5 steps you must take your early 20s become millionaire: This guide lays out a roadmap to financial freedom in your twenties. We’ll explore the crucial steps needed to build wealth, from defining your goals and developing essential financial habits to smart investment strategies and entrepreneurial ventures.

From understanding what it truly means to be a millionaire in your early twenties to building passive income streams and cultivating the right mindset, this exploration provides actionable advice for achieving your financial aspirations.

Defining “Millionaire” in Early 20s

Becoming a millionaire in your early twenties is a significant aspiration, but it requires a nuanced understanding of what it truly entails. It’s not simply about accumulating a large sum of money; it’s about achieving that financial milestone through various avenues and recognizing the potential pitfalls of unrealistic expectations. This journey involves careful planning, strategic execution, and a realistic assessment of your circumstances.Defining millionaire status in your early twenties demands a more in-depth look than just a high net worth.

It’s about building significant assets, understanding the different types of wealth, and acknowledging the unique challenges and opportunities of this age group. This exploration dives into the intricacies of wealth accumulation at a young age, providing examples and strategies for success, while also highlighting common misconceptions and the importance of realistic expectations.

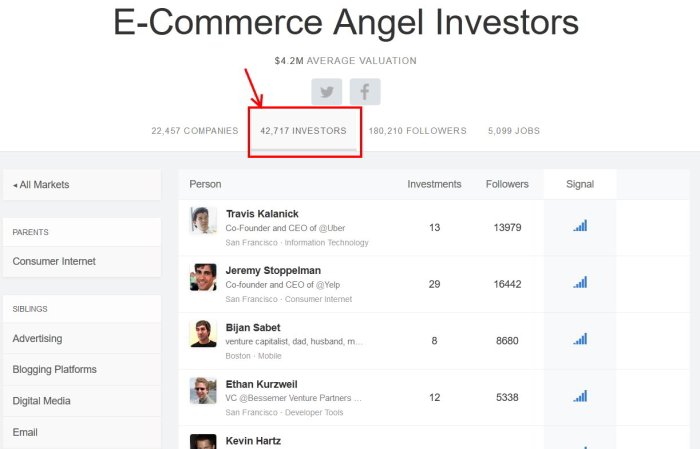

Defining Millionaire Status

A millionaire in your early twenties isn’t necessarily someone who has a million dollars in a bank account. It encompasses various asset classes, including investments, businesses, and even inherited wealth. A key aspect is understanding the total net worth, factoring in all assets and liabilities.

Different Paths to Millionaire Status

The path to becoming a millionaire in your early twenties is diverse and depends heavily on individual circumstances. Some individuals might inherit a substantial sum, enabling them to invest strategically and rapidly accumulate wealth. Others might start a successful business venture, leveraging their entrepreneurial spirit and innovative ideas. A third category might excel in high-paying professions, consistently saving and investing a substantial portion of their income.

Each path presents its own set of challenges and opportunities, emphasizing the importance of tailoring strategies to individual circumstances.

Common Misconceptions

Many misconceptions surround early wealth accumulation. One common myth is that luck is the primary driver of early wealth. While chance plays a role, hard work, strategic planning, and disciplined financial habits are equally crucial. Another misconception involves the notion that one must have a high-paying job from the start. Entrepreneurial ventures, leveraging skills, or capitalizing on investment opportunities are other ways to reach millionaire status.

The key is to understand the various avenues and approach them with a clear understanding of personal circumstances.

Types of Millionaires and Strategies

| Type of Millionaire | Typical Strategies |

|---|---|

| Inherited Wealth | Investing inherited funds wisely, diversifying portfolios, and seeking professional financial advice to maximize returns. |

| Entrepreneurial Ventures | Identifying a market need, developing a viable business model, securing funding, and scaling operations. |

| High-Income Professionals | Maximizing savings, investing consistently, and seeking tax-advantaged investment strategies. |

| High-Growth Investments | Identifying high-potential investment opportunities, understanding the risks, and diversifying across various sectors. |

This table Artikels different paths to early millionaire status, demonstrating the diverse range of approaches. Each strategy requires careful consideration and planning.

