This how millennial can buy home before their 30s is achievable! This guide dives deep into the strategies, processes, and challenges millennials face when navigating the home-buying market. From crafting effective financial plans to understanding the home-buying process, we’ll equip you with the knowledge and tools to potentially own a home before turning 30.

This comprehensive resource covers financial strategies, the home-buying process, millennial-specific challenges and opportunities, insights into the housing market, and practical tips for success. We’ll explore various approaches to saving and investing, different loan options, and how to navigate potential hurdles like student loan debt and rising interest rates. Ready to unlock your homeownership dreams?

Financial Strategies for Homeownership Before 30

Homeownership is a significant milestone, often a dream for many millennials. Achieving this goal before the age of 30 requires careful planning and execution of financial strategies, especially considering the rising cost of housing and the potentially longer time horizons to accumulate a down payment. This exploration delves into the financial strategies essential for millennials aiming to purchase a home earlier in their careers.

Saving and Investing for a Down Payment

Accumulating a substantial down payment is crucial for homeownership. Strategies for saving and investing need to be tailored to individual income levels and expenses. A combination of disciplined saving, smart investing, and potentially exploring various financial assistance options are essential.

Strategies for different income levels:

- Lower-income millennials: Prioritize maximizing savings through budgeting, cutting unnecessary expenses, and exploring side hustles. Utilizing high-yield savings accounts and potentially government-backed programs can significantly bolster savings. Look for options with minimal fees and competitive interest rates.

- Middle-income millennials: Consider a diversified approach to savings, including a combination of high-yield savings accounts, certificates of deposit (CDs), and potentially low-cost index funds. Explore opportunities to increase income streams like part-time jobs or freelance work to accelerate the saving process.

- Higher-income millennials: Diversify investment options to maximize returns, considering index funds, mutual funds, or even real estate investment trusts (REITs) while carefully managing risk. Utilize tax-advantaged accounts like 401(k)s or IRAs to reduce the tax burden on investments.

Types of Savings Accounts and Investment Vehicles

Choosing the right financial tools is crucial for effective savings. Different accounts cater to different needs and risk tolerances.

- High-yield savings accounts: Offer competitive interest rates compared to traditional savings accounts. These accounts are excellent for accumulating a down payment quickly.

- Certificates of Deposit (CDs): Provide fixed interest rates for a specified term. CDs are suitable for short-term goals like a down payment, but consider the penalty for early withdrawal.

- Index funds: Track a market index (e.g., S&P 500) and provide diversification. These funds are excellent for long-term growth and wealth building.

Importance of Budgeting and Tracking Expenses

Effective budgeting and expense tracking are fundamental to achieving financial goals. This involves identifying spending patterns, setting realistic savings goals, and consistently monitoring progress.

| Category | Example Expenses |

|---|---|

| Housing | Rent, mortgage payments, property taxes |

| Food | Groceries, dining out |

| Transportation | Gas, public transport, car payments |

| Utilities | Electricity, water, internet |

| Entertainment | Movies, concerts, hobbies |

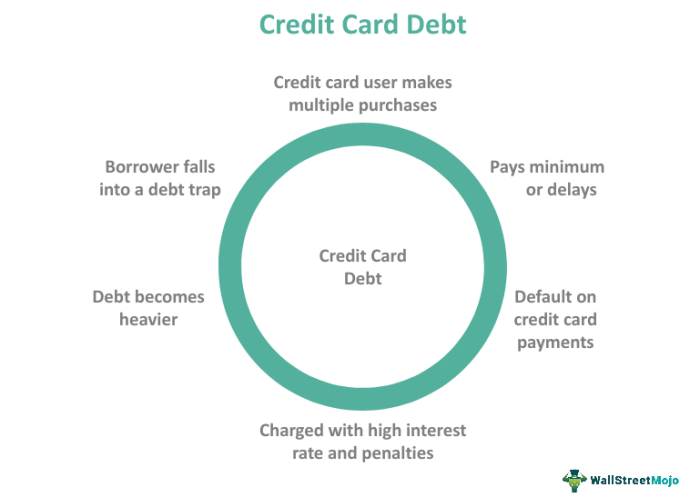

| Debt Repayment | Credit card payments, student loans |

Sample Budget Template for Millennials

This budget template is a sample and should be adjusted based on individual circumstances.

