5 hacks for overcoming financial crisis is your guide to navigating tough financial times. This isn’t about quick fixes; it’s about building solid financial foundations that will help you weather any storm. We’ll explore practical strategies to identify the root causes of your crisis, implement actionable solutions, and ultimately, achieve financial stability.

From understanding the different types of financial crises to crafting a budget, this comprehensive guide provides actionable steps to address personal financial distress and create a secure future.

Understanding Financial Crises

A financial crisis is a significant disruption in the functioning of financial markets, characterized by a sharp decline in asset values, increased risk aversion, and widespread failures of financial institutions. These crises often ripple through the global economy, impacting businesses, individuals, and governments. Understanding the causes, types, and historical examples of financial crises is crucial for developing strategies to mitigate their impact.Financial crises manifest in various forms, each with unique characteristics and implications.

They can stem from a multitude of factors, including unsustainable economic policies, systemic vulnerabilities, and external shocks. A thorough understanding of these factors is essential for developing effective strategies to prevent and manage financial crises.

Definition of a Financial Crisis

A financial crisis is a significant disruption in the functioning of financial markets, characterized by a sharp decline in asset values, increased risk aversion, and widespread failures of financial institutions. Key characteristics include a rapid decline in asset prices, such as stocks, bonds, and real estate; a surge in defaults on loans and other financial obligations; and a freezing of credit markets, making it difficult for businesses and individuals to access financing.

Types of Financial Crises

Financial crises encompass several distinct types, each with unique causes and consequences. These include debt crises, currency crises, and banking crises.

- Debt Crises occur when a country or a group of countries accumulates excessive debt, making it difficult or impossible to meet their financial obligations. This often leads to a loss of confidence in the country’s ability to repay, resulting in a flight of capital and a decline in the value of the country’s currency. Examples include the 1980s Latin American debt crisis and the 2010 Greek debt crisis.

- Currency Crises involve a sharp devaluation of a currency, typically due to speculative attacks on its value. Speculators bet against the currency, leading to a loss of confidence and a rapid decline in its exchange rate. These crises often result in economic hardship and instability for the affected country. An example is the Asian financial crisis of 1997-98.

- Banking Crises involve a wave of failures of banks and other financial institutions. These failures often result from excessive risk-taking by banks, inadequate regulatory oversight, or a combination of factors. The 2008 global financial crisis, triggered by the collapse of the US housing market and the failure of numerous financial institutions, serves as a prominent example.

Causes of Financial Crises

Financial crises are rarely caused by a single factor. Instead, they are often the result of a combination of economic shocks, policy failures, and systemic risks.

Ever feel stuck in a financial crunch? Five simple hacks can help you navigate those tricky times. Learning how to better manage your money is key, and one great way to do that is by exploring 10 innovative ways of using your smartphone, like using budgeting apps or finding discount deals. These apps can save you money and make managing your finances easier.

Ultimately, understanding how to use your smartphone effectively can empower you to overcome financial challenges, so consider exploring 10 innovative ways of using your smartphone for more insightful tips. These strategies will provide you with a powerful toolkit for financial success.

- Economic Shocks, such as sudden changes in commodity prices, interest rates, or economic growth, can create vulnerabilities in financial markets. These shocks can trigger a cascade of events, leading to a crisis. The 1973 oil crisis, for example, caused a significant increase in energy prices, impacting global economies and financial markets.

- Policy Failures, such as inadequate regulation of financial institutions or inappropriate monetary policies, can create systemic vulnerabilities that can be exploited by speculators or lead to excessive risk-taking. The subprime mortgage crisis in the US was partly attributed to lax lending standards and inadequate regulatory oversight.

- Systemic Risks, which are interconnected risks that can spread rapidly through the financial system, can trigger a widespread crisis. These risks often arise from complex financial instruments, interconnected financial institutions, and interconnected economies. The 2008 global financial crisis was partly attributed to the complexity of financial instruments, like mortgage-backed securities.

Historical Examples and Impact

Numerous historical financial crises have significantly impacted global economies and societies.

- The 1997 Asian financial crisis, triggered by speculative attacks on Asian currencies, resulted in a significant economic downturn in several countries in the region. The crisis highlighted the interconnectedness of global financial markets.

- The 2008 global financial crisis, triggered by the collapse of the US housing market, led to a severe global recession, impacting employment, businesses, and financial institutions worldwide. The crisis exposed systemic vulnerabilities in the global financial system.

