10 ways which wealthy people think differently about money. This insightful exploration delves into the mindsets, strategies, and values that separate the financially successful from the rest. We’ll uncover how they approach money, from core values and long-term planning to resourcefulness, networking, and continuous learning. Get ready to gain fresh perspectives on wealth creation and management.

The article delves into six key areas: mindset and values, resourcefulness and problem-solving, networking and relationships, learning and adaptation, financial literacy and knowledge, risk and reward perception, and generosity and philanthropy. Each section provides a detailed explanation of the strategies and thought processes that wealthy individuals employ to build and manage their wealth. It highlights how these approaches contrast with typical financial mindsets and provides actionable insights for anyone looking to improve their own financial well-being.

Mindset and Values

Wealthy individuals often possess a unique perspective on money, shaped by core values and a different approach to risk and long-term planning. This isn’t about greed, but rather a distinct philosophy that prioritizes long-term growth and strategic decision-making. They understand that wealth isn’t just about accumulating money, but also about managing it effectively for future generations and contributing to society.This mindset is often characterized by a focus on calculated risk-taking, patience, and a commitment to continuous learning.

They recognize that building wealth requires consistent effort and a long-term vision, in contrast to the more immediate gratification-oriented approach commonly found in the general population.

Core Values Driving Financial Decisions

Wealthy individuals often prioritize values like prudence, discipline, and a strong work ethic. They see financial success as a result of diligent effort and strategic planning, rather than luck or chance. This contrasts sharply with the more prevalent belief that financial success is largely determined by external factors. This often involves a mindset of delayed gratification, understanding that immediate returns may not be the most effective strategy for long-term wealth accumulation.

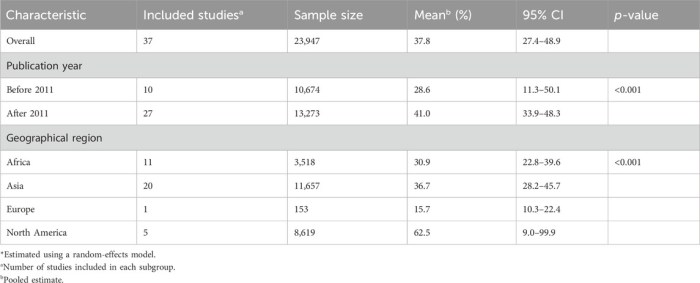

Comparison of Values

| Value | Wealthy Individuals | General Population |

|---|---|---|

| Risk Tolerance | Generally higher tolerance for calculated risk, understanding that high returns often come with high risk. | Lower tolerance for risk, often prioritizing safety and avoiding potential losses. |

| Time Horizon | Long-term perspective, focusing on generational wealth and future goals. | Short-term perspective, often prioritizing immediate needs and desires. |

| Financial Education | Actively seek knowledge and understanding of financial markets and investments. | May have limited understanding of complex financial concepts. |

| Discipline & Patience | High levels of discipline and patience, avoiding impulsive decisions. | More susceptible to impulsive spending and less patient with long-term investments. |

| Continuous Learning | Continuously seeking new knowledge and skills in financial management. | Less focused on continuous financial education. |

Risk Tolerance and Investment Strategies

Wealthy individuals often exhibit a higher risk tolerance, recognizing that high returns frequently come with higher risk. This doesn’t mean reckless gambling, but rather a calculated approach where they carefully assess potential risks and rewards. Diversification and strategic asset allocation are key elements of their investment strategies, aiming to mitigate potential losses while maximizing potential gains. Their investment decisions are often based on thorough research and analysis, not on fleeting trends or emotional impulses.

Long-Term Planning

Long-term planning is a cornerstone of their financial approach. They envision their financial future, considering factors like retirement, education for children, and estate planning. This contrasts with the more short-term focus of the general population, often centered around immediate expenses and debt repayment. They understand that building wealth is a marathon, not a sprint, and they are committed to staying the course.

Financial Philosophies and Wealth Accumulation

- Value Investing: A focus on undervalued assets with strong fundamentals, demonstrating a deep understanding of the underlying value and potential for future growth.