So, you’re aiming for millionaire status in your early twenties? It’s a fantastic goal! While building wealth takes savvy financial moves, don’t overlook the importance of digital security. Protecting your financial data, like you would with 12 ways secure your smartphone , is crucial. This means strong passwords, updated software, and a cautious approach to online transactions.

These precautions will help you stay focused on your financial goals without unnecessary distractions or security breaches. Remember, those 5 steps to millionaire status still need careful planning and execution!

Essential Financial Habits for Early 20s

Building a strong financial foundation in your early twenties is crucial for long-term wealth creation. This period offers a unique opportunity to develop habits that will compound over time, setting the stage for financial security and future aspirations. This section delves into essential financial habits, emphasizing budgeting, saving, debt management, and the importance of an emergency fund.

Budgeting Techniques for Young Adults

Effective budgeting is the cornerstone of financial success. It allows you to track income and expenses, understand where your money goes, and identify areas for improvement. Creating a budget empowers you to make informed financial decisions, fostering control over your spending and maximizing your potential for savings.

- Zero-Based Budgeting: This method allocates every dollar of income to a specific category, ensuring that every penny has a designated purpose. It provides a comprehensive view of your finances and helps you avoid overspending in any area. For example, if your monthly income is $3,000, you allocate every dollar to different categories like housing, food, transportation, entertainment, savings, and debt repayment.

This method provides a clear picture of your financial standing and helps in identifying areas for cost reduction.

- Envelope System: This system involves allocating cash to different envelopes representing various expense categories. This tangible approach helps you visualize your spending and avoid overspending in specific areas. For instance, you might have an envelope for groceries, one for entertainment, and another for gas. This physical representation of your budget can be highly effective in controlling impulse purchases.

- 50/30/20 Rule: This simple rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This method provides a structured approach to budgeting and prioritizes essential spending while maintaining room for personal enjoyment.

Choosing the Right Budgeting Tool

Various tools can assist in tracking and managing your budget effectively. The right tool should be user-friendly and cater to your specific needs and preferences. Digital tools offer flexibility and detailed analysis, while physical methods can provide a tangible representation of your budget.

- Spreadsheet Software (e.g., Google Sheets, Microsoft Excel): These tools allow for customized budgeting, detailed tracking, and sophisticated analysis. You can create custom categories, track expenses, and generate reports to understand spending patterns.

- Budgeting Apps (e.g., Mint, YNAB): These apps automate tracking, provide insights into spending habits, and offer various budgeting features. They can be valuable in providing real-time visualizations of your financial situation.

- Physical Budgeting Notebooks: A notebook with designated sections for income, expenses, and categories can be a tangible method for tracking and visualizing your budget. This can be particularly useful for those who prefer a hands-on approach.

Importance of Emergency Funds

Building an emergency fund is a critical step in financial stability. It safeguards against unexpected expenses, such as medical emergencies, job loss, or car repairs. A robust emergency fund can provide peace of mind and prevent you from falling into debt during unforeseen circumstances.

Aim to save three to six months’ worth of living expenses in an emergency fund.

Comparing Budgeting Methods

| Budgeting Method | Description | Suitability for Early 20s |

|---|---|---|

| Zero-Based Budgeting | Allocates every dollar of income to a specific category. | Excellent for detailed tracking and controlling spending. Requires discipline to allocate every dollar. |

| Envelope System | Allocates cash to different envelopes representing expense categories. | Effective for visual representation and controlling impulse spending. May be less adaptable to fluctuating expenses. |

| 50/30/20 Rule | Allocates 50% to needs, 30% to wants, and 20% to savings/debt. | Simple and easy to understand, providing a good starting point. May not be as precise for complex financial situations. |

Investment Strategies for Early 20s

Building wealth in your early twenties requires a strategic approach, especially with limited capital. This phase is crucial for establishing sound financial habits and understanding the power of long-term investment. The key is to start early, even with small amounts, and leverage the power of compounding to maximize returns over time.

Investment Strategies for Limited Capital

Young adults often face the challenge of limited financial resources when it comes to investing. A crucial strategy is to identify low-cost investment options that align with your financial goals and risk tolerance. Diversification is paramount to mitigate risk and potentially increase returns. Remember, even small consistent investments can lead to substantial gains over the long haul.

