5 ways big companies rip you off and what you can stop is a crucial guide for consumers navigating the often-deceptive world of business. From hidden fees to misleading marketing, large corporations employ various tactics to extract more money from unsuspecting customers. This article delves into five common methods, offering actionable strategies to recognize and avoid these exploitative practices, empowering you to take control of your finances.

This exploration of corporate deception unveils the tactics behind hidden costs, confusing contracts, misleading ads, manipulative pricing, and more. The goal isn’t just to expose these practices, but to arm you with the knowledge and tools to protect yourself and make informed decisions.

Introduction to Deceptive Business Practices: 5 Ways Big Companies Rip You Off And What You Can Stop

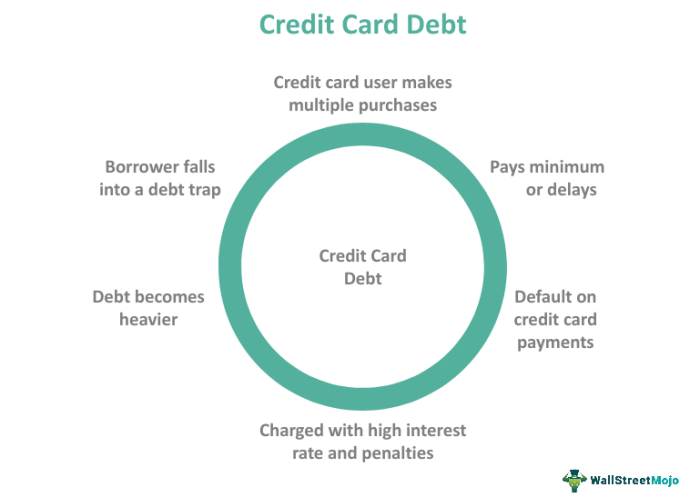

Large corporations, driven by profit maximization, sometimes employ deceptive tactics to influence consumer behavior. These practices, while often subtle, can have significant and lasting impacts on individuals and the economy as a whole. From misleading advertising to manipulative pricing strategies, understanding these tactics is crucial for consumers to make informed decisions and protect themselves from financial harm. Recognizing and avoiding these tactics empowers consumers to be more discerning and responsible in their purchasing choices.

Prevalence and Impact of Deceptive Tactics

The prevalence of deceptive business practices is undeniable. Corporations leverage various strategies to achieve higher profit margins, sometimes at the expense of consumer well-being. This can manifest in several ways, ranging from subtle psychological manipulation in marketing campaigns to more overt tactics like inflated pricing or hidden fees. These deceptive practices not only lead to financial losses for consumers but can also erode trust in the marketplace and hinder fair competition.

Moreover, a culture of deception can create a climate where ethical considerations are secondary to profit motives. The impact of these tactics extends beyond individual financial loss; it affects the overall economic climate and consumer confidence.

Categories of Deceptive Business Practices

Understanding the various forms of deceptive business practices is essential to avoid them. Recognizing these categories enables consumers to proactively look out for red flags and make informed choices.

| Category | Description | Example | Impact |

|---|---|---|---|

| Misleading Advertising | Using vague, exaggerated, or false claims to promote products or services. | A skincare product claiming to “erase wrinkles overnight” without scientific backing. | Consumers may purchase a product expecting results that are not delivered, leading to disappointment and financial loss. |

| Deceptive Pricing | Using tactics to make prices appear lower than they actually are. | A store offering a “limited-time discount” that is only slightly lower than the regular price. | Consumers may feel tricked into paying more than they intended or for a product that is not as good a value as it seems. |

| Hidden Fees and Charges | Adding unexpected fees or charges after the initial purchase or agreement. | A subscription service with a small monthly fee but additional charges for upgrades or premium features. | Consumers may be caught off guard by additional costs that significantly increase the overall price of a service or product. |

| Manipulative Marketing | Employing psychological tactics to influence consumer decisions. | Using scarcity tactics (limited quantities) or social proof (testimonials from many users) to promote a product. | Consumers may make impulsive or emotional decisions rather than rational ones, leading to purchases they may later regret. |

Hidden Fees and Charges

Hidden fees and charges are a pervasive problem in many industries, often designed to maximize profits without transparency. Consumers are frequently caught off guard by these extra costs, leading to unexpected expenses and dissatisfaction. Understanding how these fees are disguised and how to spot them is crucial for making informed decisions and protecting your financial well-being.Companies employ various tactics to conceal fees, often relying on fine print, complicated language, and a lack of clear disclosure.