- Growth Investing: Targeting companies with significant growth potential, showcasing a belief in long-term market trends and the potential for exceptional returns.

- Passive Investing: Employing low-cost index funds or ETFs, reflecting a confidence in broad market trends and the efficiency of diversified portfolios.

- Active Investing: Engaging in stock selection and portfolio management, demonstrating a belief in the ability to outperform the market with careful research and analysis.

Resourcefulness and Problem-Solving: 10 Ways Which Wealthy People Think Differently About Money

Wealthy individuals often possess a unique perspective on financial matters, viewing challenges not as roadblocks but as opportunities for innovation and growth. This perspective stems from a deep understanding of resourcefulness and problem-solving, skills honed through navigating complex financial landscapes. They approach financial issues with a proactive and strategic mindset, constantly seeking solutions rather than succumbing to obstacles.Wealthy individuals don’t simply react to financial problems; they anticipate them and proactively strategize to avoid them.

Ever wondered how the wealthy approach money differently? It’s not just about the numbers; it’s about mindset. While exploring those 10 unique ways wealthy people think about money, it’s interesting to consider how this relates to confidence and warmth. In fact, people who radiate these qualities often share some common traits, like a genuine interest in others, as highlighted in this insightful article about 6 things people who radiate warmth and confidence do in common.

Ultimately, a positive outlook on life, often mirrored in the way wealthy individuals manage their resources, seems to be a key element in achieving success.

This proactive approach often involves a combination of careful planning, meticulous record-keeping, and a willingness to seek expert advice when needed. Their problem-solving abilities extend beyond immediate financial needs, encompassing long-term goals and risk mitigation strategies.

Identifying and Solving Financial Problems

Wealthy individuals often identify potential financial problems early on through meticulous financial planning and forecasting. They don’t wait for crises to arise; instead, they proactively monitor their financial health and identify potential vulnerabilities. This proactive approach is facilitated by detailed budgeting, tracking expenses, and analyzing financial trends.

Making the Most of Limited Resources

Resourcefulness isn’t just about having a lot of money; it’s about maximizing the impact of any resources available. Wealthy individuals often seek creative solutions to optimize returns and minimize waste. They leverage diverse investment strategies, explore various funding options, and seek out undervalued opportunities. They often explore alternative financing options, such as crowdfunding or private investments, to enhance their capital deployment.

They are not afraid to take calculated risks and adapt their strategies based on changing market conditions.

Approaching Debt Management

Wealthy individuals don’t shy away from debt; they approach it strategically. Instead of avoiding debt altogether, they view it as a tool that can be used to achieve financial goals, understanding that debt, when managed properly, can accelerate growth. They carefully assess the interest rates, terms, and potential risks associated with any debt. They understand that taking on debt can be a strategic move for specific circumstances, but they prioritize careful repayment plans to minimize the burden.

Prioritizing and Managing Time

Time is a valuable asset, and wealthy individuals understand this. They prioritize tasks and activities that align with their financial goals, effectively managing their time to maximize productivity. This often involves delegating tasks when possible, automating processes, and streamlining workflows. Time management is not just about efficiency; it’s about ensuring that decisions are made strategically and that the allocation of time is in line with their financial objectives.

Common Pitfalls in Financial Management and Avoidance Strategies

| Common Pitfall | Wealthy Individual Approach |

|---|---|

| Ignoring long-term financial planning | Develop detailed financial plans, encompassing retirement, education, and estate strategies, years in advance. |

| Reactive instead of proactive financial management | Constantly monitor financial health, anticipate potential problems, and develop strategies to address them proactively. |

| Poor record-keeping | Employ sophisticated accounting software, track expenses meticulously, and maintain detailed financial records for analysis and forecasting. |

| Insufficient risk assessment | Thoroughly evaluate potential risks and rewards associated with investments and ventures, diversifying portfolios, and hedging against potential losses. |

| Impulsive spending | Develop and adhere to a strict budget, track spending meticulously, and avoid impulsive purchases. |

Networking and Relationships

Building strong relationships is paramount to wealth creation. It’s not just about who you know, but alsohow* you know them and the value you bring to the table. Successful individuals understand that genuine connections often lead to opportunities, mentorship, and collaborative ventures that fuel financial growth. This chapter delves into the specific types of relationships and strategies that wealthy people utilize.Wealthy individuals recognize that networking isn’t just about attending events; it’s about cultivating meaningful connections that can last a lifetime.

