18 things financially mature people dont – 18 things financially mature people don’t do. This isn’t about being rich, but rather about smart financial habits that lead to a secure future. We’ll explore common pitfalls and highlight the behaviors of those who’ve mastered their finances, revealing the key differences between financial maturity and simply being financially literate.

From avoiding debt traps to building a strong foundation, smart spending, and managing risks, we’ll delve into practical strategies and insights to help you navigate your financial journey. Understanding financial maturity is crucial for achieving financial freedom, and we’ll cover everything from ethical practices to the importance of continuous learning.

Understanding Financial Maturity: 18 Things Financially Mature People Dont

Financial maturity is more than just knowing how to balance a checkbook. It’s a holistic approach to managing your finances, encompassing responsible spending, long-term planning, and a proactive attitude towards wealth building. It signifies a level of financial wisdom that transcends basic financial literacy, encompassing a deeper understanding of personal values and goals. It involves a conscious effort to align financial decisions with broader life aspirations, and a recognition of the interconnectedness of financial well-being with other aspects of life.Financial maturity is characterized by a mindful and strategic approach to money management, not just a reactive response to immediate needs.

It involves a deep understanding of your financial situation, including your income, expenses, assets, and liabilities. This awareness allows for proactive planning and decision-making, rather than just reacting to financial events as they occur.

Defining Financial Maturity

Financial maturity encompasses a comprehensive understanding of personal finances, extending beyond basic financial literacy. It includes a proactive approach to saving, investing, and managing debt, coupled with a long-term perspective. Crucially, it involves a recognition of the interplay between financial choices and personal values.

Characteristics of Financially Mature Individuals

Financially mature individuals demonstrate several key characteristics that distinguish them from those with lower levels of financial maturity. These include:

- Proactive Planning: They anticipate future needs and create plans to address them, rather than simply reacting to immediate circumstances. This involves understanding potential life events like education, marriage, or retirement, and factoring those into their financial strategy.

- Responsible Spending Habits: They prioritize needs over wants and make informed decisions about purchases, considering the long-term implications. This involves understanding the difference between needs and wants, and developing a spending plan aligned with their values.

- Effective Debt Management: They actively manage and reduce debt, understanding its impact on their overall financial well-being. This involves creating a plan to tackle high-interest debt and avoiding unnecessary borrowing.

- Long-Term Perspective: They focus on building wealth and achieving financial goals over the long term, rather than solely on short-term gains. This involves understanding investment strategies and how they relate to long-term goals.

- Adaptability and Flexibility: They are able to adjust their financial plans as circumstances change, understanding that life throws curveballs. This adaptability is key to navigating unexpected events and maintaining financial stability.

Financial Maturity vs. Financial Literacy

While financial literacy forms the foundation, financial maturity builds upon it. Financial literacy focuses on understanding basic financial concepts like budgeting and saving. Financial maturity, however, involves applying this knowledge in a responsible and strategic manner to achieve long-term goals and maintain financial well-being. It’s about translating knowledge into action.

Financial Maturity vs. Other Forms of Maturity

Financial maturity shares similarities with other forms of maturity, but it has unique aspects. Emotional maturity, for instance, involves managing emotions effectively. Social maturity focuses on interacting constructively with others. Financial maturity, while influenced by these other forms, emphasizes the mindful management of financial resources to achieve personal and family goals.

Key Aspects of Financial Maturity

The following table Artikels the key aspects of financial maturity, highlighting the differences between basic financial literacy and a more developed understanding of personal finance.

| Aspect | Financial Literacy | Financial Maturity |

|---|---|---|

| Understanding | Basic concepts like budgeting, saving, and investing | Deep understanding of personal finances, including income, expenses, assets, and liabilities; interplay between financial choices and personal values |

| Behavior | Following basic financial rules | Proactive planning, responsible spending, effective debt management, long-term perspective, adaptability, and flexibility |

| Goal Orientation | Short-term financial stability | Long-term financial well-being and achieving personal goals |

| Perspective | Individual needs | Interconnectedness of financial decisions with broader life aspirations |

