10 ways make sure you never have face financial crisis. This guide delves into practical strategies for building a strong financial foundation. We’ll explore everything from creating a robust budget and building an emergency fund to managing debt, making smart spending choices, and generating additional income. By understanding these key principles, you can take control of your financial future and navigate any economic storm.

From meticulous budgeting and debt reduction to smart spending and income diversification, this comprehensive guide equips you with the knowledge and tools to achieve lasting financial security. Each section offers actionable advice and practical examples, making it easy to apply these concepts to your personal circumstances.

Budgeting and Financial Planning

Mastering your finances is crucial for long-term security. A well-structured budget is the cornerstone of financial well-being. It empowers you to understand where your money goes, identify areas for improvement, and build a path toward financial freedom. A comprehensive budget is not just a list of numbers; it’s a roadmap to achieving your financial goals.Effective budgeting involves careful tracking of income and expenses, proactive identification of unnecessary spending, and strategic prioritization of saving and investment.

This proactive approach allows you to anticipate future needs and make informed decisions about your financial resources.

Creating a Comprehensive Budget

A comprehensive budget is a detailed record of all your income and expenses over a specific period, usually a month. This detailed record allows for a thorough understanding of your financial situation. Accurate income tracking is vital, encompassing all sources of revenue, including salary, freelance income, investments, and any other inflows. Equally important is meticulous expense tracking, which includes all outflows, from essential utilities to discretionary spending.

By meticulously recording every transaction, you gain a clear picture of your spending habits.

Identifying and Eliminating Unnecessary Expenses

Pinpointing unnecessary expenses is a key step in budget management. This process often involves scrutinizing spending habits and identifying areas where costs can be reduced. Reviewing recent transactions can reveal patterns of unnecessary spending. Analyzing spending categories helps pinpoint areas for potential cost reductions. For instance, subscription services that are no longer used, or excessive dining-out habits, could be significant contributors to unnecessary spending.

Prioritizing Saving and Investing

Prioritizing saving and investing is fundamental to securing your financial future. It is vital to allocate a portion of your income towards savings and investments. This allocation is a proactive approach to building financial security. An emergency fund is essential to cushion against unexpected expenses, like car repairs or medical emergencies. Retirement planning, through dedicated contributions, ensures a comfortable financial future.

Figuring out how to avoid financial crises is crucial, especially in your twenties. Learning smart money management skills is key, and understanding the importance of budgeting and saving, like in the 10 ways to avoid financial crises, is essential. However, building a solid foundation also involves having the right tools and resources, which is what 8 things all 20 something women need own highlights.

These crucial tools, from a reliable bank account to essential tech, can help you navigate life’s financial challenges and ultimately contribute to those 10 ways to secure your financial future.

Sample Budget Template

A sample budget template helps organize your finances effectively. The template should include columns for different categories of income and expenses. A detailed breakdown of income sources and expense categories is crucial for clarity.| Category | Income | Expenses ||—|—|—|| Salary | $4,000 | Rent $1,000 || Freelance | $500 | Utilities $200 || Investments | $100 | Groceries $300 || Other Income | | Transportation $150 || Total Income | $4,600 | Clothing $100 || Total Expenses | | Entertainment $150 || Savings | $500 | Other Expenses $500 |

Saving Strategies, 10 ways make sure you never have face financial crisis

Developing effective saving strategies is crucial for achieving your financial goals. The establishment of a dedicated emergency fund safeguards against unforeseen circumstances. It serves as a financial safety net during unexpected financial challenges. Retirement savings, through dedicated contributions, ensures a comfortable financial future. Long-term financial goals can be achieved through diligent saving and investment strategies.

Regular Budget Review and Adjustment

Regularly reviewing and adjusting your budget is essential to maintain financial stability. This involves a periodic evaluation of income and expenses, identifying areas for improvement. Budget adjustments are vital to accommodate life changes, such as career transitions or increased household expenses. The budget should be flexible to adapt to evolving circumstances.

Comparison of Budgeting Methods

Different budgeting methods offer various approaches to managing finances. A comparison of these methods reveals their strengths and weaknesses.| Method | Description | Advantages | Disadvantages ||—|—|—|—|| Zero-Based Budgeting | All income is allocated to specific expenses or savings | High awareness of spending | Can be time-consuming || 50/30/20 Rule | 50% needs, 30% wants, 20% savings | Simple to understand | May not fit every lifestyle |

Emergency Fund and Financial Security

Having a solid financial plan is crucial, but a crucial component often overlooked is the emergency fund. It’s a safety net, providing peace of mind knowing you can weather unexpected storms without jeopardizing your long-term financial goals. This safety net can cushion you from financial hardship, allowing you to focus on recovery and solutions instead of being overwhelmed by the crisis.An emergency fund acts as a financial buffer against unforeseen events like job loss, medical emergencies, or car repairs.

It’s a critical component of financial security, ensuring you maintain a stable financial footing during challenging times.