They understand that building genuine relationships takes time and effort, and that it’s about mutual benefit, not just personal gain.

Types of Relationships Contributing to Wealth Creation

Successful individuals recognize that valuable relationships extend beyond superficial acquaintances. Strong bonds with mentors, business partners, advisors, and even trusted colleagues are often crucial. These relationships provide guidance, support, and access to resources that accelerate wealth building.

- Mentorship: Mentors provide invaluable guidance and experience, offering insights and strategies that accelerate a person’s understanding of wealth creation. They act as trusted advisors, providing support during challenging periods and offering fresh perspectives.

- Business Partnerships: Collaborating with like-minded individuals who possess complementary skills and resources can lead to synergistic ventures. These partnerships can unlock greater financial opportunities and create a more robust business model.

- Strategic Alliances: These connections are vital for accessing new markets, resources, or technologies. Strategic alliances can offer access to expertise, funding, and other assets that propel a business or individual’s financial success.

Leveraging Networks for Financial Gain

Wealthy individuals strategically leverage their networks to identify opportunities and access resources. They understand the importance of actively seeking out connections that can benefit their endeavors. They cultivate relationships that provide valuable insights, potential partnerships, and access to new markets.

- Targeted Networking Events: They attend industry conferences, seminars, and exclusive events that align with their goals, seeking connections that can lead to mutually beneficial outcomes.

- Building Relationships Online: The digital world offers extensive networking opportunities. Wealthy individuals utilize online platforms, engaging in relevant discussions and establishing connections with potential partners, investors, and mentors.

- Referral Systems: Wealthy individuals understand the power of referrals. They cultivate relationships that can generate referrals, fostering growth and increasing their network’s value.

Importance of Mentorship and Guidance

Mentorship plays a significant role in the wealth creation journey. Mentors provide guidance, experience, and support that can accelerate the learning curve. They offer valuable insights, strategies, and perspectives that are often crucial to success.

“A mentor is someone who sees what you can become and helps you become it.”

Ralph Waldo Emerson

Examples of Networking Impacting Success

Numerous examples illustrate the impact of strong relationships on financial success. Successful entrepreneurs frequently cite mentors who provided crucial advice and support, helping them navigate challenges and achieve their goals.

- Startup Founders: Many successful startup founders credit mentors with providing invaluable guidance on product development, market strategy, and fundraising.

- Investment Bankers: Networking and relationships within the financial industry are critical for securing deals, generating investment opportunities, and building a strong reputation.

Comparison of Networking Approaches

The networking strategies employed by wealthy individuals often differ significantly from those of the general population. Wealthy individuals prioritize building genuine relationships and value long-term connections over superficial interactions. They recognize the power of building strong, mutually beneficial relationships.

Strategies for Building Strong and Mutually Beneficial Relationships

Strong relationships are built on trust, mutual respect, and shared value. Wealthy individuals actively cultivate relationships based on these principles. They prioritize open communication, understanding the other party’s needs, and offering value.

- Active Listening: Understanding the other person’s perspective and needs is crucial for building rapport and trust.

- Value Exchange: Offering assistance and support in return for reciprocal benefits strengthens relationships.

- Follow-Up: Consistent follow-up demonstrates genuine interest and reinforces the relationship.

Networking Strategies and Effectiveness

| Networking Strategy | Effectiveness | Description |

|---|---|---|

| Targeted Networking Events | High | Attending relevant events to meet potential partners, mentors, or investors. |

| Online Networking Platforms | Medium | Using online platforms to connect with individuals in the same industry or field. |

| Referral Systems | High | Building relationships that can generate referrals for services or products. |

Learning and Adaptation

Wealthy individuals understand that financial success isn’t a destination but a continuous journey. They recognize that the market, economic conditions, and financial instruments are constantly evolving. This requires a proactive approach to learning and adaptation, rather than a static mindset.

