6 money management tips aid your startup success infographic provides a roadmap for navigating the financial complexities of launching and growing a business. From budgeting and forecasting to cash flow management and investment strategies, this infographic covers crucial aspects of financial health for new ventures. Understanding these principles is paramount to success, as poor money management can significantly hinder a startup’s potential.

This guide is designed for entrepreneurs, investors, and anyone seeking to build a strong financial foundation for their business.

This infographic will walk you through crucial steps to ensure your startup stays on track financially. We’ll explore the essentials of effective budgeting, crucial funding strategies, and the importance of meticulous expense tracking. Mastering these techniques will empower you to not only survive but thrive in the competitive landscape.

Introduction to Money Management for Startups

Effective money management is the bedrock of a successful startup. It’s not just about having a healthy bank balance; it’s about strategically allocating resources to fuel growth, navigate challenges, and ultimately, achieve profitability. This crucial skill empowers entrepreneurs to make informed decisions, prioritize investments, and build a resilient financial foundation for long-term sustainability. Ignoring sound financial practices can lead to significant setbacks, hindering progress and potentially jeopardizing the entire venture.

This infographic, designed for entrepreneurs and investors alike, highlights six key money management strategies that can propel your startup to success.

The Importance of Effective Money Management for Startups

Robust financial management isn’t a luxury, it’s a necessity for any startup. A well-defined financial strategy allows startups to track expenses, anticipate cash flow needs, and make informed decisions about investments and operational costs. Without proper control over finances, startups risk running out of capital, failing to meet payroll, and ultimately, succumbing to unforeseen challenges. Effective money management provides a critical framework for scaling operations, attracting investors, and ensuring long-term viability.

Potential Consequences of Poor Money Management for Startups

Poor money management can lead to a cascade of negative consequences for startups. Uncontrolled spending can quickly deplete capital reserves, making it challenging to cover essential operational costs. Delayed payments, inadequate budgeting, and a lack of financial planning can strain relationships with suppliers and vendors. These issues can escalate into larger problems, jeopardizing the company’s reputation and potentially leading to insolvency.

In the worst-case scenario, poor financial management can cause the startup to fail entirely.

Target Audience Overview

This infographic is specifically tailored to entrepreneurs, founders, and investors involved in the startup ecosystem. It provides actionable insights into fundamental money management principles, equipping entrepreneurs with practical tools and strategies to navigate the financial complexities of launching and scaling a business. Investors will also find valuable information about evaluating financial health and identifying promising ventures with sound financial foundations.

Opening Statement

A robust financial strategy is the cornerstone of any successful new venture. Sound money management techniques are essential to securing funding, controlling expenses, and ensuring long-term sustainability in the dynamic landscape of the startup world.

Budgeting and Financial Forecasting

A startup’s success hinges significantly on its ability to manage finances effectively. This crucial aspect involves not just tracking income and expenses, but also proactively planning for future needs. Proper budgeting and financial forecasting are indispensable tools for navigating the often-uncertain waters of entrepreneurship. They provide a roadmap for sustainable growth and profitability, enabling startups to make informed decisions and avoid potential pitfalls.

The Crucial Role of Budgeting

A well-defined budget serves as a financial blueprint for a startup. It Artikels projected income and expenses over a specific period, typically a month, quarter, or year. This detailed plan allows entrepreneurs to understand their financial standing, identify potential issues, and allocate resources strategically. A solid budget ensures that resources are used efficiently and that the startup stays within its means.

It’s a crucial management tool for steering the business toward its goals.

Methods for Creating a Realistic Startup Budget

Creating a realistic startup budget requires careful consideration of various factors. This includes a thorough understanding of all anticipated expenses, ranging from operational costs to marketing campaigns. Gathering data on past spending habits and researching industry benchmarks can provide valuable insights. It’s essential to distinguish between fixed expenses (rent, salaries) and variable expenses (marketing, supplies), as this distinction impacts budgeting strategies.

Startups should also be realistic about projected income, factoring in potential market fluctuations and sales cycles.

- Detailed Expense Tracking: Meticulously track all expenses for the previous period(s) to understand spending patterns and identify areas for potential cost savings. This data informs realistic projections for future budgets.

- Market Research and Industry Benchmarks: Research industry standards and benchmarks for similar startups to gain insight into typical costs and revenue expectations. This comparative analysis helps in creating a more accurate budget.

- Realistic Revenue Projections: Base revenue projections on realistic sales forecasts, considering market conditions, competition, and the startup’s unique selling proposition. Avoid overly optimistic estimates.