Avoiding Debt Traps

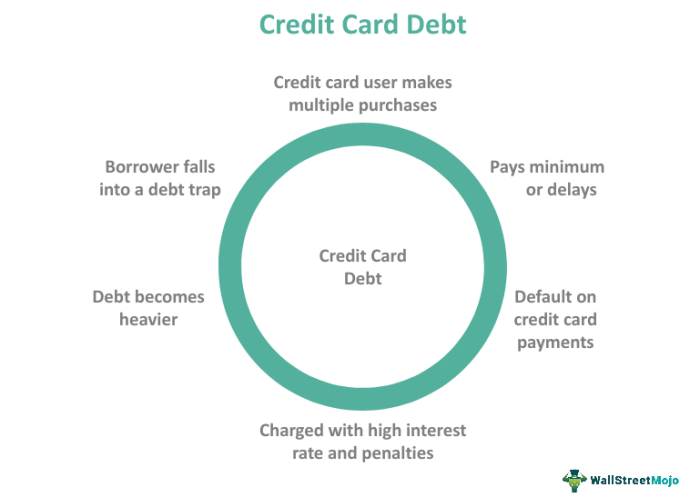

Financial maturity encompasses more than just saving; it also involves understanding and proactively avoiding debt traps. Individuals who haven’t developed strong financial literacy often find themselves ensnared in cycles of high-interest debt, which can significantly impact their long-term financial well-being. This article explores common debt pitfalls and strategies to prevent them.Excessive debt can lead to a cascade of negative consequences.

Missed payments can damage credit scores, making future borrowing more expensive and challenging. The constant pressure of debt repayment can lead to stress and anxiety, impacting overall well-being. Ultimately, accumulating significant debt can delay major life goals, such as homeownership or retirement planning.

Ever wondered what separates financially savvy individuals from those who struggle? Apparently, 18 things define financial immaturity, like not tracking expenses. But beyond the numbers, consider how your words impact your relationships. Using the right pronouns, for instance, can significantly affect the quality of those bonds, as explored in this insightful article on how pronouns can affect the quality of your relationships.

Ultimately, understanding and applying these nuances of communication, just like mastering a budget, contributes to a more mature approach to personal finance.

Common Debt Traps

Financial immaturity often leads to individuals falling into various debt traps. Understanding these common pitfalls is the first step towards avoiding them. Common examples include accumulating credit card debt beyond manageable limits, taking out payday loans for short-term needs, and failing to prioritize debt repayment.

Consequences of Excessive Debt

The long-term consequences of excessive debt can be severe and far-reaching. High-interest debt, particularly revolving credit like credit cards, can spiral out of control if not managed effectively. This can lead to a vicious cycle of accumulating debt, making it harder to escape. The accumulated interest over time can significantly increase the overall debt burden, making it challenging to meet other financial obligations.

Ever wonder what separates financially savvy individuals from the rest? It’s not just about the money; it’s about understanding that your choices reflect your values. For example, financially mature people often don’t get caught up in fleeting trends or pressured purchases. They carefully consider long-term implications and avoid impulsive decisions. And this ties directly into the concept of “you don’t marry a man, you marry a lifestyle” you dont marry man you marry lifestyle.

Ultimately, recognizing the bigger picture is key to true financial maturity. The 18 things financially mature people don’t do are all interconnected, emphasizing a mindful approach to life’s decisions.

Strategies for Avoiding High-Interest Debt

Proactive strategies can mitigate the risk of falling into high-interest debt traps. A crucial step is developing a comprehensive budget and sticking to it. This involves tracking income and expenses, identifying areas where spending can be reduced, and prioritizing debt repayment. Understanding the terms and conditions of loan agreements before committing is also critical.

Importance of Budgeting and Financial Planning

Effective budgeting and financial planning are essential for avoiding debt. A well-defined budget allows individuals to track their spending, identify areas for improvement, and allocate funds towards debt reduction. Financial planning involves setting clear financial goals, such as saving for a down payment on a house or retirement. These goals provide motivation and direction, ensuring that financial decisions are aligned with long-term objectives.

Types of Debt and Associated Risks

Different types of debt carry varying levels of risk. The following table highlights the characteristics of common debt types and their potential consequences.

| Debt Type | Description | Associated Risks |

|---|---|---|

| Credit Cards | Revolving credit with variable interest rates. | Easy access to credit can lead to overspending. High interest rates can result in significant debt accumulation if not managed carefully. |

| Payday Loans | Short-term loans with extremely high interest rates. | The high interest rates can quickly spiral into a cycle of debt. Repayment terms are often tight, leading to further financial strain if not carefully considered. |

| Student Loans | Loans taken out for educational purposes. | Can accumulate substantial debt, potentially impacting future financial decisions and ability to save for other goals. Defaulting can severely damage credit scores. |

| Mortgages | Loans used to purchase a home. | Significant debt obligation, but typically have lower interest rates compared to other forms of debt. Requires careful consideration of affordability. |

| Personal Loans | Loans for various personal needs, often with fixed interest rates. | Interest rates can vary, requiring careful comparison and consideration of repayment terms. Improper planning can lead to debt accumulation. |