This dynamic understanding fuels their continuous learning process, allowing them to adapt to shifting economic tides and capitalize on emerging opportunities. They don’t just react to changes; they anticipate them and proactively adjust their strategies accordingly. This adaptability is key to their long-term financial well-being.

Continuous Learning Process

Wealthy individuals view learning as a lifelong commitment, recognizing that financial knowledge is not static. They actively seek out new information and perspectives, constantly expanding their understanding of finance, economics, and investment strategies. This ongoing pursuit of knowledge isn’t just theoretical; it’s practical, directly impacting their investment decisions and overall financial strategy.

Adapting to Changing Economic Conditions

The ability to adapt to changing economic conditions is a crucial aspect of financial resilience. Wealthy individuals monitor economic indicators, analyze market trends, and adjust their investment portfolios accordingly. They understand that market downturns are inevitable, and a well-structured plan is essential for navigating these periods.

- They anticipate potential market shifts, considering factors like inflation, interest rates, and geopolitical events. This proactive approach helps them mitigate risks and capitalize on opportunities.

- They constantly research and analyze the impact of these trends on different investment vehicles. This involves staying informed about sectors and industries that are likely to thrive in the changing economic climate.

- They utilize various resources, such as financial news outlets, industry reports, and expert opinions, to form a comprehensive understanding of the current economic landscape.

Acquiring New Financial Knowledge

Wealthy individuals understand that staying ahead of the curve requires actively seeking out new financial knowledge. They are not afraid to learn from various sources, including books, seminars, online courses, and mentorship programs. They leverage diverse resources to gain a well-rounded perspective.

- Attending industry conferences and workshops allows them to network with peers and experts in the field, fostering knowledge sharing and expanding their understanding of market dynamics.

- They utilize online platforms and resources for continuous learning, such as financial news websites, educational platforms, and investment communities. These provide access to a wealth of information and diverse perspectives.

- Seeking mentorship from successful investors and financial advisors can provide invaluable insights and practical strategies, allowing them to learn from others’ experiences.

Staying Informed About Financial News and Trends

Staying informed about financial news and trends is a critical component of making informed decisions. Wealthy individuals dedicate time to monitoring financial news, analyzing market reports, and understanding economic indicators. This allows them to identify potential opportunities and mitigate risks.

- They subscribe to financial publications and newsletters, keeping abreast of current events and emerging trends in the market.

- They follow prominent financial analysts and commentators, gaining diverse perspectives and different interpretations of the data.

- They actively seek out independent sources and verify information from multiple sources to ensure a balanced understanding.

Analyzing Financial Data and Markets

Financial data analysis is an integral part of their decision-making process. Wealthy individuals utilize various tools and techniques to assess market trends, evaluate investment opportunities, and make data-driven decisions. They understand that financial markets are complex and require careful scrutiny.

- They employ quantitative and qualitative analysis techniques, considering both historical data and current market conditions.

- They utilize financial modeling tools to forecast potential outcomes and evaluate the risk-reward profile of different investments.

- They leverage advanced software and technology to track market data and identify patterns that could influence their investment strategies.

Importance of Lifelong Learning in Financial Success

| Aspect | Importance |

|---|---|

| Understanding market fluctuations | Allows for adapting investment strategies during market downturns and capitalizing on opportunities. |

| Identifying emerging trends | Enables proactive investment decisions based on anticipated market movements. |

| Assessing risk and reward | Supports informed investment choices, reducing potential losses and maximizing returns. |

| Staying ahead of the curve | Provides a competitive edge in the financial market, allowing for early identification of promising opportunities. |

| Adapting to regulatory changes | Facilitates compliance with evolving financial regulations and maintaining a strong legal foundation for investments. |