The Importance of Financial Forecasting

Financial forecasting extends budgeting by looking further into the future. It involves projecting financial performance over a longer period, typically one to five years, to anticipate potential challenges and opportunities. This forward-looking approach allows startups to prepare for growth, expansion, or even unexpected market shifts. By understanding potential financial scenarios, startups can adapt their strategies and ensure their long-term financial health.

Incorporating Variable Expenses

Variable expenses, unlike fixed costs, fluctuate depending on activity levels. These expenses need careful monitoring and inclusion in the budget. Accurate forecasting requires understanding how these expenses relate to sales volume, market demand, or other factors. For example, marketing expenses may vary depending on campaign performance, and raw materials may fluctuate based on supply chain factors. The budget should account for these potential variations to maintain flexibility and adapt to changing circumstances.

Examples of Different Budgeting Models

Several budgeting models can be tailored to specific startup needs. Zero-based budgeting, for example, starts from zero every period, justifying each expense. Incremental budgeting builds on the previous period’s budget, adding adjustments. Other options include activity-based budgeting, which links costs to specific activities. The best model depends on the startup’s specific situation, organizational structure, and operational complexity.

Budgeting Methods Comparison

| Budgeting Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Zero-Based Budgeting | Each expense must be justified from scratch in each budget period. | Forces thorough analysis of each expense, promoting efficiency. | Can be time-consuming and complex for large organizations. |

| Incremental Budgeting | Builds on the previous budget, adding adjustments for anticipated changes. | Relatively simple to implement. | May not reflect evolving circumstances and may not encourage cost-cutting. |

| Activity-Based Budgeting | Links costs to specific activities, providing a clearer understanding of cost drivers. | Improved cost control and accountability. | Requires detailed activity analysis and potentially complex implementation. |

Funding Strategies for Startups

Securing adequate funding is crucial for a startup’s survival and growth. The right funding strategy can propel a company forward, while an ill-advised approach can lead to failure. This section delves into the diverse funding options available, highlighting the strengths and weaknesses of each. Understanding these nuances is vital for entrepreneurs to make informed decisions about their financial future.Funding options for startups range from self-financing to seeking external capital.

The optimal approach depends on factors like the startup’s stage of development, its projected growth trajectory, and the entrepreneur’s risk tolerance. Careful consideration of each funding source is essential for maximizing success.

Various Funding Options

Different funding sources cater to various needs and situations. Startups can explore a spectrum of options, from bootstrapping to venture capital. Choosing the right fit is paramount for long-term success.

- Bootstrapping: This approach involves funding the startup primarily using personal savings, revenue generated from initial sales, and/or loans from friends or family. It’s a common strategy for entrepreneurs seeking to maintain control and avoid outside influence.

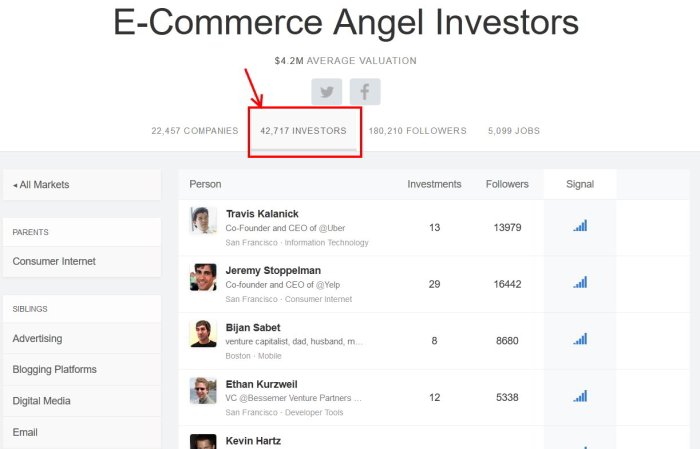

- Venture Capital (VC): Venture capital firms invest in high-growth startups in exchange for equity. VC funding typically comes with guidance and mentorship, but it also involves relinquishing a portion of ownership. The returns can be substantial for successful ventures.

- Angel Investors: Individual investors who provide capital to startups, often in exchange for equity. They frequently have experience in business and industry, providing valuable guidance and networks alongside the investment.

- Crowdfunding: This method leverages a large number of small investments from the public. It can be an effective way to raise capital, but it often comes with limitations in terms of control and investor influence.

- Debt Financing: This includes loans from banks or other financial institutions. It doesn’t require relinquishing equity, but interest payments and loan repayment schedules need careful consideration.