(Sample Budget Template Table)

Note: Allocate a portion of income specifically for savings and investments towards homeownership. Track expenses meticulously to identify areas for potential savings.

Loan Options for First-Time Homebuyers

Understanding different loan options is crucial for selecting the most suitable financing for a down payment. Low-down payment options are available, including FHA loans, VA loans, and USDA loans.

Government Programs and Incentives

Numerous government programs can aid millennials in their homeownership journey.

- FHA loans: Allow for lower down payments compared to conventional loans.

- VA loans: Available to qualified veterans and service members, offering favorable terms and potentially no down payment.

- USDA loans: Designed for rural areas, providing assistance to homebuyers in qualifying regions.

Resources for Financial Literacy and Homeownership Education

Various resources can assist millennials in building financial literacy and understanding the complexities of homeownership.

- Financial advisors: Provide personalized guidance on financial planning and investment strategies.

- Online resources: Offer comprehensive information on budgeting, investing, and homeownership.

- Local government agencies: Provide information on available homebuyer assistance programs.

Home Buying Process Simplified

Navigating the home-buying process can feel overwhelming, especially for first-time buyers. Understanding the steps, roles of key players, and potential pitfalls can significantly reduce stress and increase your chances of a smooth and successful transaction. This guide simplifies the journey, from initial property search to final closing, equipping you with the knowledge to confidently pursue homeownership.

Searching for Properties

The initial phase involves careful consideration of your needs and preferences. This includes determining your ideal location, desired property type (e.g., single-family home, condo, townhouse), and budget. Using online real estate portals, working with a real estate agent, and attending open houses are crucial steps in identifying potential properties that align with your criteria.

The Role of Real Estate Agents

Real estate agents act as your guides throughout the process. They possess expertise in market trends, property valuations, and negotiation strategies. They can provide valuable insights into the local market, showcase suitable properties, and represent your interests in negotiations. Finding a reputable and trustworthy agent is vital for a positive experience.

The Role of Mortgage Brokers

Mortgage brokers connect you with various lenders, streamlining the loan application process. They assess your financial situation, explore different loan options (e.g., fixed-rate, adjustable-rate), and help you secure the best possible mortgage terms. They also assist in understanding the complexities of the mortgage application process.

Pre-Approval for a Mortgage

Obtaining pre-approval for a mortgage is a critical step. It establishes your borrowing capacity and demonstrates to sellers that you’re a serious buyer. Pre-approval provides a clear understanding of your budget, allowing you to focus on properties within your price range and avoid being outbid by other buyers. It also gives you confidence in your financial ability to purchase a home.

So, how can millennials snag a home before 30? It’s all about smart strategies, and mastering communication is key. Learning to craft compelling emails, like in 9 tips writing effective emails get what you want , can help you negotiate better deals and secure the best mortgage options. Ultimately, meticulous planning and effective communication are crucial for millennials looking to buy a home before their 30s.

Home Buying Process Timeline

| Milestone | Estimated Timeframe |

|---|---|

| Pre-Approval | 2-4 weeks |

| Property Search & Selection | 1-3 months |

| Offer & Acceptance | 1-2 weeks |

| Home Inspection | 1-2 weeks |

| Appraisal | 1-2 weeks |

| Mortgage Closing | 4-6 weeks |

Note: Timeframes can vary based on individual circumstances and market conditions.

Common Pitfalls and Avoidance Strategies

- Failing to conduct thorough research on the property and neighborhood. This includes checking for any potential property issues, zoning restrictions, or community characteristics.