Low-Cost Investment Options, 5 steps you must take your early 20s become millionaire

Several low-cost investment options are suitable for early twenties investors. These options often offer broad market exposure, reducing individual stock selection risk. Diversification within these vehicles is key to a well-rounded investment portfolio.

- Index Funds: These passively managed funds track a specific market index, such as the S&P 500. They offer broad market exposure at low expense ratios, making them attractive for beginners. They provide broad diversification across many stocks.

- Exchange-Traded Funds (ETFs): Similar to index funds, ETFs trade on exchanges like individual stocks. They offer a diversified basket of assets, allowing for targeted exposure to specific sectors or market segments. ETFs often have lower expense ratios than actively managed mutual funds.

- Robo-advisors: These online platforms offer automated investment management services, making investing accessible to those with limited knowledge or time. They often use algorithms to diversify portfolios based on risk tolerance and goals.

Understanding Risk Tolerance and Diversification

Assessing your risk tolerance is essential in early-stage investing. This involves understanding your comfort level with potential losses and your investment timeline. Diversification across different asset classes, like stocks, bonds, and real estate (indirectly via REITs), is critical to mitigating risk and potentially increasing returns.

The Power of Compounding

“The greatest discovery of all time is that a person can change their future by merely changing their attitude.”

Oprah Winfrey

Compounding is the process where your investment earnings generate further earnings over time. The earlier you start investing, the more time your money has to grow through compounding. Small, consistent contributions, compounded over decades, can lead to substantial wealth accumulation.

Comparing Investment Vehicles

| Investment Vehicle | Description | Suitability for Early 20s |

|---|---|---|

| Index Funds | Passively managed funds tracking a market index. | Excellent, low cost, broad diversification. |

| ETFs | Exchange-traded funds providing diversified exposure. | Good, often lower expense ratios than mutual funds. |

| Robo-advisors | Automated investment management platforms. | Suitable for beginners, automated diversification. |

Building Passive Income Streams in Early 20s: 5 Steps You Must Take Your Early 20s Become Millionaire

Building passive income in your early twenties is achievable, but requires a strategic approach and a willingness to learn and adapt. It’s not about getting rich quick, but rather about developing sustainable income streams that can generate revenue while you sleep, study, or pursue other endeavors. This involves understanding various methods, identifying entrepreneurial potential, and consistently learning new market opportunities.While the initial investment of time and effort may seem significant, the long-term rewards of passive income can be substantial, enabling you to build wealth and achieve financial freedom earlier in life.

Successful implementation requires a focus on continuous learning, adapting to changing market dynamics, and carefully managing resources.

Methods for Generating Passive Income

Passive income isn’t limited to a single strategy. A diverse approach, incorporating multiple methods, often leads to greater stability and resilience. Successful individuals often employ a combination of strategies. Start with one or two methods that align with your skills and interests.

- Affiliate Marketing: This involves promoting other people’s products or services and earning a commission on each sale made through your unique link. It requires building an online presence, such as a blog or social media account, to drive traffic and establish trust with your audience. Crucially, choose products or services that genuinely align with your values and interests to maintain authenticity and credibility with your audience.

- Creating and Selling Digital Products: This encompasses selling ebooks, online courses, templates, or other digital assets. Your existing knowledge and skills can be leveraged to create valuable products that cater to a specific niche. Successful creators typically understand their target audience and provide high-quality, valuable content. Platforms like Gumroad and Etsy offer avenues for selling digital products.

- Investing in Dividend-Paying Stocks: This strategy involves purchasing shares of companies that distribute a portion of their profits to shareholders as dividends. It requires thorough research and understanding of financial markets. Diversification across various sectors can mitigate risks. The returns depend on the performance of the companies in which you invest. While considered passive, it does require some ongoing monitoring and rebalancing.

So, you’re aiming to become a millionaire in your early twenties? It takes more than just good luck; it’s a combination of smart financial decisions and consistent effort. One key aspect, of course, is building wealth through sound investments. Taking care of your physical health is also crucial, though, and incorporating simple stretches like the ones detailed in this article on 8 easy hip stretches that can ease lower back pain in 6 minutes 8 easy hip stretches that can ease lower back pain in 6 minutes can make a huge difference.