Comparison of Funding Methods

A comparison of funding approaches reveals significant differences in terms of control, investment terms, and risk tolerance.

| Funding Source | Control Retained | Investment Terms | Risk Tolerance | Examples |

|---|---|---|---|---|

| Bootstrapping | High | Minimal | Low | Many successful tech companies started with little external capital. |

| Venture Capital | Low | Complex | High | Companies like Airbnb and Uber secured VC funding to fuel rapid growth. |

| Angel Investors | Moderate | Flexible | Moderate | Numerous startups have benefited from guidance and capital from angel investors. |

| Crowdfunding | Low to Moderate | Typically Simple | Moderate | Many successful Kickstarter campaigns have provided initial capital. |

| Debt Financing | High | Structured | Moderate | Small businesses often leverage loans to cover operating expenses. |

Importance of Adequate Funding

Adequate funding is essential for sustaining growth. It enables startups to invest in critical areas like product development, marketing, and hiring. Insufficient funding can lead to missed opportunities and ultimately, failure.

“A well-funded startup has the resources to innovate and adapt to market changes, giving it a significant competitive advantage.”

Successful Funding Strategies

Many successful startups have utilized various funding strategies effectively. The approach should align with the specific goals and circumstances of each venture.

- Phased approach: Startups often adopt a phased approach, starting with bootstrapping or angel investors and progressing to venture capital as the company grows and demonstrates traction.

- Strategic partnerships: Partnerships with complementary businesses can provide access to resources, customers, and funding opportunities. This strategy is particularly valuable in specific industries.

Expense Tracking and Control

Staying on top of your startup’s finances is crucial for its survival and growth. Thorough expense tracking isn’t just about accounting; it’s about understanding where your money is going, identifying potential problems, and making informed decisions to optimize your resources. This meticulous process empowers you to allocate funds effectively, ensuring that your startup’s budget aligns with its goals.Effective expense tracking allows startups to gain a clear understanding of their financial health.

By meticulously recording every expenditure, entrepreneurs can identify patterns, pinpoint areas where costs are disproportionately high, and strategize ways to control and minimize these expenses. This data-driven approach fosters transparency and accountability, crucial for building trust with investors and stakeholders.

Importance of Meticulous Expense Tracking

Detailed expense tracking is vital for startups to monitor cash flow, spot potential financial issues, and make informed decisions. It provides an accurate picture of operational costs, enabling better budgeting and forecasting. By identifying recurring expenses, startups can look for cost-saving measures and optimize resource allocation. This transparency fosters a stronger financial foundation for the business.

I’ve been diving deep into the 6 money management tips aid your startup success infographic lately, and it’s been seriously insightful. While I’m on the topic of boosting productivity, did you know that goji berry is the best fruit for people who work in front of the computer all day? goji berry is the best fruit for people who work in front of the computer all day It’s amazing how a healthy snack can make a difference, right?

Back to the money management tips, though. These tips are proving to be incredibly helpful in planning for my startup’s future.

Methods for Effectively Tracking Expenses

Implementing a robust expense tracking system is essential. Manual spreadsheets, while simple, can become unwieldy for complex operations. Consider utilizing a dedicated software solution tailored to business needs, providing automated categorization, reporting, and analysis capabilities. The key is to find a system that fits your company’s scale and complexity, ensuring ease of use and accuracy.

Essential Tools and Software for Expense Tracking

Numerous tools cater to various startup needs, ranging from simple expense trackers to sophisticated accounting software. Selecting the right tool depends on factors like the size of your business, the number of employees, and the desired level of automation. Choose software that integrates seamlessly with other business tools and provides comprehensive reporting capabilities.

- Spreadsheet software (e.g., Google Sheets, Microsoft Excel): Simple, readily available, and often sufficient for smaller businesses. Data entry can be streamlined through templates and formulas. However, they lack advanced features like automated categorization and reporting.

- Dedicated expense tracking apps (e.g., Expensify, Zoho Expense): Designed specifically for expense management, these apps simplify the process by allowing for automated receipts scanning, expense categorization, and reporting. These apps are excellent for businesses of all sizes.

- Accounting software (e.g., QuickBooks, Xero): Comprehensive accounting software systems often incorporate expense tracking as a key feature. They offer advanced functionalities for budgeting, forecasting, and financial reporting. These are best suited for established businesses requiring a full suite of accounting tools.

Strategies for Controlling and Minimizing Unnecessary Expenses

A crucial aspect of expense control is proactive identification and elimination of unnecessary costs. Start by analyzing past spending data to pinpoint areas where expenses can be reduced. Negotiating better deals with vendors, exploring alternative suppliers, and streamlining operational processes can lead to significant cost savings. Regular reviews and adjustments to spending habits are critical for long-term financial health.