Building a Solid Financial Foundation

A solid financial foundation is the bedrock upon which all future financial success is built. It’s not about achieving overnight riches, but rather establishing a system of saving, budgeting, and investing that works for your long-term goals. This process involves understanding your income and expenses, creating a realistic budget, and making informed decisions about saving and investing.A strong financial foundation safeguards you against unexpected events, allows you to achieve significant financial milestones, and provides a stable platform for future financial growth.

By proactively managing your finances, you can take control of your financial destiny and build a future that aligns with your aspirations.

Saving and Investing: The Cornerstones of Financial Security

Saving and investing are crucial components of a robust financial foundation. They allow you to accumulate wealth over time, providing a safety net against unexpected circumstances and enabling you to pursue your long-term financial objectives. Regular savings, even small amounts, compound over time, significantly increasing your financial security. Investing strategically in assets like stocks, bonds, or real estate can further amplify your returns, leading to substantial wealth accumulation.

Creating and Managing a Budget: Your Financial Roadmap

A budget is a crucial tool for effectively managing your finances. It provides a clear picture of your income and expenses, enabling you to allocate resources strategically and identify areas where you can save or cut back. A well-managed budget empowers you to make informed financial decisions, track your progress, and stay on course towards your financial goals.

- Track Your Income and Expenses: Carefully record all sources of income and all expenditures, both large and small. This comprehensive record will reveal patterns and help you identify areas where you can optimize your spending.

- Categorize Expenses: Group your expenses into categories such as housing, food, transportation, entertainment, and debt repayments. This categorization allows you to see where your money is going and identify areas for potential savings.

- Set Realistic Financial Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These goals should align with your overall life aspirations and provide direction for your budgeting and saving strategies.

- Review and Adjust Regularly: Your budget is not a static document. Review and adjust your budget periodically to reflect changes in your income, expenses, and financial goals. This flexibility ensures that your budget remains relevant and effective.

Investment Options and Potential Returns

Understanding various investment options and their potential returns is essential for building a strong financial foundation. This knowledge allows you to make informed decisions that align with your risk tolerance and long-term financial goals. Different investments have different risk levels and potential return profiles.

| Investment Type | Description | Potential Return (Example) | Risk Level |

|---|---|---|---|

| Stocks | Ownership in a company | 10-15% annually (average) | Medium to High |

| Bonds | Loan to a government or corporation | 3-7% annually (average) | Low to Medium |

| Real Estate | Owning property | 5-10% annually (average) | Medium to High |

| Mutual Funds | Portfolio of stocks, bonds, or other assets | Vary based on fund type | Medium |

| Index Funds | Track a specific market index | Generally mirrors market performance | Low |

Note: Investment returns are not guaranteed and can fluctuate. Past performance is not indicative of future results. Consult with a financial advisor to determine the most suitable investment options for your individual circumstances.

Financial Goals and Future Planning

Establishing financial goals and planning for the future is paramount for achieving long-term financial success. These goals provide direction and motivation, driving you towards specific financial milestones. Consider short-term, mid-term, and long-term goals.

- Short-Term Goals: These goals are typically achieved within a year or less, such as saving for a vacation or a down payment on a car.

- Mid-Term Goals: These goals span several years, such as saving for a house or starting a business.

- Long-Term Goals: These goals extend over a long period, such as retirement planning, funding children’s education, or building an estate.

Smart Spending Habits

Financial maturity isn’t just about managing debt or building savings; it’s deeply intertwined with how we approach spending. Smart spending habits are crucial for long-term financial health, enabling individuals to make choices that align with their values and goals. They help avoid the pitfalls of impulsive purchases and unnecessary expenses, fostering a sense of control and financial freedom.Financial maturity involves recognizing the difference between needs and wants, and making conscious choices aligned with long-term financial well-being.

It’s about understanding that delayed gratification often leads to greater rewards and avoiding the short-term temptations that can derail financial progress.

Prioritizing Needs Over Wants

Understanding the difference between needs and wants is fundamental to smart spending. Needs are essential for survival and well-being, such as food, shelter, and essential healthcare. Wants, on the other hand, are desires that enhance our comfort and lifestyle but aren’t crucial for basic survival. Financial maturity involves prioritizing needs over wants, ensuring essential requirements are met before pursuing discretionary spending.