Importance of Building an Emergency Fund

An emergency fund is vital for safeguarding your financial well-being. It provides a safety net for unexpected expenses, preventing you from accumulating debt or compromising your long-term financial goals. Without this buffer, unexpected events can derail your progress, potentially leading to significant financial stress. Having this cushion allows you to address the situation without compromising other financial commitments.

Amount Needed for an Emergency Fund

The ideal emergency fund amount depends on your individual circumstances and lifestyle. A general guideline is to aim for 3-6 months of living expenses. This amount will cover essential costs like rent, utilities, groceries, and transportation in case of a job loss or unexpected financial disruption. A 6-month fund is ideal for individuals with significant financial obligations or those in precarious employment situations.

Examples of Unexpected Expenses Covered by an Emergency Fund

An emergency fund can cover a wide range of unexpected expenses, such as:

- Medical emergencies: Unexpected illnesses or injuries requiring substantial medical care can quickly drain savings. An emergency fund can alleviate this burden, allowing you to focus on recovery.

- Job loss: Unemployment can lead to a significant loss of income, making it difficult to cover essential expenses. An emergency fund acts as a safety net during this transition.

- Car repairs: A sudden breakdown or major repair can be an unexpected expense, placing a strain on your finances. An emergency fund provides the necessary resources to handle such situations.

- Home repairs: Unexpected home repairs or replacements can be substantial and can lead to significant financial stress. An emergency fund allows you to cover these expenses without accruing debt.

- Natural disasters: Natural disasters can cause significant damage to property and disrupt daily life. An emergency fund can provide financial support to cover the costs of repairs and recovery.

Strategies for Quickly Accumulating an Emergency Fund

Building an emergency fund takes time and discipline, but several strategies can help you achieve your goal faster.

- Create a budget: A detailed budget is essential for identifying areas where you can cut expenses and allocate funds towards your emergency fund. Tracking your income and expenses allows you to see where your money is going and make necessary adjustments to prioritize saving.

- Automate savings: Setting up automatic transfers from your checking account to your savings account each month can ensure consistent contributions to your emergency fund without requiring conscious effort. This automatic approach ensures steady growth.

- Reduce unnecessary expenses: Identify and eliminate unnecessary expenses to free up more funds for your emergency fund. This can involve cutting back on subscriptions, dining out less frequently, or finding more affordable alternatives for goods and services.

- Increase income: Consider ways to increase your income to contribute more to your emergency fund. This can involve taking on a side hustle, freelancing, or negotiating a raise at your current job.

Investment Options for Building Wealth

Investing your emergency fund can potentially grow your savings over time. However, it’s essential to consider your risk tolerance and financial goals.

- High-yield savings accounts: These accounts offer a slightly higher interest rate compared to traditional savings accounts, allowing your money to grow at a faster pace.

- Certificates of deposit (CDs): CDs offer a fixed interest rate and maturity date, providing a predictable return on your investment. They are generally considered a lower-risk option.

- Money market accounts: These accounts typically offer a higher interest rate than savings accounts and allow for limited check writing or withdrawals.

Strategies for Protecting Your Assets

Protecting your assets is an essential part of financial security.

- Insurance: Having adequate insurance coverage is vital for safeguarding your assets from unforeseen events. This includes health, life, and property insurance.

Types of Insurance and Their Importance

| Type of Insurance | Importance |

|---|---|

| Health Insurance | Covers medical expenses, ensuring you can afford necessary treatments and procedures without financial strain. |

| Life Insurance | Provides financial security for your loved ones in case of your untimely death, covering their financial needs. |

| Property Insurance | Protects your home or other property from damage caused by events like fire, theft, or natural disasters. |

Calculating Emergency Fund Amount

To determine the appropriate amount for your emergency fund, calculate your monthly living expenses. Multiply this amount by 3-6 to estimate the necessary fund. For example, if your monthly expenses are $2,000, a 3-month emergency fund would be $6,000, while a 6-month fund would be $12,000.

Amount Needed = Monthly Expenses

(Number of Months of Expenses)

Debt Management and Reduction

Managing debt effectively is crucial for financial well-being. Uncontrolled debt can lead to significant financial strain, impacting your ability to save, invest, and achieve your long-term goals. A proactive approach to debt management empowers you to take control of your financial future and build a stronger financial foundation.Debt comes in various forms, each with unique implications for your finances.

Understanding these types and their impact is the first step towards effective management.