Comparison of Different Types of Financial Crises

| Type of Crisis | Key Characteristics | Common Causes | Impact |

|---|---|---|---|

| Debt Crisis | Excessive borrowing, inability to repay debt | Unsustainable borrowing levels, economic downturn, external shocks | Loss of investor confidence, currency depreciation, economic contraction |

| Currency Crisis | Sharp devaluation of a currency | Speculative attacks, inadequate monetary policy, external shocks | Economic instability, inflation, capital flight |

| Banking Crisis | Widespread failures of banks and financial institutions | Excessive risk-taking, inadequate regulation, economic shocks | Credit freeze, reduced investment, economic recession |

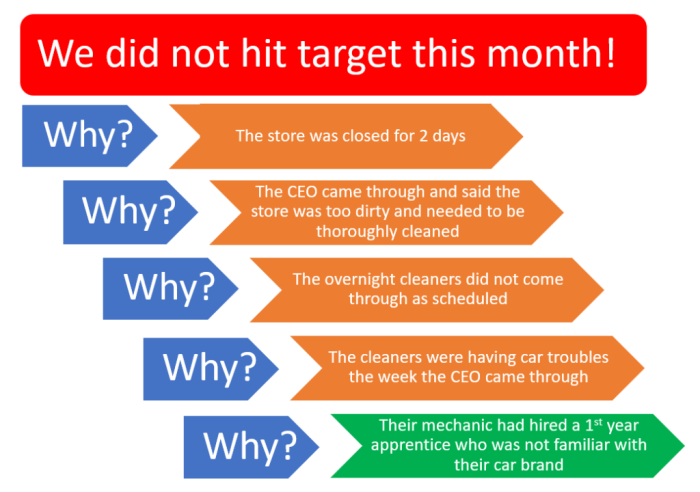

Identifying the Root Causes of Personal Financial Crises

Understanding the underlying factors contributing to financial hardship is crucial for developing effective solutions. A deep dive into the root causes reveals patterns and common pitfalls, enabling individuals to proactively address potential issues and build a stronger financial foundation. Many financial crises are not sudden events but rather the culmination of poor habits and unforeseen circumstances. By recognizing the contributing factors, individuals can better equip themselves to navigate challenges and achieve financial stability.Personal financial crises are often the result of a confluence of factors, rather than a single cause.

Poor financial planning, coupled with unsustainable spending habits and unforeseen expenses, can easily lead to a cascade of negative consequences. Recognizing these contributing factors is the first step toward developing a comprehensive strategy for financial recovery and future stability.

Common Reasons for Financial Crises

Unforeseen events and consistent poor financial decisions frequently contribute to financial hardship. Proactive financial planning and responsible spending habits are crucial in mitigating the risk of crises. Common reasons include overspending on non-essential items, neglecting savings, and inadequate budgeting strategies.

So, you’re facing a financial crisis? Five smart hacks can help you navigate these tricky times. But remember, achieving financial stability is a journey, not a sprint. Thinking about milestones, like a smarter approach for achieving life goals, can really help. What is a milestone, a smarter approach for achieving life goals ?

It’s about breaking down your financial goals into smaller, achievable steps. This will keep you motivated and focused, helping you stay on track with those 5 hacks to overcome a financial crisis.

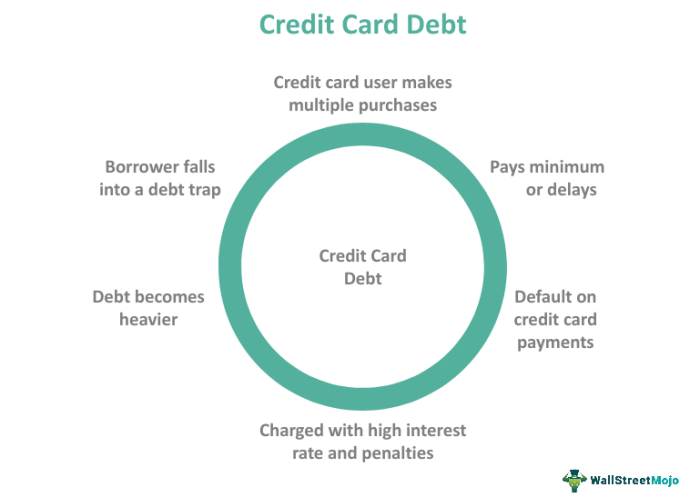

The Role of Spending Habits

Spending habits significantly impact an individual’s financial well-being. Impulsive purchases and a lack of control over discretionary spending can quickly deplete savings and create a cycle of debt. A lack of awareness regarding spending patterns and the prioritization of needs over wants is a common factor in accumulating debt. Failing to track expenses and understand where money is going often leads to an inability to control spending and manage finances effectively.

For example, consistently spending more than one earns, or falling into the trap of using credit cards for everyday expenses without a clear repayment strategy, can create significant financial strain.

