Best ways to save money is a crucial aspect of personal finance. This guide dives deep into proven strategies to help you build a solid financial foundation. From meticulous budgeting to smart saving techniques, we’ll explore various approaches, equipping you with actionable steps to achieve your financial goals.

We’ll cover everything from creating personalized budgets and reducing expenses to increasing income through side hustles and managing debt effectively. We’ll also touch on the importance of investing and avoiding common financial pitfalls. This comprehensive guide will arm you with the knowledge and tools to take control of your finances and work towards a brighter financial future.

Budgeting and Financial Planning

Mastering your finances is crucial for achieving long-term financial goals. A well-structured budget acts as a roadmap, guiding your spending and investments towards your aspirations. This section delves into various budgeting methods, personalized budget creation, and helpful tools to aid you in this journey.A strong financial foundation is built on careful planning and consistent execution. By understanding different budgeting methods and tailoring a plan to your unique circumstances, you can effectively manage your income and expenses, leading to greater financial stability and freedom.

Different Budgeting Methods

Understanding various budgeting approaches empowers you to choose the method that best aligns with your lifestyle and financial situation.Different budgeting methods offer varying levels of complexity and control. Zero-based budgeting, for example, meticulously tracks every dollar, ensuring all income is accounted for. The 50/30/20 rule provides a simple framework for allocating your funds across needs, wants, and savings.

Experiment with different approaches to find the one that best suits your needs.

- Zero-Based Budgeting: This method meticulously allocates every dollar of income to a specific category. Every expense, from rent to coffee, is accounted for, ensuring no money is left unaccounted for. This method promotes a holistic view of your finances and aids in identifying potential areas for saving. For example, if your monthly income is $3,000, every penny of that $3,000 must be allocated to a specific category (rent, food, transportation, savings, etc.).

- 50/30/20 Rule: This simple budgeting approach categorizes expenses into three buckets: 50% for needs (housing, utilities, food), 30% for wants (entertainment, dining out), and 20% for savings and debt repayment. This rule provides a clear guideline for allocating funds, fostering financial discipline and helping you prioritize essential spending.

Creating a Personalized Budget

A personalized budget is tailored to your specific income and expenses. This crucial step ensures that your budget effectively reflects your financial reality and helps you stay on track towards your financial goals.To create a personalized budget, gather detailed records of your income and expenses over a specific period (e.g., the previous month). Categorize these expenses to gain a clear understanding of where your money goes.

Saving money can feel like a monumental task, but there are simple strategies. Budgeting, tracking expenses, and prioritizing needs over wants are crucial. Sometimes, the biggest hurdle to saving is mental, and recognizing that “premium why quitters can become winners too” premium why quitters can become winners too can be a game-changer. This shift in mindset empowers you to approach savings with a more resilient and ultimately successful approach.

Finding the right balance between financial discipline and personal growth can make saving money more achievable.

This analysis is key to identifying areas where you can cut back or adjust your spending habits.

Free Budgeting Tools and Apps

Several free budgeting tools and apps are available to streamline the process of tracking your finances. These tools offer user-friendly interfaces and helpful features to make budgeting more accessible and enjoyable.

- Mint: A popular choice for budgeting and tracking finances, offering features to categorize spending, set budgets, and monitor progress. It syncs with your bank accounts and credit cards, providing a comprehensive overview of your financial activities.

- Personal Capital: This app provides a more comprehensive approach to financial management, allowing you to track investments, savings, and retirement plans in addition to budgeting.

- YNAB (You Need a Budget): While some features are offered with a paid version, a free version exists, and it’s designed to help you manage your money effectively, using the zero-based budgeting method.

Comparison of Budgeting Software

A comparison table helps you assess the features and limitations of different budgeting software.

| Software | Pros | Cons |

|---|---|---|

| Mint | User-friendly interface, comprehensive overview of finances, free | Limited investment tracking, less in-depth analysis |

| Personal Capital | Comprehensive financial management, investment tracking, advanced features | Not entirely free, might require more time to learn the interface |

| YNAB | Zero-based budgeting method, designed to encourage savings and debt reduction, some features free | Can be overwhelming for some users, learning curve can be steep |

Setting Financial Goals and Tracking Progress

Setting financial goals and tracking your progress are crucial steps in achieving financial stability and achieving your desired outcomes. These steps are crucial for maintaining motivation and staying focused on your financial aspirations.Start by defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. For instance, “Save $5,000 for a down payment on a house within three years.” Regularly track your progress toward these goals, using a spreadsheet or budgeting software to monitor your savings and spending habits.

