Identifying Spending Triggers

Understanding your spending triggers is crucial for managing impulsive purchases. Recognizing the situations, emotions, or external factors that prompt unnecessary spending allows for proactive strategies to manage them. Identifying these triggers is not about blame, but about understanding your own behavior. This knowledge empowers you to develop tailored solutions.

- Emotional Triggers: Stress, boredom, or feelings of inadequacy can often lead to impulsive purchases. Recognizing these emotional states and associating them with spending patterns is a key step towards controlling them.

- Situational Triggers: Certain environments, like shopping malls or social gatherings, can trigger spending. Being aware of these situations allows you to preemptively choose alternative activities.

- Social Pressure: Keeping up with others or feeling obligated to buy gifts or participate in activities can also lead to unnecessary spending. Setting boundaries and prioritizing your own needs is essential.

Resisting the Urge to Buy

Developing strategies to resist the immediate gratification of impulse purchases is vital. Delaying gratification often leads to a more rational decision-making process, minimizing the risk of regret.

- The “Wait 24 Hours” Rule: Before making a purchase, wait 24 hours. This timeframe allows you to consider the necessity of the item and its impact on your financial goals. If the desire still persists after 24 hours, then it’s a stronger indicator of a true need.

- Creating a “Waiting List”: For items you desire but don’t immediately need, create a waiting list. This list helps visualize the items and their potential costs, fostering a more measured approach.

- Mindful Shopping: Avoid impulse buys by actively choosing to shop at specific times or in specific places. Be aware of the environment and the emotional triggers that may arise.

Delaying Impulsive Purchases

Delaying impulsive purchases can significantly reduce unnecessary spending. Implementing methods to postpone decisions allows you to consider the item’s necessity and long-term implications.

- The “Five-Second Rule”: If you are considering a purchase, wait five seconds before making the decision. This small delay often provides enough time to consider if the purchase is truly necessary.

- The “30-Day Rule”: If you have a desire for an item, give yourself 30 days to consider if you still need it. This allows for reflection and reduces the impact of impulsive decisions.

Self-Awareness in Managing Spending Habits

Self-awareness is paramount to managing spending habits effectively. Understanding your spending patterns and triggers empowers you to make conscious choices. This is a journey of continuous learning and adjustment.

- Tracking Your Spending: Keep a detailed record of your expenses, categorizing them by necessity and want. This allows you to identify spending trends and pinpoint areas for improvement.

- Budgeting: Creating a budget is a critical step in managing spending habits. Allocate funds for essential expenses and discretionary spending, providing a framework for responsible financial management.

Mindful Shopping Practices

Mindful shopping practices are essential for making intentional purchases. By focusing on your needs and values, you can make decisions that align with your financial goals.

- Consider Alternatives: Before making a purchase, consider alternative solutions that might address the underlying need. This could include borrowing or renting instead of buying.

- Prioritize Needs Over Wants: Differentiate between needs and wants. Prioritize essential expenses before allocating funds for discretionary items.

Impact on Well-being

The relentless pursuit of material possessions, often driven by societal pressures and marketing strategies, can significantly impact our well-being. While a certain level of comfort is essential, the constant need to acquire more can lead to a vicious cycle of dissatisfaction and unhappiness. This section delves into the detrimental effects of unnecessary buying on mental and emotional health, and explores alternative paths to genuine fulfillment.The connection between material possessions and happiness is often tenuous and fleeting.

That daily quote about not buying things you don’t need? It’s a good reminder, especially when considering the impact of fundraising campaigns like the Ice Bucket Challenge. Learning more about ALS through resources like behind icebucketchallenge 19 things you should know about als can highlight how important mindful spending is. Ultimately, prioritizing needs over wants, even in the face of powerful causes, helps us make more thoughtful choices.

Studies consistently show that a correlation between wealth and happiness isn’t always direct. While acquiring basic necessities contributes to comfort, accumulating beyond that point often fails to yield lasting joy. The initial thrill of a new purchase quickly fades, replaced by a desire for the next acquisition, a pattern that perpetuates a cycle of discontent.

The Toll of Unnecessary Purchases on Mental Health

The pressure to keep up with perceived societal norms, often fueled by social media and advertising, can lead to significant stress and anxiety. Constantly comparing oneself to others’ curated lifestyles fosters a sense of inadequacy and drives the need for more. This relentless pursuit of material goods can be a significant contributor to feelings of pressure and disappointment.