- Overlooking home inspections. Hiring a qualified inspector to evaluate the property for potential issues and defects is crucial.

- Neglecting to carefully review the mortgage documents. Understanding the terms, conditions, and implications of the loan is essential.

- Rushing the process. Taking your time to make informed decisions and avoiding pressure to act quickly is important.

Thorough Research and Due Diligence

Thorough research into a property’s history, neighborhood characteristics, and potential issues is vital. This includes reviewing property records, neighborhood crime statistics, school districts, and proximity to essential services. Careful consideration of these factors contributes to a more informed decision.

Essential Documents

- Proof of income (pay stubs, tax returns)

- Bank statements

- Credit report

- Identification documents (driver’s license, passport)

- Pre-approval letter

These documents are crucial for mortgage applications and property transactions.

Snagging a home before 30 as a millennial isn’t just about saving aggressively; strong communication is key. Understanding the 5 types of communication that shape your relationships, from assertive to passive-aggressive, is crucial. 5 types communication that determine your relationships can significantly impact your financial decisions and collaborations with partners or roommates, which are essential in achieving that homeownership goal.

Solid communication fosters better financial planning and joint efforts, ultimately paving the way for a millennial’s homeownership dream.

Millennial-Specific Challenges and Opportunities

Millennials, born roughly between the early 1980s and the mid-2000s, face a unique set of circumstances when navigating the homeownership journey. Their financial landscape, shaped by factors like student loan debt and a challenging economic climate, presents both hurdles and hidden advantages. This section delves into the specific challenges and opportunities millennials encounter, comparing their situation to previous generations and highlighting strategies for success.The housing market has evolved significantly over the past few decades, with millennials experiencing different trends and pressures than their predecessors.

Understanding these nuances is crucial for effective homeownership strategies. Factors like economic downturns, changing interest rate environments, and the increasing importance of technology all play a part in the millennial homebuying experience.

Financial Challenges

Millennials often face significant financial headwinds in their pursuit of homeownership. Student loan debt, a legacy of higher education costs, frequently acts as a substantial barrier. Low savings rates, exacerbated by factors like stagnant wages and increasing living expenses, further complicate the process. These financial constraints necessitate innovative strategies for saving and acquiring a home.

Unique Advantages

Despite the challenges, millennials possess unique advantages in the homebuying market. Their digital savviness provides access to a wealth of information, tools, and resources for researching properties, comparing financing options, and streamlining the entire process. Strong social networks, often cultivated through online communities and shared experiences, can provide invaluable support during the homebuying journey. This collective knowledge and access to information often give millennials a leg up on other generations.

Comparative Housing Market Trends

The housing market trends experienced by millennials differ from those of previous generations. Rising interest rates, inflation, and the increased demand for affordable housing have created a complex landscape. Understanding these market dynamics is crucial for navigating the current environment and making informed decisions. For example, the prevalence of subprime mortgages and the housing bubble of the early 2000s created a different landscape for previous generations.

So, how can millennials snag a house before 30? It’s not just about saving aggressively; it’s about developing strong work habits. Think about the 7 traits rock star employees 7 traits rock star employees – discipline, proactive problem-solving, and a growth mindset are crucial for career success. These traits, in turn, boost earning potential, which is a major factor in being able to afford a home sooner rather than later.

Millennials must approach homeownership with a cautious yet proactive mindset.

Successful Millennial Homebuyers and Strategies

Numerous millennials have successfully purchased homes despite the challenges. Examples include those who leveraged down payment assistance programs, used creative financing strategies, or prioritized renting in a specific area to save for a down payment. A common thread among these successful buyers is a proactive approach, involving budgeting, saving, and seeking expert advice.

Impact of Rising Interest Rates

Rising interest rates directly impact the affordability of mortgages. Higher interest rates translate to higher monthly payments, potentially making homeownership less accessible. Millennials need to carefully assess the potential impact of rising rates on their budget and explore various financing options. For example, a 1% increase in interest rates can drastically increase the total cost of a mortgage over the life of the loan.