Template for Recording Income and Expenses

A well-structured template streamlines the process of recording income and expenses, allowing for easy analysis and adjustments.| Date | Description | Category | Income | Expenses ||—|—|—|—|—|| 2024-03-15 | Salary | Income | $5,000 | || 2024-03-15 | Rent Payment | Housing | | $2,000 || 2024-03-15 | Groceries | Food | | $300 |

Reducing Expenses

Cutting costs is crucial for achieving financial stability and building wealth. Identifying areas where you overspend and implementing effective strategies to reduce unnecessary expenses is a key component of a sound financial plan. This section will delve into practical methods for trimming your budget across various categories, from entertainment and dining out to utilities and household supplies.Effective cost-cutting strategies often involve a combination of awareness, discipline, and creativity.

Understanding where your money goes is the first step. Tracking your spending habits can reveal patterns and highlight areas ripe for optimization. By implementing these strategies, you can free up more resources to achieve your financial goals.

Common Areas of Overspending

Understanding where your money goes is the first step in reducing unnecessary spending. Common areas where people overspend often include entertainment, dining out, and impulse purchases. Analyzing your spending habits through budgeting and expense tracking can uncover these patterns.

Saving money effectively isn’t just about budgeting; it’s about smart choices. One key aspect is understanding your spending habits, and this often mirrors the 9 traits truly successful leaders should possess, like meticulous planning and foresight. 9 traits truly successful leaders should possess help you strategize for the long-term. By analyzing your financial situation with the same meticulousness, you’ll find the best savings strategies for your unique circumstances.

Strategies to Cut Back on Entertainment Expenses

Entertainment expenses can quickly add up. Strategies to cut back on unnecessary entertainment expenses include exploring free or low-cost entertainment options like attending community events, visiting parks, or pursuing hobbies. Consider opting for free online streaming services or renting movies instead of frequenting cinemas. Group activities, like movie nights with friends, can be a more affordable alternative.

Strategies to Cut Back on Dining Out Expenses

Dining out frequently can significantly impact your budget. Strategies for cutting back on dining out include preparing more meals at home, utilizing meal prepping strategies, and opting for picnics or cooking with friends instead of restaurant meals. Even substituting a few restaurant meals with home-cooked ones each week can make a considerable difference.

Strategies to Reduce Utility Bills

Reducing utility bills involves implementing various energy-saving practices. Strategies include turning off lights and electronics when not in use, adjusting thermostat settings, and using energy-efficient appliances. Investing in energy-efficient appliances, such as LED lights or Energy Star certified refrigerators, can also lower utility costs over time. A simple act like unplugging chargers when not in use can save energy and lower your bill.

Saving Money on Groceries and Household Supplies

Effective grocery shopping involves planning ahead and utilizing strategies to avoid impulse buys. Strategies for saving money on groceries include creating a shopping list and sticking to it, comparing prices at different stores, and opting for store brands instead of name brands. Buying in bulk for non-perishable items, taking advantage of sales, and using coupons can also significantly reduce grocery costs.

Consider making a weekly menu plan to minimize food waste. Planning your meals can also reduce the need to purchase unexpected ingredients.

Negotiating Bills and Services

Negotiating bills and services can lead to substantial savings. Contacting service providers to discuss potential discounts or lower rates can often yield unexpected results. Don’t hesitate to ask about promotions or bundled packages. Compare prices from different providers before committing to a service.

Benefits of Using Coupons and Discount Codes

Utilizing coupons and discount codes can save you money on various purchases. Coupons can be found in newspapers, magazines, or online. Taking advantage of online discount codes and deals can result in significant savings. This involves regularly checking websites for coupon codes or deals. By combining coupons and deals with sales, you can maximize savings.

Increasing Income

Boosting your income isn’t just about getting a raise; it’s about exploring opportunities to earn extra cash and build financial security. This can be achieved through various avenues, from side hustles to monetizing existing skills. Understanding the different options and their potential allows you to tailor your approach to your circumstances and aspirations.Maximizing your earning potential involves a strategic approach that goes beyond just working harder.