Importance of Regular Financial Reviews

Regular financial reviews are vital for monitoring the startup’s financial performance. These reviews provide insights into cost efficiency, revenue generation, and profitability. By examining financial statements regularly, startups can adapt their strategies, identify areas for improvement, and maintain a sustainable financial position. Consistent reviews enable proactive adjustments to budgets and expenses.

Expense Tracking Software Options

| Software | Features | Pros | Cons |

|---|---|---|---|

| Expensify | Receipt scanning, automated categorization, expense reports | Easy to use, mobile-friendly | Limited advanced accounting features |

| Zoho Expense | Automated expense reports, vendor management | Comprehensive expense management | Steeper learning curve |

| QuickBooks | Full accounting solution, invoicing, expense tracking | Robust financial management tools | More complex setup |

| Xero | Cloud-based accounting, expense tracking, invoicing | Excellent for online businesses | Might not suit all industry needs |

Cash Flow Management: 6 Money Management Tips Aid Your Startup Success Infographic

Starting a business is exhilarating, but it’s also a rollercoaster of finances. Cash flow management is the crucial bridge connecting your income and expenses, ensuring your startup stays afloat. Understanding how cash moves through your business is paramount to survival and growth. Ignoring cash flow is like ignoring the engine of your car – it might look great on the outside, but it won’t go anywhere.Cash flow isn’t just about having enough money; it’s about managing the timing and flow of money coming in and going out.

A strong cash flow management strategy allows you to meet short-term obligations, invest in growth, and ultimately, achieve long-term success. It’s the heartbeat of your startup.

Understanding Cash Flow Patterns

Cash flow patterns vary significantly depending on the nature of the business. Some startups experience a steady stream of revenue, while others face periods of high activity followed by lulls. Recognizing these patterns is essential to anticipating future needs and proactively managing resources. Knowing when your peak revenue times are and when expenses might spike helps you prepare.

Predicting these patterns can be achieved by analyzing historical data and market trends.

Strategies for Improving Cash Flow Management

Effective cash flow management requires a multi-pronged approach. Strategies include:

- Efficient Invoice Processing: Prompt invoicing and follow-up on outstanding payments are crucial. Clear terms and conditions, and robust invoicing systems, are key to ensuring you get paid on time.

- Negotiating Payment Terms: If possible, negotiating favorable payment terms with suppliers can significantly improve your cash flow. This can involve offering early payment discounts or extending payment deadlines for certain supplies.

- Optimizing Inventory Management: Excess inventory ties up capital. Optimizing your inventory levels through accurate forecasting and efficient storage can free up funds for other needs.

- Utilizing Short-Term Financing: Short-term loans or lines of credit can provide a safety net when cash flow is temporarily constrained. These options can be helpful for covering immediate needs, but should be used cautiously to avoid debt burdens.

- Building Strong Relationships with Suppliers: Positive relationships with suppliers can sometimes lead to better payment terms and potentially more flexibility in payment schedules, which can be a significant advantage.

Examples of Poor Cash Flow Management

Poor cash flow management can lead to a cascade of problems, potentially causing a startup’s failure.

- Delayed Payments: Suppliers might stop providing goods or services, which can halt production and potentially lead to loss of customers.

- Inability to Meet Obligations: Missed payments on rent, salaries, or utilities can quickly escalate into severe financial problems and potentially lead to legal action.

- Reduced Investment Opportunities: A lack of readily available funds can limit the startup’s ability to invest in growth opportunities like marketing campaigns or new equipment, potentially slowing down the growth trajectory.

- Damaged Reputation: Consistent late payments damage your credibility with suppliers and potentially affect future business opportunities.

Projecting and Forecasting Cash Flow

Accurate cash flow projections are essential for making informed business decisions. These projections enable you to anticipate potential shortfalls and plan accordingly. Methods include:

- Creating a Cash Flow Statement: A detailed statement of expected income and expenses over a specific period (e.g., monthly, quarterly) is crucial. This should include all expected revenues and expenses.

- Analyzing Historical Data: Studying past cash flow patterns provides valuable insights into typical cash flow cycles and potential fluctuations.

- Scenario Planning: Developing different scenarios for potential revenue and expense fluctuations allows for better preparedness for various market conditions.

- Using Financial Software: Specialized software can help automate cash flow projections and provide insights into potential financial challenges.

Potential Cash Flow Scenarios

| Scenario | Revenue | Expenses | Net Cash Flow |

|---|---|---|---|

| Optimistic | $10,000 | $8,000 | $2,000 |

| Moderate | $8,000 | $7,000 | $1,000 |

| Pessimistic | $6,000 | $9,000 | -$3,000 |

This table represents potential scenarios. The “Pessimistic” scenario highlights the importance of having contingency plans in place to manage potential cash flow shortfalls. Real-world scenarios often involve more intricate details.