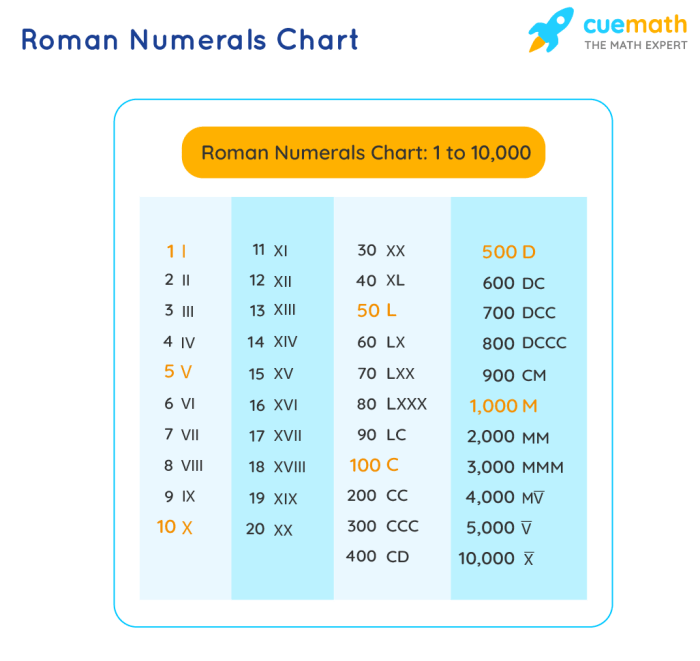

Financial Literacy and Knowledge

Wealthy individuals possess a deep understanding of financial instruments and concepts, going far beyond basic budgeting. This sophisticated knowledge isn’t just theoretical; it’s actively applied to make informed decisions, enabling them to navigate complex financial landscapes and avoid common pitfalls. They differentiate between credible financial information and misinformation, a critical skill in today’s information-rich environment.Wealth creation is not simply about accumulating assets; it’s about understanding how those assets interact and grow over time.

This requires a nuanced understanding of financial markets, investment strategies, and risk management. A comprehensive financial literacy empowers individuals to make sound judgments, avoiding costly mistakes and maximizing returns.

Depth and Breadth of Financial Knowledge

Wealthy individuals often have a comprehensive understanding of various financial instruments, including stocks, bonds, mutual funds, real estate, and alternative investments like private equity and hedge funds. They understand the nuances of different investment strategies, such as value investing, growth investing, and dividend investing, and the associated risks and rewards. This knowledge extends to understanding financial statements (balance sheets, income statements, cash flow statements), allowing them to assess the financial health and potential of businesses and projects.

Examples of Financial Instruments and Concepts

They possess a deep understanding of concepts like compound interest, diversification, inflation, and market cycles. This allows them to make strategic decisions about asset allocation, timing investments, and managing risk. They understand the mechanics of various financial products, such as options, futures, and derivatives, and how these tools can be used to manage risk and generate returns. Their knowledge encompasses understanding different taxation structures, tax implications of investments, and strategies to optimize their tax liability.

Applying Knowledge to Financial Decisions

Wealthy individuals aren’t just passive investors; they actively monitor and manage their portfolios. They understand the importance of due diligence and thorough research before making investment decisions. They are skilled at evaluating the potential of new investment opportunities and assessing the associated risks. They understand the importance of consistent monitoring, adapting strategies based on market conditions, and making adjustments to maximize returns.

Differentiating Financial Information from Misinformation

Wealthy individuals possess the critical thinking skills to discern credible financial information from misleading or inaccurate information. They recognize that market analysis often comes with biases and that no single source of information can be considered entirely objective. They rely on multiple sources and cross-reference data to form informed opinions. They understand the importance of verifying information and seek advice from reputable financial advisors, accountants, and lawyers.

Common Financial Pitfalls and Avoidance Strategies

They understand the potential pitfalls associated with impulsive decisions, excessive debt, poor risk management, and lack of diversification. These individuals are proactive in avoiding these common errors by developing comprehensive financial plans, seeking professional advice when needed, and maintaining a long-term perspective. They understand the importance of budgeting, expense tracking, and setting realistic financial goals.