This obfuscation allows them to add extra costs without explicit notice, impacting consumers who may not fully comprehend the true price of a product or service. Recognizing these tactics is the first step toward avoiding these hidden costs.

Common Methods of Concealing Fees

Companies often employ deceptive strategies to hide fees. These methods include burying information in lengthy contracts, using technical jargon, and placing crucial details in small print or obscure locations. A lack of clarity in the terms and conditions can make it difficult for consumers to understand the full cost.

Examples of Hidden Fees in Different Industries

Hidden fees appear in a variety of industries. In the subscription box industry, unexpected shipping costs, limited-time promotional offers with hidden caveats, or charges for upgrades are common examples. In the online shopping sector, shipping costs, taxes, or restocking fees are sometimes hidden. The service industry is also rife with hidden charges, such as additional service fees, mandatory gratuities, or concealed charges for specific options.

Financial services often have hidden fees, such as account maintenance fees, insufficient funds penalties, or hidden fees for early withdrawal of investments.

Transparency Comparison Across Companies

Transparency in fee disclosure varies significantly across companies. Some companies provide a clear and concise breakdown of all fees upfront, allowing consumers to make informed decisions. Others bury the fine print, making it challenging to understand the total cost. The difference in transparency highlights the importance of scrutinizing the terms and conditions carefully.

Ever feel like big companies are pulling the wool over your eyes? There are definitely 5 ways they do it, and you can take steps to stop them. For example, hidden fees in contracts are sneaky, and understanding your rights is key. Also, remember, having cold hands and feet doesn’t only mean poor circulation; it could be a sign of more serious health problems, like hypothyroidism or even an autoimmune disorder.

Check out this article to learn more: having cold hands and feet doesnt only mean poor circulation but more serious health problems. But back to those rip-offs! Be aware of misleading marketing tactics and always read the fine print. It’s your money, so know your rights!

Categorization of Hidden Fees

| Fee Type | Description | Example | How to Avoid |

|---|---|---|---|

| Hidden Shipping Costs | Additional costs for delivery that are not clearly stated initially. | A company lists a low price for an item but adds significant shipping fees later in the checkout process. | Carefully review all details during checkout, and compare shipping options from different sellers. |

| Mandatory Fees | Fees that are required to use a service or product, but are not immediately apparent. | A gym membership includes mandatory equipment rental fees. | Thoroughly read the terms and conditions before signing up for a service or purchasing a product. |

| Account Maintenance Fees | Charges associated with maintaining an account, which might not be initially disclosed. | A bank account might have a monthly maintenance fee that’s not prominently displayed. | Carefully review account statements and understand the associated costs. |

| Restocking Fees | Charges for returning a product that might not be mentioned upfront. | A retailer charges a restocking fee for returning an item. | Check the return policy thoroughly before purchasing to understand potential costs. |

| Hidden Service Fees | Fees for services that are not clearly Artikeld in the initial description. | A restaurant adds a mandatory service charge that is not disclosed on the menu. | Read menus and contracts carefully for all potential fees. |

Confusing Terms and Conditions

Big companies often use convoluted language in their terms and conditions to obscure important details and potentially hide unfair clauses. This makes it difficult for consumers to understand their rights and obligations, creating opportunities for exploitation. Understanding these tactics is crucial for protecting yourself from hidden costs and unfair practices.

Ever feel like big companies are just out to get you? Well, they probably are! Learning 5 ways they rip you off and how to fight back is super important. It’s a skill worth having, like knowing the intricate details of the human body, which you’ll discover in a post about 12 things only medical students will understand.

Knowing those medical nuances can help you spot sneaky tactics used in advertising, pricing, and more, which can help you spot those same kinds of tactics in everyday life, like how to not get ripped off by a big company. So, buckle up, and let’s dive into those 5 ways to stop getting ripped off!