The Impact of Unexpected Expenses

Unexpected expenses, such as medical emergencies, car repairs, or job loss, can quickly overwhelm even the most well-planned budgets. These unexpected events can disrupt financial stability and, if not managed effectively, can lead to significant financial hardship. The inability to handle unforeseen circumstances is a common contributing factor to financial crises. A lack of emergency funds can make these situations even more difficult to manage.

For example, a sudden illness requiring extensive medical treatment can quickly deplete savings and create substantial debt.

The Importance of Financial Planning

Effective financial planning is essential for mitigating the risk of financial crises. A comprehensive financial plan encompasses budgeting, saving, investing, and debt management strategies. Lack of financial planning often results in a reactive approach to financial problems rather than a proactive one. Without a plan, individuals are more vulnerable to financial shocks and less prepared to manage unexpected expenses or emergencies.

For example, not having a retirement plan or a strategy for handling large purchases can lead to significant financial strain later in life.

Examples of Situations Leading to Financial Hardship

Various situations can lead to financial hardship. Job loss, medical emergencies, family issues, and natural disasters are just a few examples of events that can quickly derail financial stability. The inability to cope with these events can lead to a cascade of negative consequences, making it difficult to recover from the financial crisis. For example, a sudden layoff without adequate savings or a robust financial safety net can result in a quick descent into debt and financial instability.

Similarly, a family emergency requiring substantial medical expenses can quickly drain savings and create significant financial strain.

Typical Stages of Financial Crisis Progression, 5 hacks for overcoming financial crisis

| Stage | Description |

|---|---|

| Initial Stage | Characterized by a growing gap between income and expenses, leading to increased debt or decreased savings. A lack of proactive measures is often apparent in this stage. |

| Escalation Stage | Increased debt, mounting bills, and difficulty meeting financial obligations become more prominent. Financial stress and anxiety start to impact daily life. |

| Crisis Stage | Significant financial distress, inability to meet essential needs, and potential loss of assets. Negative impacts on personal relationships and overall well-being are common. |

| Recovery Stage | Developing and implementing a financial recovery plan, focusing on debt management, budget adjustments, and building savings. |

Five Hacks for Overcoming Financial Crises

Navigating a financial crisis can feel overwhelming, but with a strategic approach, you can regain control and build a more secure future. These five hacks offer practical strategies for addressing various financial challenges, from unexpected expenses to long-term debt. Each hack emphasizes actionable steps, drawing on real-world examples to illustrate their effectiveness.Financial crises often stem from a combination of factors, including unexpected expenses, poor budgeting habits, and high-interest debt.

By implementing these strategies, individuals can develop a proactive approach to financial wellness and build resilience against future challenges. Understanding the underlying principles behind each hack is crucial for long-term success.

Budgeting and Expense Tracking

Effective budgeting is the cornerstone of financial stability. A well-structured budget helps you understand your income and expenses, identify areas where you can cut back, and allocate funds towards your financial goals.

- Detailed Expense Tracking: Maria, a young professional, realized she was consistently overspending on dining out. By meticulously tracking her expenses for a month, she discovered that eating out accounted for a significant portion of her discretionary income. This realization allowed her to identify and adjust her spending habits, ultimately saving money.

- Prioritize Needs over Wants: Recognizing the difference between needs and wants is vital. Identifying and categorizing essential expenses like rent, utilities, and groceries as opposed to discretionary expenses like entertainment or dining out helps you allocate funds effectively.

- Create a Realistic Budget: A realistic budget is key to achieving financial goals. Don’t aim for unrealistic savings targets initially. Start with a budget that you can realistically maintain and adjust it as your income and expenses change. Begin with a detailed analysis of your current income and expenses. Then, identify areas where you can cut back on spending.

Set achievable savings goals.

Debt Consolidation and Management

High-interest debt can quickly spiral out of control. Consolidating and managing debt strategically can significantly reduce your financial burden.

- Debt Consolidation Loans: Mark had multiple credit card debts with high interest rates. He consolidated these debts into a single loan with a lower interest rate, significantly reducing his monthly payments and saving him money over time. Research different consolidation options, compare interest rates, and understand the terms and conditions before making a decision.

- Debt Snowball Method: The debt snowball method involves paying off the smallest debt first, regardless of the interest rate. This approach provides a sense of accomplishment and motivation, which can help maintain momentum. List all debts from smallest balance to largest, prioritizing the repayment of the smallest debt first.

- Negotiating with Creditors: If you’re struggling to make payments, consider negotiating with your creditors. Sometimes, they’re willing to work with you to create a more manageable payment plan. Communicate with your creditors to explore options for lower interest rates or modified payment schedules.