It’s about identifying opportunities to leverage your skills and resources, whether it’s through freelance work, online selling, or even a small business venture. A well-planned strategy for increasing income can significantly enhance your overall financial well-being.

Side Hustle Opportunities

Exploring side hustles is a great way to supplement your primary income and build financial flexibility. These ventures can range from part-time endeavors to potentially lucrative full-time careers.

- Freelancing: Freelancing platforms like Upwork and Fiverr connect individuals with clients seeking specific services. This allows you to offer your skills, such as writing, graphic design, or virtual assistance, on a project-by-project basis. The beauty of freelancing is the flexibility it provides, allowing you to set your own hours and choose the projects that align with your skills and interests.

- Online Selling: Selling crafts, handmade goods, or even digital products on platforms like Etsy or Shopify allows you to turn your hobbies into income streams. The accessibility of these platforms makes it easy to reach a global audience and build a customer base.

- Tutoring or Coaching: Sharing your expertise by tutoring or coaching in a subject you’re passionate about can provide a valuable service while earning additional income. This can include tutoring children in specific subjects or providing mentorship in a professional field.

- Delivery Services: Services like DoorDash and Uber Eats allow you to use your vehicle or personal time to earn income through deliveries. Flexibility is a key aspect of this, as you can often work around your existing schedule.

Starting a Small Business

Launching a small business can be a significant step towards financial independence. It requires careful planning and execution to ensure success.

- Market Research: Understanding the needs of your target market is crucial for developing a product or service that meets their demands. This involves identifying potential customers, analyzing their preferences, and understanding their pain points. Thorough market research can increase the chances of success.

- Business Plan: A well-structured business plan Artikels your business goals, strategies, and financial projections. It’s a roadmap for achieving success, detailing how you intend to reach your objectives. A detailed business plan serves as a guide for decision-making and resource allocation.

- Legal Considerations: Understanding the legal requirements for operating a business, such as licenses and permits, is essential. Ensuring compliance with relevant regulations helps avoid legal issues and ensures your business operates within the bounds of the law.

Negotiating Salary or Commission

Negotiating your salary or commission is an essential skill for increasing your income. It’s about presenting your value and demonstrating your worth to the employer.

Looking for budget-friendly ways to keep the family entertained? Saving money doesn’t have to mean sacrificing fun! One great way to cut costs is to explore creative family activities, like the 15 fun and easy family activities that you can home. These activities are perfect for keeping everyone happy and engaged without breaking the bank.

By embracing these budget-friendly ideas, you’ll be surprised at how much you can save while having a blast!

- Research Industry Standards: Understanding industry benchmarks for salaries and commission structures provides a foundation for negotiating. This helps you to understand what others in similar roles are earning and to confidently request a compensation package that aligns with your value.

- Highlighting Value: Clearly articulate your skills, experience, and accomplishments to demonstrate your value to the employer. Highlighting past achievements and quantifying results strengthens your case for higher compensation.

- Preparing for Counteroffers: Be prepared to discuss your counteroffers and address any concerns raised by the employer. Having a well-reasoned response for any counter-offer is key to reaching an agreement.

Monetizing Skills and Hobbies

Turning your skills and hobbies into a source of income can be highly rewarding. It allows you to pursue your passions while generating revenue.

- Identifying Marketable Skills: Consider your skills and talents, and evaluate how they can be turned into a service or product that others would be willing to pay for. This could range from graphic design to writing to music production.

- Developing a Portfolio: Creating a portfolio of your work demonstrates your expertise and capabilities. A strong portfolio can attract clients and demonstrate your skills to potential employers.

- Pricing Strategy: Determining a fair and competitive price for your services or products is essential for attracting customers and maximizing profits. Consider your experience, the time involved, and the value you provide when setting your pricing.

Saving Strategies

Saving money effectively is crucial for achieving financial security and independence. Beyond simply budgeting and reducing expenses, strategic saving involves understanding different account types, building emergency funds, and planning for both short-term and long-term goals. This section delves into various saving strategies to help you maximize your financial growth.