I’ve been diving deep into those 6 money management tips for startup success, and honestly, it’s been super helpful. Managing finances effectively is crucial, but sometimes I find myself feeling sluggish after a meal. It’s a common problem, and if you’re wondering why you feel tired after eating, check out this article on the topic: why do i feel tired after eating.

Understanding that can help you make better food choices and optimize your energy levels. Getting a handle on these money management tips will set your startup up for better long-term success.

Investment Strategies for Startups

Smart investment decisions are crucial for a startup’s survival and growth. They can accelerate product development, expand market reach, and ultimately, determine the company’s trajectory. Without a well-defined investment strategy, startups risk squandering capital and failing to capitalize on opportunities. Strategic investments can be the difference between a promising venture and a failed one.

Significance of Smart Investment Decisions

Smart investments are vital for startups to achieve their goals. They enable startups to leverage capital effectively, fostering rapid expansion and innovation. Well-considered investments can lead to significant returns, potentially generating substantial revenue streams and securing future funding. Conversely, poor investment choices can result in substantial losses, jeopardizing the company’s financial stability and future.

Investment Opportunities for Startups

Startups have a diverse range of investment options. These include venture capital (VC) funding, angel investors, crowdfunding platforms, and debt financing. Each option carries its own set of terms and conditions, influencing the startup’s ownership structure and financial obligations. Understanding the nuances of each opportunity is paramount to making informed decisions.

Diversifying Investment Strategies

Diversification of investment strategies is critical for startups. It mitigates risk by spreading capital across various avenues. For example, a startup might seek both VC funding and angel investor support, ensuring a more robust financial foundation. A diverse portfolio of investments can also create greater flexibility for the company in times of economic downturn.

Examples of Successful Investments

Numerous startups have achieved success through strategic investments. For instance, companies focusing on disruptive technologies often attract venture capital funding. Similarly, startups in the e-commerce sector may leverage crowdfunding to expand their customer base. These successful examples demonstrate the positive impact of well-timed and strategic investment decisions.

Evaluating Investment Opportunities Carefully

Thorough evaluation of investment opportunities is essential. Startups should assess the investment terms, the potential return on investment (ROI), and the reputation of the investor. Understanding the investor’s track record and their understanding of the industry can significantly influence the startup’s success. Detailed due diligence should be conducted to ensure alignment with the company’s long-term goals.

Comparison of Investment Options

| Investment Option | Description | Pros | Cons |

|---|---|---|---|

| Venture Capital (VC) | Investment from professional VC firms | Large capital injection, experienced guidance | Potential loss of control, high dilution |

| Angel Investors | Investment from individual investors | Mentorship, tailored support | Limited capital, potential for less experience |

| Crowdfunding | Raising capital through online platforms | Exposure to a broad market, community engagement | Time-consuming, less capital |

| Debt Financing | Borrowing money from financial institutions | Maintain ownership control, flexible terms | Interest payments, potential for higher interest rates |

Risk Management for Startups

Navigating the entrepreneurial landscape often involves navigating unpredictable challenges. Startups, particularly in their nascent stages, face a unique set of financial risks that can significantly impact their trajectory. Proactive risk management is crucial for mitigating these potential threats and ensuring the long-term viability of the business. A robust risk assessment framework is essential for identifying vulnerabilities and developing strategies to mitigate them.

Importance of Risk Assessment, 6 money management tips aid your startup success infographic

A thorough risk assessment is not just a theoretical exercise; it’s a practical necessity for startups. By identifying potential financial risks early, startups can develop contingency plans and allocate resources effectively. This proactive approach allows for a more resilient business model, better prepared to weather unforeseen circumstances. A comprehensive risk assessment helps prioritize potential issues and allocate resources to the most critical risks.

This strategic planning ensures the startup’s resources are utilized efficiently and effectively.

Potential Financial Risks

Startups face a multitude of financial risks, ranging from market fluctuations to unforeseen operational challenges. These risks can stem from various sources, including:

- Market Volatility: Changes in consumer demand, economic downturns, or shifts in industry trends can significantly impact a startup’s revenue streams. A startup dependent on a single product or market segment is particularly vulnerable.

- Competition: The emergence of new competitors or the expansion of existing players can quickly erode market share and profitability. Startups need to constantly adapt to the evolving competitive landscape.

- Cash Flow Disruptions: Delays in payments from clients, unexpected operational expenses, or insufficient funding can severely impact a startup’s ability to meet its financial obligations. A clear understanding of cash flow projections is critical.