These little steps, like those for your physical well-being, all contribute to a healthier lifestyle that ultimately supports your financial goals. Focus on those five key steps for a solid foundation to your millionaire dreams.

- Creating and Licensing Content: This encompasses creating and selling intellectual property, such as music, art, or written material. This strategy requires a creative skill set and a market understanding to effectively monetize the content. Building a portfolio and leveraging platforms like royalty-based content marketplaces can increase visibility and potential revenue.

Identifying and Leveraging Entrepreneurial Skills

Identifying entrepreneurial skills involves self-assessment. Entrepreneurial skills are not just about starting a business, but also about identifying and leveraging opportunities to create value and generate income. This includes problem-solving, communication, and leadership abilities. Practice these skills in everyday life and evaluate your strengths and weaknesses.

- Problem-solving: Identifying needs and offering solutions. A keen eye for problems and a willingness to find creative solutions is essential for identifying opportunities.

- Communication: Effectively conveying ideas and building relationships. Clear communication is crucial for marketing and engaging with customers.

- Adaptability: Adjusting to changing market demands. The ability to pivot and adapt to market shifts is vital for sustained success.

Importance of Continuous Learning and Adaptation

The financial landscape is constantly evolving. Staying updated with market trends and adapting to changes is crucial for success in building passive income. Continuous learning is a key factor in adapting to new opportunities and emerging markets.

- Staying Informed: Monitoring industry trends, market changes, and new technologies can lead to early identification of opportunities.

- Seeking Knowledge: Utilizing online resources, attending workshops, and pursuing relevant courses can enhance understanding of the latest techniques and strategies.

- Networking: Connecting with people in related fields can expose you to new ideas and potential collaborations.

Time Commitment and Resources

Establishing and maintaining passive income streams requires a dedicated time commitment and careful resource allocation. The level of commitment varies significantly depending on the chosen strategy.

- Time Investment: Initial setup, content creation, or market research can take significant time, but subsequent efforts become more streamlined.

- Resource Allocation: Initial investment in tools, software, or marketing materials is essential for starting a passive income stream.

Comparison of Passive Income Streams

| Passive Income Stream | Potential ROI | Time Commitment | Initial Investment |

|---|---|---|---|

| Affiliate Marketing | Moderate to High | Moderate | Low |

| Digital Products | High | High (initially), Moderate (long-term) | Moderate |

| Dividend Stocks | Low to Moderate | Low | Moderate |

| Content Licensing | Variable | High (initially), Moderate (long-term) | Variable |

Developing Entrepreneurial Skills in Early 20s

Embarking on the entrepreneurial journey in your early twenties can be incredibly rewarding, offering the potential for significant financial success and personal growth. This stage presents a unique blend of youthful energy and a burgeoning understanding of the world, making it an ideal time to develop the skills and mindset necessary for building a thriving business. However, it’s not about overnight riches; it’s about laying the groundwork for future success.Developing entrepreneurial skills is more than just having a great idea; it’s about nurturing a proactive mindset, resilience, and a willingness to learn from setbacks.

This involves continuous learning, adapting to changing market dynamics, and recognizing that failure is often a crucial step on the path to success. Cultivating these skills is paramount for wealth creation in the long run.

Importance of Entrepreneurial Skills

Entrepreneurial skills are crucial for navigating the complexities of the business world and achieving long-term success. These skills are not innate; they can be learned and honed through practice and experience. They provide a competitive edge, enabling individuals to identify opportunities, overcome challenges, and achieve financial independence.

Key Entrepreneurial Skills

Cultivating key entrepreneurial skills is fundamental to success. Problem-solving involves identifying and analyzing challenges, developing innovative solutions, and implementing effective strategies. Networking involves building relationships with potential partners, mentors, and clients, fostering collaboration and expanding one’s reach. Resourcefulness entails finding creative ways to utilize available resources efficiently, maximizing returns and minimizing costs.