Financial strain resulting from unnecessary purchases can further compound these issues, creating a cascade of negative emotions.

The Power of Experiences Over Possessions

Experiences, unlike material possessions, tend to hold more enduring value. Travel, hobbies, and social connections create lasting memories and emotional connections that contribute significantly to overall well-being. These experiences often foster personal growth and build stronger relationships, creating a more profound and fulfilling sense of accomplishment and joy. The richness of shared experiences, whether with family, friends, or in new environments, often outlasts the fleeting satisfaction derived from material purchases.

Short-Term Gratification vs. Long-Term Benefits of Saving

The allure of immediate gratification associated with impulsive purchases is powerful. The instant feeling of satisfaction, however temporary, often outweighs the long-term benefits of saving. This can lead to accumulating debt, financial instability, and ultimately, a decline in overall well-being. By contrast, saving money enables financial security, freedom from worry, and the ability to pursue meaningful experiences and goals, ultimately fostering a more stable and fulfilling life.

A focus on long-term financial health, through responsible spending and saving, is often more conducive to overall happiness.

Visual Representation

Seeing is believing, they say, and visualizing the financial and emotional impact of unnecessary spending can be a powerful motivator for change. This section presents visual representations in the form of tables to illustrate the various aspects of impulsive purchases and strategies for curbing them. Understanding these visual aids can help you better grasp the patterns and potential consequences of your spending habits.

Types of Unnecessary Purchases

This table categorizes common types of unnecessary purchases, providing a clearer picture of the scope of the problem. Recognizing these categories can help you identify your own spending patterns and pinpoint areas where you might be overspending.

| Category | Examples |

|---|---|

| Clothing | Fast fashion items, trendy clothes not fitting your needs, multiple similar outfits |

| Electronics | Latest phone models, gadgets with limited use, upgrades without a clear need |

| Subscriptions | Streaming services, gym memberships, online courses not consistently used, multiple overlapping services |

| Dining Out | Frequent expensive meals, replacing home-cooked meals with takeout, impulse purchases at restaurants |

| Entertainment | Tickets to events you don’t need, expensive hobbies, impulsive purchases on entertainment apps |

Financial Impact of Non-Essential Purchases

The following table demonstrates how seemingly small, non-essential purchases can accumulate over time. The impact can be substantial and highlights the importance of mindful spending.

| Month | Non-essential Purchase (average $ amount) | Total Yearly Cost (estimated) |

|---|---|---|

| 1 | $20 | $240 |

| 3 | $30 | $360 |

| 6 | $40 | $480 |

| 12 | $50 | $600 |

This illustrates how small, regular purchases add up quickly. Consider how this amount could be invested or used for something more meaningful.

Emotional Triggers for Impulsive Purchases

Identifying the emotional triggers behind impulsive purchases is crucial for developing effective coping strategies. This table provides a glimpse into common emotional states that can lead to unplanned spending.

| Emotional Trigger | Description | Example |

|---|---|---|

| Boredom | Feeling uninspired or lacking stimulation | Buying something new to distract from boredom |

| Stress | Experiencing anxiety or pressure | Using shopping as a way to relieve stress |

| Happiness | Celebrating or feeling joyful | Treating yourself with an unnecessary purchase |

| Social Pressure | Feeling compelled to keep up with others | Buying something because it’s trending or popular |

Practical Strategies for Avoiding Unnecessary Spending

This table Artikels effective strategies for curbing unnecessary spending. These methods can be tailored to individual needs and preferences.

| Strategy | Description |

|---|---|

| Budgeting | Creating a detailed spending plan to track income and expenses |

| Delayed Purchase | Waiting 24-48 hours before buying something you want to avoid impulse |