This conscious choice helps prevent overspending and builds a stronger financial foundation.

The Value of Delayed Gratification and Long-Term Financial Planning

Delayed gratification is the ability to resist immediate temptations for a larger reward in the future. Financially mature individuals understand that making sacrifices today, such as forgoing a luxury item, can lead to significant financial gains in the long term, such as building an emergency fund, achieving a down payment on a house, or investing in retirement. Long-term financial planning is essential for navigating life’s uncertainties and achieving significant financial milestones.

This planning often includes setting financial goals, creating a budget, and consistently saving.

Avoiding Impulsive Purchases and Unnecessary Expenses

Impulsive purchases are often driven by emotions rather than rational considerations. Financial maturity involves developing a strategy to avoid these pitfalls. A critical component is recognizing triggers that lead to impulsive spending. This might involve identifying specific situations, like shopping malls or social media advertisements, and developing strategies to mitigate the impact of these triggers. Financial maturity also involves creating a system for evaluating the true value of an item before making a purchase.

This evaluation involves asking questions about necessity, affordability, and long-term value. Developing a system of tracking spending, understanding your spending patterns, and using a budget are critical steps.

Needs vs. Wants Comparison

| Characteristic | Needs | Wants |

|---|---|---|

| Definition | Essential for survival and well-being | Desires that enhance comfort and lifestyle |

| Examples | Food, shelter, healthcare, transportation | Dining out, entertainment, luxury items |

| Impact on Finances | Essential spending that must be met | Optional spending that can be adjusted |

| Importance | Crucial for basic needs and maintaining health | Adds comfort and pleasure but not essential |

Managing Risks and Unexpected Events

Life is full of surprises, some pleasant, some less so. Financial maturity includes the proactive preparation for unforeseen circumstances. Understanding and mitigating risks is crucial to maintaining financial stability and achieving long-term goals. A well-defined strategy for handling unexpected events can prevent significant setbacks and promote peace of mind.Financial risks are not limited to large-scale disasters; they can also manifest as smaller, but still impactful, events.

By implementing sound financial strategies, individuals can better navigate these challenges and maintain a positive financial outlook. This includes having a clear understanding of potential risks, developing contingency plans, and possessing the resilience to overcome setbacks.

Emergency Fund Essentials

A robust emergency fund is the cornerstone of financial preparedness. It acts as a safety net, providing a financial cushion to absorb unexpected expenses like job loss, medical emergencies, or car repairs. Ideally, this fund should cover 3-6 months of living expenses. Having this financial buffer reduces the pressure to resort to high-interest debt during times of crisis.

It provides peace of mind and the ability to make sound decisions without being forced into immediate, potentially damaging, financial actions.

Insurance Coverage Strategies

Insurance is a vital component of a comprehensive financial plan. It protects against potential losses arising from various unforeseen events. Different types of insurance address different risks, and the appropriate coverage depends on individual circumstances. It’s crucial to assess your needs and select insurance products that provide adequate protection against potential financial losses.

Financial Planning for Unforeseen Circumstances

Proactive financial planning for unforeseen circumstances is essential. This involves regularly reviewing and updating your financial plan to account for potential risks and changes in life circumstances. Regular financial planning reviews can help adjust strategies and mitigate risks. This is an ongoing process, not a one-time event. It should be part of a larger financial strategy.

Handling Financial Setbacks

Financial setbacks are inevitable. The key is to develop strategies for handling them. This includes maintaining a positive mindset, seeking professional advice when necessary, and developing a plan for recovery. Financial setbacks are a normal part of life. The ability to adapt and maintain a positive outlook is a critical component of financial resilience.

It’s about more than just the money; it’s about the mindset and approach to overcoming challenges.

Types of Insurance and Their Benefits

| Type of Insurance | Description | Benefits |

|---|---|---|

| Health Insurance | Covers medical expenses | Protects against substantial medical bills, preventing financial ruin. |

| Homeowners Insurance | Protects your home against damage | Covers repairs or replacement in case of fire, theft, or other events. |

| Auto Insurance | Covers damages from accidents | Protects against financial loss from accidents or damage to your vehicle. |

| Life Insurance | Provides financial security for beneficiaries | Provides a financial safety net for dependents in case of death. |

| Disability Insurance | Covers lost income due to disability | Provides income replacement if you are unable to work due to illness or injury. |

Responsible Investing and Asset Management

Financial maturity isn’t just about avoiding debt; it’s also about making smart choices with your investments. Responsible investing goes beyond simply seeking high returns; it considers the environmental, social, and governance (ESG) factors that impact your portfolio and the world around you. This approach aligns your financial goals with your values, creating a more sustainable and ethical investment strategy.Understanding how to manage and diversify investments is crucial for long-term financial health.