- Regulatory Changes: Changes in regulations, industry standards, or government policies can affect a startup’s operations and financial performance. Compliance with evolving regulations is essential.

- Operational Inefficiencies: Poorly managed operations, inefficient supply chains, or high overhead costs can negatively impact profitability. Efficient resource allocation is paramount.

Strategies for Mitigating Financial Risks

Several strategies can help startups mitigate financial risks. These include:

- Diversification: Reducing reliance on a single product, market segment, or customer base can lessen the impact of market fluctuations. Expanding into multiple product lines or target markets helps to diversify revenue streams.

- Contingency Planning: Developing detailed plans for handling potential financial setbacks, such as reduced revenue or increased expenses, is crucial. These plans should include clear financial targets and timelines.

- Strong Financial Management Practices: Implementing sound financial management practices, such as meticulous budgeting, accurate forecasting, and regular financial reporting, can help to anticipate and address potential financial issues. A solid financial foundation is essential for long-term success.

- Insurance: Insurance policies can provide protection against various financial risks, such as property damage, liability claims, and business interruption. Insurance is a proactive measure to mitigate risks.

Examples of Risk Management in Startups

Several successful startups have effectively managed financial risks. For instance, companies that diversify their product offerings or target markets are better equipped to weather economic downturns. Furthermore, companies that develop strong relationships with their suppliers and clients often experience more consistent cash flow.

Importance of Insurance for Startups

Insurance plays a vital role in protecting startups from unforeseen financial losses. It can provide coverage for various potential risks, such as property damage, liability claims, and business interruption. Insuring key assets and liabilities protects the startup’s financial stability.

Financial Risks and Mitigation Strategies

| Financial Risk | Mitigation Strategy |

|---|---|

| Market Volatility | Diversify product offerings, target markets, and revenue streams. |

| Competition | Focus on unique value propositions, innovative products, and efficient operations. |

| Cash Flow Disruptions | Implement tight cash flow management, improve collections, and explore alternative funding options. |

| Regulatory Changes | Stay informed about relevant regulations, consult legal professionals, and build compliance procedures. |

| Operational Inefficiencies | Implement lean processes, optimize supply chains, and track operational metrics. |

Key Metrics for Startup Success

Understanding your startup’s financial health is crucial for navigating the complexities of the entrepreneurial journey. Key performance indicators (KPIs) serve as vital signposts, offering insights into progress, potential challenges, and areas needing improvement. Tracking and analyzing these metrics allows you to make informed decisions, optimize resource allocation, and ultimately increase your chances of success.Financial health isn’t just about profit; it encompasses a comprehensive view of the company’s performance across various facets, including revenue generation, expense management, and cash flow.

That infographic on 6 money management tips for startup success is a great starting point, but retaining top talent is equally crucial. Think about how crucial it is to understand your employees’ needs and motivations, and how not to lose your best employee here. Ultimately, strong financial management and a healthy work environment go hand-in-hand for a thriving startup.

So, let’s dive back into those smart money management strategies for your startup’s future.

By focusing on these KPIs, startups can gain a clearer picture of their strengths and weaknesses, enabling them to adapt strategies and stay ahead of the curve. A strong understanding of these metrics empowers startups to make data-driven decisions and fine-tune their operations to achieve sustainable growth.

Importance of KPIs in Financial Management

KPIs provide a structured framework for measuring and monitoring progress towards financial objectives. They are essential for evaluating the effectiveness of strategies and identifying areas needing adjustments. Without these quantifiable benchmarks, it becomes challenging to assess the overall health of the startup, leading to potential missed opportunities and financial setbacks. Effective KPI tracking helps startups stay aligned with their financial goals and makes necessary course corrections.

Key Metrics Demonstrating Financial Health

Several key metrics provide valuable insights into a startup’s financial health. These metrics encompass various aspects of the business, from revenue generation to expense management and cash flow. Understanding and tracking these metrics is crucial for making data-driven decisions and ensuring the company’s long-term viability.

- Revenue Growth Rate: This metric tracks the percentage change in revenue over a specific period. A consistent and healthy growth rate indicates a thriving business, reflecting effective sales and marketing strategies. It also helps in forecasting future revenue and planning for expansion.

- Customer Acquisition Cost (CAC): This metric measures the average cost of acquiring a new customer. A low CAC indicates efficient marketing and sales strategies. By understanding this cost, startups can optimize their marketing spend and ensure profitability.

- Customer Lifetime Value (CLTV): This metric estimates the total revenue a customer is expected to generate throughout their relationship with the company. A high CLTV suggests a strong customer base and long-term value. It’s important to consider how CLTV compares to CAC to ensure the acquisition of new customers is profitable.