Different Types of Debt and Their Impact

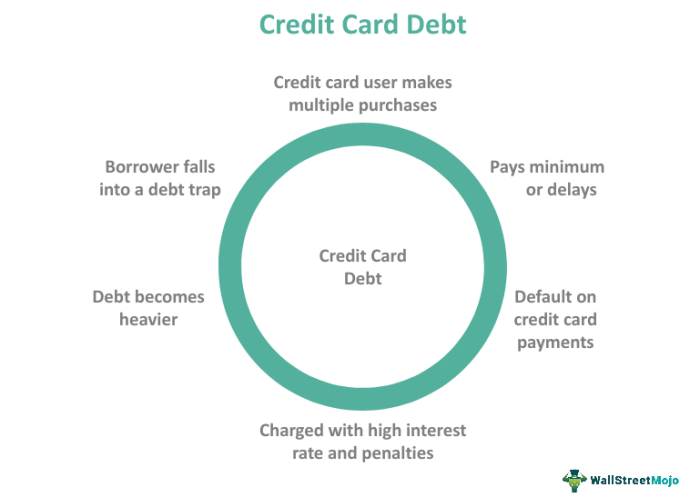

Different types of debt have varying degrees of impact on your finances. Credit card debt, with its often high interest rates, can quickly spiral out of control if not managed carefully. Student loans, while often necessary for educational advancement, can represent a substantial financial burden for years to come. Personal loans, used for various purposes, also carry interest charges that must be factored into your budget.

Knowing 10 ways to avoid financial crises is crucial, especially for entrepreneurs. Facing the pressures of starting a business can be incredibly stressful, and understanding these challenges is key to navigating them successfully. For example, check out entrepreneurial stress 10 scenarios and their solutions to see how different situations impact your financial well-being. Ultimately, proactively addressing these potential stressors is a vital part of building a solid financial foundation for your entrepreneurial journey.

Understanding the characteristics of each type of debt is essential to developing a personalized debt reduction strategy.

Strategies for Reducing High-Interest Debt

High-interest debt, like credit card debt, can quickly accumulate significant interest charges. Strategies for reducing this type of debt often involve aggressive repayment plans. Prioritizing high-interest debt for repayment can substantially reduce overall interest paid. For example, if you have a credit card with 18% interest and another with 10%, focusing on the 18% card first can significantly reduce your total interest costs.

Utilizing a balance transfer card, with its 0% introductory APR, can be a temporary solution, but only if you pay off the balance before the introductory period ends to avoid accruing interest.

Debt Consolidation and Balance Transfer Strategies

Debt consolidation involves combining multiple debts into a single loan or account with a potentially lower interest rate. This can simplify repayment and potentially save you money in interest charges. Balance transfer cards offer a temporary reprieve from high interest rates, often with a 0% APR introductory period. However, it’s crucial to pay off the balance completely within the introductory period to avoid incurring significant interest charges.

Example: Consolidating multiple credit card debts into a personal loan with a lower interest rate can significantly reduce your monthly payments and total interest paid.

Importance of Credit Management and Building a Good Credit Score

Maintaining a healthy credit score is crucial for future financial opportunities. A good credit score can help you secure loans, mortgages, and other financial products at favorable rates. Credit management involves responsible use of credit cards and timely payments. Paying bills on time and keeping credit utilization low are key factors in maintaining a good credit score.

For example, consistently paying your credit card bills on time and keeping your credit utilization below 30% will positively influence your credit score.

Techniques for Negotiating with Creditors

Negotiating with creditors can sometimes result in better terms on your debt. While not always successful, contacting creditors to discuss potential payment plans or reduced interest rates might lead to favorable outcomes. Example: If you’re experiencing temporary financial hardship, contacting your creditors to discuss a temporary payment plan can provide a lifeline. It’s essential to be upfront and honest about your situation.

Debt Management Plans

| Debt Management Plan | Description | Advantages | Disadvantages |

|---|---|---|---|

| Debt Snowball | Focuses on paying off the smallest debts first to build momentum. | Motivational, builds confidence, quick wins. | May result in paying more interest overall. |

| Debt Avalanche | Prioritizes debts with the highest interest rates first. | Reduces overall interest paid, potentially saves money. | Less motivational, requires more discipline. |

Different debt reduction methods have their own set of advantages and disadvantages. Careful consideration of your financial situation and personal preferences is key to choosing the most effective strategy. For instance, the debt snowball method might be more suitable for individuals motivated by achieving quick wins, while the debt avalanche method might be better for those seeking the most significant financial savings over the long term.

Smart Spending Habits and Avoiding Impulse Purchases

Mastering your spending habits is crucial for long-term financial health. Impulse purchases, driven by emotional triggers, can quickly erode your savings and derail your financial goals. This section dives into the psychology behind these urges and provides actionable strategies to break free from the cycle of impulsive spending.Understanding the psychological underpinnings of spending is key to managing it effectively.

Our brains are wired to seek immediate gratification, often overriding rational financial decisions. This tendency is amplified by factors like advertising, social media, and peer pressure, making impulse purchases a common challenge for many.

The Psychology of Impulse Buying

Impulse purchases are often driven by emotional responses rather than rational considerations. Factors like stress, boredom, or even feelings of inadequacy can trigger the urge to buy. Understanding these emotional triggers is the first step toward managing them. Recognizing patterns in your spending can help you identify what situations and emotions lead to impulsive purchases. This self-awareness is critical to developing effective strategies for control.