A diversified portfolio, with a range of assets, can help protect your wealth from market fluctuations and maximize potential returns. This involves carefully assessing risks and understanding the potential consequences of different investment choices. It’s not about taking unnecessary risks, but rather about making informed decisions based on your individual financial situation and goals.

Different Approaches to Responsible Investing

Responsible investing encompasses various strategies, moving beyond purely profit-driven approaches. Socially responsible investing (SRI) focuses on companies with strong ethical records, environmental performance, and fair labor practices. Impact investing seeks to generate financial returns while simultaneously creating a positive social or environmental impact. These approaches aren’t mutually exclusive; investors can combine elements of different strategies to create a portfolio that aligns with their values and financial objectives.

Strategies for Managing and Diversifying Investments

Effective investment management requires a proactive approach to diversification and risk mitigation. Diversifying across asset classes, such as stocks, bonds, real estate, and alternative investments, can reduce the impact of market downturns on your overall portfolio. Strategic asset allocation involves determining the optimal mix of assets based on your risk tolerance, time horizon, and financial goals. Regular rebalancing ensures your portfolio stays aligned with your desired asset allocation, especially as market conditions change.

Understanding Investment Risks, 18 things financially mature people dont

Investment risk is inherent in any market. Market risk refers to fluctuations in the overall market, impacting the value of various investments. Credit risk is the possibility that a borrower may not repay a loan or meet their obligations. Liquidity risk arises when an investment cannot be easily converted into cash without significant loss of value. Inflation risk reflects the potential erosion of purchasing power due to rising prices.

Understanding these risks and how they affect your investments is paramount to making informed decisions. Developing a risk tolerance profile helps to determine which investments best suit your individual situation and comfort level.

Creating a Diversified Investment Portfolio

A well-diversified portfolio is built on a foundation of understanding your personal circumstances and goals. The proportion of different asset classes in your portfolio should reflect your tolerance for risk, time horizon, and financial objectives. Factors like your age, employment status, and income level should all play a part in the composition of your portfolio. This should not be a one-time exercise but an ongoing process that needs to be adapted as your circumstances change.

Investment Options and Potential Risks/Returns

| Investment Option | Potential Risk | Potential Return |

|---|---|---|

| Stocks (Equities) | Market risk, company-specific risk | High, but variable |

| Bonds | Credit risk, interest rate risk | Generally lower than stocks, but still subject to market conditions |

| Real Estate | Liquidity risk, property-specific risk, market risk | Potentially high, depending on market conditions and property type |

| Alternative Investments (e.g., Private Equity, Hedge Funds) | Illiquidity, higher management fees, less transparency | Potentially higher returns, but also higher risk |

| Cash and Cash Equivalents | Low risk, low return | Preserves capital |

“Diversification is the only free lunch in investing.”

Ever wondered what separates financially savvy individuals from the rest? It’s not just about avoiding debt; it’s about a whole different mindset. While exploring the “18 things financially mature people don’t do,” it’s fascinating to see how these principles align with the 10 habits successful CEOs embody, like consistently seeking new knowledge and opportunities. For example, 10 habits successful ceos that you should adopt often revolve around calculated risk-taking and long-term vision – characteristics crucial for building lasting financial security.

Ultimately, understanding these principles helps you move past impulsive spending and towards a more mature approach to money management.

Harry Markowitz

Seeking Professional Advice

Financial maturity isn’t just about mastering budgeting or avoiding debt. It’s also about recognizing when you need expert guidance. Sometimes, navigating the complexities of investments, taxes, or estate planning requires specialized knowledge that even the most diligent self-learner might lack. This is where seeking professional financial advice becomes invaluable.Seeking professional advice is a proactive step, not a sign of weakness.

It’s about acknowledging the limitations of your own knowledge and leveraging the expertise of someone who has dedicated their career to understanding these intricate financial landscapes. Just like you wouldn’t attempt a complex surgery without a surgeon, you shouldn’t tackle a significant financial decision without considering professional consultation.