Importance of Financial Knowledge Areas in Wealth Creation

| Financial Knowledge Area | Importance in Wealth Creation |

|---|---|

| Investment Strategies | Understanding different investment approaches and their potential returns. |

| Financial Statement Analysis | Assessing the financial health and potential of businesses and projects. |

| Taxation Strategies | Minimizing tax liabilities and maximizing returns. |

| Risk Management | Identifying and mitigating potential financial risks. |

| Portfolio Management | Adapting investment strategies based on market conditions. |

| Market Analysis | Evaluating investment opportunities and assessing associated risks. |

Risk and Reward Perception

Wealthy individuals often approach risk and reward with a unique perspective, shaped by their experiences and financial resources. This distinct viewpoint stems from a deeper understanding of the long-term implications of financial decisions, allowing them to make calculated choices that prioritize potential gains while mitigating potential losses. They don’t shy away from calculated risks, but rather approach them with a meticulous assessment of the potential payoff and the potential downsides.Wealthy individuals understand that financial success is often tied to taking calculated risks.

This doesn’t mean recklessness, but rather a strategic approach to evaluating the likelihood of success against the potential for loss. Their financial history and accumulated knowledge often allow them to identify and assess risks more accurately than the general population.

Ever wondered how the wealthy approach money differently? It’s not just about accumulating it, but also how they think about it. Exploring 10 different ways they approach finances is fascinating. Interestingly, a parallel can be drawn between these financial mindsets and what successful people don’t do. For example, 9 things that successful people dont highlight the importance of avoiding certain pitfalls.

Ultimately, understanding these different approaches to money reveals a deeper truth about wealth, revealing the mindset that fuels success.

Different Risk Assessment Strategies

Wealthy individuals frequently employ a more nuanced and comprehensive approach to risk assessment. They often analyze potential outcomes, considering not only the immediate profit or loss but also the long-term implications. This meticulous process allows them to identify and manage potential pitfalls effectively. They’re not afraid of setbacks, viewing them as learning opportunities within a larger financial framework.

Long-Term Perspective in Risk Evaluation, 10 ways which wealthy people think differently about money

Wealthy individuals often possess a long-term perspective in evaluating risk and reward. They understand that short-term fluctuations are often a part of the market cycle and are not necessarily indicative of long-term trends. This long-term orientation allows them to make investments with a broader view, considering the potential for sustained growth over many years. Their financial decisions are not influenced by short-term market volatility.

Instead, they focus on the overall trajectory of their investments.

Ever wondered how the ultra-wealthy approach money differently? It’s fascinating to see how they think about investments and long-term financial strategies. Perhaps a crucial element is a detachment from the constant social media pressure to keep up appearances. A social media detox, like the one outlined in this insightful article on 9 positive benefits of a social media detox , can help you focus on your own financial goals, free from the distractions of others’ perceived success.

Ultimately, understanding how wealthy individuals manage their money can offer valuable lessons for anyone looking to improve their financial well-being.

Risk Tolerance Comparison

The risk tolerance of wealthy individuals often differs significantly from that of the general population. Wealthy individuals, having accumulated significant capital, may be more comfortable taking calculated risks, as they have a greater cushion to absorb potential losses. This doesn’t equate to recklessness, but rather a different calculus for assessing risk based on the accumulated wealth and its potential to withstand market downturns.

The general population, often lacking the same financial safety net, may exhibit a lower risk tolerance.

Illustrative Table of Risk Management Strategies

| Investment Scenario | Risk Assessment | Risk Management Strategy | Potential Reward | Potential Loss |

|---|---|---|---|---|

| Emerging Market Stocks | High growth potential, but with significant volatility | Diversification across multiple emerging markets, use of stop-loss orders, and holding a long-term perspective. | High potential for significant returns if the market performs well | High potential for loss if the market experiences a downturn |

| Bonds with High Yield | Higher yield potential, but with increased credit risk | Thorough credit analysis of the issuer, diversification across various bond types, and careful consideration of the overall economic environment. | High potential for higher returns compared to traditional bonds | Increased potential for default, leading to loss of principal |

| Real Estate Investment Trusts (REITs) | Relatively stable income stream, but subject to market fluctuations and interest rates | Diversification across different sectors, careful analysis of rental income and property values, and a long-term investment horizon. | Steady income stream and potential capital appreciation | Potential for losses due to economic downturns, changes in interest rates, or market fluctuations |

Generosity and Philanthropy

Wealthy individuals often understand that true wealth extends beyond financial accumulation. Generosity and philanthropy are not merely acts of charity; for many, they are integral components of a sophisticated wealth management strategy, intertwined with personal values and long-term financial success. These activities can foster a sense of purpose and fulfillment, building enduring legacies that extend far beyond financial gains.Philanthropic endeavors can contribute significantly to the long-term financial success of wealthy individuals by fostering positive community relations and brand building.