Emergency Fund Building

Having an emergency fund is essential for navigating unexpected financial setbacks. This fund acts as a safety net, providing a buffer against unforeseen circumstances.

- Establishing a Savings Goal: Aim for a savings goal of at least three to six months’ worth of living expenses. Start small and gradually increase your contributions to reach your goal.

- Automatic Transfers: Set up automatic transfers from your checking account to your savings account on a regular basis to build consistency and avoid procrastination. Schedule automatic transfers to your savings account on a recurring basis.

- Prioritizing Savings: View savings as a necessity, not a luxury. Make savings a priority by setting aside funds before paying other expenses. Dedicate a specific portion of your income towards your savings goal.

Seeking Professional Guidance

Professional guidance can provide valuable insights and support in managing financial crises. Financial advisors can offer personalized advice and create tailored strategies for your specific needs.

- Consult a Financial Advisor: Consult with a certified financial advisor to gain personalized advice on your specific situation. Ask about strategies to manage your debts, create a budget, and build an emergency fund.

- Leveraging Resources: Explore resources offered by non-profit organizations or government agencies that provide financial counseling services. Contact local organizations or government agencies to explore available support services.

Selling Unnecessary Assets

Downsizing your belongings can free up valuable capital to address your financial crisis. Selling items you no longer need or use can generate immediate cash flow.

- Identify Unused Items: Take inventory of items you no longer need or use. Consider selling clothes, electronics, or furniture on online marketplaces or at local consignment shops.

- Set Realistic Selling Prices: Research comparable items to determine a fair selling price. Avoid underpricing or overpricing your items. Research similar items to establish a realistic market value for your assets.

- Utilize Online Platforms: Leverage online marketplaces like eBay, Craigslist, or Facebook Marketplace to reach a wider audience for your items. Consider platforms for selling used goods.

Benefits and Drawbacks of Each Hack

| Hack | Benefits | Drawbacks |

|---|---|---|

| Budgeting and Expense Tracking | Increased awareness of spending habits, improved financial control, and better resource allocation | Requires discipline and consistent effort; potential for frustration if not properly implemented |

| Debt Consolidation and Management | Reduced interest payments, simplified debt management, and potential for lower monthly payments | Requires careful research and comparison of loan options; may not be suitable for all debt situations |

| Emergency Fund Building | Financial security during unexpected events, reduced stress and anxiety, and peace of mind | Requires consistent savings discipline; potential for delays in reaching the target |

| Seeking Professional Guidance | Personalized advice, tailored strategies, and objective insights | Can be costly; requires finding a qualified and reputable advisor |

| Selling Unnecessary Assets | Immediate cash flow, increased financial resources, and reduced clutter | May not be suitable for all situations; requires time and effort to sell items |

Hack 1: Emergency Fund & Budgeting

A financial crisis can be a devastating blow, but having a proactive approach can significantly reduce its impact. This first hack focuses on establishing financial safety nets and implementing effective budgeting strategies. These crucial steps provide a solid foundation for navigating challenging times and achieving long-term financial stability.Effective management of finances is crucial during a crisis. A well-structured emergency fund and a disciplined budget are essential tools to withstand unexpected expenses and maintain control over your finances.

This approach is not just about surviving a crisis but about building a sustainable financial future.

Importance of an Emergency Fund

An emergency fund acts as a financial safety net, providing a cushion against unforeseen circumstances such as job loss, medical emergencies, or car repairs. It’s a vital component of financial preparedness, allowing you to weather unexpected storms without resorting to high-interest debt or jeopardizing your long-term financial goals. A healthy emergency fund is like an insurance policy for your financial well-being.

Strategies for Building an Emergency Fund

Building an emergency fund requires consistent effort and a commitment to saving. A realistic goal is to save 3-6 months’ worth of living expenses in a readily accessible account. The following strategies can help you achieve this:

- Track your income and expenses: Accurate record-keeping is essential to understand your financial situation and identify areas where you can cut back. Tools like budgeting apps or spreadsheets can aid this process.

- Create a budget: A budget is a plan for managing your income and expenses. It helps you prioritize spending and identify areas where you can save.

- Automate savings: Set up automatic transfers from your checking account to your emergency fund account each month. This ensures consistent savings without conscious effort.

- Cut unnecessary expenses: Identify and eliminate non-essential expenses. This can include eating out less, reducing entertainment costs, or canceling subscriptions you no longer use.

- Increase income: Explore opportunities to earn extra income, such as taking on a part-time job, selling unused items, or freelancing.