Different Types of Savings Accounts

Savings accounts offer a safe place to store money and earn interest. Different types cater to various needs and goals. Understanding the nuances of each can help you choose the best option for your circumstances.

- Basic Savings Accounts: These are the most common type, typically offering a low-interest rate. They are straightforward to open and maintain, making them suitable for general savings. They are a good option for those who prioritize ease of access over high returns.

- High-Yield Savings Accounts: These accounts pay a higher interest rate than basic savings accounts. The higher interest rate is usually a result of the bank having a greater amount of deposits to work with or through higher demand on the deposits from the customers. This makes them beneficial for those looking to maximize their returns. The interest rates can fluctuate, so regular monitoring is advised.

- Money Market Accounts: These accounts offer higher interest rates than standard savings accounts and often allow for more frequent transactions, such as writing checks. They usually have higher minimum balance requirements and may have limitations on the number of transactions allowed each month.

- Certificates of Deposit (CDs): CDs lock your money away for a fixed period, typically earning a higher interest rate than other accounts. The longer the term, the higher the potential return. However, withdrawing funds early often results in penalties. This is a good option for those seeking guaranteed returns for a specific time horizon.

Examples of High-Yield Savings Accounts

Several institutions offer high-yield savings accounts. Researching current rates and comparing options across different banks and credit unions is crucial for maximizing returns. For example, some popular high-yield savings accounts often feature competitive interest rates. Specific accounts and their associated interest rates are constantly changing, so it’s best to check current offerings directly with financial institutions.

Process of Opening a Savings Account

Opening a savings account is generally straightforward. Most banks and credit unions provide online or in-person options. The process typically involves providing personal information, such as your name, address, and social security number, and agreeing to the terms and conditions. A minimum deposit is often required, but the amount varies among institutions.

Importance of Emergency Funds and Building One

An emergency fund is a crucial component of financial stability. It provides a safety net to cover unexpected expenses, such as medical emergencies, job loss, or car repairs. Building an emergency fund is a vital step toward achieving financial independence and stability. A common recommendation is to have enough saved to cover 3 to 6 months of living expenses.

This will protect you from potential financial hardship.

Strategies for Saving for Short-Term and Long-Term Goals

Effective saving strategies depend on your timeframe and goals.

- Short-Term Goals: For smaller, near-term goals, such as a vacation or a new appliance, consider setting up a separate savings account. Regular contributions and disciplined spending habits are key to achieving short-term objectives.

- Long-Term Goals: For larger, long-term goals, such as retirement or a down payment on a house, consider utilizing investment accounts that offer compounding interest over time. Starting early and contributing consistently is essential for achieving long-term financial security.

Comparison of Investment Options

Different investment options cater to various risk tolerances and financial goals. A table outlining potential options and their associated risks and returns can help you make informed decisions.

| Investment Option | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Savings Accounts | Low | Low | High |

| Certificates of Deposit (CDs) | Low | Moderate | Low (early withdrawal penalties) |

| Money Market Accounts | Low | Moderate | Moderate |

| Stocks | High | High | Moderate to High |

| Bonds | Moderate | Moderate | Moderate |

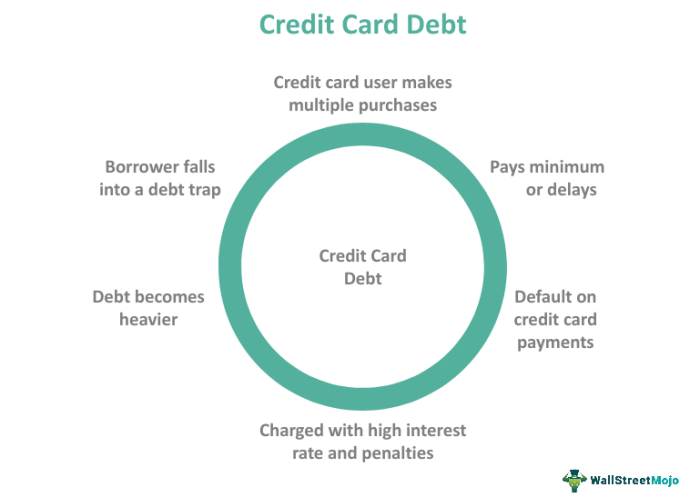

Debt Management

Accumulating debt can quickly spiral out of control, impacting your financial well-being and future opportunities. Understanding the dangers and implementing effective strategies for managing debt is crucial for long-term financial stability. Ignoring debt often leads to significant stress, missed opportunities, and even legal issues.High-interest debt, such as credit card debt, is particularly detrimental due to its compounding nature.