Deceptive Language in Contracts

Deceptive language in terms and conditions is often characterized by overly technical jargon, long and complex sentences, and the use of vague or ambiguous phrasing. These tactics aim to confuse consumers and make it harder to spot potential problems. This ambiguity allows companies to avoid specific responsibilities or create clauses that could potentially work against the consumer.

Examples of Deceptive Language

Numerous examples exist of deceptive language used in contracts. These include phrases that are overly broad, leaving the company with wide-ranging interpretations. Examples might include clauses that are intentionally vague about responsibilities, or that use terms with multiple possible meanings.

- Vague or open-ended descriptions of services or products. For instance, a contract might say “services will be provided as needed,” without specifying what “needed” means or who determines it.

- Use of industry-specific terminology without clear definitions. A contract might use a term specific to a certain industry without explaining what it means in the context of the agreement.

- Unclear or overly broad statements about liability or warranties. A contract might include a broad disclaimer about potential problems without clearly defining what is covered or excluded.

- Hidden fees or charges disguised within complex language. Fees may be included in a clause that is buried deep within the terms and conditions or phrased in a way that makes it difficult to detect.

Consequences of Not Understanding Terms and Conditions

Failing to fully understand terms and conditions can lead to various negative consequences. These range from unknowingly agreeing to unfavorable terms to incurring unexpected costs or penalties. Not understanding can also leave consumers vulnerable to exploitation.

- Unforeseen fees or charges: Unclear clauses might lead to the application of hidden charges that were not anticipated.

- Loss of rights or benefits: A lack of understanding can result in the consumer forfeiting rights or benefits that are spelled out in the contract.

- Difficulty in resolving disputes: Ambiguous language makes it more challenging to resolve problems or disputes should they arise.

- Potential for fraud or misrepresentation: Unclear clauses could be interpreted in ways that benefit the company and potentially deceive the consumer.

Detailed Example of a Contract

Contract for Software Subscription

Clause 1: Service Provision: The company agrees to provide the software and associated support services as needed. The specific nature of support services is determined by the company at its sole discretion.

Clause 2: Termination: The company may terminate this agreement at any time, for any reason or no reason, with 30 days’ written notice. The customer is responsible for all charges incurred up to the date of termination.

Clause 3: Fees: Monthly subscription fees are payable in advance. Additional charges may apply for features not explicitly stated in the initial agreement.

Ever feel like big corporations are just squeezing every last penny out of you? We’ve all been there. Learning to spot those 5 sneaky ways they rip you off is key. But hold on, it’s not all doom and gloom! Discovering how nice people achieve more, like in this article on 10 things nice people differently that make them achieve more , can help us build better strategies for navigating the world of business.

By understanding those strategies, you can better protect yourself from those same sneaky tactics big companies employ. So, let’s get back to those 5 ways to stop them from ripping you off!

Highlighted Deceptive Clauses and How to Avoid Them

- Clause 1 (Service Provision): The vagueness of “as needed” and “at its sole discretion” leaves the customer vulnerable to inconsistent support levels and potential unfair treatment.

- Clause 2 (Termination): The clause allows for arbitrary termination without recourse. The customer should look for a clause with clearly defined termination reasons and potentially a more equitable process.

- Clause 3 (Fees): The “additional charges” clause creates ambiguity about potential costs. The customer should seek a contract that lists all foreseeable costs and clearly defines any possible extra charges.

To avoid these issues, always carefully review all terms and conditions before signing any contract. If possible, seek legal counsel to ensure your rights are protected. If any clause seems vague or overly broad, ask for clarification before proceeding.

Misleading Advertising and Marketing

We’re bombarded daily with marketing messages designed to grab our attention and persuade us to buy. Unfortunately, some companies employ tactics that go beyond persuasive advertising and delve into misleading practices. These tactics prey on our desires and vulnerabilities, often making it difficult to discern truth from fiction. Understanding these deceptive techniques is crucial for making informed purchasing decisions and protecting ourselves from being manipulated.

Common Marketing Strategies That Manipulate Consumers

Many marketing strategies leverage consumer psychology to create a sense of urgency, exclusivity, or fear, encouraging impulsive purchases. These strategies, while sometimes subtle, can be powerful tools for manipulating consumers.

- False Promises and Exaggerated Claims: Companies frequently make promises they can’t keep or exaggerate the benefits of their products or services to attract customers. This can involve overstating the product’s performance, durability, or efficacy.