Principles of Effective Budgeting

Effective budgeting is about understanding your financial situation, planning for the future, and consistently managing your money. A well-defined budget acts as a roadmap for your financial journey, helping you make informed decisions and stay on track toward your financial goals.

- Transparency and accountability: Be honest with yourself about your income and expenses. Regularly review your budget to ensure it aligns with your goals.

- Prioritization: Allocate your income to essential expenses and savings before allocating it to discretionary spending.

- Flexibility: Life happens; budgets should be adaptable to accommodate unexpected changes or opportunities.

- Regular review and adjustment: Review your budget periodically and make adjustments as needed. This will ensure your budget remains relevant and effective.

Creating a Budget

A budget is a structured plan for managing your income and expenses. It allows you to track your spending, identify areas for improvement, and ensure that your money is being used effectively. It’s a living document, constantly evolving with your circumstances.

| Budgeting Method | Description | Example |

|---|---|---|

| Zero-Based Budgeting | Every dollar of income is allocated to a specific category. | If your monthly income is $3,000, each category (rent, food, savings, etc.) receives a specific allocation, summing up to $3,000. |

| 50/30/20 Rule | Allocate 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. | For a $3,000 monthly income, $1,500 would be allocated to needs, $900 to wants, and $600 to savings and debt repayment. |

| Envelope System | Allocate cash to different expense categories in separate envelopes. | Allocate cash to food, entertainment, and other expenses in separate envelopes. |

A well-defined budget is a powerful tool for controlling your finances and achieving your financial goals.

Hack 2: Debt Management & Consolidation: 5 Hacks For Overcoming Financial Crisis

Debt management is crucial for navigating financial crises. Uncontrolled debt can spiral into insurmountable problems, impacting your ability to meet essential needs and potentially leading to significant financial distress. Effective debt management provides a structured approach to address outstanding debts, allowing for a more sustainable financial future.Debt management involves developing a comprehensive strategy to address various types of debts, such as credit cards, loans, and other outstanding obligations.

This involves understanding the terms of each debt, evaluating your ability to repay, and implementing a plan to minimize the impact of these debts on your overall financial well-being.

Debt Management Strategies

Debt management strategies are crucial for tackling financial burdens. They offer a roadmap to navigate debt effectively, promoting a more stable financial future. Different approaches cater to various financial situations and priorities. Choosing the most appropriate strategy depends on individual circumstances, such as income, expenses, and debt amounts.

- Debt Avalanche: This method prioritizes paying off debts with the highest interest rates first. By tackling high-interest debts aggressively, you save on accumulated interest over time, accelerating debt reduction and ultimately reducing the total cost of borrowing. This method can lead to faster debt repayment, but may not always be the most practical depending on the individual’s income and debt load.

- Debt Snowball: This method prioritizes paying off debts with the smallest balances first. This approach focuses on achieving early wins and building momentum. The psychological boost of successfully paying off smaller debts can be motivating, leading to increased confidence and continued commitment to the debt repayment plan. However, the interest rates may not be factored into the repayment strategy.

- Debt Consolidation: This strategy involves combining multiple debts into a single, lower-interest loan. This method simplifies payments and can reduce monthly interest expenses. It allows for a single monthly payment, making budgeting and tracking progress easier. However, it is crucial to carefully assess the terms of the consolidation loan to ensure it aligns with your financial goals.

Debt Consolidation Options

Debt consolidation methods offer various avenues for simplifying debt management. Each option has its own advantages and disadvantages. Carefully considering the pros and cons of each approach will allow you to make an informed decision.

- Balance Transfer Credit Card: Transferring balances from high-interest credit cards to a new credit card with a lower interest rate or a 0% introductory APR can save on interest. However, be mindful of the transfer fee and the expiration of the promotional APR.

- Personal Loan: A personal loan allows you to consolidate various debts into a single loan with a fixed interest rate. The advantage lies in potentially lower interest rates and a fixed monthly payment. However, eligibility and interest rates may vary depending on your creditworthiness.

- Debt Management Plan (DMP): A DMP involves negotiating with creditors to reduce interest rates or adjust payment terms. This method can be beneficial for individuals facing financial hardship, but may not always be achievable or effective for all types of debts.

Sample Debt Repayment Plan

A sample debt repayment plan Artikels a structured approach to debt reduction. It details the steps to follow and the potential outcomes of the plan. By meticulously tracking your progress, you can refine your approach to better align with your financial situation.

| Debt Type | Balance | Interest Rate | Monthly Payment |

|---|---|---|---|

| Credit Card 1 | $3,000 | 18% | $150 |

| Credit Card 2 | $2,000 | 20% | $100 |

| Personal Loan | $5,000 | 12% | $300 |

| Total Monthly Payment | $550 |

Example: If the repayment plan includes a $550 monthly payment, it is vital to factor in additional living expenses and potential unexpected costs to ensure financial stability.