Technology’s Role in Streamlining the Process

Technology has revolutionized the homebuying process, providing millennials with unprecedented access to information and tools. Online property portals, mortgage calculators, and virtual tours significantly simplify the search and decision-making processes. The integration of technology has made the process more efficient and transparent.

Millennial Demographics and Homeownership

| Demographic | Homeownership Challenges | Homeownership Opportunities |

|---|---|---|

| First-time homebuyers with student loan debt | High debt-to-income ratio, limited savings | Down payment assistance programs, flexible financing options, leveraging digital tools for research |

| Millennials in high-cost areas | Limited affordability, high property values | Shared housing options, investment in property management, leveraging their digital savviness for rentals |

| Millennials with strong social networks | Collective knowledge and support | Collaboration in finding properties, support in the mortgage process |

| Millennials in diverse industries | Varied income levels and employment situations | Financial planning tailored to individual career paths, negotiating mortgage terms, exploring alternative financing options |

Housing Market Insights for Millennials

Navigating the current housing market can feel like a minefield for millennials, especially when aiming to buy a home before turning 30. Affordability is often a major hurdle, but understanding the market trends and factors affecting it can empower you to make informed decisions. This section dives into the key elements influencing home prices and provides actionable insights for millennials seeking to enter the housing market.The housing market is a complex interplay of economic forces, location-specific trends, and individual preferences.

Millennials need to be aware of these factors to strategically approach homeownership. This analysis explores the current climate, highlighting potential opportunities and challenges.

Current Housing Market Trends

The current housing market presents a mix of challenges and opportunities for millennials. Interest rates, inflation, and overall economic conditions play a significant role in determining affordability. Some regions are experiencing increased demand, leading to higher prices, while others offer more affordable options. Understanding these regional differences is crucial for finding a home that fits your budget and lifestyle.

Factors Influencing Housing Affordability

Several factors contribute to the fluctuating affordability of housing. Location is a primary consideration. Properties in desirable areas, near amenities and employment centers, often command higher prices. The type of property also impacts affordability. Single-family homes typically come with a higher price tag compared to condos or townhouses.

Furthermore, market conditions, such as supply and demand, heavily influence affordability. A shortage of available homes can drive prices up, while an oversupply might lead to price drops.

Impact of Economic Factors

Economic conditions exert a powerful influence on the housing market. Inflation, for example, can increase the cost of materials and labor, thus affecting construction costs and ultimately home prices. Interest rate fluctuations also play a significant role. Higher interest rates increase mortgage payments, making homes less affordable. Millennials need to stay informed about economic forecasts and their potential impact on housing costs.

Affordable Housing Options

Finding affordable housing options requires strategic research and a willingness to explore alternative solutions. Areas with lower housing costs, like certain cities in the Midwest or the South, often present more affordable options for millennials. Considering less-traditional housing options, such as co-housing communities or shared ownership programs, can also make homeownership more accessible.

Importance of Location

Location is arguably the most critical factor in homeownership. Choosing a location that aligns with your lifestyle, career goals, and family plans is paramount. Proximity to work, schools, and entertainment can significantly impact your quality of life. Researching neighborhoods and their amenities before making a decision is crucial.

Average Home Prices in Different Regions

| Region | Average Home Price (USD) |

|---|---|

| Northeast | $500,000 |

| Midwest | $350,000 |

| South | $300,000 |

| West | $600,000 |

Note

* These are approximate averages and can vary significantly depending on the specific city or town within each region. Local market conditions should be thoroughly investigated.

Affordable Housing Options for Millennials

Exploring alternative housing models can make homeownership more attainable. Co-housing communities offer a unique blend of shared living and individual space, often with shared amenities. Shared ownership programs allow individuals to pool resources and acquire a property they might not be able to afford on their own. These models can provide a more affordable entry point into homeownership.