Identifying Triggers for Impulsive Spending

Several factors can trigger impulsive spending. These include: experiencing strong emotions like stress, boredom, or anxiety; seeing desirable products advertised or promoted; social pressure to keep up with peers; or simply a lack of awareness regarding your financial situation. Recognizing these triggers is crucial to preventing impulsive spending. Keeping a spending journal can help track spending patterns and identify common triggers.

Strategies for Making Conscious Spending Choices

Conscious spending involves making deliberate choices about what you buy and how much you spend. This approach requires mindful awareness of your financial situation and goals. The goal is to separate emotional desires from rational needs. Consider the following steps:

- Prioritize Needs Over Wants: Distinguish between essential items and non-essential items. Focusing on needs first allows for more conscious spending choices, preventing you from overspending on wants.

- Create a Budget and Stick to It: A well-defined budget provides a clear framework for spending. This limits discretionary spending to allocated amounts.

- Delay Gratification: Resisting the immediate urge to purchase items can save you money. Consider the long-term implications of each purchase.

Budgeting Apps and Tools

Several budgeting apps and tools can assist in tracking spending and managing finances. These tools provide valuable insights into spending patterns and help users develop better spending habits. Examples include Mint, Personal Capital, and YNAB (You Need a Budget). These tools often offer features like automated savings, goal setting, and expense tracking, all of which aid in responsible financial management.

The Importance of Delayed Gratification and Financial Discipline

Delayed gratification is the ability to resist immediate temptations in favor of long-term rewards. Financial discipline is crucial for achieving financial goals and avoiding unnecessary debt. Delayed gratification often requires self-control and a commitment to long-term financial well-being.

Managing Impulse Purchases

Different methods can be used to manage impulse purchases. These include waiting periods, mental budgeting, and setting spending limits. The effectiveness of each method depends on individual preferences and circumstances.

| Method | Description | Pros | Cons |

|---|---|---|---|

| Waiting Period | Postponing a purchase for a set period (e.g., 24 hours, 3 days). | Reduces emotional spending, allows for reflection. | Requires discipline, might miss out on limited-time offers. |

| Mental Budgeting | Allocating a mental budget for non-essential purchases. | Helps visualize spending limits, improves awareness. | Can be less precise than written budgets. |

| Setting Spending Limits | Establishing a maximum amount to spend on non-essential items. | Provides clear boundaries, prevents overspending. | Might require adjustments if needs change. |

Avoiding Overspending During Special Occasions

Special occasions and holidays can often lead to increased spending. It’s essential to plan ahead and create a budget specifically for these events. Setting realistic expectations and limiting gift-giving can help manage expenses effectively. Also, consider alternative ways to celebrate that don’t involve large expenditures.

Income Generation and Increasing Earnings

Expanding your income stream is crucial for achieving financial security and stability. Beyond your primary job, exploring supplementary income sources provides a buffer against unexpected expenses and allows for greater financial flexibility. This can be achieved through various avenues, from part-time work to freelance gigs, and even by developing in-demand skills.

Strategies for Increasing Income

Diversifying income sources isn’t just about making more money; it’s about building resilience and controlling your financial destiny. Strategies include exploring additional work opportunities, upskilling, and leveraging existing talents. By adopting these strategies, you can develop a more robust financial foundation.

Part-time Jobs and Side Hustles

Exploring part-time jobs or side hustles can significantly increase your income. These opportunities often require less commitment than a full-time position and can be tailored to your schedule and interests. Consider your existing skills and available time to find suitable options.

- Tutoring: Sharing your expertise in a subject you’re passionate about can be a lucrative side hustle. Subjects like math, science, or English can be highly sought after, especially in communities with high student populations.

- Virtual Assistant: Many businesses require assistance with tasks like scheduling, email management, or social media marketing. If you have strong organizational and communication skills, this could be a good fit.

- Delivery Services: Platforms like DoorDash or Uber Eats provide opportunities for flexible work, allowing you to set your own hours and earn income based on demand.

Freelance Work and Online Opportunities

The internet has opened up a world of freelance opportunities. Many freelancers work remotely, offering services like writing, graphic design, web development, or social media management. This flexibility is appealing to many, especially those with a specific skill set.

- Writing: If you have strong writing skills, consider offering your services for blog posts, articles, or website copy. Many freelance writing platforms connect you with clients seeking writers.

- Graphic Design: Design skills are in high demand across various industries. If you’re proficient in design software, you can create logos, brochures, or other visual materials for clients.

- Social Media Management: Helping businesses manage their social media presence can be a rewarding and potentially lucrative side hustle. Strong communication and marketing skills are key here.

Skills Development and Career Advancement

Investing in your skills is a crucial aspect of increasing your income potential. Continuous learning and skill enhancement are essential for long-term financial growth and advancement in any field.

- Online Courses: Platforms like Coursera, Udemy, and edX offer a vast selection of online courses that can teach new skills or enhance existing ones.

- Certifications: Earning certifications in specific areas can increase your marketability and command higher fees or salaries.

- Networking: Connecting with professionals in your field can open doors to new opportunities and help you discover freelance projects or potential career advancements.