Hack 3: Cutting Unnecessary Expenses

Financial crises often necessitate drastic measures, and one crucial step involves scrutinizing and eliminating unnecessary expenses. Identifying and eliminating these expenditures can free up significant funds, allowing for more efficient allocation towards essential needs and debt repayment. This hack emphasizes the importance of mindful spending and responsible resource management.

Identifying Unnecessary Expenses

A critical first step in cutting expenses is identifying areas where spending is excessive or unnecessary. This involves a thorough review of all financial transactions, including bills, subscriptions, and entertainment costs. Careful tracking of spending habits can highlight patterns and areas for potential savings. Consider analyzing your spending for the past few months. Review receipts, bank statements, and credit card statements to pinpoint recurring expenses that may not be essential.

Strategies for Cutting Unnecessary Expenses

Minimizing unnecessary expenses requires strategic approaches that don’t compromise essential needs. A proactive approach is key to effectively cutting costs without sacrificing vital resources.

- Review subscriptions and memberships: Assess the value received from each subscription. Cancel unused or unnecessary subscriptions, such as streaming services, gym memberships, or magazines. Evaluate the cost-benefit ratio for remaining subscriptions.

- Re-evaluate entertainment spending: Analyze your entertainment expenses. Consider alternatives like free or low-cost activities such as attending community events, going for walks in parks, or enjoying hobbies that don’t require significant financial investment.

- Reduce dining out frequency: Cooking at home more often can significantly reduce dining-out costs. Meal planning and preparation can save considerable money over time.

- Negotiate bills: Contact service providers (e.g., internet, phone, cable) to explore potential discounts or lower rates. Negotiation can lead to substantial savings.

- Shop smart: Practice mindful shopping by avoiding impulse purchases. Compare prices across different stores and use coupons or discounts to save money on groceries or other household items. Prioritize needs over wants.

Benefits of Minimizing Unnecessary Spending

Minimizing unnecessary spending offers a range of benefits, from immediate financial relief to long-term financial stability.

- Increased savings: By eliminating non-essential expenses, individuals can significantly increase their savings and create a financial cushion for unexpected events.

- Reduced debt burden: Increased savings can be directly channeled towards paying down debts, thus reducing the overall financial burden.

- Improved financial well-being: Financial stability fosters a sense of security and control, impacting mental and emotional well-being positively.

Real-Life Examples of Expense Reduction

Many individuals have successfully reduced expenses during financial crises. One example involves a young professional who reduced their dining-out frequency by 75% and started preparing meals at home, freeing up funds for debt repayment. Another case involves a family that canceled unused streaming services and entertainment subscriptions, freeing up a significant portion of their monthly budget. These examples demonstrate the effectiveness of cutting unnecessary expenses.

Ever feel stuck in a financial crisis? Five hacks can help you get unstuck, but sometimes, it’s those sneaky assumptions holding us back. For example, some people hold onto a whole host of wrong beliefs that hinder their financial well-being. Understanding these, like the 50 wrong assumptions that make you a dumbass, 50 wrong assumptions that make you a dumbass , can be the first step towards overcoming any financial challenge.

Ultimately, these five hacks can put you on the path to a brighter financial future.

Comparing Expense Reduction Techniques

| Expense Reduction Technique | Description | Potential Savings | Impact on Essential Needs |

|---|---|---|---|

| Canceling unused subscriptions | Identify and cancel unnecessary subscriptions like streaming services or magazines. | Significant, depending on the number and cost of subscriptions. | Minimal or none; focuses on discretionary spending. |

| Cooking at home more often | Reduce dining-out frequency and prepare meals at home. | Significant, especially for families. | Minimal or none; focuses on food costs. |

| Negotiating bills | Contact service providers to explore potential discounts or lower rates. | Variable; depends on the provider’s willingness to negotiate. | Minimal or none; focuses on utility costs. |

| Mindful shopping | Avoid impulse purchases and compare prices across different stores. | Variable; depends on shopping habits. | Minimal or none; focuses on discretionary spending. |

Hack 4: Increasing Income Streams

Facing a financial crisis often necessitates a shift in perspective, moving beyond existing income streams to explore additional avenues. This proactive approach can provide much-needed breathing room and a pathway to financial stability. A crucial element of overcoming a crisis is not just reducing expenses, but also increasing income.Exploring alternative income sources is not merely about supplementing existing earnings; it’s about building resilience and creating a more sustainable financial future.