The interest charges add up rapidly, making it challenging to pay off the principal balance. Proactive management of debt is essential for avoiding this trap.

Dangers of Accumulating Debt

Excessive debt can severely limit your financial flexibility. It can lead to missed opportunities for saving, investing, or pursuing personal goals. High-interest debt, in particular, can quickly become overwhelming, making it difficult to meet other financial obligations. Debt can also negatively impact your credit score, which is a critical factor in obtaining loans, mortgages, and other financial services.

Strategies for Paying Off High-Interest Debt

A proactive approach to paying off high-interest debt is crucial. Strategies often include the debt avalanche method, focusing on the highest interest debt first, or the debt snowball method, prioritizing the smallest debts first to build momentum. Either method, when coupled with a budget and discipline, can significantly reduce debt. These methods focus on prioritizing debt repayment to maximize savings.

Creating a Debt Repayment Plan

Developing a debt repayment plan is a crucial step in managing and reducing debt. This plan should Artikel the specific debts, interest rates, and minimum payments for each. A detailed budget should be incorporated to allocate resources to debt repayment. The plan should also consider factors like income, expenses, and emergency funds. A plan will increase accountability and focus.

Debt Consolidation Options

Debt consolidation involves combining multiple debts into a single, lower-interest loan. This can simplify payments and potentially reduce overall interest costs. Personal loans, balance transfer credit cards, and home equity loans are examples of consolidation options. Choosing the right option depends on your individual financial situation and the terms offered by each lender.

Negotiating Debt Terms with Creditors

Negotiating debt terms with creditors can be beneficial in some situations. If you’re experiencing financial hardship, you may be able to negotiate lower interest rates, longer repayment periods, or a temporary reduction in payments. Contacting creditors directly and expressing your financial situation can lead to better terms.

Importance of Credit Score and Improvement

Maintaining a good credit score is essential for accessing favorable financial products and services. A good credit score reflects responsible financial management and can impact loan approvals, interest rates, and even rental applications. Improving your credit score involves paying bills on time, keeping credit utilization low, and avoiding unnecessary credit inquiries.

Investing: Best Ways To Save Money

Investing is a crucial component of long-term financial health. It allows your money to grow over time, potentially outpacing inflation and helping you achieve your financial goals, such as buying a house, funding your children’s education, or retiring comfortably. Understanding the different investment options and strategies is key to making informed decisions that align with your risk tolerance and financial objectives.

Investment Options for Beginners

For beginners, the investment landscape can seem daunting. However, there are numerous options available that are relatively accessible and low-risk. These include low-cost index funds, exchange-traded funds (ETFs), and even high-yield savings accounts.

Low-Cost Investment Strategies

Low-cost investing focuses on minimizing fees and expenses associated with investments. This allows your capital to grow faster and more efficiently. Index funds and ETFs are excellent examples of low-cost investment strategies because they track a market index (like the S&P 500), often with very low expense ratios.

Researching and Selecting Investments, Best ways to save money

Thorough research is essential before committing to any investment. Begin by understanding your risk tolerance, financial goals, and time horizon. Consider consulting with a financial advisor to discuss your specific needs and tailor an investment strategy accordingly. Researching companies or sectors you’re interested in investing in, and understanding their fundamentals is also critical. Look for investment options with proven track records and consistent performance.

Diversification in Investments

Diversification is a cornerstone of sound investment strategy. It involves spreading your investments across various asset classes (stocks, bonds, real estate, etc.) to mitigate risk. By not putting all your eggs in one basket, you reduce the impact of potential losses in a single investment on your overall portfolio.