| Needs vs. Wants | Identifying and prioritizing needs over wants |

| Mindfulness | Practicing awareness of your spending habits and motivations |

| Alternatives | Finding more affordable or fulfilling alternatives |

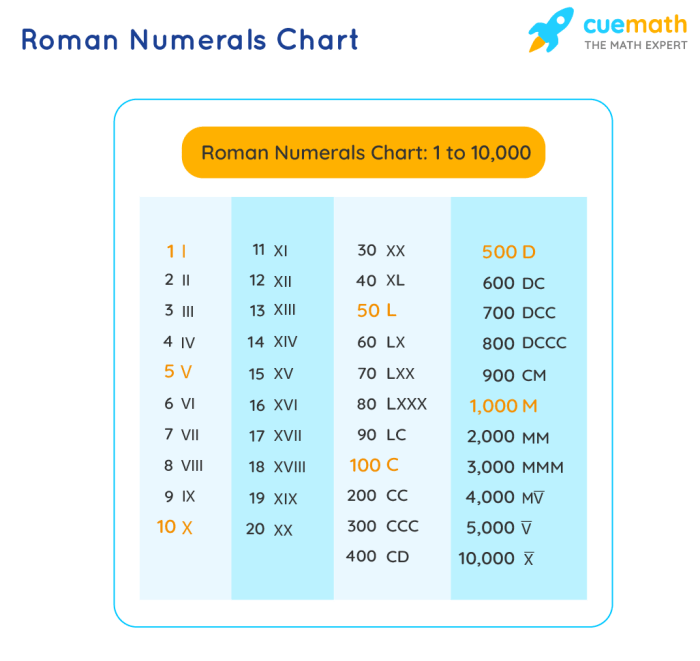

Approaches to Managing Finances and Prioritizing Needs

This table highlights different approaches to managing finances and prioritizing needs over wants. Different approaches work for different people.

That daily quote about not buying things you don’t need is a great reminder, isn’t it? It’s all about mindful spending, and it ties in perfectly with making healthy eating habits a priority. For example, if you’re mindful of what you buy at the grocery store, and focus on whole foods, you’ll be less likely to buy processed foods and sugary drinks, which can be costly in the long run.

Check out these 10 tips for building healthy eating habits that will help you make better food choices and stick to a budget 10 tips make healthy eating habit. Ultimately, this all boils down to the same principle – buying only what you need to nourish your body and mind, not just your wallet.

| Approach | Description |

|---|---|

| Zero-Based Budgeting | Allocating every dollar of income to a specific category |

| Envelope System | Assigning cash to different spending categories |

| 50/30/20 Rule | Allocating 50% for needs, 30% for wants, and 20% for savings and debt repayment |

| Investing | Using financial resources to build long-term wealth |

Illustrative Examples

Reducing unnecessary spending is more than just a financial strategy; it’s a lifestyle shift. This section explores real-world examples of successful transformations, showcasing the potential for positive change. We’ll delve into the motivations and impacts, highlighting how mindful consumption can lead to significant improvements in financial well-being and personal fulfillment.Successful transformations often begin with a clear understanding of spending habits.

Recognizing patterns and identifying triggers for impulsive purchases is crucial. The examples below illustrate how individuals have effectively addressed these challenges.

Successful Spending Reduction Stories

Several individuals have successfully curbed unnecessary spending. One example is Sarah, a young professional who realized she was consistently buying trendy clothes she rarely wore. By consciously evaluating her wardrobe needs and setting a budget for clothing purchases, she reduced her spending by 30% within six months. She also started a clothing swap with friends to acquire new pieces without buying them.

This illustrates the power of mindful consumption and re-evaluating shopping habits.

Fictional Account of Unnecessary Spending

Imagine Emily, a recent college graduate, constantly striving to keep up with her peers’ perceived lifestyles. Driven by social media comparisons and a desire for material possessions, she accumulated significant credit card debt. Luxury items, like designer handbags and electronics, became her primary focus, overshadowing her need for practical necessities. The constant pressure to maintain a certain image, fuelled by social media, led to a downward spiral in her financial health.

This fictional account highlights the potential negative impact of external pressures and the importance of prioritizing financial well-being over perceived social status.

Positive Impact of Mindful Consumption

Maria, a dedicated environmental advocate, transitioned to a mindful consumption approach. She carefully researched products, choosing durable, sustainable options. Instead of frequent, impulsive purchases, she prioritized quality and longevity. This resulted in significant cost savings and a reduced environmental footprint. She focused on purchasing experiences rather than material possessions, recognizing the lasting value of memorable moments.

This illustrates the positive impact of thoughtful choices on both personal finances and the environment.