- Emotional Appeals: Playing on emotions like fear, insecurity, or the desire for belonging is a common tactic. Advertisements often trigger these feelings to associate a product with a positive emotional response, encouraging purchase.

- Bandwagon Effect: The idea that something is popular simply because many others are doing it is a common marketing technique. This involves suggesting that a product is desirable due to its widespread use or popularity.

- Testimonials and Endorsements: Using testimonials from individuals, especially those perceived as credible or trustworthy, can influence purchasing decisions. However, these testimonials may be misleading or inaccurate.

- Scarcity Tactics: Creating a sense of urgency by suggesting that a product or service is in limited supply encourages immediate purchase. This tactic often uses phrases like “limited-time offer” or “while supplies last.”

Examples of Misleading Advertising Campaigns

Across various industries, companies have used misleading advertising to promote their products or services. These examples highlight the need for consumers to be critical and evaluate claims.

- Weight-Loss Products: Many weight-loss products claim significant and rapid results, often using testimonials or before-and-after photos to support their claims. However, these claims are often unrealistic and lack scientific backing.

- Health Supplements: The supplement industry is rife with exaggerated claims regarding health benefits, often presented without rigorous scientific evidence.

- Financial Products: Financial institutions have been known to employ misleading advertising to promote high-risk investments, promising unrealistic returns or obscuring potential risks.

- Automotive Industry: Certain car manufacturers may advertise fuel efficiency without accurately reflecting real-world conditions, leading to misleading impressions about the vehicle’s performance.

The Role of Consumer Psychology in Deceptive Practices

Understanding consumer psychology is essential for companies to tailor their marketing strategies effectively. However, it can also be used to manipulate consumers. By appealing to their emotional needs, cognitive biases, and psychological vulnerabilities, companies can influence purchasing decisions.

Comparison of Misleading Marketing Techniques, 5 ways big companies rip you off and what you can stop

| Technique | Description | Example | Consumer Impact |

|---|---|---|---|

| False Promises | Overstating product benefits or features | A weight-loss pill promising “10 pounds lost in 7 days” | Consumers may experience disappointment or frustration if results don’t match the claims. |

| Emotional Appeals | Using emotions to evoke a desired response | A charity ad showing starving children to encourage donations | Consumers may feel compelled to act based on emotions rather than rational thought. |

| Bandwagon Effect | Creating a perception of popularity | “Millions of people use our product!” | Consumers might feel pressured to join the trend, even if they don’t need the product. |

| Testimonials | Using endorsements to build trust | A celebrity endorsing a beauty product | Consumers may be influenced by a perceived authority figure’s opinion, even if it’s not genuine. |

| Scarcity Tactics | Creating a sense of urgency | “Limited-time offer! Only 24 hours left!” | Consumers may make impulsive purchases out of fear of missing out. |

Manipulation of Pricing and Bundling

Big companies often employ sophisticated pricing strategies to maximize profits, sometimes at the expense of consumers. These tactics can range from subtly increasing costs through hidden fees to aggressively bundling products or services in ways that make individual purchases seem more expensive. Understanding these manipulative techniques is crucial for informed consumer decisions.Companies use a variety of methods to inflate costs without directly raising the price of a single item.

Bundling, in particular, can obscure true value and encourage purchases of unwanted extras. Understanding these strategies is key to avoiding overspending and ensuring you get the best possible deal.

Pricing Strategies and Their Impact

Pricing strategies are often designed to increase perceived value or necessity, even when those items are not genuinely needed. A careful analysis of the individual components within a bundle is essential to avoiding overpaying. Companies employ different pricing tactics, and understanding how these work can help you make informed decisions.

| Strategy | Description | Example | Consumer Impact |

|---|---|---|---|

| Hidden Fees | Extra charges tacked onto a product or service after the initial purchase. | A phone plan with a low monthly fee, but high roaming charges. | Consumers are surprised by unexpected costs that inflate the final price. |

| Deceptive Bundling | Combining multiple products or services into a package, making the individual components appear more expensive than buying them separately. | A software package with many unused features bundled with essential ones. | Consumers may end up paying for extras they do not need or use. |

| Price Anchoring | Setting a high initial price to make a lower price seem more attractive. | A retail store that displays a high-priced item alongside a lower-priced one, making the latter seem like a bargain. | Consumers are influenced by comparisons and perceive lower prices as significant savings. |

| Premium Pricing | Pricing a product or service higher than its perceived value due to branding or perceived quality. | A luxury brand charging a high price for a product similar to one made by a less-known brand. | Consumers pay more due to brand perception, rather than inherent value. |

| Psychological Pricing | Using pricing strategies to influence consumer perception. | Pricing a product at $9.99 instead of $10.00. | Consumers perceive the product as less expensive, despite the minimal difference. |