Finding Freelance Work and Side Hustles

Various platforms and resources can help you connect with potential clients or employers. Using these resources can greatly improve your chances of success in finding the right freelance opportunities.

- Freelance Platforms: Sites like Upwork, Fiverr, and Guru connect freelancers with clients seeking various services.

- Job Boards: General job boards may also list freelance or part-time positions.

- Networking Events: Attending industry events or workshops can provide opportunities to network and find new clients or employers.

Salary Negotiation

Negotiating your salary or fees is a crucial skill for maximizing your income. Researching industry standards and understanding your worth is key to getting a fair compensation.

- Market Research: Understanding the prevailing rates for your skills and services in your region is vital.

- Value Proposition: Highlighting your unique skills and accomplishments can support your requests for higher compensation.

- Confidence: Present yourself professionally and confidently when discussing your compensation.

Comparing Income-Generating Opportunities

A table comparing different income-generating options can help you evaluate their potential risks and rewards.

| Opportunity | Potential Earnings | Time Commitment | Skills Required | Potential Risks |

|---|---|---|---|---|

| Tutoring | Variable | Flexible | Subject Matter Expertise | Finding students, managing schedules |

| Virtual Assistant | Variable | Flexible | Organization, Communication | Maintaining client relationships, dealing with technical issues |

| Freelance Writing | Variable | Flexible | Strong Writing Skills | Finding clients, managing deadlines |

Risks and Rewards

Each income-generating method comes with potential risks and rewards. Understanding these aspects is crucial for making informed decisions. Carefully consider your resources and circumstances before committing to a particular opportunity.

- Freelancing: While offering flexibility, freelance work can be unpredictable in terms of income. Building a consistent client base and managing your own workload are essential.

- Part-time Jobs: These options can provide a consistent income stream, but often come with a set schedule and may not always offer the flexibility of other opportunities.

- Side Hustles: These options can vary significantly in their potential for earning and often require initial investment of time and resources to build a client base or establish a reliable income stream.

Investing and Financial Literacy

Investing is a crucial component of long-term financial security. It allows your money to grow over time, outpacing inflation and helping you achieve your financial goals, whether it’s buying a home, funding your children’s education, or retiring comfortably. Understanding basic investment principles and strategies is essential for making informed decisions and maximizing your returns.Mastering investment principles empowers you to make sound financial choices.

It enables you to assess risks, evaluate potential returns, and align your investment strategies with your individual financial goals and risk tolerance. This knowledge is a key element in building a sustainable and prosperous financial future.

Understanding Basic Investment Principles

Investment principles are fundamental to navigating the world of finance. Understanding these principles allows you to make informed decisions and align your investments with your personal financial goals. A key principle is the concept of risk and return: generally, higher potential returns come with higher risks. Diversification, spreading your investments across different asset classes, is another important principle to mitigate risk.

Examples of Different Investment Options

A variety of investment options exist, each with its own characteristics and risk profiles. Stocks represent ownership in a company, potentially offering significant returns but also carrying higher risk. Bonds represent loans to a government or corporation, offering a more stable return but often with lower growth potential. Mutual funds pool money from multiple investors to invest in a diversified portfolio of assets, offering a convenient way to diversify your holdings.

Strategies for Diversifying Your Investment Portfolio

Diversification is a critical strategy for managing risk. A diversified portfolio includes investments across various asset classes (stocks, bonds, real estate, etc.) and industries to reduce the impact of any single investment’s poor performance. By spreading your investments, you mitigate the risk of significant losses if one area of your portfolio underperforms. Consider factors such as your risk tolerance, investment horizon, and financial goals when creating a diversified portfolio.

Resources for Learning More About Personal Finance and Investing

Numerous resources are available to enhance your knowledge of personal finance and investing. Books, websites, and financial advisors can provide valuable insights. Online courses and workshops are also effective learning tools, offering practical guidance and interactive learning experiences. Seek out reputable sources for information and consider consulting a financial advisor for personalized guidance.

Figuring out 10 ways to avoid financial crises often boils down to smart decision-making. Developing strong critical thinking skills is crucial for evaluating potential investments and understanding market trends. Learning how to identify and avoid scams, analyze risk, and make informed choices, like through how to learn critical thinking , will ultimately help you navigate the complexities of finances and make sound decisions that keep you out of trouble.

Ultimately, these practical skills are key to long-term financial security.

Importance of Long-Term Financial Planning

Long-term financial planning is essential for achieving your financial goals. It involves defining your financial objectives, creating a budget, and developing an investment strategy aligned with your goals and timeline. Consider your desired lifestyle, future expenses, and potential income sources to develop a comprehensive plan that guides your financial decisions.

Investment Strategies and Potential Returns

| Investment Strategy | Potential Return | Risk Level |

|---|---|---|

| Growth Stocks | High | High |

| Index Funds | Moderate | Low |

| Bonds | Low to Moderate | Low |

| Real Estate | Moderate to High | Moderate |

This table illustrates the potential return and risk associated with various investment strategies. Note that past performance is not indicative of future results. Always conduct thorough research and consider your risk tolerance before making investment decisions.