This involves evaluating various options, from part-time work to selling unused assets, and carefully selecting those that align with your skills, resources, and time commitments. It’s about thinking outside the box and identifying opportunities that can contribute significantly to your overall financial well-being.

Identifying Additional Income Sources

Expanding your income streams can be achieved through a variety of methods. A crucial first step is assessing your existing skills and resources. Are you proficient in a particular area that could be monetized? Do you own items that are no longer needed but could be sold? By understanding your strengths and assets, you can identify avenues for generating extra income.

Potential Income Stream Options

- Part-time Jobs: Consider part-time jobs that align with your skills and availability. These can range from retail work to tutoring or customer service roles. A flexible schedule is key to accommodating existing commitments.

- Freelance Work: Leveraging existing skills, such as writing, graphic design, or web development, through freelance platforms can provide a consistent income stream. This allows for setting your own hours and often greater flexibility than traditional employment.

- Selling Unused Items: Decluttering your home can reveal valuable items that can be sold online or at local markets. This can include clothing, electronics, furniture, or collectibles.

- Renting Out Assets: If you own a spare room, parking space, or even a vehicle, consider renting it out. This can generate passive income with minimal effort.

- Investing in a Side Hustle: Starting a small business, such as a food truck or a craft store, can create a dedicated income stream that has the potential for long-term growth.

Evaluating and Selecting Income Streams

Carefully evaluate each potential income stream based on your resources, skills, and time constraints. Factor in the upfront costs, ongoing expenses, and potential earnings. Consider how much time you can realistically dedicate to each option and whether it aligns with your long-term goals. This careful assessment helps avoid overwhelming yourself and ensures you’re choosing sustainable options.

Real-Life Examples

During financial crises, many individuals have successfully increased their income by embracing alternative avenues. One example is a stay-at-home parent who started a freelance writing business, leveraging their existing writing skills and educational background. Another example involves someone selling unused electronics and furniture online, generating a substantial amount of additional income to cover unexpected expenses. These examples highlight the adaptability and resourcefulness required during challenging times.

Potential Income Streams and Associated Costs

| Income Stream | Potential Earnings | Associated Costs |

|---|---|---|

| Part-time Job (Retail) | $10-$20/hour | Transportation, uniform, and potential training costs |

| Freelance Writing | $20-$50/article | Software, marketing, and potential editing costs |

| Selling Used Clothes | Variable | Decluttering and listing costs |

| Renting Out a Spare Room | $500-$1500/month | Security deposit, cleaning, and utilities |

| Side Hustle (Food Truck) | High potential | Significant upfront investment, permits, and ongoing operational costs |

Hack 5: Seeking Professional Guidance

Facing a financial crisis can feel overwhelming. The sheer number of options and the potential for making mistakes can be paralyzing. Seeking professional guidance is a crucial step in navigating these challenges and developing a sustainable financial recovery plan. A qualified professional can provide personalized advice, tailored strategies, and support to help you regain control and move forward.Financial crises often stem from complex issues, requiring expertise beyond basic financial literacy.

A trained professional can identify the root causes, develop effective solutions, and monitor progress. This proactive approach can prevent further financial damage and accelerate the path to recovery.

Importance of Professional Advice

Professional guidance is essential during financial crises for several reasons. First, financial advisors, counselors, and debt relief agencies possess specialized knowledge and experience in dealing with various financial situations. They can offer insights and strategies that might not be apparent to an individual facing a crisis. Second, their objective perspective can help individuals make rational decisions without being emotionally swayed by the immediate pressures of the situation.

Third, they can act as accountability partners, motivating individuals to stick to the agreed-upon financial plan.

Types of Financial Professionals

Various professionals can assist individuals during financial crises. Financial advisors, often certified, provide comprehensive financial planning services. They can help with investment strategies, retirement planning, and estate management, alongside crisis management. Financial counselors, typically focusing on individual needs, can offer guidance on budgeting, debt management, and overall financial well-being. Debt relief agencies specialize in helping individuals resolve debt issues, offering strategies such as debt consolidation or negotiation with creditors.

Role of Professionals in Financial Crises

Financial professionals play a vital role in guiding individuals through financial crises. They help individuals assess their current financial situation, identify areas of concern, and develop tailored solutions. This includes creating budgets, negotiating with creditors, exploring debt consolidation options, and establishing realistic repayment plans. They also offer support and encouragement, motivating individuals to stay on track with their financial recovery plan.

Furthermore, they can provide education and guidance to prevent future financial difficulties.