- Problem-solving: The ability to identify, analyze, and solve problems effectively is critical. It involves breaking down complex issues into smaller, manageable parts, researching potential solutions, and implementing the best strategy. Practice this through brainstorming sessions, role-playing, or real-world scenarios.

- Networking: Building relationships with people in your industry is essential. Attend industry events, join relevant online communities, and reach out to mentors or potential collaborators. Consistent effort in building relationships will yield long-term rewards.

- Resourcefulness: This involves finding creative solutions to limitations and leveraging available resources effectively. Explore free or low-cost resources, seek out mentors, and leverage online tools to streamline your operations.

Examples of Successful Young Entrepreneurs

Numerous individuals have achieved remarkable success in their early twenties. For example, Elon Musk, founder of Tesla and SpaceX, demonstrated a strong understanding of engineering and innovation at a young age. His persistence and vision led to the creation of groundbreaking companies. Another example is Mark Zuckerberg, who built Facebook in his college years, showcasing the power of innovation and a strong understanding of technology.

These entrepreneurs highlight the potential for achieving significant wealth and success at a young age.

Learning from Failures and Adapting to Market Conditions

Entrepreneurship involves embracing calculated risks. Failures are inevitable, and the ability to learn from them is crucial. Analyzing the reasons behind setbacks, adapting strategies, and pivoting when necessary are essential for navigating market fluctuations. The market is constantly changing, and adaptability is key.

Developing a Business Idea: Steps to Execution

| Step | Description |

|---|---|

| Ideation | Brainstorming potential business concepts, identifying target markets, and researching industry trends. |

| Validation | Testing the viability of the business idea through market research, surveys, and feedback from potential customers. |

| Planning | Developing a comprehensive business plan, outlining the business model, financial projections, and marketing strategies. |

| Implementation | Executing the business plan, building the team, and launching the product or service. |

| Growth & Adaptation | Continuously monitoring performance, adapting to changing market conditions, and scaling the business to meet evolving demands. |

Mindset and Habits for Wealth Creation

The journey to becoming a millionaire in your early twenties isn’t just about financial strategies; it’s profoundly shaped by your mindset and daily habits. A strong foundation of mental fortitude, coupled with consistent positive action, is crucial for navigating the challenges and seizing the opportunities that come your way. This section delves into the essential mental frameworks and routines that will fuel your wealth-building aspirations.Developing a millionaire mindset isn’t about overnight transformations but rather consistent effort and a proactive approach to personal development.

It involves cultivating habits that support long-term financial growth, embracing challenges as learning opportunities, and staying motivated through setbacks. This section will Artikel the key components of such a mindset and offer actionable steps to implement them in your daily life.

The Power of Perseverance and Resilience

Financial success often involves overcoming obstacles and enduring periods of uncertainty. Perseverance and resilience are paramount in navigating these difficulties. Individuals who demonstrate these qualities are better equipped to adapt to changing market conditions, learn from failures, and maintain a positive trajectory towards their financial goals. These traits allow for sustained effort in the face of setbacks, a key element in achieving long-term financial objectives.

Embracing challenges as learning experiences, rather than insurmountable hurdles, is crucial for building a resilient mindset.

Want to become a millionaire in your early 20s? It takes more than just a lucky break; it demands a willingness to step outside your comfort zone. Like, seriously, you need to embrace the idea that you want more creative, and that means not fearing embarrassment – it’s a crucial part of the journey. Check out this insightful article on overcoming the fear of failure and embracing your creativity for a more fulfilling life: you want more creative you should not fear embarrassing yourself.

Ultimately, that boldness and willingness to try new things are essential for achieving your financial goals.

The Impact of Positive Self-Talk and Motivation

Positive self-talk and consistent motivation play a pivotal role in achieving financial success. A strong internal dialogue focused on empowerment and belief in one’s capabilities can significantly influence behavior and outcomes. By replacing negative self-criticism with encouraging affirmations, you can foster a more optimistic and proactive approach to financial matters. Motivational strategies, such as setting clear goals, celebrating milestones, and seeking support from mentors or peers, can further bolster this positive momentum.