Investment Vehicles Comparison

| Investment Vehicle | Description | Potential Risks | Potential Rewards |

|---|---|---|---|

| Stocks | Represent ownership in a company. | Significant price fluctuations, company-specific risks. | Potentially high returns, participation in company growth. |

| Bonds | Represent a loan to a company or government. | Credit risk (default), interest rate risk. | Generally lower risk than stocks, fixed income stream. |

| Mutual Funds | Pools money from multiple investors to invest in a diversified portfolio of assets. | Management fees, market fluctuations. | Diversification benefits, professional management. |

Compound Interest

Compound interest is the interest earned on both the principal amount and the accumulated interest from previous periods. It’s a powerful force that can significantly enhance your investment returns over time. The formula for compound interest is A = P(1 + r/n)^(nt), where:

A = the future value of the investment/loan, including interestP = the principal investment amount (the initial deposit or loan amount)r = the annual interest rate (decimal)n = the number of times that interest is compounded per yeart = the number of years the money is invested or borrowed for

For example, if you invest $1,000 at an annual interest rate of 5% compounded annually for 10 years, the future value will be more than $1,628.89. The key is to start saving and investing early, as compound interest works best over extended periods.

Avoiding Financial Pitfalls

Navigating the world of personal finance can be tricky. There are countless ways to make mistakes, from impulsive spending to falling victim to financial scams. Understanding these common pitfalls and developing strategies to avoid them is crucial for building and maintaining a healthy financial future. By proactively identifying potential problems and implementing preventative measures, you can significantly improve your chances of achieving your financial goals.Financial well-being isn’t just about accumulating wealth; it’s also about protecting yourself from unnecessary losses and ensuring your financial stability.

This involves a multifaceted approach, encompassing smart spending habits, vigilance against scams, and seeking professional guidance when needed. By being aware of the potential dangers and taking proactive steps, you can steer clear of financial setbacks and build a secure financial foundation.

Common Financial Mistakes to Avoid

Common financial mistakes often stem from a lack of awareness or discipline. Ignoring your budget, overspending, and failing to prioritize saving are just a few examples. Proactively identifying these potential pitfalls is the first step in developing a robust financial strategy.

Importance of Budgeting and Tracking Spending

A well-defined budget acts as a roadmap for your financial journey. It allows you to allocate your income effectively and track your spending patterns. Regularly tracking your expenses helps you identify areas where you might be overspending and allows you to adjust your budget accordingly. This proactive approach empowers you to make informed financial decisions and maintain control over your finances.

Avoiding Impulse Purchases

Impulse purchases can quickly derail your financial goals. Before making a purchase, take a moment to evaluate its necessity. Ask yourself if the item aligns with your financial plan and if it truly adds value to your life. Consider setting a cooling-off period before making significant purchases to allow for more thoughtful consideration.

Examples of Scams and How to Protect Yourself

Phishing scams, investment fraud, and fake loan offers are prevalent in today’s digital landscape. Be wary of unsolicited emails, phone calls, or messages promising high returns or requiring immediate action. Verify the legitimacy of any financial opportunity before committing to it. Never share sensitive financial information with unknown entities. Do your due diligence and seek verification from trusted sources.

Review your bank and credit card statements regularly to detect any unauthorized transactions.

Importance of Seeking Professional Financial Advice

When faced with complex financial decisions or uncertain situations, consulting a qualified financial advisor can be invaluable. A financial advisor can provide personalized guidance and support tailored to your specific needs and circumstances. They can help you develop a comprehensive financial plan, manage debt effectively, and make informed investment choices. Seeking professional advice is a proactive step towards securing your financial future.

Warning Signs of Potential Financial Fraud

| Warning Sign | Description |

|---|---|

| Unexpected or unsolicited contact | Be wary of offers or requests from unfamiliar sources, especially if they require immediate action or the disclosure of sensitive financial information. |

| Promises of unusually high returns | Be cautious of investments or opportunities promising returns that seem too good to be true. Legitimate investments typically come with reasonable risk and reward profiles. |

| Pressure to act quickly | Avoid financial decisions made under pressure. Take your time to thoroughly research and evaluate any offer before making a commitment. |

| Requests for sensitive information | Never share personal or financial information with unknown entities. Verify the legitimacy of any request before providing sensitive data. |

| Guarantees of success | Avoid investments or opportunities that guarantee success. Financial markets are inherently unpredictable, and no investment strategy guarantees a certain outcome. |

Resources and Tools

Armed with a solid understanding of budgeting, expense reduction, income enhancement, saving strategies, debt management, investing, and recognizing financial pitfalls, you’re well-positioned to take control of your financial future. However, continuous learning and utilizing the right resources are crucial for long-term financial success. This section will provide you with valuable tools and information to navigate your financial journey.Knowing where to find trustworthy financial advice and effectively utilizing helpful resources is paramount.