Choosing a Reputable Financial Professional

Selecting a reputable financial professional is crucial. Begin by researching credentials and certifications. Look for advisors with relevant certifications like CFP (Certified Financial Planner), or those with proven experience in dealing with financial crises. Check their track record and testimonials. Look for transparency in their fees and services.

Schedule consultations to assess their understanding of your specific situation and their approach to problem-solving.

Comparison of Financial Advisors

| Type of Advisor | Expertise | Typical Services | Potential Fees |

|---|---|---|---|

| Certified Financial Planner (CFP) | Comprehensive financial planning, investment strategies, retirement planning | Budgeting, debt management, investment advice, estate planning | Hourly rates, percentage-based fees, or a combination |

| Debt Counselor | Debt management, negotiation with creditors | Debt consolidation, budgeting, repayment plans, credit counseling | Fees may vary, some agencies offer free or low-cost services |

| Debt Relief Agency | Debt resolution, negotiation with creditors, bankruptcy options | Debt management plans, bankruptcy assistance, credit repair | Fees vary significantly, often a percentage of debt relief or upfront costs |

Maintaining Financial Well-being After the Crisis

Navigating a financial crisis can be incredibly challenging, but emerging stronger is possible. It’s not just about recovering the lost ground; it’s about building a foundation for lasting financial health. This involves more than simply regaining lost income; it’s about adopting and reinforcing positive financial habits that prevent future crises.Sustaining financial stability after a crisis demands a proactive approach.

It requires understanding the lessons learned from the past, developing strategies to avoid repeating errors, and cultivating consistent good habits. This approach is crucial for long-term financial security.

Strategies for Long-Term Financial Stability

Post-crisis financial stability hinges on consistently applying sound financial practices. Simply returning to old habits is insufficient. Instead, a conscious effort is needed to integrate new and improved approaches into daily life. This includes creating a realistic budget, regularly reviewing spending, and prioritizing savings.

- Budgeting and Tracking: Maintaining a budget is not just a tool for surviving a crisis; it’s a foundation for sustained well-being. It’s important to understand where your money goes. Track spending diligently to identify areas for improvement and ensure your expenses align with your income. Use budgeting apps, spreadsheets, or even a simple notebook to keep tabs on your inflows and outflows.

- Regular Savings and Investments: A dedicated savings account is crucial for unexpected expenses, while investments can help build wealth over time. Set aside a portion of your income for savings, even if it’s a small amount. Explore different investment options like stocks, bonds, or mutual funds to build long-term financial security. Consider consulting a financial advisor for personalized guidance on investment strategies.

- Debt Management and Avoidance: Effective debt management is essential. Paying off high-interest debts promptly and avoiding unnecessary borrowing is critical. If you have outstanding debt, create a plan to repay it systematically. Be cautious about taking on new debt unless it’s for a worthwhile investment or essential need.

Reinforcing Positive Financial Habits

Cultivating and maintaining positive financial habits is paramount to long-term stability. The goal is not just to avoid future crises but to proactively build wealth and financial freedom.

- Review and Adjust: Regularly review your financial situation. This could be monthly, quarterly, or annually, depending on your needs. Evaluate your budget, spending patterns, and savings goals. Adjust your approach as needed to ensure your financial plan remains aligned with your current circumstances.

- Seek Professional Guidance: Consider seeking guidance from a financial advisor. A professional can provide personalized advice and help you develop a comprehensive financial plan tailored to your specific needs and goals. They can offer insights into investment strategies, debt management, and long-term financial planning.

- Continuous Learning: Financial literacy is a continuous process. Stay informed about personal finance through books, articles, workshops, or online courses. Keep learning about new strategies, market trends, and opportunities for growth. Regularly update your knowledge base to stay ahead of the curve.

Resources for Continuing Financial Education

Staying informed is crucial for long-term financial well-being. A wealth of resources are available to help you continue your financial education.

- Online Courses: Numerous online platforms offer courses on personal finance, investing, and budgeting. Explore reputable platforms for credible and relevant information. Look for courses that offer certifications or practical applications.

- Financial Advisors: Financial advisors can provide personalized guidance and support. They can help you create a comprehensive financial plan, offer insights into market trends, and answer your specific questions.

- Books and Articles: Numerous books and articles offer valuable insights into personal finance and investing. Look for reputable authors and publications for credible information.

Epilogue

In conclusion, overcoming a financial crisis isn’t a sprint; it’s a marathon. By implementing these five hacks—building an emergency fund, managing debt, cutting unnecessary expenses, exploring additional income streams, and seeking professional guidance—you’ll be well-equipped to not only recover but also build a stronger financial future. Remember, financial wellness is a journey, not a destination. Continuously refining your habits and seeking advice will be key to long-term success.