Examples of Successful Individuals

Numerous successful individuals have demonstrated the power of perseverance and a growth mindset. For instance, consider entrepreneurs like Elon Musk, who faced significant setbacks and failures in his ventures but consistently persevered, ultimately achieving remarkable success. Similarly, Warren Buffett’s long-term investment strategy, built on patience and rigorous analysis, exemplifies the importance of consistent effort and resilience in the realm of finance.

These examples underscore that achieving financial success is not about avoiding failures, but about learning from them and adapting to overcome obstacles.

Actionable Steps to Cultivate a Growth Mindset

| Actionable Step | Description |

|---|---|

| Set SMART Goals | Define specific, measurable, achievable, relevant, and time-bound financial goals. |

| Embrace Failure as a Learning Opportunity | View setbacks as opportunities to refine strategies and gain valuable experience. |

| Seek Feedback and Mentorship | Actively solicit input from experienced individuals to gain insights and improve decision-making. |

| Practice Self-Compassion | Treat yourself with kindness and understanding during challenging times, avoiding self-criticism. |

| Continuously Learn and Adapt | Stay informed about financial markets and adapt strategies to evolving circumstances. |

Real-World Examples of Early 20s Millionaires

Becoming a millionaire in your early twenties is a remarkable feat, often fueled by innovative ideas, relentless work ethic, and a touch of luck. While the path to wealth is rarely straightforward, studying the journeys of those who achieved this milestone can offer valuable insights and inspiration for aspiring entrepreneurs. This section delves into the stories of individuals who defied expectations, demonstrating that financial success is attainable at a young age with the right approach.Understanding their strategies and the obstacles they overcame can illuminate the potential paths for aspiring millionaires.

These examples aren’t about mimicking specific approaches, but about learning from the principles that underpin their success.

Early Success Stories: A Glimpse into Diverse Paths

Several individuals, despite diverse backgrounds and starting points, have amassed significant wealth in their early twenties. These stories highlight the fact that a myriad of avenues can lead to financial freedom at a young age. These stories offer practical insights into how to navigate the challenges and seize opportunities that arise.

Key Strategies and Challenges Faced

These early millionaires often leverage a combination of factors to achieve their goals. Some are exceptional at identifying and capitalizing on market opportunities, while others demonstrate exceptional skills in entrepreneurship and business acumen. They often face hurdles like limited resources, skepticism, and the need to balance personal and professional responsibilities. Their stories showcase the importance of persistence, adaptability, and a growth mindset.

Table of Real-World Examples

| Name | Background | Strategy | Challenges | Advice |

|---|---|---|---|---|

| Elon Musk | South African-born, entrepreneurial family | Disruptive innovation in technology (space exploration, electric vehicles) | Competition, funding uncertainties, high risk | “Focus on solving significant problems. Embrace long-term vision.” |

| Mark Zuckerberg | Harvard student | Social media platform development | Early skepticism, privacy concerns, regulatory pressures | “Be prepared for the unexpected. Focus on building a strong team.” |

| Evan Spiegel | University student | Mobile messaging application | Building a successful product, navigating rapid growth | “Stay focused on your vision and iterate based on user feedback.” |

| Kylie Jenner | Reality TV star | Beauty brand, business ventures | Balancing personal brand with business, managing public image | “Be creative and innovative. Don’t be afraid to take risks.” |

| Robert Kiyosaki | Real estate investor, author | Financial literacy and investing strategies | Building credibility, adapting to market changes | “Education is key. Diversify your income streams.” |

Advice for Aspiring Millionaires

These success stories offer a wealth of insights for those aiming to achieve financial freedom early. These early millionaires demonstrate that a combination of factors, including a clear vision, strategic execution, and perseverance, can yield significant results. It’s crucial to learn from the trials and tribulations faced by those who achieved success. Learning from the experiences of others, however, doesn’t negate the importance of tailoring one’s own approach.

Last Word

In conclusion, achieving millionaire status in your early twenties is achievable with the right strategy and mindset. By defining your goals, establishing strong financial habits, investing wisely, generating passive income, and developing entrepreneurial skills, you can significantly increase your chances of success. This journey requires dedication, persistence, and a willingness to adapt to changing circumstances. Remember, building wealth is a marathon, not a sprint, and every step counts.