Real-World Examples of Deceptive Pricing

A prime example of deceptive bundling is seen in many mobile phone contracts. Often, a low introductory price is offered, but hidden fees for data usage or international calls can quickly inflate the monthly bill. Similarly, software packages often include features that are rarely used, but the bundled package is priced as if those features are essential. These hidden costs, or bundled extras, can result in significant financial burdens for consumers.

Analyzing the individual components of a bundled package can help to avoid these types of situations.Another common example is in the entertainment industry, where bundled subscriptions often contain many channels that consumers may not want or use. The total cost of the package can be substantial, and the consumer may find themselves paying for content they never access.

Protecting Yourself from Deceptive Tactics

Big companies, despite their size and influence, are not immune to the temptation of employing deceptive tactics to increase profits. Understanding these tactics is the first step towards safeguarding yourself from becoming a victim. This involves recognizing the subtle ways businesses try to manipulate consumers and learning to spot the red flags. By arming yourself with knowledge and critical thinking skills, you can confidently navigate the marketplace and make informed decisions.Careful scrutiny of every aspect of a product or service is crucial.

Businesses often employ elaborate strategies to present products in a positive light, masking any potential downsides or hidden costs. However, through careful examination, consumers can discern the truth and avoid being misled. Understanding the legal recourse available to you is equally important, providing a safety net in case of unfair or deceptive practices.

Recognizing Deceptive Tactics

Businesses employ various tactics to manipulate consumers, from misleading advertising to confusing contracts. Recognizing these tactics is vital to protecting yourself. A keen eye for detail and a healthy dose of skepticism are essential tools in this process. Be wary of overly inflated promises, vague descriptions, and lack of transparency regarding terms and conditions. Scrutinize the fine print to uncover any hidden fees or charges that might significantly alter the initial price.

Importance of Careful Reading and Critical Thinking

Thorough reading and critical thinking are fundamental to avoiding deceptive practices. Carefully reviewing all terms and conditions before committing to a purchase or agreement is crucial. This meticulous approach can help you identify potential pitfalls and safeguard your financial interests. Avoid making impulsive decisions based on enticing marketing campaigns. Always take the time to thoroughly investigate the product or service before making a commitment.

Question assumptions, compare prices across different providers, and seek independent reviews. This practice allows for a more objective and informed decision-making process.

Legal Recourse for Consumers

If you believe you have been a victim of deceptive business practices, you have legal recourse. Contacting consumer protection agencies or seeking legal counsel can help you navigate the process and seek redress. Gathering evidence, such as contracts, receipts, and correspondence, is vital for building a strong case. The specific legal options available to you may vary depending on your location and the nature of the deceptive practice.

Researching local consumer protection laws and contacting legal professionals can provide valuable insights into your rights and potential avenues for recourse.

Steps to Protect Yourself

- Thoroughly review all contracts, agreements, and terms and conditions before signing.

- Compare prices and features from different providers to ensure you are getting the best value.

- Seek independent reviews and testimonials to gain a more comprehensive understanding of a product or service.

- Be cautious of overly inflated promises and vague descriptions. Demand clear and concise details about the product or service.

- Report any suspected deceptive practices to relevant consumer protection agencies or authorities.

- Maintain detailed records of all transactions, communications, and interactions with the business.

- If you suspect deceptive practices, consult with a legal professional to understand your rights and options.

Last Recap

In conclusion, understanding the tactics employed by large corporations to deceive consumers is paramount. By being aware of these strategies – from hidden fees to misleading advertising – you can safeguard your financial well-being. Armed with this knowledge, you’re better equipped to navigate the marketplace and make informed choices that serve your best interests. This knowledge empowers you to shop smarter and live more financially secure.