- Gross Profit Margin: This metric represents the percentage of revenue remaining after deducting the cost of goods sold. A healthy gross profit margin indicates efficient operations and cost management.

- Net Profit Margin: This metric represents the percentage of revenue remaining after deducting all expenses, including operating expenses and taxes. A higher net profit margin demonstrates profitability and efficient resource utilization.

- Cash Flow: This metric measures the movement of cash into and out of the business. A positive cash flow indicates sufficient liquidity to cover expenses and investments.

- Burn Rate: This metric calculates the rate at which a startup is spending its cash. A controlled burn rate is crucial for ensuring sufficient funding to sustain operations until profitability.

Tracking and Analyzing Key Metrics

Regular tracking and analysis of KPIs are essential for informed decision-making. This involves consistently monitoring the metrics, identifying trends, and evaluating their impact on the business. Using tools like spreadsheets, financial software, or business intelligence platforms can streamline this process. Regular reporting and analysis sessions with key stakeholders are crucial for maintaining awareness and taking necessary actions.

Comparing Metrics Against Industry Benchmarks

Comparing your startup’s KPIs against industry benchmarks provides context and allows for performance evaluation. Benchmarking allows startups to identify best practices, understand areas needing improvement, and adjust strategies to enhance their competitive advantage. Reliable industry data sources, including market research reports and industry associations, provide valuable information for benchmarking.

Examples of KPIs Relevant to Specific Startup Industries

The relevance of KPIs varies depending on the industry. For example, in the e-commerce industry, metrics like conversion rate, average order value, and cart abandonment rate are critical. In the software industry, metrics such as monthly recurring revenue (MRR) and customer churn rate are key indicators of success.

| Metric | Significance |

|---|---|

| Revenue Growth Rate | Indicates sales effectiveness and market penetration |

| Customer Acquisition Cost (CAC) | Reflects the efficiency of marketing and sales efforts |

| Customer Lifetime Value (CLTV) | Evaluates the long-term value of a customer relationship |

| Gross Profit Margin | Highlights operational efficiency and cost management |

| Net Profit Margin | Measures overall profitability and efficiency |

| Cash Flow | Assesses the company’s ability to meet its financial obligations |

| Burn Rate | Indicates the pace of cash consumption and funding requirements |

Building Financial Resilience

Navigating the startup landscape often involves unpredictable challenges, from unexpected market shifts to unforeseen operational hiccups. Building financial resilience is crucial for startups to weather these storms and thrive. A strong financial foundation enables startups to adapt to changing circumstances, seize opportunities, and ultimately achieve long-term success.Financial resilience isn’t just about having enough money; it’s about having the ability to adapt and overcome financial setbacks.

It’s about developing strategies that allow a startup to maintain stability and profitability even during periods of economic uncertainty or operational difficulties. This proactive approach empowers startups to not just survive, but to thrive in the long run.

Developing a Financial Safety Net

A robust financial safety net is essential for mitigating the impact of unforeseen events. This involves setting aside reserves for unexpected expenses, such as equipment malfunctions, supply chain disruptions, or regulatory changes. Adequate cash reserves allow startups to absorb short-term shocks without jeopardizing operations or compromising commitments. Establishing a contingency fund is paramount for safeguarding against unforeseen circumstances.

This fund should be accessible and readily available for use during emergencies.

Adapting to Economic Fluctuations

Economic fluctuations are an inevitable part of the business world. Startups need to develop strategies to adapt to these changes. This includes closely monitoring market trends, adjusting pricing strategies, and exploring alternative revenue streams. Flexibility is key in navigating economic uncertainties. By understanding market dynamics and adapting business models, startups can minimize the impact of downturns.

Furthermore, diversification of revenue streams can provide a buffer against dependence on a single market or customer base.

Examples of Financially Resilient Startups

Several startups have demonstrated exceptional financial resilience. Companies like Airbnb, despite initial skepticism, successfully adapted their business model and pricing strategies to navigate economic downturns. Similarly, companies like Zoom, leveraging existing infrastructure, quickly responded to the shift in work-from-home trends, capitalizing on the opportunity for exponential growth. These examples illustrate how flexibility and adaptability are vital for long-term success.

Seeking Expert Financial Advice

Seeking expert financial advice is crucial for startups seeking to build financial resilience. Experienced financial advisors can provide valuable insights into budgeting, forecasting, and risk management. Professional guidance can help startups make informed financial decisions, optimizing resource allocation and mitigating potential risks. They can also offer tailored solutions to address specific startup needs and challenges.