Practical Tips and Advice for Millennials

Buying a home before 30 is achievable for millennials with the right strategies and mindset. This isn’t about chasing a dream; it’s about making informed financial choices that align with your goals. This section dives into actionable steps to navigate the complexities of homeownership, from saving for a down payment to managing potential risks.

Saving for a Down Payment

A significant hurdle for many millennials is accumulating enough savings for a down payment. Creating a dedicated savings account and automating regular contributions is crucial. Track your expenses diligently to identify areas where you can cut back without sacrificing essential needs. Consider exploring high-yield savings accounts or certificates of deposit (CDs) to maximize your returns. Small, consistent contributions add up over time.

For example, saving $500 a month for five years can build a substantial down payment. Don’t be discouraged by the initial amount; focus on consistent, disciplined saving.

Navigating the Home Buying Process

The home buying process can feel overwhelming. A crucial aspect is finding a reliable real estate agent who understands your needs and can guide you through the process. Don’t be afraid to interview several agents to find a good fit. Negotiating effectively with sellers is an essential skill. Thorough research into comparable home sales in the area can empower you to make a well-informed offer.

Understanding the market conditions allows you to propose a realistic offer that you can defend.

Managing Potential Risks

Homeownership comes with responsibilities beyond the initial purchase. Property taxes and maintenance costs are recurring expenses that must be factored into your budget. Creating a detailed budget that incorporates these expenses will provide a realistic financial picture. Be proactive in addressing potential maintenance needs, as deferred maintenance can lead to significant expenses. Having an emergency fund to cover unexpected repairs can significantly alleviate financial strain.

For instance, setting aside 10% of your monthly income for home maintenance is a prudent strategy.

Important Tasks Checklist

Careful planning and organization are key to a smooth home buying experience. Here’s a checklist to help you stay on track:

- Financial Assessment: Review your credit report and score to identify areas for improvement. Address any outstanding debts or credit issues.

- Budgeting: Create a detailed budget that incorporates potential homeownership expenses, including mortgage payments, property taxes, insurance, and maintenance.

- Researching Home Loans: Explore various mortgage options and compare interest rates and terms. Understanding different loan types will allow you to choose the best fit for your financial situation.

- Finding a Real Estate Agent: Interview several agents and select one who understands your needs and preferences.

- Home Inspection: Schedule a thorough home inspection to identify any potential issues.

- Closing Costs: Factor in closing costs, which can include appraisal fees, title insurance, and other expenses.

Leveraging Technology for Home Searches

Technology has revolutionized the way we search for homes. Utilize online real estate portals and mobile apps to browse listings, view virtual tours, and narrow down your search. These tools can help you locate homes that meet your criteria and preferences efficiently. Consider using real estate filtering tools to refine your search based on specific criteria, such as location, size, and budget.

Choosing the Right Home Loan

Selecting the appropriate home loan is critical to your financial well-being. Compare different mortgage types, including fixed-rate and adjustable-rate mortgages. Understand the terms and conditions of each loan to make an informed decision. Consider factors like interest rates, loan terms, and fees. Shop around for the best possible rates and terms.

Millennial Success Stories, This how millennial can buy home before their 30s

Many millennials have successfully purchased homes before 30. These stories demonstrate the feasibility of achieving this goal with diligent planning and financial discipline. These stories showcase the potential and determination of a generation committed to homeownership. They serve as inspiration for those pursuing the same goal.

Closure: This How Millennial Can Buy Home Before Their 30s

Ultimately, buying a home before 30 is a journey, not a sprint. This guide provides a roadmap to navigate the financial and practical aspects of homeownership, empowering millennials to make informed decisions and achieve their housing goals. By understanding the strategies, challenges, and opportunities, millennials can increase their chances of homeownership and financial security. We encourage you to apply the knowledge and tips shared here to your own unique circumstances and situations.