These relationships often translate into opportunities for collaboration, investment, and strategic partnerships that can enhance financial returns and create a lasting impact. By contributing to causes aligned with their values, individuals can cultivate a reputation for ethical business practices and social responsibility, attracting both investors and customers who share those values.

The Role of Philanthropy in Wealth Management

Philanthropy is a powerful tool in wealth management, encompassing a range of activities beyond simple donations. Strategic philanthropy can enhance financial security by diversifying investments and generating positive returns in various ways. It also often facilitates access to networks and opportunities that would otherwise be unavailable, creating avenues for future financial growth. This strategic approach considers not only the impact on the recipient but also the potential for long-term financial gain and societal impact.

Examples of Wealthy Individuals Integrating Philanthropy

Many wealthy individuals have integrated philanthropic activities into their wealth management strategies. Bill and Melinda Gates Foundation, established by the eponymous couple, exemplifies this approach. Their foundation has a significant global impact, funding research and development in healthcare and global development, activities that, in turn, foster economic growth and stability. Similarly, Warren Buffett, through the Berkshire Hathaway foundation, has focused on education and local community initiatives, demonstrating a strong commitment to sustainable growth.

These examples highlight the connection between philanthropy and sustainable wealth creation.

Strategic Philanthropic Approaches

Strategic philanthropy goes beyond simply donating money. It involves careful consideration of alignment between philanthropic efforts and personal values, long-term financial goals, and potential societal impact. A key element is establishing a clear philanthropic strategy that considers the organization’s mission, impact, and financial sustainability. This involves assessing potential partners, evaluating their track record, and ensuring a clear understanding of the goals and expectations.

For example, a wealthy individual focused on sustainable agriculture might invest in organizations promoting environmentally friendly farming techniques, potentially leading to both environmental and financial benefits.

Motivations Behind Philanthropic Giving

The motivations behind philanthropic giving are multifaceted. While financial gain is often a consequence, the driving forces can be more intrinsic, including a desire to leave a positive legacy, support causes aligned with personal values, and foster positive societal change. The feeling of contributing to a greater good can lead to a profound sense of fulfillment and purpose, which, in turn, can positively influence financial decisions and long-term wealth management.

Philanthropy and Wealth Preservation

Philanthropic giving can contribute to wealth preservation in several ways. By diversifying investment portfolios, and building strong relationships with organizations that align with values, individuals can ensure a more sustainable future for their wealth. This approach involves careful consideration of both short-term and long-term implications, fostering sustainable wealth creation and societal impact.

The Connection Between Generosity, Wealth, and Societal Impact

| Generosity | Wealth | Societal Impact |

|---|---|---|

| Strategic Philanthropy | Diversified Investments, Network Building | Sustainable Economic Growth, Positive Community Relations |

| Charitable Donations | Tax Benefits, Reputation Enhancement | Improved Infrastructure, Community Development |

| Community Involvement | Business Opportunities, Long-term Value | Enhanced Reputation, Social Responsibility |

Conclusion

In conclusion, the 10 ways which wealthy people think differently about money reveal a comprehensive approach to wealth creation that goes beyond just accumulating assets. From a strong foundation of values and a long-term perspective to strategic resourcefulness, impactful networking, and continuous learning, these individuals demonstrate a holistic approach to financial success. The key takeaway is that building wealth is not just about acquiring money, but about cultivating a mindset and a set of skills that drive sustainable financial growth.

By understanding these principles, anyone can start to shift their financial thinking towards greater prosperity.