Strategies for Building Financial Resilience

| Strategy | Description |

|---|---|

| Contingency Planning | Developing a comprehensive plan to address potential financial crises. This includes identifying potential risks, assessing their impact, and outlining mitigation strategies. |

| Diversification of Revenue Streams | Exploring alternative revenue sources to reduce reliance on a single customer base or market. This can include developing new products or services, expanding into new geographic markets, or leveraging new technologies. |

| Strong Budgeting and Forecasting | Creating detailed budgets and financial forecasts to anticipate potential financial challenges. This includes accurately projecting income, expenses, and cash flow. |

| Cash Flow Management | Implementing strategies to optimize cash flow, including accelerating collections and managing expenses efficiently. This ensures a constant flow of funds to support operations. |

| Risk Assessment and Mitigation | Identifying and assessing potential risks, developing strategies to mitigate them, and building resilience into the business model. This includes considering market fluctuations, regulatory changes, and operational disruptions. |

Conclusion for Infographic Design

This infographic aims to equip aspiring entrepreneurs with practical money management strategies. By presenting these key concepts in a visually engaging and easily digestible format, we hope to empower startups to navigate the financial landscape with confidence and clarity. A well-designed infographic will not only convey information but also inspire action.This final section focuses on the crucial aspects of infographic design, ensuring the money management tips resonate effectively with the target audience.

The visual representation will play a significant role in boosting comprehension and retention of the presented concepts.

Summary of Money Management Tips

The infographic consolidates six critical money management strategies for startup success. These encompass budgeting and forecasting, funding strategies, expense control, cash flow management, investment strategies, and risk mitigation. Each section provides a foundation for sound financial decision-making, enabling startups to build sustainable growth and resilience.

Importance of Visual Appeal

A visually appealing infographic is key to capturing attention and ensuring information retention. A well-structured design with a consistent color palette, appropriate typography, and high-quality visuals fosters a positive user experience. This will increase engagement with the content and drive home the critical money management principles. A visually engaging infographic can be more impactful than a lengthy text-based document.

Optimal Layout and Structure

The infographic’s layout should be clear, concise, and easily navigable. A logical flow from one topic to the next is paramount. Sections should be clearly defined with headings and subheadings. Using icons and visual cues to highlight key points will reinforce the message. Infographics should be visually balanced, avoiding overly cluttered or empty spaces.

Employing a consistent style throughout the infographic enhances the overall aesthetic appeal and ensures a cohesive user experience.

Examples of Effective Infographics

Numerous examples exist showcasing effective infographic design. The “Startup Costs” infographic from Inc.com demonstrates a clear layout with distinct sections and visual representations of key figures. Other successful examples often employ charts, graphs, and icons to represent data in a digestible manner. Visual representations of financial data are particularly effective.

Use of Visuals to Enhance Understanding

Visuals, such as charts, graphs, icons, and images, dramatically enhance comprehension. For instance, a pie chart representing different expense categories in a budget will make the concept more understandable than a lengthy textual description. Images or illustrations that visually depict a particular concept, such as a cash flow cycle, can make complex information more accessible. Visual aids provide a quick and easy way to absorb data, reinforce key concepts, and make the entire infographic more memorable.

Basic Infographic Layout

The infographic will be presented in a modular format, with each money management tip displayed in a dedicated section.

| Section | Visual Placeholder | Text Content |

|---|---|---|

| Budgeting & Forecasting | Pie chart illustrating expense allocation | Detailed description of the budgeting process, including examples of financial forecasting models. |

| Funding Strategies | Image of a startup receiving funding | Overview of different funding options for startups, including venture capital, angel investors, and bootstrapping. |

| Expense Tracking & Control | Graph showing expense trends over time | Methods for tracking expenses, managing budgets, and identifying cost-saving opportunities. |

| Cash Flow Management | Flowchart depicting cash flow | Explanation of cash flow management principles, including forecasting and managing cash flow. |

| Investment Strategies | Comparison chart of investment options | Overview of investment strategies for startups, including equity crowdfunding and real estate investment trusts. |

| Risk Management | Image of a warning sign with a dollar sign | Strategies for mitigating financial risks, such as market fluctuations, competition, and regulatory changes. |

Final Thoughts

In conclusion, 6 money management tips aid your startup success infographic provides a comprehensive overview of the financial strategies necessary for startup success. From initial planning to long-term growth, understanding and applying these tips can significantly improve your chances of navigating the challenges and achieving profitability. By embracing sound financial practices, you can cultivate a resilient and sustainable business model.

Remember, strong financial foundations are the bedrock of any thriving startup.