This section delves into accessible financial education materials, government programs, and crucial steps in selecting a financial advisor, equipping you with the knowledge to make informed financial decisions.

Financial Education Resources

A strong foundation in financial literacy is essential for making sound financial choices. Numerous websites, apps, and books offer valuable insights into various financial aspects.

- Websites: Websites like Investopedia, NerdWallet, and the Financial Planning Association provide comprehensive articles, tutorials, and calculators. These resources often offer practical advice and tools to assist in understanding complex financial concepts.

- Apps: Several apps, such as Mint and Personal Capital, offer budgeting tools, expense tracking, and investment management features. These apps can be particularly useful for those who prefer a mobile-centric approach to managing their finances.

- Books: Numerous books, such as “The Total Money Makeover” by Dave Ramsey and “Rich Dad Poor Dad” by Robert Kiyosaki, provide actionable strategies and insightful perspectives on personal finance. These books can serve as valuable resources for learning and implementing practical financial strategies.

Free Financial Education Resources

Many organizations offer free resources to promote financial literacy. These resources are invaluable for those seeking to enhance their financial knowledge without incurring costs.

| Organization | Resources |

|---|---|

| Khan Academy | Offers free courses on personal finance, covering topics like budgeting, saving, and investing. |

| Consumer Financial Protection Bureau (CFPB) | Provides educational materials, videos, and tools on consumer financial topics. |

| National Foundation for Credit Counseling | Offers free financial counseling and resources to help individuals manage debt and improve their financial situations. |

| Your Local Library | Often hosts workshops and provides access to financial literacy materials. |

Importance of Financial Literacy and Education

Financial literacy is more than just understanding how to balance a checkbook; it encompasses a wide range of financial concepts and strategies. Acquiring financial literacy empowers individuals to make informed decisions, manage their finances effectively, and achieve their financial goals.

Financial literacy is the ability to understand and apply knowledge about personal finance, including budgeting, saving, investing, and debt management, to make informed and responsible financial decisions.

Government Programs Supporting Savings and Planning

Several government programs aim to support individuals in saving and planning for their financial future. These programs often offer incentives and assistance for those looking to improve their financial situations.

- 401(k) plans: These employer-sponsored retirement plans offer tax advantages for saving toward retirement.

- Individual Retirement Accounts (IRAs): These accounts allow individuals to save for retirement with tax benefits.

- Student loan programs: Government programs and initiatives can provide support to those facing student loan debt. Understanding the different options is key for managing this financial responsibility effectively.

Finding and Evaluating a Financial Advisor

Selecting a qualified financial advisor is a crucial step in achieving financial goals. Finding a trustworthy and competent advisor requires careful consideration and evaluation.

- Credentials: Look for advisors with relevant certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate a certain level of expertise and adherence to professional standards.

- Experience: Consider the advisor’s experience and track record in managing client portfolios. Inquire about their experience with clients similar to your situation.

- Fees and charges: Understand the advisor’s fee structure and any associated charges. Transparent fee structures are a sign of professionalism and trust.

- References: Request references and testimonials from previous clients to assess the advisor’s performance and reputation.

Financial Literacy Courses

Many organizations offer financial literacy courses to help individuals enhance their financial knowledge and skills. These courses can provide valuable insights and practical strategies.

- Online Courses: Platforms like Coursera and edX offer online courses on personal finance, covering various topics and skill levels.

- Community Colleges: Many community colleges and adult education centers provide financial literacy workshops and courses.

- Financial Institutions: Banks and credit unions often offer financial literacy seminars and workshops to their customers.

Final Wrap-Up

In conclusion, mastering the best ways to save money is a journey, not a destination. By implementing the strategies Artikeld in this guide, you’ll gain a greater understanding of your finances and the power of saving. Remember that consistent effort and a proactive approach are key to achieving long-term financial success. We encourage you to apply these strategies, adjust them to your specific circumstances, and track your progress.

The key is to consistently work towards your goals, no matter how small they may seem. Your financial well-being is worth the effort.