Importance of Professional Financial Advice

Financial advisors possess a wealth of knowledge and experience that can significantly impact your financial well-being. They can offer objective perspectives, unbiased analysis, and tailored strategies that cater to your specific circumstances. This expertise can help you avoid costly mistakes and make informed decisions that align with your long-term goals.

Benefits of Consulting a Financial Advisor

Consulting a financial advisor can bring numerous benefits. They can help you develop a comprehensive financial plan, identify potential risks, and create strategies to mitigate them. A financial advisor can also provide ongoing support and guidance as your circumstances evolve. This ongoing support is particularly helpful when dealing with significant life changes, such as starting a family, buying a home, or planning for retirement.

Different Types of Financial Advisors

Various types of financial advisors cater to specific needs and specializations. Understanding the differences is crucial in selecting the right advisor for your situation.

- Certified Financial Planners (CFPs): These advisors have undergone rigorous training and testing to demonstrate their proficiency in diverse financial areas, including retirement planning, investment strategies, and estate planning. They are committed to helping clients develop comprehensive financial plans that align with their personal values and goals.

- Investment Advisors: These advisors specialize in helping clients manage their investment portfolios. They provide guidance on selecting suitable investments, managing risk, and achieving long-term financial objectives. They often have specific expertise in different asset classes, such as stocks, bonds, or real estate.

- Estate Planners: Estate planners focus on the distribution of assets after death. They help clients develop wills, trusts, and other legal documents to ensure their assets are transferred according to their wishes.

- Tax Advisors: Tax advisors provide expertise in tax planning and compliance. They help individuals and businesses minimize their tax liability while adhering to all applicable regulations.

Situations Requiring Professional Help

There are numerous situations where seeking professional financial advice is crucial.

- Major Life Changes: Events like marriage, divorce, birth of a child, or significant career changes can drastically alter your financial situation. A financial advisor can help you adapt your plan to these new circumstances.

- Complex Investments: Navigating complex investment strategies, such as hedge funds or alternative investments, requires specialized knowledge. A financial advisor can help you understand the risks and rewards associated with these strategies.

- Retirement Planning: Retirement planning is a complex process requiring careful consideration of your goals, income, and expenses. A financial advisor can help you develop a retirement plan that meets your needs.

- Estate Planning: Estate planning ensures your assets are distributed according to your wishes. A financial advisor can guide you through the legal complexities of estate planning.

Financial Advisor Expertise Table

| Advisor Type | Areas of Expertise |

|---|---|

| Certified Financial Planner (CFP) | Retirement planning, investment strategies, estate planning, insurance planning, tax planning |

| Investment Advisor | Portfolio management, investment selection, risk management, asset allocation |

| Estate Planner | Will preparation, trust creation, asset distribution, probate administration |

| Tax Advisor | Tax planning, tax compliance, tax preparation, tax litigation |

Continuous Learning and Adaptation

Financial maturity isn’t a destination; it’s a journey of constant learning and adaptation. The world of personal finance is dynamic, with market trends, economic conditions, and personal circumstances constantly evolving. A financially mature individual understands the importance of staying informed and adjusting their strategies accordingly.The financial landscape is constantly shifting, making continuous learning a crucial component of financial well-being.

This isn’t just about keeping up with the latest investment strategies; it encompasses understanding broader economic trends, personal financial goals, and even adapting to life changes like marriage, children, or career transitions. A proactive approach to learning equips you with the tools to navigate these shifts effectively.

Staying Updated on Financial Matters

Staying informed about financial matters is not a one-time event but an ongoing process. This involves a blend of actively seeking knowledge and adapting to new information. Regularly reviewing your financial situation and updating your strategies based on new knowledge is essential for maintaining financial health.

- Financial News and Publications: Staying current with economic news and financial publications is crucial. Major financial news outlets, such as the Wall Street Journal, the Financial Times, and reputable online financial publications, offer valuable insights into market trends, economic forecasts, and investment strategies. By following these sources, you can identify emerging trends and adjust your financial plans accordingly.

- Online Courses and Workshops: Numerous online platforms provide comprehensive courses on personal finance, investing, and financial planning. These resources offer structured learning experiences, allowing you to gain specific knowledge in areas like budgeting, debt management, and retirement planning. Many platforms also provide certificates upon completion, enhancing your professional credibility and demonstrating a commitment to financial literacy.

- Financial Advisors and Mentors: Seeking guidance from financial advisors or mentors can provide personalized insights and support. They can help you navigate complex financial situations and adapt your strategies to your unique circumstances. This personalized approach can be invaluable in understanding and adjusting to market fluctuations and economic changes.