Choosing Investments Aligned with Your Risk Tolerance

Understanding your risk tolerance is crucial for making informed investment decisions. Assess your comfort level with potential losses and evaluate your ability to withstand market fluctuations. Conservative investors may favor lower-risk investments like bonds, while aggressive investors may prioritize higher-risk, higher-return investments like growth stocks. Align your investments with your risk tolerance to achieve your financial goals without undue stress.

Risk Management and Insurance

Financial security isn’t just about building wealth; it’s also about protecting it. Unforeseen events can significantly impact your financial well-being. A robust risk management strategy, coupled with appropriate insurance coverage, is crucial for weathering these storms and maintaining financial stability. Understanding and mitigating potential risks is key to building a resilient financial future.Effective risk management involves proactively identifying and addressing potential threats to your financial health.

This proactive approach can prevent significant financial setbacks caused by unforeseen events, ensuring you can maintain your financial goals and avoid undue stress. Insurance acts as a safety net, providing financial support when unexpected events occur.

Risk Assessment and Mitigation

A critical step in risk management is assessing potential financial risks. This involves evaluating various factors that could negatively impact your financial situation. Examples include health issues, job loss, natural disasters, and accidents. Proper assessment allows for the development of strategies to mitigate these risks. By identifying potential problems, you can create a plan to lessen their impact.

Examples of Financial Risks

Unforeseen events can disrupt financial stability. These risks can stem from various sources. Health issues, such as unexpected illnesses or accidents, can lead to substantial medical expenses. Job loss can result in a sudden cessation of income, impacting your ability to meet financial obligations. Natural disasters, such as floods or earthquakes, can cause significant property damage, impacting both your assets and your budget.

These are just a few examples; the key is to acknowledge their potential impact and create strategies to protect yourself.

Importance of Insurance Policies

Insurance policies provide a safety net, offering financial protection against various risks. Purchasing appropriate insurance policies is vital for safeguarding your assets and financial well-being. Policies can offer coverage for various potential risks, allowing you to manage the financial fallout of unexpected events. This helps maintain your financial stability in times of adversity.

Diversifying Assets to Manage Risk

Diversifying your assets is a fundamental risk management strategy. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and mutual funds. This strategy helps to reduce the impact of potential losses in any single investment. If one investment performs poorly, others may offset the losses, minimizing the overall financial impact. This strategy, therefore, is crucial for a comprehensive risk management plan.

Resources for Understanding Risk Management

Numerous resources are available to enhance your understanding of risk management in personal finance. Financial advisors, online courses, and reputable financial publications can provide valuable insights and guidance. Seeking professional advice can be highly beneficial in developing a personalized risk management plan tailored to your specific circumstances and goals.

Types of Insurance and Coverage

| Type of Insurance | Coverage |

|---|---|

| Health Insurance | Covers medical expenses arising from illnesses or injuries. |

| Life Insurance | Provides financial support to beneficiaries upon the death of the insured. |

| Homeowners Insurance | Covers property damage and liability from various events like fire, theft, or accidents. |

| Auto Insurance | Covers damage to your vehicle and liability in case of accidents. |

| Disability Insurance | Provides income replacement if you become unable to work due to injury or illness. |

Evaluating Risk Tolerance and Selecting Insurance Options

Understanding your risk tolerance is key to selecting suitable insurance options. Consider factors such as your income, assets, and overall financial goals. A high-risk tolerance might allow for less comprehensive insurance coverage, while a low-risk tolerance may necessitate more extensive protection. Carefully evaluate your needs and select insurance options that provide adequate coverage without unnecessary financial burden.

Seeking Professional Advice and Support

Financial success often requires more than just personal effort. Seeking guidance from qualified professionals can be a crucial step in navigating complex financial landscapes and achieving long-term goals. A financial advisor can offer personalized strategies tailored to your unique circumstances and help you avoid potential pitfalls.Understanding your financial situation, identifying your goals, and developing a comprehensive plan can be challenging.

A financial advisor can act as a valuable resource, helping you make informed decisions, manage risk effectively, and ultimately build a secure financial future. Their expertise extends beyond basic budgeting and includes investment strategies, retirement planning, and estate management.

Benefits of Consulting a Financial Advisor

A financial advisor can provide a wealth of benefits, from personalized financial plans to objective advice. They can help you:

- Develop a comprehensive financial plan tailored to your individual needs and goals.

- Navigate complex financial situations, such as high-value investments or complicated estate planning.

- Manage risk effectively, protecting your assets and minimizing potential losses.

- Make informed investment decisions, maximizing returns and mitigating risk.

- Reduce financial stress by providing clear strategies and support.

- Develop effective budgeting and saving strategies to achieve your financial goals.

Different Types of Financial Advisors and Their Services

Various financial advisors cater to different needs and offer diverse services.