Budgeting System Excluding Unnecessary Spending

A successful budgeting system doesn’t just track income and expenses; it actively prevents unnecessary spending. One example is the zero-based budget. In this method, every dollar of income is allocated to a specific category, including savings, essential expenses, and discretionary spending. Unnecessary spending is avoided by meticulously planning for each dollar. The system ensures that no money is left unallocated, making sure that only necessary expenses are included.

By carefully tracking income and expenses, individuals can avoid overspending and create a healthier financial picture.

Reframing Desires for Experiences

Instead of focusing on material possessions, reframe desires towards experiences. Consider a person who yearns for a new car. Instead of buying the car, they might choose a road trip across the country. This experience provides lasting memories, strengthens relationships, and builds personal growth, all while saving money. The focus shifts from material acquisition to personal development and creating meaningful memories.

This reframing strategy allows individuals to appreciate the value of experiences over material possessions.

Real-world Case Studies

Turning desires into needs is a significant challenge for many. However, numerous individuals have successfully navigated this shift, demonstrating that mindful consumption can lead to greater financial security and overall well-being. This section will explore real-world examples of people who have made conscious changes in their spending habits, highlighting successful strategies and the positive impact on their lives.Shifting from a culture of instant gratification to one of mindful spending requires deliberate action and commitment.

By examining the experiences of others, we can gain valuable insights into the practical strategies that lead to lasting change and how they avoided unnecessary debt and embraced a more fulfilling life.

Examples of Shifting Spending Habits

Changing spending habits is not a one-size-fits-all approach. Successful strategies often involve identifying specific triggers, developing coping mechanisms, and establishing clear financial goals. These examples illustrate diverse methods for achieving this transition.

- Sarah, a young professional, realized she was spending a significant portion of her income on trendy clothing she rarely wore. She started a “no-buy” month, focusing on repairing existing items and seeking affordable alternatives. By consciously choosing experiences over material possessions, she found a greater sense of fulfillment and a healthier relationship with her finances. This demonstrates the power of deliberate choices and a shift in focus.

- Mark, a mid-level manager, recognized a pattern of impulsive online shopping. He implemented a 24-hour waiting period before making any online purchases. This simple strategy allowed him to evaluate the necessity of each item, leading to a significant reduction in unnecessary spending. This shows how simple rules can curb impulsive purchases and encourage mindful decision-making.

- Emily, a single mother, faced financial strain from accumulating debt on non-essential items. She created a detailed budget and categorized her spending. By understanding where her money was going, she identified areas where she could cut back and prioritized her family’s needs. This emphasizes the importance of meticulous budgeting and prioritizing needs over wants.

Strategies for Resisting Unnecessary Purchases

Developing strategies for resisting impulsive purchases is crucial for maintaining financial stability. These examples highlight the effectiveness of various approaches.

- Many individuals use a “waiting period” technique. This involves delaying a purchase by a set amount of time, usually 24-48 hours, to allow for a more rational evaluation of the item’s necessity. This helps curb impulsive buys and encourages thoughtful decision-making.

- Creating a “want vs. need” list can be helpful. Listing items as “wants” or “needs” can provide clarity on spending priorities. This method can help people distinguish between desires and essential items, enabling better allocation of resources.

- Some individuals use a “no-spend” period or challenge. Taking a break from non-essential spending can help people identify what truly matters to them and create a stronger financial foundation. This can foster a more mindful relationship with finances and spending.

Avoiding Debt through Mindful Consumption

Mindful consumption can directly impact debt accumulation. These case studies illustrate the positive relationship between focused spending and financial security.

- David, a recent graduate, avoided student loan debt by prioritizing his educational expenses. He minimized unnecessary costs and focused on essential learning materials, reducing his reliance on expensive resources.

- By understanding their spending patterns, many individuals identified areas where they could cut back and prioritize their needs. This understanding led to the ability to manage debt and work towards financial stability.

Closure: Daily Quote Buy Things Dont Need

In conclusion, the daily quote buy things don’t need serves as a powerful reminder to pause and consider our spending habits. We’ve explored the reasons behind impulsive purchases, the detrimental effects on our finances, and the impact on our well-being. By understanding the motivations behind our spending, we can develop practical strategies for change. Ultimately, the key to financial freedom and improved well-being lies in prioritizing our needs, resisting the temptation of unnecessary purchases, and focusing on experiences rather than material possessions.