Adapting to Changing Economic Conditions and Market Trends

The global economy is inherently unpredictable, with economic cycles, market fluctuations, and geopolitical events influencing financial conditions. Adaptability is crucial in navigating these changes and ensuring your financial plan remains effective.

- Diversification of Investments: Diversifying your investments across various asset classes can help mitigate risk during market downturns. This approach reduces your exposure to any single investment and helps your portfolio withstand fluctuations in specific sectors or markets. For example, if a particular stock market sector declines, other investments may help cushion the blow.

- Adjusting Budget and Spending Habits: Economic downturns or unexpected events might require adjustments to your budget and spending habits. By reevaluating your spending patterns and identifying areas for potential savings, you can better weather economic storms. This may involve cutting discretionary expenses or finding ways to generate additional income.

- Reviewing and Rebalancing Investment Portfolio: Periodically reviewing and rebalancing your investment portfolio is essential to maintain alignment with your financial goals. Market conditions, economic shifts, and changes in your personal circumstances might necessitate adjustments to your asset allocation. This process ensures your investments continue to support your long-term financial objectives.

Reputable Financial Resources and Educational Materials

Access to reliable financial resources and educational materials is crucial for continuous learning. This allows you to make informed decisions and adapt your financial strategies to evolving conditions.

- Books: Numerous books offer valuable insights into various aspects of personal finance, investing, and financial planning. These resources provide a wealth of information on topics such as budgeting, saving, investing, and retirement planning. Authors such as Suze Orman and Dave Ramsey are recognized for their practical approaches to personal finance.

- Websites: Many reputable websites offer educational materials and resources on personal finance. Sites like NerdWallet, Investopedia, and The Motley Fool provide valuable insights, tools, and articles to help you understand financial concepts and make informed decisions.

- Government Resources: Government websites often provide valuable information on financial literacy and assistance programs. These resources can be a crucial starting point for learning about financial aid and other government initiatives that can help improve your financial situation.

Financial Independence and Freedom

Financial independence and freedom aren’t just about having a lot of money; they’re about having the financial resources to live life on your own terms. It’s the freedom to pursue passions, take calculated risks, and avoid the pressure of financial constraints. This crucial stage of financial maturity requires a deliberate and well-structured approach.Financial independence isn’t an automatic consequence of wealth; it’s a state of mind and a deliberate choice.

It’s the culmination of sound financial habits, strategic planning, and a proactive approach to building a robust financial future. It empowers individuals to live life according to their values and priorities, rather than being dictated by financial obligations.

The Relationship Between Financial Maturity and Independence

Financial maturity plays a pivotal role in achieving financial independence. Mature individuals approach finances with a long-term perspective, understanding that financial freedom is a journey, not a destination. They develop strategies for building wealth, minimizing debt, and maximizing their financial resources, rather than relying on quick fixes or impulsive decisions.

Strategies for Achieving Financial Freedom

A crucial aspect of achieving financial freedom is developing a comprehensive strategy. This involves understanding your current financial situation, setting realistic goals, and creating a roadmap to reach them. This roadmap should include a clear understanding of expenses, income, and investment opportunities. A realistic budget is essential for tracking progress and making necessary adjustments. Building an emergency fund is also a critical step.

- Detailed Budgeting and Expense Tracking: Careful monitoring of income and expenses allows for identification of areas for improvement. Using budgeting tools, apps, or even a simple spreadsheet can significantly aid in this process. Understanding where your money goes is the first step toward making informed decisions about how to allocate it more effectively.

- Debt Management and Elimination: High-interest debt, such as credit card debt, significantly hinders financial progress. A strategic debt repayment plan, such as the debt avalanche or snowball method, can accelerate debt reduction and free up resources for savings and investments.

- Investment Diversification: Diversifying investments across various asset classes (stocks, bonds, real estate, etc.) is crucial for long-term growth and risk mitigation. A well-diversified portfolio can help weather market fluctuations and maximize returns.

Building Passive Income Streams

Passive income streams are a powerful tool for achieving financial freedom. They provide a consistent flow of income without requiring significant time investment. This is a key characteristic of financial independence. The beauty of passive income is that it allows you to build wealth while also having more flexibility in your life.

- Dividend-Paying Stocks: Investing in companies that pay regular dividends can generate a steady stream of passive income. Researching companies with a history of consistent dividend payments and evaluating their financial health is essential.