- Certified Financial Planners (CFPs): CFPs are highly qualified professionals who possess a comprehensive understanding of financial planning. They offer a wide range of services, including retirement planning, investment management, estate planning, and debt management. They are typically well-versed in various investment strategies and risk tolerance assessments.

- Investment Advisors: These advisors specialize in investment strategies, helping clients choose and manage investments aligned with their financial objectives and risk tolerance. Their expertise lies in stock market analysis, portfolio diversification, and investment selection.

- Insurance Agents: Insurance agents specialize in providing guidance on various insurance products, including life insurance, health insurance, and property insurance. They help you evaluate your insurance needs and select appropriate coverage.

- Accountants: Accountants provide financial and tax advice, assisting with financial record-keeping, tax preparation, and business financial planning.

Importance of Professional Guidance for Complex Financial Situations

Complex financial situations, such as large inheritances, significant debt, or business ownership, often require specialized guidance. A financial advisor’s expertise can help you navigate these situations effectively and make informed decisions that align with your long-term goals.

Finding Qualified Financial Advisors

Finding a qualified financial advisor involves careful research and consideration. Consider these resources:

- Professional Organizations: Organizations like the Certified Financial Planner Board of Standards (CFP Board) provide resources and tools to help you find qualified CFP professionals.

- Online Directories: Online directories can connect you with financial advisors based on your location and specific needs.

- Recommendations: Seek recommendations from trusted individuals or professionals who have used financial advisors successfully.

Choosing a Financial Advisor and Understanding Fees

Selecting a financial advisor involves careful evaluation of their qualifications and services. Understanding their fees is crucial to ensure transparency and alignment with your budget. Research the advisor’s experience, credentials, and fee structure before committing.

Table of Financial Advisor Qualifications and Services

| Advisor Type | Qualifications | Common Services |

|---|---|---|

| Certified Financial Planner (CFP) | CFP certification, typically extensive experience | Comprehensive financial planning, investment management, retirement planning, estate planning |

| Investment Advisor | Investment licenses, experience in portfolio management | Portfolio construction, investment selection, risk management |

| Insurance Agent | Insurance licenses, knowledge of various insurance products | Insurance product recommendations, coverage assessments |

| Accountant | Accounting certifications, knowledge of tax laws | Financial record-keeping, tax preparation, business financial planning |

Asking Relevant Questions to a Financial Advisor

Effective communication is key to receiving appropriate advice. Questions to ask a financial advisor include:

- What is your experience and expertise in my specific financial situation?

- What is your fee structure, and are there any hidden costs?

- How will you communicate with me, and what is your availability?

- What are your investment strategies, and how do they align with my risk tolerance?

- How do you stay updated on current financial market trends?

Building Good Financial Habits

Cultivating strong financial habits is crucial for long-term financial well-being. It’s not just about accumulating wealth; it’s about developing a mindset and approach to money that fosters security, freedom, and peace of mind. This involves more than just saving; it’s about understanding your spending patterns, making informed decisions, and continually adapting your strategies as your life evolves.Developing these habits early in life significantly impacts your future financial health.

The earlier you start, the more time your money has to grow and compound, making a substantial difference in the long run. Consistent, disciplined actions build a foundation for financial success, empowering you to handle unexpected expenses, achieve your goals, and ultimately enjoy a more secure and fulfilling financial life.

Importance of Early Financial Education

Children learn by observing and imitating their parents’ financial behaviors. Establishing good financial habits early in life provides a solid foundation for future financial stability. Introducing children to concepts like budgeting, saving, and responsible spending helps them develop a healthy relationship with money. This early exposure can prevent future financial struggles and instill a proactive approach to managing finances.

Positive Financial Behaviors to Adopt

A multitude of positive financial behaviors can contribute to long-term financial well-being. These include setting clear financial goals, tracking expenses, and creating a budget. Avoiding impulse purchases, saving consistently, and regularly reviewing your financial plan are all vital components of developing strong financial habits.

- Setting Clear Financial Goals: Defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals is essential. These goals can range from saving for a down payment on a house to paying off debt or investing for retirement. Having clear targets provides motivation and direction, guiding your financial decisions.

- Tracking Expenses: Understanding where your money goes is crucial for effective budgeting and identifying areas for potential savings. Tracking expenses, whether through a spreadsheet or dedicated budgeting app, provides a clear picture of your spending habits.

- Creating a Budget: A budget is a roadmap for managing your income and expenses. It helps you allocate your funds effectively towards your goals and ensures you’re not overspending.

- Avoiding Impulse Purchases: Impulse purchases often lead to unnecessary spending and can derail financial goals. Developing the discipline to resist these urges and prioritize needs over wants is essential for financial well-being.

- Saving Consistently: Regular saving, even small amounts, can accumulate significantly over time. Automating savings transfers into a separate account can further reinforce this positive habit.

- Regularly Reviewing Your Financial Plan: Life circumstances change, and financial plans need adjustments. Regularly reviewing your budget, goals, and investments ensures your strategies remain relevant and effective.