- Rental Properties: Owning and managing rental properties can create a significant passive income stream. However, it requires significant upfront investment and ongoing management responsibilities.

- Online Businesses: Creating and managing an online business, such as a blog, e-commerce store, or digital product, can generate passive income through recurring sales or subscriptions.

Comparing Passive Income Methods

| Method | Description | Investment Required | Time Commitment | Risk |

|---|---|---|---|---|

| Dividend-Paying Stocks | Investing in companies that pay regular dividends. | Moderate | Low | Moderate (market risk) |

| Rental Properties | Owning and managing rental properties. | High | Moderate | Moderate (property management, market risk) |

| Online Businesses | Creating and managing an online business. | Variable | Variable | Variable (depends on the business model) |

Ethical Financial Practices

Honesty and integrity are cornerstones of financial well-being. Ethical financial practices not only build trust but also foster a sense of responsibility and long-term stability. This section delves into the importance of ethical conduct in financial matters, highlighting the potential consequences of dishonest dealings and showcasing examples of both ethical and unethical behavior.Ethical financial practices are crucial for building a strong financial foundation.

They ensure trust with financial institutions, creditors, and fellow individuals, laying the groundwork for positive relationships and future opportunities.

Importance of Ethical Financial Practices

Ethical financial practices build trust and credibility. This trust is essential for securing loans, attracting investors, and maintaining positive relationships with financial institutions and fellow individuals. When financial dealings are conducted with integrity, it fosters a sense of security and stability, both personally and within the broader financial community.

Implications of Dishonest Financial Dealings

Dishonest financial dealings have severe repercussions. Lying about income or assets can lead to the rejection of loan applications, the loss of trust with lenders, and legal penalties. Fraudulent activities, such as embezzlement or misrepresentation, can result in criminal charges and significant financial losses for both the perpetrator and the victims. Furthermore, dishonest dealings can harm one’s reputation and make it difficult to secure future financial opportunities.

Examples of Ethical Financial Behaviors

Ethical financial behaviors include accurate record-keeping, transparent communication with creditors, and adhering to all relevant financial regulations. Honoring commitments, such as loan repayments or contract obligations, exemplifies responsible financial conduct. Open communication and truthfulness in all financial dealings build trust and reinforce a reputation for integrity.

- Accurate reporting of income and expenses in tax filings.

- Paying bills on time and in full.

- Honoring financial commitments, such as loan agreements.

- Maintaining transparent and honest financial records.

- Seeking professional advice from certified financial advisors.

Examples of Unethical Financial Behaviors and Their Consequences

Unethical financial behaviors encompass a range of dishonest practices. These include misrepresenting income, falsifying documents, and intentionally defaulting on loans. These actions not only damage personal reputation but also erode trust within the financial system. Consequences can range from financial penalties and legal ramifications to reputational damage that can hinder future financial opportunities.

- Tax evasion: Avoiding or underreporting taxes can result in significant fines, legal penalties, and damage to one’s reputation.

- Fraudulent activities: Misrepresenting information to obtain loans or other financial benefits leads to legal issues and potential imprisonment.

- Identity theft: Using someone else’s identity to obtain financial benefits results in criminal charges and severe consequences for both the victim and the perpetrator.

- Embezzlement: Misappropriating funds entrusted to one’s care leads to significant financial penalties, criminal prosecution, and damage to one’s career.

- Defaulters: Intentionally failing to meet financial obligations, such as loan repayments, damages creditworthiness and can result in legal actions.

How to Make Responsible Financial Decisions

Responsible financial decisions are based on transparency, honesty, and a commitment to adhering to ethical standards. It is essential to be mindful of the potential consequences of actions, to ensure decisions align with personal values and principles. Seeking professional advice from certified financial advisors can offer guidance and support in navigating complex financial situations ethically.

- Thorough research: Before making any financial decisions, conduct thorough research to understand the implications and potential risks.

- Seek professional advice: Consult with certified financial advisors to gain guidance and insights into ethical financial practices.

- Prioritize transparency: Maintain transparent communication with financial institutions and creditors to build trust and avoid misunderstandings.

- Adhere to legal and ethical standards: Ensure all financial activities comply with legal and ethical guidelines.

Epilogue

In conclusion, financial maturity isn’t about perfection, but about conscious choices. By avoiding the 18 things highlighted here, you can build a stronger financial foundation, navigate challenges with confidence, and ultimately achieve financial freedom. Remember, it’s a continuous journey of learning and adaptation. Let’s embrace the power of financial intelligence!