Setting Clear Financial Goals

Defining specific, measurable, achievable, relevant, and time-bound (SMART) financial goals is crucial. These goals provide a roadmap for your financial journey. For example, a SMART goal might be “Save $10,000 for a down payment on a house within three years.”

Continuous Learning and Staying Informed

The financial landscape is constantly evolving. Staying informed about current trends, economic conditions, and investment opportunities is essential for making informed decisions. Reading financial publications, attending workshops, and seeking guidance from qualified professionals can keep you up-to-date.

Resources for Building Good Financial Habits

Numerous resources can assist in building good financial habits. These include reputable financial websites, books, and courses. Financial advisors can provide personalized guidance and support.

Key Financial Habits to Adopt

| Habit | Description |

|---|---|

| Setting SMART Financial Goals | Defining clear, measurable, achievable, relevant, and time-bound financial objectives. |

| Budgeting | Creating a plan for allocating income and expenses to achieve financial goals. |

| Tracking Expenses | Monitoring spending patterns to identify areas for potential savings and adjustments. |

| Avoiding Impulse Purchases | Developing self-control to resist unnecessary spending and prioritize needs over wants. |

| Consistent Saving | Regularly setting aside funds for future goals, even in small amounts. |

| Regular Financial Review | Periodically assessing financial plans and adjusting strategies based on life changes and evolving goals. |

Creating a Personal Financial Philosophy

Developing a personal financial philosophy involves understanding your values, priorities, and long-term goals. It’s a personalized set of principles guiding your financial decisions. This philosophy should encompass your approach to saving, spending, investing, and managing debt. It should be a guide for all financial choices, helping you stay consistent and focused on your overall financial well-being.

Handling Financial Crises Effectively

Navigating a financial crisis can feel overwhelming, but proactive steps and a supportive network can make a significant difference. Understanding the stages of a crisis, prioritizing expenses, and communicating openly are crucial for managing the situation effectively. This section will explore strategies for weathering financial storms and emerging stronger.Financial crises often unfold in stages, progressing from a perceived problem to a full-blown emergency.

Recognizing these stages allows for timely intervention and prevents the situation from escalating. Early detection and proactive measures are essential to mitigate potential long-term damage.

Stages of a Financial Crisis

Financial crises typically progress through several stages. Initially, there might be a warning sign, such as a significant drop in income or an unexpected expense. The second stage involves escalating financial pressures, where the individual or family struggles to meet their basic needs. The final stage is a full-blown crisis, where the individual or family is facing severe financial hardship and may be unable to meet essential needs without significant assistance.

Understanding these stages allows for better preparation and response.

Prioritizing Expenses During a Crisis

When facing a financial crisis, prioritizing expenses is essential for survival. Essential expenses like housing, utilities, food, and healthcare should take precedence. Non-essential expenses, such as entertainment or dining out, should be temporarily reduced or eliminated. Creating a detailed budget that Artikels income and expenses is crucial for making informed decisions.

Importance of Seeking Support

Seeking support from family and friends can be invaluable during a financial crisis. A strong support system can provide emotional comfort, practical assistance, and financial aid. It is crucial to communicate openly and honestly with loved ones about the situation. They can offer a listening ear, practical advice, and a helping hand.

Adjusting Your Lifestyle During a Financial Crisis

Adjusting your lifestyle during a financial crisis is necessary for long-term sustainability. This may involve reducing spending on non-essential items, finding ways to generate additional income, or exploring ways to save money. These changes may require sacrifices, but they are often necessary to overcome the crisis. It is important to make realistic adjustments to the lifestyle that are sustainable in the long run.

Resources for Getting Help

Numerous resources are available to help individuals and families facing financial crises. Government assistance programs, non-profit organizations, and community centers can provide crucial support. It is important to research and identify resources that best fit individual needs.

Steps to Take When Facing a Financial Crisis

| Step | Description ||—|—|| 1. Assess the Situation | Identify the source and extent of the financial crisis. Create a detailed budget. || 2. Prioritize Expenses | Identify essential expenses and prioritize them. Eliminate or reduce non-essential expenses. || 3. Seek Support | Communicate openly with family, friends, and trusted advisors.

Explore financial assistance programs. || 4. Adjust Your Lifestyle | Make necessary adjustments to your spending habits, income sources, and daily routines. || 5. Seek Professional Help | Consider consulting with a financial advisor or counselor for personalized guidance. |

Communicating with Your Partner or Family

Open and honest communication is crucial when discussing financial challenges with your partner or family. Creating a safe space for dialogue, actively listening to each other’s concerns, and collaboratively developing solutions are vital. Empathy and understanding are key to finding solutions that work for everyone involved.

Conclusive Thoughts: 10 Ways Make Sure You Never Have Face Financial Crisis

In conclusion, achieving financial stability is a journey, not a destination. By implementing these ten strategies, you can build a strong financial foundation, mitigate risks, and effectively navigate potential crises. Remember, consistent effort and a proactive approach are key to long-term financial well-being. So, take control of your finances today and build a secure future.